Griffin_11

advertisement

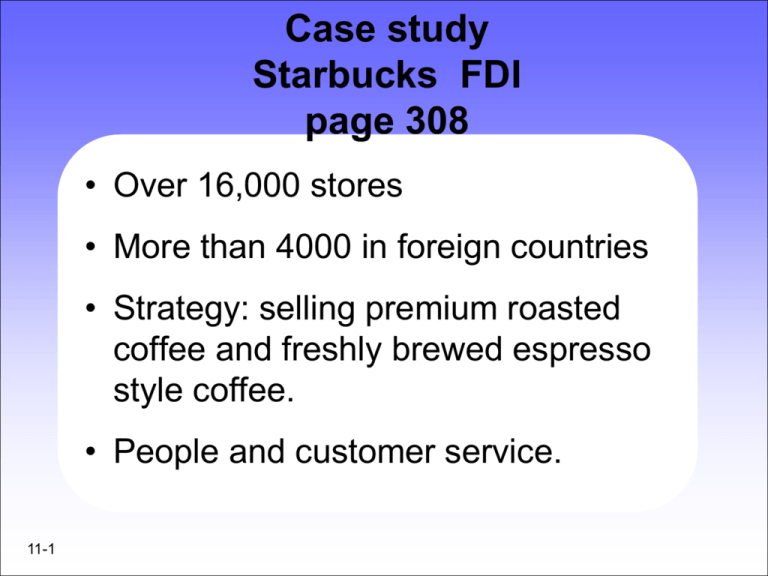

Case study Starbucks FDI page 308 • Over 16,000 stores • More than 4000 in foreign countries • Strategy: selling premium roasted coffee and freshly brewed espresso style coffee. • People and customer service. 11-1 Starbucks • 1995 in Japan, by licensing its format. • Joint venture to control the formula • To ensure that formula Starbucks transferred some employees to the Japanese operation. 11-2 Starbucks • What is the licensing agreement? 1.All managers and employees must attend training classes. 2.Store design. 3.Stock options for all employees in Japan. 11-3 Starbucks • Replicating US stores is very important in the license. • 2007 = over 700 stores in Japan 11-4 Starbucks 1998 aggressive FDI 1. British Coffee Chain 2. Taiwan, China, Singapore, South Korea, KSA, and now all over the world. Licensing its format for royalty fee and licensing fee. 11-5 Starbucks • From straight licensing into joint ventures for more control. • 2002 in Switzerland and then into China favoring joint ventures and acquisitions over licensing. Answer the questions at the end of the case to the best of you knowledge 11-6 The strategy of International Business international business, 5th edition chapter 12 The Strategy of International Business • Strategy and the firm • Global expansion, profitability and Profit Growth • Cost pressure and pressure for local responsiveness • Choosing a strategy 11-8 The Strategy of International Business • Can you explain the concept of strategy? • How firms can profit by expanding globally? • Do you know how pressure for cost reduction and local responsiveness influence strategic choice? • Can you understand the different strategies for competing globally? • Can you explain the pros and cons of using strategic alliances to support global strategies? 11-9 The Strategy of International Business • First strategy and the firm We talk in this section about: strategy, profit, value creation, positioning, the firm as a value chain. 11-10 First section strategy and the firm • Strategy? Strategy: the actions that managers can take to attain the goals of the firm. Goal: maximize the value of the firm Maximizing profitability will maximize the value of the firm. 11-11 First section strategy and the firm • See figure 12.1 • Profitability -----by reduce costs and raise prices. • Profitability growth-----by sell more in current market and enter new markets 11-12 First section strategy and the firm • What is value creation? • Profit leads value and value leads to profit. • Value = value perceived by consumer – costs of production. • This leads to consumer surplus in the consumer mind. See figure 12.2 11-13 First section strategy and the firm value creation • So • Value creation = V-C in figure 12.2 • So you as a manager you must thing of increasing V and reducing C! • You must think of all ways to do that. 11-14 First section strategy and the firm Value creation • As a result of either concentrating on C or V you might want to use one strategy over the other: 1.Low cost strategy-----C or 2.Differentiation strategy-------V 11-15 First section strategy and the firm value creation • Let us talk about Porter strategies for a minute. • Do you have any idea? • Competitive advantage? So value creation for the business can be created by being competitive by increasing the gap between V and C against competitors. 11-16 First section strategy and the firm and strategic positioning • Look figure 12.3 • Efficiency frontier • Differentiation Vs Cost structure • Your strategic position in the mind of your consumers. • Diminishing return? • Viable position? 11-17 First section strategy and the firm and strategic positioning To maximize profit: Integration between three elements: 1- Viable position on the efficiency frontier. Strategy 2- internal operations. 3- organization structure. S.O.S- see wall-Mart- Gap, Al-Haram 11-18 First section strategy and the firm operations • Operations: the firm as a value chain • Primary activities • Support activities Value via R&D, Marketing, Production and customer service. You can increase value by reducing the cost or improving the quality. Caterpillar 24 hour spare parts service. 