Annual Report - WordPress.com

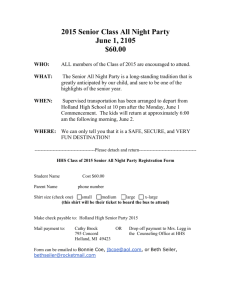

advertisement

Annual Report 2009 2009 ANNUAL REPORT Susana Wu Chen 11023481 Ilya Fabian 10011188 Simona Majerská 11013613 Annual Report | The Wheels Of Holland Page 1 of 28 IBMS AP1: IP4 Annual Report 2009 IBMS AP1: IP4 WELCOME TO OUR ANNUAL REPORT Table of Contents FINANCIAL SUMMARY............................................................................................................................. 4 Letter to Shareholders ............................................................................................................................ 6 COMPANY OPERATION ........................................................................................................................... 8 Company overview ............................................................................................................................. 8 Goal ..................................................................................................................................................... 8 Mission ................................................................................................................................................ 8 Future strategy.................................................................................................................................... 8 Company Structure ........................................................................................................................... 10 Marketing strategy & Sales ............................................................................................................... 12 Sales .................................................................................................................................................. 13 Production plant ............................................................................................................................... 14 Distribution Center ........................................................................................................................... 14 Manager type .................................................................................................................................... 14 Global strategy .................................................................................................................................. 14 Local strategy .................................................................................................................................... 14 Marketing campaign ......................................................................................................................... 15 Promotion ......................................................................................................................................... 15 Public Relationship ............................................................................................................................ 16 Market share ..................................................................................................................................... 16 Press release .................................................................................................................................. 17 .......................................................................................................................................................... 17 Main Event ........................................................................................................................................ 18 .......................................................................................................................................................... 19 FINANCIAL STATEMENTS ...................................................................................................................... 20 STATEMENT OF FINANCIAL POSITION .............................................................................................. 20 STATEMENT OF CHANGES IN EQUITY ............................................................................................... 21 STATEMENT OF INCOME................................................................................................................... 21 STATEMENT OF CASH FLOW ............................................................................................................. 22 Notes to financial statements ........................................................................................................... 23 Analysis of Financial statements ....................................................................................................... 23 Page 2 of 28 Annual Report 2009 IBMS AP1: IP4 Profit Margin ................................................................................................................................. 23 Return on Assets ........................................................................................................................... 