Five-Year Marketing Plan

advertisement

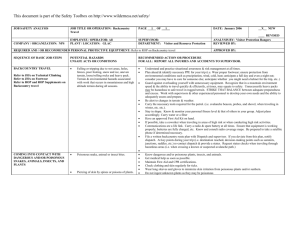

FIVE-YEAR MARKETING PLAN Prepared by Victor Collum March 2012 Table of Contents Executive Summary 3 Company Description 5 Strategic Focus and Plan 6 Situation Analysis 8 Market-Product Focus 14 Marketing Program 17 Financial Data and Projections 22 Organization 23 Implementation Plan 24 Evaluation 25 Appendix A. Biographical Sketches of Key Personnel 27 2 Executive Summary Backcountry.com is the leader in online retailing for high-end outdoor products. We operate our core website, backcountry.com which offers our full array of products and then several other specialty websites focused on niche outdoor sports, such as skiing, cycling, and extreme sports. In addition to our regular-price websites, we also operate several “deal of the day” websites that sell one item at a time, until they are gone at well below market pricing to create buzz and clear out old merchandise taking up space in our warehouses. Backcountry.com has been successful in the past and enjoys a dominant place in the outdoor retail segment. However, the barriers to entry are being lowered every day as technology advances and new competitors are coming online at a more frequent rate than in years past. As a result, backcountry.com is seeking to grow its current market share. To do this we will be launching three new genre-specific segment websites before the year 2017. Simultaneous to the new website launches, we will promote both the Backcountry.com website as well as our three new specialty websites through three mediums. First, for the next 5 years we will be a key sponsor of the Winter X-Games aired on the ESPN television network every February. Second, we will purchase full page magazine advertisements in popular 3 magazines such as Powder, Transworld, and Backcountry. Thirdly, we will bolster our social media campaign by offering our customers frequent coupons and promotional offers through the most popular social media sites, such as Facebook, Twitter, and Pintrest. The marketing budget of $4 million annually will help us grow our sales by 10% year over year for the next five years resulting in an increased profit of $1.089 billion for the five year period. Simultaneously, we will have gained additional market share and will possess a market share of 30 percent in the outdoor gear retail segment. 4 Company Description Backcountry.com is an online seller of high-end outdoor products and is focused on serving the hardcore outdoor-gear enthusiast. Their websites offer the ability for enthusiasts to purchase hard to find high-end products, obtain technical information about these products, and connect with other gear enthusiasts. Backcountry.com was founded in 1996 by Jim Holland and John Bresee as a business venture aimed at combining their love of backcountry skiing together with e-commerce. The roots of the company started with a $2,000 investment by the two co-founders and a converted spare bedroom as their office space. The first sale, an avalanche beacon, occurred in 1997 and since then, the company has seen triple digit growth, as well as the move into new headquarters and an advanced fulfillment center in Salt Lake City, Utah. The company has come a long way from that first sale and now offers nearly 1,000 separate brands and touts a lofty average of 13 million unique visitors each month to its websites. Backcountry.com remains focused on the outdoor gear enthusiast, and is growing in three primary directions to serve these customers: First, they are focused on building customer value and building relationships through their online communities. Second, expansion is underway into genrespecific websites dedicated to enthusiasts of a particular sport, such as cycling, skiing, or snowboarding. Finally, they are continuing to increase the 5 number of products available through all of their websites. This marketing plan outlines how Backcountry.com will achieve a market share of 30 percent in the Outdoor Gear retail segment. Strategic Focus and Plan This section covers three aspects of corporate strategy that influence the marketing plan: (1) the mission, (2) goals, and (3) core competency/sustainable competitive advantage of Backcountry.com Mission The mission of Backcountry.com is to be “The Best Core Gear Ecommerce retailer.” Currently, Backcountry.com is in a growth phase and is striving to increase the number of customers that visit and purchase items from its websites and increase its market presence in the Outdoor Gear retail segment. Goals For the coming five years Backcountry.com seeks to achieve the following goals: Nonfinancial goals 1. Increase the number of unique visitors each month to its websites to an average of 16 million each month. 2. To increase the number of brands offered to 1500. 3. To achieve a customer satisfaction rating of 99 percent. 6 4. To increase online search engine conversion rates to 40 percent. 5. To launch 3 new genre segment websites. 