Don't - NYU School of Law

advertisement

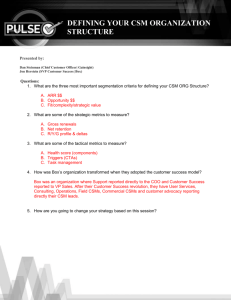

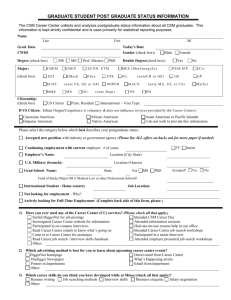

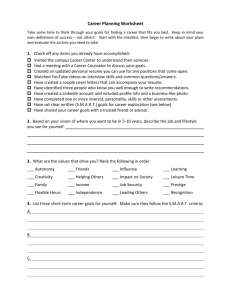

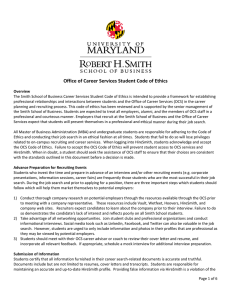

Office of Career Services Tax & International Tax Job Search Workshop 2013 1 Objective • Timing • Resources • Strategy 2 Role of the OCS Job search facilitators Craft effective correspondence Research employers Interview Network It is up to you to use these skills and resources to find the perfect job for you 3 Career Services Team Irene Dorzback, Assistant Dean Clara Solomon, Director Sejal Sanghvi, Career Counselor Laura Mowry, Program Coordinator 4 Using the OCS Register Communicate • CSM Profile • CSM Announcements • Principles of Professional Conduct • Job Search Workshop • CSM Job Listings • Rocket Docket • Online Calendar 5 Opportunities Provided by OCS Day @ the Tax Court On-Campus Interviews (OCI), Fall & Spring Taxation Interview Program (TIP) Resume Directories CSM Job Listings Networking events and educational panels Don’t rely on these programs alone; use your network and other resources to supplement your job search! 6 On-Campus Interviews (OCI) • • • • Administered on CSM Not pre-screened Fall (9/16-10/25) Spring Job Market Snapshot Class of 2013 Method of Employment 2013 2012 2011 2010 Employed (by September)* September)* 79% 67% 73% 66% 89/113 74/111 95/130 71/108 20% Referral from professor, friend, colleague, networking Law Firm 40 45 47 45 Accounting Firm 31 16 36 14 Government 4 0 1 4 9% OCS Job Listing Clerkship 9 7 5 5 Other/Unknown 5 6 6 3 17% NYU OCI (Fall & Spring) 19% Taxation Interview Program 4% Returned to pre-LLM Employer * Students who responded to the graduation employment survey 8% Day at the Tax Court 22% Other 8 When Should I Start? Most LL.M. students report finding jobs in April or later Factors to Consider: • Market • Grades • Geography • Type of employer • Prior education • Work experience • Prior interview/job search experience • LL.M. course load 9 Create a Job Search Plan To Do List: Update your documents Create a CSM Profile Research employers of interest Expand your network 10 Update Your Resume NYU format & style JD tax coursework JD grades Bar Status Proofread!! Resume Directory: Deadline 9/20 11 Additional Documents Cover Letter “Skeleton” text Personalized Highlight skills Write to partners Be organized Writing Sample 5-10 pages Recent Your writing Tax related? References 2-3 people Reach out now Transcripts Unofficial Photocopy/pdf NYU guidelines 12 Basic Job Search Resources • LL.M. Job Search Handbook • Employer Research Websites • CSM and Resources on the OCS Website – LL.M. Tip Sheets – Web videos of past panels & programs • PILC Government/Clerkship Resources • • – USA Jobs website (www.usajobs.gov) – Arizona Government Handbook – PSLawNet (www.pslawnet.com) – Federal Staff Attorney Positions; State Court Clerkships ABA Careers In Tax Law Vault Guide to Tax Law Careers 13 Networking •Why? •What? •Who? •How? 14 “Asking a stranger to be a mentor rarely, if ever, works, approaching a stranger with a pointed, wellthought-out- inquiry can yield results” - Sheryl Sandberg, Lean In 15 Informational Interviewing & Networking • Research in advance • Make it “easy” • Respect the other person’s time • Don’t ask for a job • Follow up • Use references to your advantage “The follow-up is the hammer and nails of your networking toolkit” - Keith Ferrazzi, Never Eat Alone 16 Professionalism • Principles of Professional Conduct • Online Persona • Headhunters 17 Using the OCS • Career Counseling Appointments – Review all materials first – Call 212-998-6090 or come to FH 430 – Send resume, transcripts, LLM Intake form in advance • Drop-Ins available Wednesday & Friday from 4:00-5:00 18 Reminders Tillinghast Lecture & Coffee Chat, September 10 Resume Directory Deadline, September 20 Accounting Firm Practice Panel, October 7 SCPS Federal Tax Institute, October 20-25 Interview Skills Workshop, November 1 Tax Practice Interview Evening, November 19 Don’t forget: Graduate Tax Program Events & Lunches 19