23 Return on Equity ........................................................................................................................... 23 Turnover ratio ............................................................................................................................... 23 Debt to Equity ratio....................................................................................................................... 24 MAIN EVENTS .................................................................................................................................... 24 Chief Marketing Officer ........................................................................................................................ 25 Chief Executive Officer .......................................................................................................................... 26 Chief Financial Officer ........................................................................................................................... 27 Page 3 of 28 Annual Report 2009 IBMS AP1: IP4 FINANCIAL SUMMARY After major decrease in profits in 2007, The Wheels of Holland learned from the mistakes and recorded a huge upturn in both revenues and sales in the past 2 years. Because of undertaking successful expansion of the corporation and building new factories in Asia, we decreased cost of production, met the demand for bicycles globally and therefore recorded profit of € 39 381 925. Net turnover and profit development is shown in the graph below, as well as the profit contribution per country in the year 2009. Net Turnover and Profits of The Wheels of Holland €90,000,000.00 €80,000,000.00 €70,000,000.00 €60,000,000.00 €50,000,000.00 €40,000,000.00 €30,000,000.00 €20,000,000.00 €10,000,000.00 €€(10,000,000.00) 1/2005 2/2005 1/2006 2/2006 Profit 1/2007 2/2007 1/2008 2/2008 Net Turnover Profit contribution per country 10% 9% 10% 20% 16% 6% 29% France United Kingdom The Netherlands Germany Brazil Denmark The United States of America (US) Page 4 of 28 1/2009 Annual Report 2009 We achieved €76 370 072,04 in sales revenue while increasing our market share to 11,35% globally. Sales and market share, however, are not the only upward-sloping figures in the financial statements. Earnings per share are continuously raising, just in 2009 it has IBMS AP1: IP4 increased by 60%. Issuance of 1 000 000 shares was a successful step, therefore we do not exclude possibility of issuing 200 000 more shares in the following fiscal period. The trend in EPS is shown in the graph below. EPS € 40.00 € 35.00 € 30.00 € 25.00 € 20.00 € 15.00 € 10.00 € 5.00 € 0.00 -€ 5.00 1/2005 2/2005 1/2006 2/2006 1/2007 2/2007 1/2008 2/2008 1/2009 EPS € 0.27 -€ 0.47 € 3.58 € 4.86 € 0.24 € 10.46 € 21.87 € 24.39 € 39.14 The Wheels of Holland generated adjusted free cash flow of €31 million in the first half of 2009, well ahead of the initial position of around €23 million for the year. This shows the improved profitability and net working capital performance within the year in the company. We accomplished the operating cash flow positive milestone a year ahead of our expectations. The goal for the next fiscal periods is to make our best to avoid any fluctuation and sustain the steady growth of the company´s financial figures such as EPS, profits, revenue, sales, etc. Page 5 of 28 Annual Report 2009 IBMS AP1: IP4 Letter to Shareholders The Wheels of Holland´s most important news in 2009 was our increased market share accompanied by profit maximisation Dear Shareholder, Thank you for choosing the brand The Wheels of Holland as an international producer of bicycles with the especial focus to innovations, developments and trends. Hereby, we are pleased to provide you with an Annual Report of the company performance between second half of 2008 and the first half of 2009. The report discloses all necessary information about the marketing decisions and strategy, financial performance, investments and developments. At the moment The Wheels of Holland is acknowledged local brand of 7 western countries in Europe, North and South America. At the beginning of 2009 we have invested in to construction of a large factory in China and Japan due to a good sailing seasons and excess in demand from the previous three years. Furthermore, we have opened new distribution centers in Germany, France and U.S. so that we were able to put the cost of production of bicycles down. On the highly competitive market we have adapted a new pricing strategy and increased our investments in to market perspectives within each selling country. From that point The Wheels of Holland have finally start increasing its market share with 13.5% this year. The Wheels of Holland has closed its fiscal year at the middle of 2009 with high profit growth of 60.48% and 82% from the sold inventory. These indicators have brought to our company a profit of over €39.000.000 in cash and new opportunity for investing. With a positive business cycle and enlarged current account, our marketing specialists have implemented a research on the current