6. To double the number of commission based athletes providing content and consumer advice. Financial goals 1. To obtain a market share of 30 percent in the Outdoor Gear retail segment. 2. To increase sales by 15 percent. 3. To increase revenues by 10 percent each year. Core Competency and Sustainable Competitive Advantage In terms of core competency, Backcountry.com seeks to achieve a unique ability to create new product sales by (1) attracting new customers through promotion of the Backcountry.com websites through social media platforms and through the use of Search Engine Optimization (SEO) directing new web traffic to the websites that we operate and (2) serving as the experts for the products we sell. To translate these core competencies into a sustainable competitive advantage, the company will work closely with its social media and website teams to bolster the social media conversations about the company and continue to increase the use of SEO keywords. We will also continue to increase sponsorship of Backcountry.com athletes that provide technical 7 information and product reviews. The ability for customers to be directed to one of the Backcountry.com websites easily and then have an expert’s opinion confirming their product selection will provide us with a distinct and sustainable advantage. Situation Analysis This situation analysis starts with a snapshot of the current environment in which Backcountry.com finds itself by providing a brief SWOT (strengths, weaknesses, opportunities, threats) analysis. After this overview, the analysis probes ever-finer levels of detail: industry, competitors, company and consumers. SWOT Analysis Figure 1 shows the internal and external factors affecting the market opportunities for Backcountry.com. Stated briefly, this SWOT analysis highlights the great strides taken by the company since its’ first product was sold online. Figure 1. SWOT Analysis for Backcountry.com Internal Factors Strengths Management Highly skilled and tenured management team. Offerings Large offering of regular use items as well as hard to find products. Marketing High visibility on search engines through 200,000 keywords in operation for SEO practices. Weaknesses Very large online competitors can operate under the economies of scale principle to offer customers wider selection and lower prices. Compared to some online retailers, the company is less well know and prevalent in customers minds. 8 Personnel Finance Partnerships Fulfillment External Factors Consumer/Social Competitive Technological Economic Legal/Regulatory Highly engaged, internet savvy, product experts. Continued revenue growth and financial backing from parent company. Relationships with technology consultants provide internet visibility driving conversion rates. New fulfillment center coming online in 2012. Opportunities More households are purchasing items online than ever before. Also, positive referrals can improve brand recognition and perception of company. Operation costs are low since there are no storefronts to maintain and staff. Advances in customer service management and supply chain and delivery methods will improve customer value. Customers’ ability to purchase products is consistent with disposable incomes. The current legal and regulatory environment is favorable towards online retailers. Gaps can occur when key employees leave. The cost of inventory limits the liquidity of the company. Dependence on the assistance of partners could prove problematic if the relationship sours or poor performance is provided. The size of current warehouses determines the capacity for product delivery and slow down delivery times. Threats Negative social media reviews could damage brand reputation and perceptions. Larger online retailers can offer wider product selection at lower prices. Also, some customers want to touch and feel products before they purchase an item. Customers can easily search for competitors and compare product prices. Customers’ ability to purchase products is consistent with disposable incomes. Changes to tax laws and eTailer regulations could discourage consumer purchases. Additionally, tariffs and taxes in foreign countries could be prohibitive to international orders. 9 Weather/Climate Favorable weather can help promote certain sport segments. For example large snowfalls encourage the purchase of skiing and snowboarding equipment. Suppliers/delivery Advances in supply chain services technology allow for quick and relatively inexpensive delivery to customers. Poor weather conditions may limit seasons for certain sport segments and seasonal trends may limit purchasing behaviors of customers. Bad weather can delay shipments from suppliers and to purchasing customers. In the company’s favor internally are its strengths of an experienced and tenured management team and highly technical and well-trained staff. Additionally, the company was able to make early gains in the Internet space through the use of Search Engine Optimization (SEO) and now has over 200,000 keywords that help direct Internet traffic to the backcountry.com websites. Favorable external factors (opportunities) include the increasing trend of households purchasing more items purchased via the Internet. Additionally, there are very few key competitors in the online retails segment dedicated to outdoor products. Among unfavorable factors, the main weakness for Backcountry.com is its relative size compared to other online retailers. The size of these competitors allows them to offer a larger product array and also to sell at lower prices due to the volume of product that is sold. Additionally, the these larger on-line retailers are often household names which are more prevalent in consumers’ minds before they think of Backcountry.com 10 Industry Analysis: Trends in the online retail space The future for online shopping looks bright as more and more consumers are finding that the simplicity of online shopping, the wide array of products available, and lower prices are great reasons to purchase online as opposed to from a physical store. Global E-Commerce revenues are estimated to be 680 billion and are expected to continue to grow. In 2011, 148 million US consumers ages 14 and older made at least one purchase online. It is estimated that nearly 30 million more consumers will join the ranks of online buyers by the year 2015. While more consumers are purchasing items online, the internet is also lowering the barriers to entry, which allows new competitors to start competing in a global marketplace more quickly and at lower costs than ever before. Competitor Analysis The largest and most substantial competitor in the online retail space is Amazon.com. Amazon.com revenues were $48 billion in 2011 and has over 56,000 employees. Amazon.com is the Wal-Mart of the Internet and focuses on low costs, and a large product offering. However, when customers are looking for specialized or specific products for outdoor activities, Amazon.com sometimes will fall short, as it does not carry these unique and specialized products. 11 The next closest competitor is Recreational Equipment Incorporated (REI), whose product offerings are much more closely aligned with those of Backcountry.com. Although REI does have a website to facilitate customer orders and extend their sales, their primary focus is on their physical storefronts. REI currently operates 110 retail stores in 30 states and roughly opens four to six new stores each year. REI's sales revenue was 1.66 billion in 2010. Sports Authority is also a primary competitor and operates 460 stores in 45 states. Like REI, Sports Authority does sell products online, but focuses on its physical storefronts as their primary revenue driver. Sports Authority has revenues of 3.05 billion and has 14,240 employees. Company Analysis The company that was originally founded by Jim Holland and John Bresee has since been sold to new owners and also is under new leadership. CEO Jill Layfield started with Backcountry.com in 2004 and has substantial experience in the ecommerce arena. Then in 2007 Liberty Media Corporation purchased the controlling interests in Backcountry.com. The purchase has allowed Backcountry.com to have access to large cash reserves to assist with the purchase of technology needs and to help facilitate the purchase of new warehouses and order fulfillment centers. While the company has new owners, the focus has remained on Internet technology and online marketing especially in the social commerce 12 area. The highly trained staff prides themselves on their unwavering passion for the outdoors and their love of gear and sharing it online with customers. Customer Analysis In terms of customer analysis, this section describes the characteristics of customers that purchase from Backcountry.com. Consumer Characteristics. Demographically, consumers representing a broad range of socioeconomic backgrounds purchase outdoor products. However, there are three main categories of consumers that purchase from Backcountry.com: Weekend warriors – This is the casual product user and are outfitting themselves for weekend get-a-ways or fairly short trips. This group of customers are predominantly married with children and are interested in product safety, cost effectiveness, and desire a fairly high performance level out of their products. This group of customers is approximately 60% male and 40% female. Expeditionary customers – This group is the hardcore sport enthusiast. These customers are less concerned with the price of a product and are more interested in advanced performance and safety in the products that they need for well-planned vacations and expeditions. Typically these users are well financed either by professional sponsors or are relatively affluent. This group is predominantly male ages 20-50. 