11-19 Second section Global Expansion, profitability and profit growth By 1- expanding the market: Leveraging products and competencies To do that and enter new market you need to offer something that is not offered, or different. Core competencies that competitors can not match. Core competencies ----source of competitive advantage. 11-20 Second section Global Expansion, profitability and profit growth 2- Location Economies: are the economies that arise from performing a value creation activity in the optimal location for that activity. IBM select India, why? It is the right location for IT services. It must be that location enabling one of two things: 11-21 Second section Global Expansion, profitability and profit growth It must be that location enabling one of two things: 1. Lowering cost or 2. Differentiating the product. 11-22 Clear Vision, the case in page 410, represents both using China as a location for low-cost production and Japan for high quality design (two different locations). Second section Global Expansion, profitability and profit growth How to create the global web? Lenovo’s ThinkPad Laptop. 1. design-----US 2. Case, keyboard, hard drive---Thailand 3. Screen and memory----South Korea 4. The built-in wireless card-----Malaysia 5. Microprocessor--------------US 6. Assembly-----------------Mexico 7. Marketing and sales strategy--------US. 11-23 Second section Global Expansion, profitability and profit growth • Experience Effects • Experience curve- figure 12.5 page 412. • Economies of scale 11-24 Section 3 Cost Pressures and Pressures for Local Responsiveness • Check figure 12.6 page 415 • Two forms of pressure: 1- Pressure for cost reductions 2- pressure for local responsiveness 11-25 Section 3 Cost Pressures and Pressures for Local Responsiveness Let us start with number one: Pressure for cost reductions As an international company, what would you do to reduce cost and encounter the competitive pressure? As a bank for example? Answer: moving the activity of Information Processing to a developing country where wages are lower to produce lower cost per unit. 11-26 Section 3 Cost Pressures and Pressures for Local Responsiveness Cost pressure: Mass production at optimal location in the world and economies of scale. Cost pressure forced IBM to run its global professional services business from India not the united states. This always the case when moving through the product life cycle- from introduction to growth, to maturity and when the innovation is becoming no more than a commodity. 11-27 Section 3 Cost Pressures and Pressures for Local Responsiveness • Second type of pressure is the pressure for local responsiveness (V not C). • This pressure requires differentiation strategy not cost strategy. 1- It is due to different customer tastes and preferences from one country to another. In this case standardization will not solve our problems. Take for example BBC. Banks, cars, mobile phone, Starbucks in KSA adapting to the culture 11-28 Section 3 Cost Pressures and Pressures for Local Responsiveness . 2- the second reason local responsiveness is: differences in infrastructure and traditional practices. Examples of driving in the UK and different voltage in electricity. And different technical standards from one country to another. Whereas, standardisation makes life easy more than customization some times not all the time 11-29 Section 3 Cost Pressures and Pressures for Local Responsiveness • http://www.alarabiya.net/articles/201 1/11/14/177090.html • http://www.flynas.com/ar/index.aspx 11-30 Section 3 Cost Pressures and Pressures for Local Responsiveness • Number three is: 3- differences in distribution channels: in some countries like Japan they sell cars door to door 4- host Govt demands: country’s specific health regulations, or tradition or cultural issues 11-31 Section number four Choosing a strategy • Select your best str from figure 12.7 page 419. 1- Global standardization strategy with low pressure for responsiveness and high for cost. 2- localization str with high degree of pressure for responsiveness and low for cost. 3- transnational str with with high pressure from both. 4- international str. With low for both. 11-32 Section number four Choosing a strategy • The evolution of strategy- Canon against Xerox • And see the evolution strategy at Procter and Gamble page 423. See also opening and closing cases. Good luck 11-33