organization structure. From the revealed exploration we are considering to invest 1.5 million euro to the new organizational structure that has broader and more secure bases for our company growth. As a company with a focus on future profit maximization through innovation and social contribution, we are looking forward to hearing your feedbacks and opinions about the performance of The Wheels of Holland today. Sincerely, Susana Wu, CEO Page 6 of 28 ● ● ● Company Operation ● ● ● Annual Report 2009 IBMS AP1: IP4 COMPANY OPERATION Company overview Mission The Wheels of Holland is one of the largest bicycle manufactures on the Netherland market in terms of sales and is one of Europe’s primary producers. The company provide services and full responsibility for the quality and the comfort designed with experience gained throughout endless roads across the Netherlands. The bicycles are produced to meet different consumer needs. The company products vary from normal bikes for everyday and travel use, to racing bikes for competition purposes and delivery bikes. The bicycles are sold to retailers who offer end consumers professional advice and services. All bicycles are developed in the Netherland, Japan and China, the company’s new factories. Wheels of Holland strive to achieve profitable growth both now and in the future by providing high quality bicycles yet still benefit the environment. The company wants to: Goal Wheels of Holland`s goal is to be one of the top bicycle manufacturing company in the Netherlands, providing innovative and quality products to our customers and secure high sales by offering superior environmental transportation of remarkable value in sense of quality and price. Company`s financial objectives is to allocate capital profitability toward growth initiatives and to maximize earnings by infiltrating Europe and Western countries. - To internationalize the business - To expand sales and strengthen brand To secure the reputation for - innovation, quality and trends by means development activities. new of Future strategy In the beginning of 2006, Wheels of Holland was intensively targeting the Netherlands, United Kingdom and Denmark to become the market leader. The company has a good beginning and expands its sales in France and Germany. However Wheels of Holland encounter some loses in Denmark due to crises, which leads to the decision to expand production overseas in 2007 in order to meet the demands of costumers. The company has a sustain revenue and aim to further invest in research and development and innovation of production. The next step towards the future is to sustain and reinforce the growth of the company in a more efficient way by shifting internalization to efficiency improvement. The strategies for the upcoming year are: Page 8 of 28 Annual Report 2009 The company experiences a low market share in the year of 2008. Wheels of Holland market share were average 10.10% (second half of 2008 8.86% and first half of 2009). The aim of the company is to increase its market share by 30% in the upcoming years. 11.35% The company internationalized 63.69% of sales in Netherland, Denmark, France, Germany, United Kingdom, United States and Brazil and cover 70% of sales around the world. The IBMS AP1: IP4 30% future strategy is to further internationalize its business by reaching 70% and cover 80% of the world. Wheels of Holland will also cut cost of production. Internationalized World Cover 66.01% 70% First Half of 2009 Second Half of 2009 63.69% 70% Goal Goal 70% 80% Page 9 of 28 Annual Report 2009 Company Structure The Wheels of Holland aims sustainably and raise the status of bicycles in the modern society. The Wheels of Holland is a fast growing company located in the heart of the Netherland in terms of sale. The achievement is due to the broad product line that we offer such as Western Region IBMS AP1: IP4 normal bicycles, racing bicycles and delivery bicycles that design to meet costumer’s requirement. The company has three factories and operates in 7 countries around the world, namely in Denmark, Germany, France, Brazil, United States, United Kingdom and Netherland itself. As a fast growing company, we respond to trends and diversify the product from competitors. Europe Region Nethelands USA Denmark Brazil France Germany UK Page 10 of 28 Annual Report 2009 Wheels of Holland operate according to the Geographic structure which has a more pleasant outlook for the company. This structure is decentralized which allows each unit of business to operate as its own entity based on where it is located. This structure allows the Wheels of Holland to improve its performance by hiring local managers who have a better understanding of local market and social environment. IBMS AP1: IP4 Meeting local needs will provide us the opportunity to set the most beneficial prices for our products, moreover keep the market share strong by offering a better customer service. Each manager will have more space to design its own marketing strategy that will improve flexibility of our performance on the global