The United States - Centers on the Public Service

advertisement

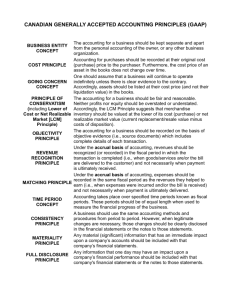

REBUILDING FISCAL FEDERALISM IN THE AFTERMATH OF THE FINANCIAL CRISIS: THE UNITED STATES Paul Posner and Tim Conlan George Mason University The Great Recession had significant impacts on governments at all levels in the federal system in the United States. As the largest downturn since the New Deal, the economy’s sharp and prolonged dip affected both the revenue and spending sides of budgets across the federal system. The effects were most pronounced at the state and local levels, as they were obligated to balance budgets with significant spending cuts or tax increases. The federal government played a different role. In the first several years, both the Bush and Obama Administrations responded by enacting major economic stimulus, first through tax cuts and then through historical levels of new grant funding to the state and local sector. The latter stimulus, enacted as one of the first initiatives of the new Obama Administration, amounted to nearly 5 percent of GDP. Federal budget deficits soared to 10 percent of GDP in the ensuing several years – a record for the United States in peacetime. As evidence accumulated that this countercyclical program worked to stem job losses and other cuts at the state and local level, the national government reversed fiscal gears, enacting reductions in federal spending starting in 2011. This fiscal reversal lightened the federal balance sheet at the expense of the state and local sector, causing renewed retrenchment throughout the entire federal system. As state and local budgets have finally normalized, all levels of government face the challenge of mitigating and resolving long term structural fiscal deficits stemming from the aging of populations and rising health care costs. Should these trends continue, deficits will balloon to unsustainable levels across all levels of government. Such fiscal gaps will test the 1 ability of our intergovernmental system to foster collaborative and coordinated fiscal and policy responses across levels of government. While the U.S. federal system is distinguished by high levels of revenue independence by subnational governments, those governments will face wrenching challenges in dealing with these pressures alone, without federal assistance or collaboration. Rising health care costs are difficult to solve without national policy reforms to an industry that spans state boundaries for instance. Unfortunately, the nation has experienced an erosion of collaborative intergovernmental institutions that could help facilitate joint federalstate- local action. Immediate Impact of and Responses to the Great Recession The past several years have been the most difficult times for federal, state and local governments in the United States since the Great Depression. The federal deficit exploded into the largest peacetime deficit in our history. Federal deficits reached a high of 10 percent of the economy, thanks to collapsing revenues and expanding costs from stimulus spending and the automatic stabilizers built into federal programs. State tax collections dropped by record levels. Compared to other postwar recessions, it took nearly four times longer for state and local revenues to recover. A major federal stimulus program provided some significant relief to the state and local sectors thanks to reductions in state matching required for Medicaid and the major infusions of federal funds for education through the state stabilization fund. Indeed, for the first time in U.S. history, federal assistance was the single greatest source of revenue for state governments in 2009 and 2010, eclipsing sales and use and income tax revenues. However, federal stimulus funds ended well before state and local governments experienced full economic recovery. 2 Fiscal Effects of Recession The Great Recession brought significant fiscal consequences for all levels of government in the United States. Federal revenues declined 18% percent –or $463 billion-- from FY 2007 to FY 2009, and did not return to FY 2007 levels until 2011. State income tax revenues fell an average of 10.3% from fiscal year 2007 to fiscal year 2010, and in a dozen states income tax revenues collapsed by more than 20%.1 State corporate income tax receipts fell by almost 30% during this same period (see table 1). (Table 1 about here) Revenue effects at the local level were more variable and often delayed, due to heavy local government reliance on real property taxes. The lag time involved in the process of assessing changes in property values delays the impact of business cycle changes on property tax revenues. Thus, while state tax revenue declined significantly 2008 and 2009, local own source revenues increased until 2010, when they declined by nearly 2%.2 However, localities where the housing bubble was most severe experienced significant revenue declines. And those communities with the weakest economies and finances, such as Detroit, Michigan, San Bernadino, California, and Central Falls, Rhode Island were among a group of cities that entered bankruptcy to reconcile burgeoning costs with declining revenues.3 On the expenditure side, the recession caused spending for safety net programs like Medicaid and unemployment benefits to rise, further contributing to serious budgetary shortfalls in many states.4 A survey of state legislative fiscal analysts by the National Conference of State Legislatures estimated that states were facing budget shortfalls of $117 billion in FY 2009 and $174 billion in FY 2010 due to falling revenues and expenditure demands.5 (see figure 1) Such 3 fiscal changes led to unprecedented declines in state and local government employment when compared to earlier recessions.6 Although private sector job losses from the recession were deeper and began earlier than job losses in the state and local government sectors, the private job market began recovering in 2010 and 2011 while public sector job losses continued to grow. Policy Responses to Recession State and local governments, almost all of which operate under statutory or constitutional balanced budget requirements, responded in predictably pro cyclical fashion. Virtually all states cut their budgets and many raised taxes, thus exacerbating the economic downturn. The national government, however, responded by undertaking an economic stimulus program of over 5 percent of GDP and taking aggressive actions to relieve strains on the financial sector. In addition to monetary easing by the Federal Reserve, Congress enacted a $700 billion Troubled Asset Relief Program (TARP) in October 2008, and a $787 billion program of economic stimulus—the American Recovery and Reinvestment Act (ARRA)-- in February 2009. As a result, the federal budget deficit grew from $459 billion in fiscal year 2008, which ended in September of that year, to $1.2 trillion