13 One purchasing individual on behalf of the specific group typically represents group purchases – this category of customers. The most common groups requiring outdoor products are adventure camps purchasing supplies for their activities, Boy/Girl Scouts troops outfitting for upcoming expeditions, and lastly, some governmental purchasers supplying community programs items and a few rescue/emergency departments such as fire and rescue teams. The demographics for these groups vary based on the purchasing organization however; we do see a large increase in this segment for products for children and teenagers. Market-Product Focus This section descries the five-year marketing and product objectives for Backcountry.com ant the target markets, points of difference and positioning of its websites and products offered. Marketing and Product Objectives Backcountry.com is intent on building on its established brand reputation and position in the outdoor product e-tailing marketplace as well as expanding into new niche website categories. Core websites. Sales through the core Backcountry.com website and the other core genre websites will be grown by increasing the number of products available on these websites, additional product reviews by the “gear gurus” as well as expansion of Search Engine 14 Optimization and keywords to drive web traffic to the core websites. Additionally, non-core websites will also help direct traffic to the core sites and help build brand awareness through repeat visits. Deal of the day websites. The deal of the day websites will help to limit the number of items that have proven to be slow sellers and are taking up valuable inventory space. These websites will focus on selling one product a day well below our standard price of the item to recover our costs and to clear warehouse space. As an additional benefit, the increased daily traffic generated from the deeply discounted products will help build repeat visitors to the deal of the day websites and will also help to brand the core websites in the customers’ minds for future purchasing needs of regular priced items. Links on these pages will also redirect visitors to the core websites further helping to generate revenue. New websites. The Backcountry.com brand will continue to expand through the addition of three new genre segment websites. The launch of these websites will be made in successive years 2, 3, and 4. Target Markets The primary target market for Backcountry.com are households with one to three people, where both adults are between the ages of 20 and 40 and have a combined income of above $80,000 per year. These younger 15 households are more likely to be active and with a higher disposable income are more likely to be able to afford the cost of high performance products. Points of Difference The “points of difference” – characteristics that make Backcountry.com unique relative to competitors fall into two key areas: “We use the gear we sell.” All of the employees at Backcountry.com are encouraged to be active outdoor enthusiasts and are regular contributors to the product review and community forums surrounding the products. Recent website enhancements also allow for customer service representatives to chat live with customers on the websites about the products that they are considering 24 hours a day. With this high level of communication, customers can be comfortable in their purchase decisions, as the experts also use and recommend the same products. Convenience – The gear that we sell is often times difficult to find and highly specialized and are all offered through the core websites. Additionally, the current capability of our fulfillment center and overnight carriers, such as FedEx, and UPS allow for quick next day or two day delivery of products to customers front doors. Positioning In the past, consumers looking for high-end outdoor products have been unable to find their products, as many of those products were not 16 carried by traditional sporting good stores. Additionally, information about these products was hard to find and customers didn’t have the details necessary upon which to base their purchasing decisions. Backcountry.com makes it easy for customers to find products and takes the guesswork out of product selection by offering expert information on all of the products offered. Marketing Program The four marketing mix elements of the Backcountry.com marketing program are detailed below: Product Strategy After first summarizing the current product lines, the approach to product development and website design is discussed. Product Line. Backcountry.com is our core site, which offers every single brand and product that we sell. From that point forward, our websites begin to divide the products that we sell into categories for specific customer segments and product groups: RealCyclist.com – Cycling gear for the average and performance rider. Bonktown.com - High-end road biking gear to the expert cyclist. Dogfunk.com – Snowboarding gear for the powder obsessed. HucknRoll.com - Mountain biking products and gear. Additionally, our deal-of-the-day websites sell discontinued and 17 clearance items at deep discounts. These discounts will create excitement and customers will in turn talk about the great bargain that they found and will help to foster repeat customer visits: WhiskeyMilitia.com– One deal at a time for extreme sports and the youth market. SteepandCheap.com - One