market. Page 11 of 28 Marketing strategy & Sales Netherland Denmark Germany France United States √ Brazil China Japan √ United Kingdom √ Sales √ √ √ √ √ √ Production Plant Normal X X X X X X Large Large Distribution X Center X X X X X X X X Manager Type Local Local Local Local Local Local Local Local Local Autonomy Fully Partly Partly Partly Partly Partly Partly No No Market Research √ √ X X √ X X √ √ Thorough Thorough Thorough Normal Thorough Normal X X Investment Normal Market Perspective Sales The Marketing strategy of The Wheels of Holland is to ensure long term loyalty of its customers to its products and brands. Through communication with retailers we will ensure to respond to their needs, and able to market our products in line with the customer demand. They are considered as environmentally friendly from of mobility and a rapid means of transportation in inner city environment. People in all age group are placing increasingly strong focus on health factor. Cycling allows fitness to be integrated into everyday life. Wheels of Holland operate its business through three regions namely Europe, Western and Asia. The Europe region comprise of Netherlands, Denmark, Germany, France and United Kingdom. Western region consist of America and Brazil. The Asia region comprises China and Japan. Main reason Wheels of Holland choose to target these countries because of the large population. The most profitable sales derived from Denmark, United Kingdom and United States. Racing bikes are especially design for competition purposes and high level sportsperson. The racing bikes are made of high quality materials, super light weight at the same time provides comfort while racing. Delivery bikes are tailored for small business that needs bicycles as a convenient and fast way to delivery their product in the busy cities. The bicycle market is split into three product groups with primary differentiation between normal, racing and delivery bikes. Normal bikes are design for daily use in modern society. Denmark, United Kingdom and United States are Wheels of Holland most important sales markets. The market in Denmark encounters a decrease in sales volume by 18% in the first half year of 2009 compare to 2008 but is still manage to be the most profitable country due to high sales prices. The Annual Report 2009 Denmark market generate revenue of €95.906.822, - in 2009. Bicycles sales also decline in United Kingdom by 25.8% in 2009 compared to previous year. However generate a revenue of €7.829.474, - due to high sales prices. The United States market experience a growth in sales by 27.8% with substantial revenue of €7.829.474. The United States market seems as a stable in comparison with € 1.271.261, - revenue made in second half of 2008. Production plant Wheels of Holland were established in 2004 in Netherland and manufacture in a normal size factory. The company expand its market and comprise sustainable grow in sales. In order to meets the demand of bicycles from its customers, the company decided to shift it production buy building two large factories in Japan and China. The cost of production was low in the Asia region, therefore will be beneficial for the company. Wheels of Holland manufacturing structure are very flexible which allows the company to adjust to the seasonal pattern of bicycle production. Distribution Center No distribution center is build at the operating countries. The factory in Netherlands supply bicycles to Europe and the Western region. China and Japan acts as a spare for the company. The company’s sales was increasing, the factory in Netherlands itself cannot supply the quantity of bicycles demanded. China and Japan therefore fill in the gap of production. IBMS AP1: IP4 Manager type Managing business around the globe, Wheels of Holland choose to use the geocentric attitude. In other word, the company has a world oriented view and focus on using the best people from around the globe to manage its business. Local managers have a better understanding of the culture from the country. Global strategy Wheels of Holland global strategy are to further extend it strength through investing in research and development and internationalization of its sales activities. By doing so, the company’s purpose is to continue the growth that it has attained over the recent year. Local strategy The company’s local strategy is to provide its target market a bicycle that meets their requirements. Each country is based on the market oriented strategy which the strategy indentify goals and focuses on the action based on the structure of the marketplace. Business in each operating country act in response to what the customers want. In order to compete with competitors, the company is perceptive of its customers’ needs. Page 14 of 28 Marketing campaign Wheels of Holland target groups are individual consumer and distributors. Individual consumer can be targeted through our website. Distributor will be targeted through deals and sales by representative of the company. Distributors can purchase a wider quantity of