in FY 2009. For OECD as a whole, the automatic stabilizers accounted for about 50 percent of the cumulative deterioration of fiscal balances, while fiscal stimulus accounted for about 20 percent of the increased deficits. In the United States, the magnitude of the counter-cyclical financial bailouts and the economic stimulus programs was higher as a share of the fiscal response. From 2009 through 2011, the two major stimulus measures passed in 2009 and 2010 spent over $1.1 trillion during those three years alone, slightly more than the $1 trillion fiscal effects of the 4 automatic stabilizers. Indeed, the United States and Korea had the largest fiscal stimulus packages as a share of GDP of any of the OECD nations.7 Of all these policy responses, ARRA was the most important from an intergovernmental perspective. The composition of the stimulus package was a mix of spending increases and tax cuts, reflecting in part the differing partisan priorities in Congress. Republicans sought a package that emphasized tax cuts, while Democrats generally viewed spending as more effective stimulus. The final Recovery Act package was a combination, with a little over one-third—or $285 billion--going to states and localities in form of grants, roughly another third ($275 billion) provided in the form of tax cuts, and the remainder a mix of direct federal spending for purposes such as enhanced information technology in health care, clean energy production and transmission, and improvements to federal facilities and infrastructure. All funds were directed by law to be obligated, and preferably spent, within two years of enactment in order to maximize their stimulative effect on the economy. The assortment of grants in the Recovery Act included a mix of flexible aid to the states, enhanced spending for existing grants in areas such as education, social services, and infrastructure, and new programs designed to stimulate innovative programs at the state and local levels. Twenty five of the largest grant programs in the Recovery Act are listed in table 2. (Table 2 about here) About half of the Recovery Act’s grant-in-aid funds were delivered in the form of flexible assistance, which allowed state and local governments to plug holes in their budgets and finance existing policy priorities such as K-12 education. Aligning this aid with subnational 5 governments’ existing goals helped to assure that it would be expended in an expeditious, countercyclical manner. This approach was somewhat unusual in the US context, because it runs counter to Congress’s traditional tendency to seek maximum credit for federal aid funds, a goal which is best assured by utilizing a narrow categorical aid structure. In addition, Members of Congress and clientele groups are often suspicions that state and local governments will divert grant funds away from their intended national purposes in favor of state and local priorities. Consequently, the US relies heavily on narrower, categorical grants in aid rather than general assistance to subnational governments.8 The only major federal program of broad based aid, General Revenue Sharing, was of modest size and existed only between 1972 and 1986. Nevertheless, ARRA’s two largest federal aid initiatives were highly flexible in design, in hopes that these funds would be rapidly expended for maximum countercyclical effect. One was a 6.2% increase in the federal matching rate for Medicaid (FMAP)—the federally assisted, state implemented program of health insurance for the poor and the elderly in long term care. The other was a newly created, temporary State Fiscal Stabilization Fund for education and government services. Both were designed in large part to help cushion state budgets from the rapid falloff in tax revenues and, in the process, minimize layoffs of state and local government employees. Of the two, FMAP funding was particularly flexible. The overt political rationale was to assist states with their growing Medicaid caseloads, which expand during recessions as unemployed workers and their dependents become eligible for benefits. By precluding the need for states to redirect resources from elsewhere in their budgets in order to meet their Medicaid obligations, FMAP freed up state resources for other needs. 6 The State Fiscal Stabilization Fund (SFSF) was composed of three separate funding elements, with varying degrees of flexibility. Eighty two percent of the SFSF formula funds, or about $39 billion, were provided through the education stabilization fund. This fund was intended to help states maintain their levels of support for K-12 and higher education during the fiscal downturn. Eighteen percent of the SFSF funds, or $9 billion, were provided through the government services fund, which could be used to support a broad range of state functions and activities, including education, law enforcement, infrastructure, and general management. Finally, a $4.5 billion program of competitive project grants called “race to the top” was established to help drive state innovations in educational reform and performance. In addition to these forms of flexible assistance, other stimulus funding went to existing federal aid programs, such as Title 1 Education grants, IDEA special education grants, Community Development Block Grants, and social services programs. Overall, the Recovery Act provided funding for over 90 separate federal grant programs. Using such established programs generally had the advantage of enabling faster expenditure of funds by state and local governments—one of the signature goals of stimulus spending--by taking advantage of existing administrative procedures and implementation networks.9 Finally, other stimulus funds went into new initiatives and infrastructure enhancements, such as health IT, expanded broadband access in underserved areas, developing high speed rail networks, and transportation infrastructure improvements. Such infrastructure investments had greater potential for enhancing long term economic growth and promoting specific new policy objectives, but such aid entailed a much longer implementation timeframe. Hence, while the ARRA funds were required to be committed within the first two years of the program, GAO 7 estimated that roughly $50 billion in ARRA grants would be outlayed between fiscal years 2012 and 2016.10 One other dimension of intergovernmental crisis coordination deserves mention with respect to the Recovery act and intergovernmental grants. The need for rapid countercyclical spending in an intergovernmental context revived active coordination between what Samuel Beer called the “topocrats” in American government.11 By this he meant elected officials at all three levels of American government as well as the top level budget and management careerists who assisted them, as opposed the technocrats and program specialists deployed throughout government to implement programs and