amazing ski gear deal, one item at a time until it's gone. Chainlove.com - One deal at a time for the avid cyclist. DepartmentOfGoods.com –Offering old and discontinued products. (Formerly Backcountryoutlet.com) Website Design – We sell fun products that make up part of an active outdoor experience. Our web design brings the thrill and excitement of outdoor sports to our websites and the products that we offer. Our continuing website design will focus on displaying the products we sell in action photography in the outdoors, as well as, combining a technological feeling to the website, our new web design theme will be “outdoor tech.” Price Strategy The pricing strategy for Backcountry.com can be divided into two primary strategies. The first strategy covers our core websites and the second pricing strategy covers our clearance and deal of the day websites. Core website pricing. Since we don’t have many of the overhead costs that typical physical location retailers have, such as the large cost of 18 storefronts, we are able to sell items lower than the Manufacturers Standard Recommended Price (MSRP.) We will typically price our items at 20% below the MSRP. Our key competitor in the online space is Amazon.com; we recognize that they are much larger and due to the scale of their operations, may be able to offer lower prices than we can. The selected price structure of 20% less than MSRP will allow us to be remain competitive with Amazon.com’s prices, however not necessarily always lower. Clearance and deal-of-the-day pricing. For our clearance and deal-ofthe-day websites, we will sell our products with a standard 5% mark-up above the cost that we paid for the item when purchasing from our suppliers. This pricing strategy will typically result in a net-loss on the majority of these items; however the strategy for these items is designed not to generate revenue on the particular items but rather create excitement and to draw traffic to our core sites where we receive a higher profit margin. Promotion Strategy Winter X-Games. We will become one of the primary sponsors of the ESPN X-Games that are held annually in February. This event has gained a large following and has benefited in popularity in recent years. The “2012 Winter X-Games telecast on ESPN earned a 1.2 U.S. rating and 2.015 million viewers, up 33% in ratings and 25% in viewership from 2011 year (0.9, 1.619M).” (http://www.sportsmediawatch.com/2012/02/ratings- 19 winter-x-games) The competition includes many sports that align perfectly with the primary demographic to which we cater our products. Sponsorship will include television advertisements in between events and will also include branding banners at the events. Social Media. We already have a team of employees manning the social networks, such as Twitter and Facebook, but we will be increasing the frequency of online coupons to our Facebook fans and Twitter followers. As an online retailer, our customers are online and when they visit their favorite social media sites, we know they are online at that very moment, but the key at that point is to drive traffic to our websites from the social media site that they are using. To that point, we will offer coupons to our Facebook fans and Twitter followers, which will not only create more traffic to our websites but also increase the number of purchased products. As an additional component of our social media content, we will begin publishing regular product reviews and stories about recent expeditions written by our sponsored athletes. We will post these reviews and stories on the Blog.Backcountry.com site and each post will include links to purchase the products being discussed. To bring web traffic to these blog posts, we will use our social media sites to promote these new articles. Advertisements in magazines. Lastly, our in-house marketing team will create several full-page advertisements to be placed in popular industry magazines such as Powder Magazine, Transworld, Rock & Ice, Backcountry 20 Magazine (not affiliated with Backcountry.com), and Cycling World. The advertisements in each magazine will be published a month before the key season for each sport segment and then through the duration of the season. For example, in Powder Magazine and Transworld, which are popular publications covering the skiing and snowboarding sports, we will begin advertising in November and end with the March issues coinciding with the end of winter in the northern hemisphere. Tradeshows and group presentations – We will continue to capitalize on the popularity and image that our professional athletes offer. We will begin attending outdoor industry tradeshows and conventions and will be conducting “meet and greet” sessions with our athletes at the Backcountry.com booths. Place (Distribution) Strategy Since we are an Internet retailer, we will sell all of our products on line through our websites. Once a customer order is received through any of our websites, that purchase will be sent directly to one of our new warehouses and state of the art fulfillment centers to prepare the order. The advances in inventory management at our new warehouses will allow us to ready our shipments for delivery to the package courier like UPS, FedEx, DHL and the United States Postal Service quickly and thus deliver the product to our customers’ front doors quickly. 