bicycles. Also distributors help in the selling of the bicycle to the end consumers. The company marketing objective will be to develop strong brand name recognition and loyalty among its customers. The wheels of Holland marketing communication objective is firstly build brand awareness within the retail bicycle industry by setting up a marketing campaign. The overall objective is to increase the brand name The Wheels of Holland will generate its message in an emotional appeal to attract more attention and create believe in our brand. The message we and brand image, in which will increase sales. The company will launch marketing campaign during this year Olympic racing game to target market from unawareness to awareness. The key is to build a long lasting impression. Once awareness is created, audience might still have little knowledge of the company. Using promotional materials such as print ads can show the design of the company and also the usage of press release will keep the buzz going about the product. When awareness and knowledge is created the audience must be moved to the liking stage. The wheels of Holland has to position itself as the top manufacture of bicycle in the eye of the consumers, therefore consumer will prefer its products rather than competitors product. are sending to our audience is “cycling is healthy and good for the environment. Promotion For the marketing, Wheels of Holland will be using the direct marketing approach. Direct response marketing is cost efficient and the best form of communication to target our endconsumer and retailers. Tools of direct marketing is face-to-face selling, online marketing, direct mail marketing and catalog marketing. Direct mail is very fast and effective way to reach our current and potential Annual Report 2009 clients. In our business Email found many ways of using it. Common benefits from the direct email are reaching response and drawing attention, making agreements, arranging the meeting, building strong relationship We have a well-designed mail advertisement that provides a directly link to our website. Our website is powerful online marketing tool that has been modified up with a latest web technology that gave an opportunity to make it easy in use and memorable. There is all necessary information about the prices, delivery cost, quotas, VAT, new bicycles design and release, marketing tendency and so on. We have adopted new development of Google Multilanguage platform to make instant translation of our website according with preferences of the visitors. There are exceptions with biggest retailers and loyal partners for whom we arrange face-to-face meeting before every new bicycle collection release. Face-to-face meeting conducted by our marketing specialist that is mainly involve a presentation about new bicycles collection, distributing of catalogues and establishing strong relationship with a retailer. IBMS AP1: IP4 customers is equally important as creating a new demand and affection of the consumers to our brand. Establishing public recognition we want to put our company’s logo as supporters of healthy lifestyle and people who suffer from health problems. There are many sport events during the summer in which we would like to invest. It will help us to increase the market share and set strong rivalry to the other bicycle brands. Market share In the second half of 2008, Wheels of Holland was generating a profit growth of 11.50% and achieved sales revenue of €60.839.039, 72,-. Even through high sales growth, the company experiences an immense decrease in market share with only 8.86% compare to the first half of 2008. This is mainly cause by constant change of pricing strategy of the company. However the company recovers from its low market share and achieved value of 11.35% compare to the second half of 2008. The company growth in profit has reach 60.48% and generates profit of €39.141.526, 41,- Public Relationship Tendency of living healthy is creating a huge buzz. The company will promote the bicycles through media, public organization and event to generate an impact on society. Public relation has a strong impact on public awareness at a low price. We believe that participation in public campaign can perpetuate and establish a good brand image on a long run. Setting a right mood with Page 16 of 28 Annual Report 2009 IBMS AP1: IP4 Press release Tienhovenselaan 114 2516WH Den Haag Jean Conteau Human Resources Manager Google Sacrelise 236 2514CC Paris Bicycles have a strong connection to French culture even though everybody thinks of the Netherlands as the country of bikes. Since the term “bicycle” was invented in France, and everybody in Holland loves it, we would like to create a connection between these two countries of two-wheelers. Are you eager to distribute an environmentally friendly product supporting healthy and active lifestyle, by which you can get fast from place to place without waiting in traffic jams? All customers are looking for it, do not hesitate to use this unique opportunity. Wheels of Holland, a rapidly emerging