deliver services. An intergovernmental topocratic network was painstakingly constructed during the 1960s and 1970s but fell into disrepair during the subsequent bouts of austerity. The newly emergent topocratic network was strengthened by the unprecedented role given to Vice President Biden for overseeing implementation of the Recovery Act programs. The high political stakes of the legislation were constantly communicated to agencies, and the Vice President openly called himself the “sheriff” of recovery act monitoring, to ensure that federal agencies took care to avoid politically exploitable mishaps. The Vice President’s office was projected into the day-to-day world of grants administration to an unprecedented degree. It reviewed many grant awards for propriety before they were issued--an unprecedented action for most domestic programs—and the VP often took weekly monitoring trips to selected projects. The Vice President’s office was assisted by the Office of Management and Budget (OMB), which became a far more central player in developing guidance for ARRA grant accountability and reporting than ever before. During the Nixon Administration, OMB had 8 played a key role in standardizing and professionalizing grant administration, but its institutionalized grants management expertise had largely faded over time. OMB reemerged with a prominent role in grants management thanks to ARRA. It issued a rolling series of emergency rules and guidance governing the spending and management of ARRA funds and it worked to actively manage agency implementation of those rules. This effort also featured OMB seeking new management partners on the ground, in state and local governments. Major programs in ARRA, such as the State Fiscal Stabilization Fund, required explicit involvement and signoff by state governors, in contrast to the specialized bureaucratic lines of authority in most federal grant programs. OMB coordination was accomplished in part through weekly conference calls with governors and state budget directors. The idea was to stimulate the development of healthy engagement by governors and local elected officials who shared a common interest in promoting the economic agenda of the president. At the same time, organizations like the National Governors’ Association (NGA) and the National Association of State Budget Officers (NASBO) worked both independently and in coordination with OMB to exchange information among their members, to prod federal agencies for the issuance and clarification of rules, and to provide feedback on emerging problems. Political Responses to Recession and their Implications The developing economic challenges posed by the Great Recession during 2008 contributed to Barack Obama’s election as president that year. As the extent of the financial crisis became clearer after September 2008, and as monthly job losses grew to several hundred thousand per month, a potentially close election turned into a landslide victory for both Obama and Democrats running for Congress. Claiming an electoral mandate, the new President 9 advanced a policy agenda that promoted the most sweeping expansion of the federal government’s role since the Great Society of the 1960s. In addition to his massive stimulus program, this agenda included the enactment of comprehensive health insurance reform, the “race to the top” education initiative, the passage of financial sector regulatory reform, and a failed effort to enact a “cap and trade” program to address climate change. All of these had significant implications for American intergovernmental relations and the balance of national and state power in the federal system.12 Yet, Obama’s window of opportunity for expansionary national initiatives lasted only two years. Both real and exaggerated perceptions of federal government growth and centralization under President Obama provoked a powerful political backlash in the 2010 midterm elections. Republicans made major gains, seizing control of the House of Representatives away from the President’s party, cutting the Democrats’ margin in the Senate, and taking over numerous governorships and state legislative chambers across the country. Moreover, many of these new Republican elected officials were extremely conservative, having run on platforms pledging to repeal national health insurance reform and to dramatically cut the size and expenditures of the federal government. Both sets of issues were prominent features of the 112th Congress and in Supreme Court challenges to the Affordable Care Act. Tea party populism in 2010 was reinforced by budgetary experts’ concerns about the rapid expansion of the federal government’s deficit and the long term sustainability of health care and entitlement spending. Three separate deficit reduction commissions issued reports in 2010, and all recommended significant cuts in federal spending growth, major changes in federal entitlement programs, and reform of the federal income tax system. 10 Consequently, austerity and deficit reduction became central issues on the policy agenda for both Congress and President Obama after 2010, and their responses had significant implications for American federalism. The enactment of reductions in so-called non-defense discretionary spending, totaling more than $1 trillion over ten years, will reduce the growth of, and in some cases absolute levels of, federal aid to state and local governments. [See figure 2] Proposals impacting both federal aid and state-local tax expenditure programs were also central to the negotiations between the Congress and the White House over the so-called “fiscal cliff” in late 2012. Finally, conservative challenges to the constitutionality of the Affordable Care Act were partially successful, with the Court deciding that the federal government could not require states to participate in the expansion of subsidized health care under Medicaid. (Figure 2 about here) The Rise of Polarized Federalism Growing partisan polarization has helped generate a new political regionalism in American politics that has made the implementation of federal policies more challenging and exacerbated intergovernmental tensions across the federal system. One result has been to increase the degree of fiscal policy divergence among the states, with conservative states like Kansas pursuing tax cutting and spending reduction agendas while more liberal states like California have increased taxes on upper income earners. Another result has been to encourage new governing strategies from the Obama administration that resemble the processes of differential integration and variable geometry in the European Union, 11 Specifically, the 2010 and 2012 elections brought a regionally based form of partisan polarization to American state governments. The proportion of states with unified party government has grown, continuing a trend away from divided government that started ten years