21 Financial Data and Projections Past Sales Revenue Historically, Backcountry.com has benefited from a steady increase in sales revenue since its' founding in 1996. In 2007 and 2008 sales were lowered due to the slowing US economy. In 2009, sales revenue rebounded and has shown a general increase as the US economy has improved. Sales Revenues appear in figure 2. Figure 2. Sales Revenues 1405 1600 Ssaes revenues (000's) 1400 1125 1200 953 1000 800 600 400 405 153 503 207 200 0 2005 2006 2007 2008 Year 2009 2010 2011 Five-Year Projections Five-year financial projections for Backcountry.com appear below. These projections reflect the continuing the continuing growth trend in 22 orders purchased, as well as offered on our websites. Additionally, the on boarding of additional websites coming online in years 2013, 2014 and 2015 have been considered. Lastly, these figures reflect the cash expenditure to purchase the advertising mentioned in the Marketing Program section. Financial Element Orders Placed Net Sales Gross Profit Operating Profit (loss) Actual 2012 4268 1545 757 Year 1 2013 4699 1701 833 205 226 Projections Year 2 Year 3 2014 2015 5171 5691 1872 2060 917 1009 248 273 Year 4 2016 6262 2267 1111 Year 5 2017 6890 2494 1222 300 330 Included in the above figures are the assumptions of the $4 million dollar expenditure annualy for the marketing and advertising budget. Given the current average of $362 per customer order, if we can gain 11,050 purchases each year, we will break even on the marketing budget. However, our expectation is that the results will actually be much higher and that the advertisements will help contribute to annual increases year over year of 10% to our sales revenue. Organization The present organizational structure appears below in Figure 3. It shows the four key people reporting to the Chief Executive Officer, and the departments that report to each. Below the department levels are the full time and part-time employees of the company. Due to the seasonal demand 23 for many of our winter and summer based products, we maintain a core staff and supplement our workforce with temporary and part-time labor to mediate the seasonal spikes in volume. Figure 3. Organizational Structure Board of Directors Chief Executive Officer Chief Financial Officer Chief Technology Officer Chief Marketing Officer Finance Information Technology Marketing Chief Operating Officer Fulfilment Product Management Customer Support Merchandising Implementation Plan The creation of the three new niche websites should not be a very difficult task as we have experience building and launching these types of sites. We are fortunate in that our technical staff has launched niche websites already and the necessary programming can be replicated from our currently operational websites. The majority of the work will not fall in the realm of the Information Technology departments, but actually under the Merchandising and Marketing departments. Since we are launching new 24 genre websites, new relationships with product manufactures will need to be established. Additionally, the best method for marketing each product on its purchase page will need to be designed by our Marketing Team. In addition to the launch of the new websites, the purchase of television advertisements during the Winter X-Games will commence in 2013 and will continue each year through 2017. Recent rates for sponsorship of the X-Games varied from $1 to $3 million per year (http://emergingadvertising-media.wikispaces.com/X+Games+Ads). In anticipation of seeing this marketing plan out fully for the next five years, we will request a discount in the sponsorship rate for a guaranteed five year deal with the ESPN Network. We will also continue to build the Backcounry.com brand by purchasing full-page advertisements in popular periodical magazines focused towards our ideal customer such as Powder, Transworld, and Backcountry. Similar to the X-Games Sponsorship, we will work with these magazine publishers to secure bulk pricing for extended periods of time. Our annual budget for these periodicals annually is $1 million. Evaluation Monthly sales targets in terms of total numbers of orders placed have been established for Backcountry.com for each of the new websites as well as the existing websites. Actual order numbers will be compared with the 25 targets and tactical marketing campaigns modified to reflect the unique purchasing behaviors of customers in each genre specific market. As an additional evaluation tool, at the release of specific advertising such as the X-Games and magazine articles, we will look at website visits and sales before, during and after each advertisement to monitor the effectiveness of each advertisement. The end result of the actions