bicycles producer will help you reach this! We offer long-lasting and unchanging normal, racing and delivery bicycles of the highest quality. Being a partner of Wheels of Holland means counting on both products and service of the highest quality. Distribution, maintenances and replacement are all granted, as well as the conducting all orders and billing processes. In addition, personalized bike decorations are available too. Provide your customers with our products and make them feel unique. However, not only them- becoming our partner means getting an oversize bike Wheels of Holland decorated consistently with your shop for the promotional purpose. Contact our Sales Department during office hours by calling 070-236 36 36 or sending an email to wohsalesdepartment@gmail.com Wheels of Holland Be better, bike faster, think greener Page 17 of 28 Main Event Throughout the year, Wheels of Holland encounter event that impact the company’s business. The World Health Organization announced in 2006 the circulation of flu in Demark and Netherlands. In the same year Denmark was in economic crisis. These events have decreases the demand for bicycles in Denmark and Netherlands. In 2007, Netherlands, Denmark and France were threatening by swine flu. This has declined sales and profit drastically in Denmark and Netherlands. Denmark had a loss of €619.917, - and Netherlands profit decrease from €553.399, - (second half of 2006) to € 97.945, - (first half of 2007). Wheels of Holland entered the France market in the first half of 2007. The swine flu has a small effect on the sale in France. Although the demand was not enormous, the company manages to make €502.316, - in profit. As a globalize company, adapting to changes is essential for Wheels of Holland. ● ● ● Financial Statements ● ● ● Annual Report 2009 IBMS AP1: IP4 FINANCIAL STATEMENTS STATEMENT OF FINANCIAL POSITION Page 20 of 28 Annual Report 2009 IBMS AP1: IP4 STATEMENT OF CHANGES IN EQUITY Statement of Changes in equity Wheels of Holland as of June 30, 2012 Balance 2nd half of 2008 Total comprehensive income Balance 1st half of 2009 Retained earnings 68 664 515,00 € 39 141 527,00 € 107 806 042,00 € STATEMENT OF INCOME Statement of Income Wheels of Holland as of June 30, 2012 Net turnover Cost of sales Gross sales margin Costs of sales General administration costs First half of 2009 €76,370,072 €45,232,760 Second half of 2008 €60,839,040 €35,339,900 €31,137,312 €3,397,812 €3,314,598 €25,499,140 €2,914,642 €3,851,424 Total costs €6,712,411 €6,766,066 Operating income €24,424,901 €18,733,074 Other company revenues Other company costs Interest income Interest costs €14,836,625 €0 €0 € 120,00 €5,777,000 €0 €0 € 120,00 Financial result €14,716,625 €5,657,000 Operational earnings before taxes Taxes over operational earnings Operational earnings Incidental losses and profits €0 Taxes over exceptional result €0 Exceptional result after taxes €39,141,526 €24,390,074 €0 €39,141,526 €0 €24,390,074 €0 €0 Net income €39,141,526 €24,390,074 €0 €0 Page 21 of 28 Annual Report 2009 IBMS AP1: IP4 STATEMENT OF CASH FLOW Statement of Cash Flow Wheels of Holland as of June 30, 2012 First half of 2009 Second half of 2008 Sales revenues €76,370,072 €60,839,040 Received interest Other income €0 €0 €0 € 35,00 Cash flow from operational activities €76,370,072 Account payable Remunerations Paid interest Distribution costs Dividends Sustainability projects Costs market research Marketing costs Other costs Emission costs Research and development Taxes Cash flow from financing activities Paid company taxes Change in short term debt Change loan Change investments Emission €38,288,375 €1,469,322 € 120,00 €1,950,190 €0 € 300,00 €0 €1,447,622 €1,252,516 €0 € 200,00 €0 €60,874,040 €29,470,430 €1,469,322 € 120,00 €1,464,483 €0 € 400,00 €0 €1,450,159 €1,720,800 €0 € 200,00 €0 €45,028,025 €36,295,194 €31,342,047 €24,578,846 €0 €0 €0 €0 €0 €0 €0 €0 €0 €0 €0 Cash flow from investment activities Investment in property € 350,00 Investment in equipment €0 Investment in machinery €0 Change in cash €0 €1,825,000 €0 € 700,00 € 350,00 €2,525,000 €30,992,047 €22,053,846 Page 22 of 28 Annual Report 2009 IBMS AP1: IP4 Notes to financial statements Property: distribution centers, offices and factories in possession of Wheels of Holland which are adjusted by depreciation Machinery: devices and equipment in possession of Wheels of Holland which are adjusted by depreciation Inventory: Total value of products in inventory 1.000.000 ordinary shares issued in 2006, no preferred shares No cash dividends paid throughout the years 2006 to 2008. Long bank credit: Total value of long term loans borrowing from the bank. Research and development: includes cost of environment research, product research, safety research and features research undertaken by Wheels of Holland in order to improve efficiency of production and sales in a given country Remunerations: Payments for labor including the wages of employees including expats and foreign managers. Loan of €400 000 has been borrowed in the second half of 2007 from bank