earlier. After the 2012 elections, only 12 states have divided party government, where one party controls the executive branch and the other has a majority in one or both chambers of the state legislature. This is the lowest number of states with divided government since 1952.13 Fully half of the states now have a single party that controls a supermajority in the legislature, up from only 14 states ten years ago. Importantly, 23 states now have unified Republican Party control of both the governor’s office and the legislature. This gives conservative Republican Governors greater leverage to challenge federal mandates and policy prescriptions authored by a Democratically controlled Administration in Washington. For the most part, states’ participation in federal programs is increasingly reflective of their ideological and partisan composition, with conservative “red” states holding out and liberal “blue” states joining in national programs. The ideological winds are strong enough to cause many states to act in defiance of fiscal logic and rationality. For example, researchers at the Urban Institute have estimated that the 24 states not expanding Medicaid under the Affordable Care Act are foregoing $423.6 billion in federal Medicaid funds from 2013 to 2022, while saving only $31 billion in state matching funds.14 A similar situation arose with states refusing to extend unemployment benefits even if paid for by the federal government. The states opting out of major federal grant programs with high federal matching rates, such as expanded Medicaid or federal high speed rail grants, give up the opportunity for their states’ taxpayers to get a return on 12 their federal taxes, ensuring that their federal tax payments will, in effect, subsidize programs in other states to the neglect of their own. Although it is not unheard of for state officials to reject federal funding when it is politically expedient, one study found that state refusals of federal funds have been far higher in the Obama administration than in previous periods, reflecting higher levels of polarization between a Democratic Administration in Washington and ideologically conservative Republicans controlling the states. All told, over 40 percent of Republican Governors refused federal money from the Obama Adminstration.15 Tools of State Variation in Federal Programs Increasingly, federal officials have sought to accommodate these state-based political developments with a selection of tools that permit a greater degree of variation in the implementation of federal programs and standards. Such tools include state opt outs, expanded federal waivers, partial or “one tail” preemptions (which set a minimum federal standard but allow more aggressive state action if desired), and outright exit strategies. For example, Congress’s presumption in devising the health care exchanges in the Affordable Care Act was that conservative states would seize the option to establish their own exchanges in order to accommodate their local private insurance market. Ironically, however, Republican controlled states rushed to opt out instead. As it stands now, 18 states operate their own exchanges, 25 have opted to let the federal government do so, and about 7 states have opted for a third option called partnerships. (see figure 3) (Figure 3 about here) 13 Many states are also resisting Medicaid expansion. As of June, 2014, 21 states had refused to expand their Medicaid programs, three were still debating expansion, and 27 states (including the District of Columbia) were implementing expansion. However, five of the states expanding their Medicaid programs, including three with Republican governors, were doing so under special Medicaid waivers, allowing them greater flexibility. Arkansas, for example, received a special federal waiver to expand its Medicaid coverage through private health insurance coverage on the state health care exchange. In the regulatory push for federal climate programs, the Obama administration appears willing to maximize differential implementation across the states as well. The federal government before 2008 was largely inactive in climate policy, relying on industries’ voluntary carbon reduction measures and state activism. Seeking to jumpstart this stalled climate agenda, the Obama administration in June 2013 announced a "Climate Action Plan" to reduce carbon pollution. As a linchpin of the climate action plan, the EPA recently proposed the “Clean Power Plan Rule” to cut carbon pollution from power plants that account for roughly one-third of the US greenhouse gas emissions. In this proposed rule, the EPA plans to reduce carbon emission from the power sector by 30 percent nationwide below 2005 levels. Noteworthy is that the EPA proposes state-specific rate-based goals for carbon emissions from the power sector. The state-by-state goals are based upon a state’s unique policy context and current energy mix, which would lead to significantly different savings even when the same set of emission reduction tools is applied. West Virginia, with a power industry heavily reliant on coal, would be expected to cut their power plant 14 emissions by 21 percent while Washington, with just one coal fired plant, would be required to achieve an 85 percent reduction.16 Structural Fiscal Challenges in American Federalism In 2014, the economy is in recovery mode and state and local finances are improving, as are federal revenues. Federal deficits are projected to drop to 4 percent of GDP and many states are again building up surpluses in reserve accounts. While the sector as a whole recovers, the recession proved to have far more lasting effects for those governments. Looking forward, all levels of government face a daunting set of structural deficits brought about by economic, demographic and global trends that will affect intergovernmental finances for decades to come. An aging society will transform the spending priorities and revenues of all levels of government. Absent fundamental reforms of spending and tax policies, the spending commitments for an aging society will rapidly overwhelm the revenues available to finance them. Escalating pensions, health care and social security costs will together cause deficits to escalate at federal, state and local governments on the spending side. This long term fiscal scenario is compounded by slower economic growth expected in the future, thanks to a decline in workforce growth. Most analysts project that economic growth at full employment will slow from over 3 percent to 2 percent in the next several decades. This means less tax revenue from which to finance the escalating health care, pension and Social Security costs of the baby boom retirement bulge. The Congressional Budget Office expects that the retirement of the baby boom generation as well as their lower birth rates will cause the 15 number of workers to grow more slowly, leading to