described in this marketing plan will lead to increased sales, improved brand recognition and a 30% larger market share by the end of 2017 26 Appendix A. Biographical Sketches of Key Personnel Chief Executive Officer: Jill Layfield. In 2004, Jill Layfield stumbled upon a posting for a marketing position with a small eCommerce company called Backcountry.com and decided to send over her resume. Little did she know she’d not only uproot from the San Francisco bay area to Park City, UT, but that she’d also move up through the ranks from Backcountry’s Director of Customer Marketing role to become the VP of Product Development in 2009, COO in 2010 and CEO in 2011. Prior to joining the Backcountry team, Jill was with Shutterfly.com, where she managed customer acquisition, retention and loyalty, partner marketing, and retail business development programs. She’s also held positions with Cisco Systems, Infogear (a startup focused on the marketing for Internet appliances), and 8x8 (a manufacturer of videoconferencing products and a VOIP service provider). Jill graduated from Santa Clara University with a BA in Communications. Chief Financial Officer: Scott Klossner. Scott Klossner is the Chief Financial Officer at Backcountry.com. Scott has more than 25 years of financial and executive experience. Prior to joining Backcountry in 2005, he served as CFO and in other finance positions with HomeClub, SportsClub, Major Market, and Big O Tires. His expansive experience includes public offerings, Sarbanes-Oxley compliance, mergers and acquisitions, institutional negotiations, strategic planning and analysis, and productivity enhancement. Scott holds a BA in finance from the University of Utah and an MBA in finance and economics from the University of Southern California. 27 Chief Marketing Officer: Dustin Robertson. Dustin Robertson is a graduate of the University of Utah with a BS in marketing. Although he grew up in California and Georgia, Utah was the family ski destination each year which infused in him a desire to move west as soon as possible. He received a subsequent education in ski bumming from Snowbird, after which he was the sales manager of the Wasatch Canyon Reporter and Marketing Manager for Valassis Communications Inc. with direct responsibility for the Kraft, Kellogg's, and Nabisco accounts. Joining Backcountry.com was a perfect fit for Robertson to combine his marketing vision with his desire to be surrounded by outdoor oriented individuals. Dustin has sculpted his career and education around his passion for the outdoors and backcountry skiing specifically. However, he has recently turned his skiing focus back to his roots of alpine skiing as the new technology and equipment have finally reached his high standards. Chief Technology Officer: CJ Singh. CJ brings with him more than a decade’s-worth of technology prowess teamed with leadership and organizational integration experience earned at some of the country’s leading tech companies. Singh joins Backcountry.com after a two-plus-year stint at Synacor, most recently as Senior Vice President of Technology, where he focused on delivering highgrowth products and creating the technology vision to increase the scalability of the business. Prior to that, he spent three years as Director of Engineering and Product Development at Yahoo!, where he was responsible for leading the company’s development centers in Latin America. He’s also an Oracle alum, during which time he was integral in the creation of the now-ubiquitous Electronic Records and Electronic Signature (ERES) product, and was awarded two patents for innovative solutions created for XML record searching and XML-based security models. He holds a Bachelor of Engineering, Computer Science degree from Gulbarga University in India, and earned a Masters in Information Systems Management from Carnegie Mellon University. 28 General Manager, Bike: Brendan Quirk. Brendan Quirk co-founded CompetitiveCyclist.com in 2000. He served as its CEO until the company was acquired by Backcountry.com in 2011. CompetitiveCyclist.com was widely considered the leading online retailer of mid-tohigh end bikes and bike-related gear. Brendan holds a B.A. in English Literature from Swarthmore College and a M.A. in Creative Writing from University of Wisconsin-Milwaukee. A combination of his love of writing and his love of cycling is what originally inspired him to grow CompetitiveCyclist.com through an emphasis on technical and information-rich content. General Manager, Closeout: Sam Bruni. Sam Bruni has built and managed service and sales teams for fortune 500 companies such as AT&T, Bank of New York, and Direct T.V. In early 2000, Sam tenured with the Generations Network and Ancestry.com, where he grew their service and sales teams from 35 employees to more than 500. In 2003, Sam joined Backcountry.com as Director of Customer Experience. In 2008, he assumed the role of General Manager of ODAT (One-Deal-at-a-Time). In 2010, his role expanded and he was named General Manager of Closeout, overseeing all of the company's closeout