with interest rate of 3%. The repayment is being paid back at the end of each fiscal period. Analysis of Financial statements Profit Margin Profit Margin = Net Income / Net Turnover Profit margin=€39,141,526 / €76,370,072 Profit Margin of Wheels of Holland is 51,25% Profit margin is an indicator of a corporation's pricing strategies and how well it controls costs. Shareholders can see profitability of sales expressed in percentage, therefore we can claim that our profit margin represent a low risk. Return on Assets Return on Assets = Net Income / Total Assets Return on Assets=€39,141,526 / €111,806,042 Return on Assets of of Wheels of Holland is 35% ROA express the profitability of the assets in terms of generating revenues. Return on Equity Return on Equity = Net Income / Group Equity Return on Equity==€39,141,526/ €107,806,042 Return on Equity of Wheels of Holland is 36,3% ROE measures a company's efficiency at making profits from each unit of shareholders' equity. Turnover ratio Fixed Assets Turnover ratio = Net Turnover / PPE Fixed Assets Turnover ratio = €76,370,072 / €8,006,979 Fixed Assets Turnover ratio of Wheels of Holland is 953,79% It is a measure of how much turnover the firm was able to generate with their plant, Page 23 of 28 Annual Report 2009 IBMS AP1: IP4 property and equipment. Reasonably, the higher the percentage is, the better. Therefore we can say that Wheels of Holland did a really good job. Debt to Equity €107,806,042 ratio =€111,806,042 / Debt to Equity ratio Debt to Equity ratio = Total liabilities / Group Equity Debt to equity ratio indicate investors the dependency between total liabilities and the equity they invested in the corporation. Debt to Equity ratio of Wheels of Holland is1,03% MAIN EVENTS Pulling out the operations from Australia after the first fiscal period 2005: Entering Danish market First half of 2007-Entering markets in France and China. Second half of 2007 Wheels of Holland pulled out its operations from China, However we expanded to Brazil From 2008, Wheels of Holland operates in Germany and USA. Demand is high enough, moreover, USA is one of the most profitable countries looking at average profits. Therefore in the future the operations will concentrate on this market. Page 24 of 28 Financial crisis in Denmark due to flu resulted in a dramatic drop in sales in the country, therefore our overall profits dropped as well. Change of our pricing strategy influenced the demand in many countries. Majority of demand decreased as well as our profits Due to high demand which we did not meet, we decided to build a factory in Japan and China because of low production costs. However, Wheels of Holland did not enter the market in Asia, since the selling price was low and the demand was already high in other countries where we operated ` Academic Year 2011-2012 Chief Marketing Officer Name: Ilia Fabian Age: 23 years old Nationality: Russian Specialization: Marketing& commerce, Economy & Globalization Background: Hague University - Bachelor International Business Management University of Sao Paulo – Master Economy & Globalization In Wheels of Holland: Second half of 2004 Role: Ilia Fabian is our Marketing expert and trusted entity since the establishment of the first factory of “Wheels of Holland” in the Netherlands. Today “Wheels of Holland” is the international brand which partially is the result of a great marketing performance and persistence of Ilia Fabian during last five years. If to think of a person who knows the culture of the company from its fundamental start, then this man would be the best representative who actually made it. Contribution and responsibility: Presence of Ilia Fabian in “Wheels of Holland” has been acknowledged and perceived through his contribution, namely spread awareness of our brand, build a pleasant public relationship, increase demand and boost sailing in the most profitable locations. All these contributions has been attributed to the company growth. Main function and execution of Ilia Fabian in “Wheels of Holland” : brand internationalization marketing research pricing strategy budgeting strategy inventory control designing of commercial campaigns manipulation of sales growth product development recognize trends and demand Each of these responsibilities is a challenge of high importance that our CMO has been taking care of. To do business on a global scale we needed to achieve transparency that was Ilia’s job to do. As a specialist in economy and globalization he used his experience and instinct to identify local trend and new opportunity for the Wheels of Holland to expand. Within seven countries that we are operating Ilia had designed the most suitable global strategy that has made our brand so recognizable. The result of it has boomed the demand and focused our attention to the products that has the highest potential on return from sales. He was working close to CEO and CFO that played a significant role in making the internationalization of Wheels of Holland financially feasible. Salaries and Bonuses: For the last five years