sharply lower economic growth potential for the economy as a whole.17 A major component of fiscal pressure now and in the future is the growth of health care costs. The growth rate of health care has typically exceeded the rate of inflation, and the United States now spends far more than any nation in the world. This can cause federal health care entitlement programs such as Medicare and Medicaid to grow faster than inflation as well. All of these trends contribute to unsustainable budgets over the long term at the federal level. Assuming no further policy changes, the priorities in the federal budget would be overtaken by social security and health care program spending. The CBO projects that health care alone would double as a share of the economy by 2038, while social security would increase grow by 50 percent.18 While entitlements grow, discretionary spending appropriated annually by the Congress shrinks as a share of the economy and of the budget. Most recent projections show that domestic discretionary spending – which finances many grants to states and localities – would decline to the lowest level in postwar history. This will put future federal aid to state and local governments under increasing pressure, particularly for non-entitlement programs such as education, highways, transit, public health, and social services. The “bottom line” is that the federal budget is on an unsustainable course. This is shown in Figure 4 with GAO simulations illustrating that deficits could balloon to nearly 20 percent of the economy, should Congress fail to tame health care costs or raise revenues sufficiently. Assuming that revenues remain at their historic levels of 18 percent of GDP, rising health and 16 social security, as well as exploding interest on the federal debt, combine to send debt to levels close to 200 percent of the economy. The ability of the nation to fund domestic investments, national defense, as well as grants to state and local governments, would collapse in the face of rising entitlements. State and local budgets are also on an unsustainable course. Even once the recession’s effects are over, the U.S. Government Accountability Office reports that states and localities will face a long-term structural deficit that will exceed 3 percent of GDP by 2050, as shown in Figure 5. As with the federal budget, the primary culprit in long term state and local imbalances is demography: an aging America is driving up health care and pension costs and liabilities. The states are connected to the health care crisis by their financing role in Medicaid as well as insuring their own employees. States and localities also face unfunded employee pension costs and revenue systems that fail to keep pace with the sources of growth in the economy. In general, states and localities cannot run deficits in their general funds. So the chronic fiscal deficits projected over the longer term indicate the size of the spending cuts and tax increases that state and local officials will have to impose over many decades. In their 2013 report, GAO estimates that the state and local sector would have to reduce spending or raise revenues by over 14 percent annually to bring about an operating balance each year through 2060.19 FIGURE 5 HERE As with the federal government, aging and health care costs will crowd out other priorities in state and local budgets, assuming no major policy changes in those long term commitments. The GAO report shows that health care costs nearly double as a share of GDP for 17 states and localities over the next 50 years, while other spending areas decline commensurately. Similarly, pension costs take over more fiscal room in state and local budgets during this period as well. Calculations by Alicia Munnell at the Boston University Center for Retirement Research show that state and local pension contributions will increase as a share of spending in the future, with the actual amounts dependent on discount rates.20 Other pressures are also destabilizing state and local finance as we currently know it. The sales tax has been eroding for years, thanks to shifts in economic transactions toward services and remote sales – items that conventional sales taxes do not reach. As a result, the productivity of the sales tax has been declining. According to research by William Fox, the U.S. sales tax base declined from roughly 53% of personal income in 1979 to 36% in 2009.21 Moreover, the increasing globalization of economic activity increases opportunities for income shifting and tax planning to avoid taxes in particular states or even at the national level. 22 Unlike recessions, neither state and local governments nor their federal counterparts can simply grow their way out of this structural fiscal gap through economic growth or full employment. Rather, the answers lie in complex and difficult choices on the tax and spending sides of the budget of all levels of government Yet making those difficult choices on taxing and spending has become more complex politically, due to the federalization of partisan polarization. On the one hand, polarization has made coalition building at the national level more difficult, increasing the potential for each party to create gridlock and stalemate. The difficulties of enacting national solutions to issues with significant intergovernmental fiscal implications--including intergovernmentally sensitive deficit reduction strategies and reform of the national income tax system--will complicate the fiscal future of state and local governments. At the same time, the increased pattern of unified 18 party government at the state level may make the crafting of state level fiscal reforms somewhat easier, albeit by generating a wider diversity of state policy solutions. Conservative states seeking to address their fiscal problems through more drastic austerity measures coupled with state and local tax cuts will be mirrored by “blue” states seeking to raise revenues to support more generous public services. Intergovernmental Implications of Long Term Scarcity Going forward, all levels of government will be struggling with the fiscal implications of an aging society, rising health care costs, and revenue system erosion. Whether it be rising Medicare costs at the federal level or employee pensions in state and local governments, all levels of government will be faced with paying for the elderly and their doctors from a slower growing economy featuring fewer workers. In the past several years alone, pension and health entitlements and revenue slippage are crowding out other priorities, such as education and infrastructure, at all levels of government. All governments will be eyeing a shrinking tax base through which to finance expanding commitments. Unlike the past, the national government will be increasingly less able to contribute debt financed countercyclical aid to hard pressed states and localities in the