Budgets

advertisement

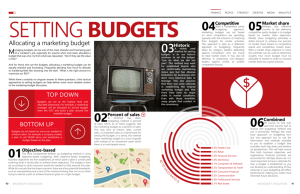

IB Business and Management 3.4 Budgeting Learning Outcomes • To be able to explain the importance of budgeting for organisations • Calculate and interpret variances • Analyse the role of budgets and variances in strategic planning What is a budget? • A budget is a financial plan for costs and/or revenues for a given future period of time. • Budget holders will be given responsibility for different areas of the business UK Government Budget 2013 What would the benefits of creating a budget be? BENEFITS OF BUDGETING Why set budgets? • To control (reduce) expenditure • To forecast outcomes • To allocate resources • To promote forward thinking • To set targets in numerical terms • To assign financial responsibilities to budget holders • To provide motivation for managers • To improve efficiency • To evaluate performance (compare actual performance against the budget ) Types of Budget Sales Budgets Expenditure Budgets Master Budget Sales Budgets A sales budget is the budget for sales revenue. This could be broken down into: - Product Lines - Departments - Branches • What information would be needed in order to produce a sales budget Expenditure Budgets An expenditure budget is the plan for how much will be spent. This will be broken down into different categories. What type of expenditures will businesses have to budget for? Key Expenditure Types • • • • • • • • Staffing Training Marketing Utilities Rent Maintenance Equipment purchase Administration Raw Materials Contingency How could these types be broken down even further in order to create a detailed budget? Master Budgets • The master budget pulls together all of the other budgets to provide an overall plan. • As all costs and revenues are now planned for, budgeted profit/loss figures can be determined How are budgets set? APPROACHES TO BUDGETING Top Down Budgeting Budgets are prepared by top management and imposed on the lower layers of the organisation. What are the advantages/disadvantages of this method? Bottom up Budgeting Supervisors and middle managers prepare the budgets and then forward them up the chain of command for review and approval. Zero budgeting Zero based budgets exist when budgets are automatically set at zero and budget holders have to justify their case to receive any funds. What would be the advantages and disadvantages of using this approach? Zero budgeting • Pros: • Zero-based budgeting represents a move towards allocation of resources by need and benefit. • It creates a questioning attitude rather than one which assumes that current practice represents value for money. • It focuses attention on outputs in relation to value for money. • It leads to increased staff involvement which may lead to improved motivation and greater interest in the job. • Cons: • Effective zero budgeting requires considerable management time spent in identifying and justifying the appropriate budget level. • Bigger budgets may go to those more persuasive managers rather then those most in need of funds What information would managers need to know before they can set budgets for the following year? PRE-BUDGETING RESEARCH Setting budgets • Many firms will work on last years budget and other historical data and try and build in adjustments to take account of – expected changes in demand – price changes – cost rises This is known as Incremental budgeting Other considerations • • • • Available finance Company objectives Planned purchases Negotiation process Budgets for New Businesses Budget setting will be harder for a new business as they don’t have access to historical data. What information will they use instead? Information about competitor products Market research Entrepreneur expertise and experience Instinct based on market knowledge BUDGETARY CONTROL – VARIANCE ANALYSIS Variance Analysis • Budgetary control involves corrective measures being taken to ensure that actual performance meets budgeted performance • VARIANCE ANALYSIS is the practice of examining any differences between budgeted and actual performance and investigating causes • Corrective Action can be taken or amendments to the budget made Budgeting – An ongoing process Budget variances A Variance is the amount by which the actual result differs from the budgeted figure. • Variance = Actual outcome – Budgeted Outcome • A favourable variance is one that leads to higher than expected profits. • An adverse variance is one that reduces profit. Example Budget - January Budgeted Actual Variance Sales 5,000 5,020 20 Stock 1,050 1,060 10 Wages 1,400 1,370 30 Salaries 400 410 10 Power 200 200 0 Profit 1,950 1,980 30 F/A Favourable Unfavourable Favourable Unfavourable Favourable Task • Watch the video clip ‘Variance Analysis’ (7 mins) Analysing Variances What could the potential reasons be for the following variances? And what should be done? More money has been spent of stock than budgeted for Wage costs are lower than budgeted figures Sales figures are lower than budget Task Complete the worksheet Edex 6 Budgets and Variances POTENTIAL PROBLEMS WITH BUDGETING Important issues regarding budgets…. • What happens if there is an unexpected change that affects costs or revenues? • What happens if a budget holder spends less than their budgeted figure? • What happens if all of the budgeted amount has already been spent way before the end of the year? • How can it be ensured that budgets are fairly allocated? • What happens if an unexpected opportunity has arisen but it has not been budgeted for? Task – In pairs Write a list of: • Benefits of budgeting to a business • Potential Problems with budgeting Summary • Watch the video ‘Accounting and Finance - Budgeting’ (6 mins) Add any additional points to your notes Do you have any further questions relating to budgeting? Evaluation • A useful management tool. And help to COORDINATE, CONTROL and MOTIVATE • They force businesses to plan ahead and think about the needs of the business • Thought needs to be given to the budgeting process in order to avoid problems associated with budgeting • Good budgets should be flexible and reviewed regularly Homework Task • Answer questions a-c • Grimsby and Dyke There are no past IB questions on budgeting (apart from explaining benefits) Is this a sign it is due to come up soon?