the salary of CMO has changed enormously. Current annual salary of Ilia Fabian is 45.000 Euros (net) compared to 35.000 in 2004. That growth was motivated by successful expand of our company and increase in sales from production. For Ilia Fabian it has transmitted with extra working hours and pressure from the new rivalry. Due to Ilia is our trusted entity and stay with us since the beginning of the company, we are interesting to keep our employees satisfaction. Therefore, at the end of each fiscal year we provide bonuses in amount between 2000-3000 Euros, depending on the sum of annual achievements. ` Academic Year 2011-2012 Chief Executive Officer Name: Susana Wu Age: 21 years old Nationality: Venezuelan Specialization: Sustainability of business, global marketing and finance. Background: The Hague University - bachelor in International Business Management Erasmus University - global marketing and finance In Wheels of Holland: Second half of 2004 Role: Susana Wu is a founder of Wheels of Holland whose discipline and high entrepreneurial skill has built the result of the company development today. With a highly intensive work that we have Susana is managing and sustaining the bridge in communication between marketing and financial departments. Her role and influential position was especially focused on investments, overall company performance and structure, monitoring governmental sustainability and rivalry, cultivating a partnership with bicycle retailers within seven countries. Contribution and responsibility: Susana´s major contribution: Investments decisions Research and development Building and enlargements of a new factory Sustainability Distribution centers Allocate production source Distribution centers Make decision for geographic expansion Susana’s active performance has been perceived through the company constant growth within international scale. With her smart decision we have managed to establish 2 large factories in China and Japan. Furthermore, we have enlarged Wheels of Holland first factory in the Netherlands. In 2007 our company made contribution in to social development like: Corporate Governance, Promotion of cultural projects, Participation of employees in social projects and so on. In general we managed to cut our cost of production and increase sailing price with a most profitable countries. Salaries and Bonuses: As a CEO of the company, Susana’s annual salary is 50.000 euros (net) that didn’t change for last five years. This is a good CEO salary that compensates the pressure from hard work and risky decisions that she is in charge of. Susana’s position doesn’t require having any extra bonus due to it is a typical contribution for the middle and lower line of managers. ` Chief Financial Officer Name: Simona Majerská Age: 21 years old Nationality: Slovak Specialization: Finance analyst Background: The Hague University - bachelor in International Business Management Ibiza University – master in Finance and Accounting In Wheels of Holland: Second half of 2004 Role: Regardless on marketing success that Wells of Holland has experienced they wouldn’t be so achievable without a precise and analytical estimation of our CFO Simona Majerská. Simona is a financial heart of our company who is making primary decisions if the project is achievable or profitable to invest. Her main role is has to do with monitoring financial statements, project company’s financial health condition on the long run and work collaborative work with CEO. Contribution and responsibility: Simona did all major contribution for the company financial growth: Financial planning Financial risk Projection on sales Monitor balance sheet Cash-flow statement Income statement Keep all board of directors with about the latest financial performance. Our company is highly dependent on the performance of CFO on the short and long run. Wheels of Holland had difficult time during 2005 caused by cash outflow and poor sales. Nevertheless, Simona’s highly outstanding financial instinct has forcasted a better season for our company through new investments in the market of emerging economies. Next following years after 2005 we have made a profit with a constantly growing return. The accurate evaluation of our CFO has especially reflected on company’s balance account that at the first half of the 2009 hit the record number in cash reserve of over 95 million euros. Salaries and Bonuses: For the last five years the salary of CFO has changed enormously. Current annual salary of Simona Majerska is 45.000 Euros (net) compared to 35.000 in 2004. That growth in salary was motivated by a great performance in financial work that has multiplied the wealth of “Wheels of Holland”. With companies expand Simona Majerska has more hours and responsibilities in her job. Due to Simona is our trusted entity and stay with us since the beginning of the company, we are interesting to keep our employees satisfaction. Therefore, at the end of each fiscal year we provide bonuses in amount between 2000-3000 Euros, depending on the sum of annual achievements.