recessions to come. Of course, we have seen such scarcity overtake and reshape other federal systems, most notably in Europe where national and subnational governments struggle to resolve historically high deficits and debt. Such systems are in the process of undergoing fiscal centralization, as nations yield to central fiscal controllers in the European Union and the IMF. In the search for solvency, answers are often forthcoming from central governments with access to the broadest tax base and financing. However, such a process is not without costs, as higher level governments and multilateral institutions impose conditions on public spending, taxation and 19 debt. Indeed, one observer argues that the European Union may be in the process of leap frogging beyond federalism to something approaching a unitary state, where the center dictates taxation and spending in ways that would have been unthinkable before the crisis.23 Within the American states, a comparable process of fiscal and policy centralization is underway as well, especially for cities undergoing bailouts and other extraordinary financial emergencies, such as Detroit, Michigan and Central Falls, Rhode Island. When compared with other federal systems, the United States remains one of the most devolved federal fiscal systems in the world. Only Switzerland and Canada approach the high levels of fiscal autonomy realized by states and localities, as most spending at those levels is financed by taxes imposed and collected by those units of government. Those traditions have remained strong over time, thwarting national responses to widespread state bankruptcies in the 1840’s and the New Deal. Most recently, the notion of federal bailouts or even major grants for hard pressed bankrupt cities like Detroit has remained off the table. Implicitly, Jonathan Rodden argues our system of competitive federalism places credit markets rather than governments as the fiscal monitor for state and local governments.24 Indeed, like Canada, no state or local official came to Washington seeking a broad financial bailout during this wrenching Great Recession and its aftermath.25 Thus, in the view of Rodden, our federal system can truly be characterized as “fend-for-yourself federalism.“ From this standpoint, federal and state and local governments will be like fiscal ships passing in the long night, free to make difficult choices with little or no mutual influence or interference. But this perspective is incomplete. The seeming independence of budgetary policy making among governments in the United States belies their growing fiscal interdependence. In fact, the spending and revenues of different levels of government have become increasingly 20 intertwined. State and local governments, employing nine times as many employees as the national government, have become the real workhorses of public governance. They are vital partners in implementing many major federal programs in the United States, including those involving welfare, health care and environmental protection. Federal reliance on state and local capacities has accelerated in the past five years, bringing new tensions. Federally devised efforts have extended into policy areas once controlled primarily by lower levels of government – elections administration, fire departments, educational quality and motor vehicle licensing, among others.26 State and local governments have become more dependent on federal aid to fund key services. Federal grants had grown to comprise 19.8 percent of state and local revenues, according to Census data. In an historic first, federal government assistance to states and local governments supplanted sales, property, and income taxes as the biggest single source of revenue for state governments. However, in contrast to general revenue sharing programs found in nearly all federal systems, nearly all of the more than 900 federal grants are conditional and restricted to narrow purposes. Federal preemptions of state-local tax bases have also limited states’ capacities to handle expanded responsibilities from federal mandates and policies. State and local sales and use tax revenues have been eroded by the rapid growth of remote internet sales – an area which the Supreme Court has ruled off limits to states unless Congress passes new legislation. This federal regime has not only had an impact on states and local governments, but also has established an uneven playing field where businesses offering products through remote sales gain tax-free advantages over traditional brick-and-mortar retailers. 21 As the foregoing suggests, unilateral actions can create imbalances in any interdependent system. Unilateral actions risk overgrazing the “fiscal commons” -- the fixed resources available to each level of government as well as business entities and other taxpayers. In the case of federal or state governments, this unilateral behavior often takes shape by way of spending mandates (more resource demands on the commons) and revenue limitations (more fences). These actions have the effect of both limiting total state and local revenues as well as encumbering the use of those revenues for federally defined purposes. Imbalances can also result when governments separately impose tax burdens on the private economy without carefully considering their aggregate impact on economic efficiency and equity. As all levels of government face common fiscal challenges in the future, how will governments respond? While this is difficult to predict, we can suggest three potential approaches: Go-it-alone – comparable to the old dual federalism model, each level of government develops approaches to deficits on their own. While easier to achieve politically, such approaches will fall short in their impact on the economy and on policy effectiveness. For instance, solving the fiscal costs associated with health care is most efficiently accomplished through concerted action. Each government can strike their own deal but at a disadvantage when dealing with a complex national industry. Similarly, extending the sales tax to the internet can only be addressed through concerted national action by states working collectively. Each state attempting to tax remote sales risks violating Supreme Court rulings as well as suffering from opportunistic actions of other states courting national businesses through lower taxes. 