stores. Sam regularly speaks as an expert on Customer Experience, Fraud Prevention, Employee Satisfaction, and Internet Business and Strategy. He has served as Vice President on the board of the ICSA (International Customer Service Association) UT local chapter. Vice President of Fulfillment: Jeff Carter. Jeff Carter is a native of Utah and the Wasatch Front. He left Utah to pursue a degree in Finance and Real Estate Management from Cal State University, Hayward. His career started and continued for 15 years with Mervyn's California in the Logistic Division where he managed almost every department in two of their state-of-the-art distribution centers. He also served on several internal improvement and community relations committees. Carter then took his expertise and drive to 29 the Sundance Catalog Company, spending two and a half successful years as manager over warehousing, distribution, and transportation. In joining Backcountry.com, Carter saw the future potential for the company as well as himself. Jeff is an avid hiker. In fact, when not at work 2-3 times a week he can be found hiking his favorite peak in the world, Lone Peak. In an effort to keep up with his three daughters, he gave up skiing two years ago and is now passionate about snowboarding. Needless to say he's committed to his family. Vice President of Merchandising: Mark Koppes. With more than 25 years of head-of-operations experience at some of the most renowned names in sports apparel, Mark Koppes joined Backcountry.com as Vice President of Merchandising in August 2010. When he came to Backcountry, Mark was fresh off a five-year stint at Columbia Sportswear, where he held three consecutive VP positions: Men’s Apparel, USA Apparel, and, ultimately, Global Apparel. To earn his big boss chops, he spent the 15 previous years at Nike. During the company’s heyday 90s, Koppes worked his way up from Product Line Manager, through high posts in merchandising and marketing at Nike Europe, to GM of Sport Apparel back at company HQ in Portland. Oh, and he started off his career at a little old retailer called Nordstrom. Vice President of Product Management: Jonathan Nielson. Technology has been the constant thread through Jonathan Nielson’s career. As VP of Product Management, he is responsible for championing user experience and the overall success of all of Backcountry.com's websites. He came to Backcountry in 2010 to focus on mergers and acquisitions and business strategy, and led the company’s successful acquisition and integration of Competitive Cyclist in 2011. Prior to joining Backcountry, Jonathan was part of eBay’s corporate development team, working on mergers and acquisitions and strategy across all eBay businesses (eBay, PayPal, and Skype), and globally as well. Before eBay, he was part of Piper Jaffray’s technology investment banking group. He began his career at Ancestry.com, working in various operations, marketing, and business development positions. Jonathan 30 earned a BS in Finance from Brigham Young University. Jonathan lives in Park City with his wife Brooke, and their two young sons, Jack and Blake. Co-founder and Executive Chairman of the Board: Jim Holland. Jim Holland is a two-time Olympian and six-time national champion Nordic ski jumper. Holland was a member of the US Ski Team for nine years. After graduating from the University of Vermont, Holland migrated to Utah and founded Wasatch Web Works, a Web development company. Holland then teamed with John Bresee to found Backcountry.com. Holland's focus on cost-effective retailing has led to exceptional yearover-year growth. Jim continues to be an avid athlete in all aspects. From rallying company Ultimate Frisbee games at lunch to long adventurous backcountry ski tours, Jim approaches everything outdoors with the same passion and focus that has made Backcountry.com the success it is today. Co-founder: John Bresee. John Bresee is a lifelong ski bum who has flipped burgers at Alta, washed dishes at Snowbird and taught skiing at Stowe. After the rockstar appeal of dish-washing wore off, he became a writer/entrepreneur. He launched the Wasatch Canyon Reporter newspaper, co-founded Backcountry.com and became editor of Powder Magazine. His work has been published in Bike, Skiing, Powder and other outdoor rags. John graduated from Johnson State College with a BA in psychology. John is a plainspoken commentator on the world of ecommerce and has presented at industry conferences like Internet Retailer Shop.org, Etail, and the RBC Tech Conference. John's passion for skiing has not waned with time as he can often be found near the front of the line as the lifts open on the deepest of powder days. Intensely fascinated by the power of the internet and the multitude of options it creates for business, he spends what little spare time he has researching the ends of the internet for the next wave. His hobby is helping entrepreneurs understand the power of the internet. Bibliography information located at: (http://www.backcountrycorp.com/corporate/section/0/aboutus_team.html) 31