22 Fiscal buck passing and off loading – federal or state or local governments can off load their fiscal problems by passing them off to other governments in our system. The unfunded mandate requiring states to spend nearly $11 billion to change drivers licenses under the Real ID Act of 2005 is one example of how the federal government can abuse its constitutional supremacy to pass costs to other governments in our federal system. Similarly, states impose unfunded mandates and preemptions on local governments, while both state and local governments can abuse federal grant funds intended for specific purposes by using them to replace their own funds, resulting in the undermining of federal program goals. Fiscal collaboration - governments can join together in developing common, solutions to common problems. Health care is one obvious example. The passage of legislation that yields real cost savings in the delivery of health care would constitute such an approach, with savings for all governments involved in financing health care. We might expect federal deficits to serve as an inflection point in intergovernmental finance, prompting national governments to take unilateral actions centralizing revenues and shifting costs on the state and local sector. Indeed, federal fiscal actions have imposed such costs on the state and local sector. While national officials might be expected to shift costs to states and localities during times of deficit reduction, these are not the only times when fiscal loads are passed across boundaries. During a time of budget surplus in his first year in office, President George W. Bush succeeded in gaining adoption of record income tax cuts which had the effect of reducing revenues for the majority of states whose tax bases are linked to the federal base. Moreover, the 2001 tax legislation phased out the federal estate tax, undercutting a long-standing 23 federal-state partnership, leaving a $9 billion hole in state revenues, Congress neither considered nor requested any analysis of the potential fiscal impact of its proposals and actions on states.27 Recent proposals to resolve long term federal deficits proposed by the Simpson-Bowles Commission in 2010 had a unilateral centralizing thrust. Plugging a $4 trillion federal fiscal gap, the commission reached into state and local revenue systems for savings, proposing the elimination of state and local tax deductibility as well as the tax exempt bond. 28Tax-exempt debt had helped state and local governments reduce their borrowing costs by 20% to 50% and played a critical role in financing much-needed infrastructure improvements throughout the nation.29 It is not surprising that the predominant members of the Commission were federal fiscal officials, with no representation from state and local governments. The 2011 Budget Control Act imposing new caps and sequesters on defense and domestic discretionary spending also have potential negative fiscal consequences for state and local government grants funded by discretionary appropriations. As the chart in Figure 3 shows, domestic discretionary is scheduled to fall below its modern low in the next several years, absent actions by the Congress. While conventional wisdom suggests that any federal system would have incentives to centralize when the fiscal going gets tough, at times national governments can see it in their interest to engage in fiscal collaboration. After all, unilateral federal actions jeopardize the state and local support and active partnership that is so essential to the successful implementation of nearly all federal domestic initiatives. A healthy federal system in fact should provide subnational governments with sufficient leverage to prevent unilateral centralization by national governments. When all governments in our federal system suffer from common maladies, joint solutions can be more effective and legitimate. 24 Other systems have followed the fiscal collaboration model when crafting tax and fiscal policy. For instance, nearly all OECD nations have a national consumption tax, or a value added tax (VAT); the United States is the only major advanced nation without a national consumption tax. When compared with state sales taxes, a VAT has several advantages, including a national and international reach into the service economy and revenue potential that could go a long way toward filling fiscal gaps at all levels of government. Absent an intergovernmental partnership, the danger to the states from a national consumption tax is very real. A federal government desperate to solve its own billowing deficits could enact a consumption tax unilaterally that would threaten to undermine state sales taxes. However, many federal systems have collaborated with subnational governments to ensure that these units could either piggy back on the expanded consumption tax base or realize proceeds allocated from the collections from this tax. In Australia, the states supported national adoption of a new consumption tax to replace a series of inefficient wholesale taxes. States were able to replace these outmoded taxes by working with national officials to gain the proceeds of the revenues of a new national consumption tax administered by the national government, but reallocated across the states through a complex fiscal equalization formula. Whether states piggyback or gain revenues through such a formula, collaboration between national and state officials is absolutely essential to realize these fiscal reforms. 30 Conclusions The federal system faces challenges anew with each generation, to paraphrase Woodrow Wilson. Past generations were able to work through that system to achieve historic economic recoveries in the New Deal as well as broad based reforms in national policies epitomized by the Great Society. More recently, that governance capacity has been undermined by tensions 25 between central and subnational governments, as well as polarization that have eroded cooperation among the states themselves. Against this backdrop, the national response to the Great Recession through the stimulus and other fiscal rescue measures has to be considered a great policy success story. Hobbled by institutional and political conflict, national leaders rose to the challenge by providing fiscal stimulus that saved millions of jobs. Combined with the bailouts of financial institutions and other major companies, the federal interventions may have saved the economy from a serious Depression. However, the nation’s ambivalence about federal action in the economy was revealed by the rapid pivot toward fiscal consolidation at a time when the economy was still operating well below capacity. The shift toward fiscal consolidation, while prolonging the recession, nonetheless lightened the federal balance sheet by reducing long term deficits and debts going forward. For the intergovernmental system, the early stimulus was the best of times, illustrating national policymakers working in effective partnerships with state and local counterparts to cope with fiscal and economic stress in the worst of times. However, the turn toward fiscal consolidation reflected a federal system in conflict, as the federal government imposed cuts without consultation or reflection on their effects on hard pressed state and local budgets. Going forward, all levels of government are sailing into troubled fiscal waters stemming from common challenges of aging populations, rising health care costs and slower growing revenues. At the very time when fiscal collaboration and joint policy is called for to resolve vexing fiscal challenges, the federal system has lost much of its capacity for institutional collaboration and renewal. National institutions that once harbored dialogue and brokered 26 negotiations across levels of government have atrophied or been abolished. Congress and the President have both deemphasized institutions that focused on the federal system, whether it be subcommittees dedicated to those issues or major staff in the Office of Management and Budget that provided stewardship for federal grants. The elimination of the Advisory Commission on Intergovernmental Relations epitomized the eclipse of cooperative federalism, reflecting a turn toward coercive and contentious federalism that dominates today. At a time of polarization among parties unlike any seen in over a hundred years, such a neutral policy institution is needed like never before. At a time when federalism has become a secondary value that often is trumped by ideological or party attachments, expert based institutions that can transcend short term political passions are needed to highlight long term perspectives and values. The same forces of polarization have weakened the institutional capacity of state and local government interest groups, neutering their ability to even take positions on the key issues affecting the federal system. Fend for yourself federalism appears to be in the offing for years to come. While many would applaud the self reliant nature of our states and localities, serious doubts remain whether such a splintered federal system is equal to the fiscal and governance challenges in the coming decades. 27 Table 1: Impact of Great Recession on State and Local Revenues (in Billions), 2007-2010 2007 General Revenue Grants from Federal Government General Revenue From Own Sources Taxes Property Sales & Gross Receipts General Sales Individual Income Corporate Income Charges and Misc. General Revenue 2010 % Change 20102007 2,329.4 2,502.10 7.4% 464.6 623.7 34.2% 1,864.7 1,878.3 0.7% 1,283.3 388.7 440.3 300.5 290.3 60.6 1,269.60 441.7 431.2 284.9 260.3 42.7 -1.1% 13.6% -2.1% -5.2% -10.3% -29.5% 581.5 608.7 4.7% Source: US Bureau of the Census, Census of Governments, State and Local Finances Summary 28 29 Table 2 - Major Grant Programs in the Recovery Act Source: http://www.whitehouse.gov/omb/budget/fy2010/assets/crosscutting.pdf, page 109. 30 Figure 2 31 Figure 3: State Patterns of Medicaid Expansion and Health Care Marketplaces 32 Figure 4 33 Figure 5 State and Local Operating Balance as share of GDP 34 Endnotes National Governors’ Association and National Association of State Budget Officers, Fiscal Survey of States, June 2010, pp. 1,53. 2 Harold Wolman, National Fiscal Policy and Local Government during the Economic Crisis (Washington: German Marshall Fund, 2014), p. 20. 3 George Mason University Center on the Public Service, http://fiscalbankruptcy.wordpress.com/the-reports/ 4 Council of Economic Advisors, Economic Report of the President, 2014, table B-24. 5 National Conference of State Legislatures, State Budget Update: March 2011 (Washington: NCSL, 2011), p. 8. 6 Lucy Dadayan and Donald J. Boyd, “The Depth and Length of Cuts in State-Local Government Employment Is Unprecedented” Jan 2013. 7 Paul Posner and Jon Blondal, “Democracies and Deficits: Prospects for Fiscal Responsibility in Democratic Nations,” Governance 25 (January 2012): pp 11–34. 8 David Beam and Timothy Conlan, “Grants,” in Lester Salamon, ed. The Tools of Government (New York: Oxford University Press, 2002). 9 For more details, see Timothy Conlan, Paul Posner, and Pris Regan, “Implementation Networks and Shared Governance in the U.S. Intergovernmental System.” Paper delivered at 2012 Annual Meeting of the American Political Science Assn. 10 U.S. Government Accountability Office, Recovery Act: States’ and Localities Uses of Funds and Actions Needed to Address Implementation Challenges and Bolster Accountability, GAO 10-604, p. 6. 11 Samuel H. Beer, “Federalism, Nationalism, and Democracy in America,” The American Political Science Review , Vol. 72, No. 1 (Mar., 1978), pp. 9-21. 12 Timothy J. Conlan and Paul L. Posner, “Inflection Point? Federalism and the Obama Administration,” Publius: The Journal of Federalism 41 (Summer 2011). 13 Karl Kurz, “ A Significant Decline in Divided Government” in The Thicket at State Legislatures, Nov 7, 2012. 14 Stan Dorn, Megan McGrath, and John Holahan, What Is the Result of States Not Expanding Medicaid, (Robert Wood Johnson Foundation and Urban Institute, August, 2014), pp. 1-2. 15 Sean Nicholson-Crotty, “Leaving Money on the Table: Learning from Recent Refusals of Federal Grants in the American States.” Publius: The Journal of Federalism 42 (2012): 449-466. 16 Georgetown University Climate Center, Key Issues for States in EPA’s Clean Power Plan Proposed Rule, June 13, 2014 17 Congressional Budget Office, Budget and Economic Outlook, 2014, February, 2014. 18 Congressional Budget Office, The 2013 Long Term Budget Outlook, September, 2013 19 U.S. Government Accountability Office, State and Local Governments’ Fiscal Outlook, April, 2013, GAO-546SP 20 Alicia Munnell, Jean-Pierre Aubrey and Laura Quimby, The Impact of Public Pensions on State and Local Budgets (Boston: Center For Retirement Research, October, 2010) 21 William F. Fox, “Eroding Sales Tax Base: The Effects of E-Commerce,” (Knoxville: Center for Business and Economic Research, 2011), p. 2. 22 Raymond Scheppach and Frank Shafroth, “Intergovernmental Finance in the New Global Economy” in Timothy J. Conlan and Paul L. Posner, Intergovernmental Management for the 21st Century (Washington: Brookings, 2008), p. 58. 23 Daniel Zibbitt, “Between Centralization and Federalism in the European Union”, in Paul E. Peterson and Daniel Nadler, eds., The Global Debt Crisis: Haunting U.S. and European Federalism (Washington: Brookings, 2014), p. 129. 24 Jonathan Rodden, Hamilton’s Paradox: The Promise and Perils of Fiscal Federalism (New York: Cambridge University Press, 2006) 25 Richard Simeon, James Pearce and Amy Nugent, “The Resilience of Canadian Federalism” in Peterson and Nadler, The Global Debt Crisis, p. 218 26 Paul L. Posner, “Mandates: The Politics of Coercive Federalism,” in Timothy J. Conlan and Paul L. Posner, Intergovernmental Management for the 21st Century (Washington: Brookings, 2008). 27 Paul L. Posner and Frank Shafroth, Deficits All Around: The Need for Fiscal Collaboration (Fairfax, Va: George Mason University Center on Public Service, March, 2011) 1 35 28 National Commission on Fiscal Responsibility and Reform, Moment of Truth, 2010. Lynn Hume, “Vote for Deficit-Cutting Report Falls Short,” Bond Buyer, December 6, 2010 30 Harley Duncan, and Jon Sedon, “Coordinating a Federal VAT With State and Local Sales Taxes”, Tax Notes, 2011. 29 36