St98-2007-Data - Alberta Energy Regulator

advertisement

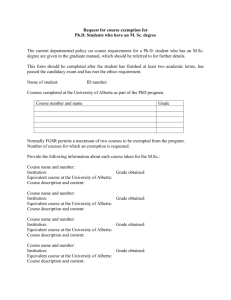

Figure 1. Total energy production in Alberta 16000 actual 14000 forecast 12000 Petajoules Conventional natural gas 10000 8000 6000 Mined and in situ bitumen 4000 Conventional heavy oil 2000 Conventional L&M oil Coal 0 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 Figure 2 Figure 3. same as 3.23 250.0 actual forecast 200.0 109m3 150.0 100.0 50.0 0.0 1997 1999 2001 2003 2005 Conventional marketable gas Process gas from upgrading bitumen 2007 2009 2011 2013 Coalbed methane Gas from bitumen wells Figure 4 same as 5.27. Total gas production in Alberta 2015 $450 400 300 200 100 Major Oil Field Discoveries 1947 – Leduc 1948 – Redwater 1949 – Golden Spike 1952 – Bonnie Glen 1953 – Pembina 1957 – Swan Hill 1959 – Judy Creek 1959 – Swan Hill South 1965 - Rainbow Export Pipelines 1950 – Interprovincial Pipeline (Enbridge) 1953 – Trans Mountain Pipe Line Major Events Affecting Price 1973 – Oil Embargo 1979 – Iranian Revolution 1980 – Iran / Iraq War 1986 – OPEC Crumbles 1990 – Gulf War 1998 – Asian Econ. Crisis 2001 – 9 / 11 2003 – Iraq War $400 $350 $300 $250 $200 $150 1938 - Petroleum and Natural Gas Conservation Board (EUB) created to enforce production standards $100 $50 0 1938 1943 1948 1953 1958 1963 1968 1973 1978 1983 1988 1993 1998 2003 Alberta Production Alberta Crude Oil Price Source: Prices - CAPP Statistical Handbook Figure 5. Alberta Conventional Crude Oil Production and Price $0 Cdn$/cubic metre thoudsand cubic metres per day EUB Prorationing Plan (restricted production) $500 Great Canadian Oil Sands (Suncor) Startup Alberta Oil Sands Project Startup Syncrude Startup $400 100 $300 $200 50 $100 0 $0 1967 1970 1973 1976 1979 Mined Bitumen 1982 1985 1988 SCO Production 1991 1994 1997 2000 2003 SCO Price Figure 6. Alberta mined bitumen and synthetic crude oil production and price 2006 Cdn$/cubic metre thousand cubice metres per day 150 100 300 Cold Lake Phases 1-6 Cold Lake Phases 7-13 250 80 First SAGD Production AEC (EnCana) Foster Ck. 200 60 Am oco (CNRL) Wolf Lake & Prim rose Startup 150 40 100 20 50 Shell Peace River Startup 0 0 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 In Situ Production Bitumen Price Figure 7. Alberta in situ bitumen production and price Cdn$/cubic metres thousand cubic metres per day Cold Lake Pilot Production Hurricanes Katerina and Rita hit U.S. Gulf Coast Foothills Pipe Lines built for gas exports to California and the mid-western U.S. 1956: TransCanada Pipelines built to take Alberta gas to central Canada and the U.S. 200 after debate over its charter in Parliament $8 PGT expansion Regulated gas price tied to oil prices. $6 Surplus built up Surplus gas drives down prices 150 Price deregulation Arbitration awards price increase $4 100 Gas prices as a by-product of oil production. Price less than replacement cost $2 50 0 $0 1962 1966 1970 1974 1978 Gas production 1982 1986 1990 1994 1998 2002 Alberta plant gate price Figure 8. Historical natural gas production and price 2006 $Cdn/GJ billion cubic metres 250 Late 1998: Northern Border/TCPL expansion 2000: Alliance Pipeline 140 25 120 100 15 80 60 10 40 5 20 0 0 1971 1976 1981 Gas Processing Plants 1986 1991 Oil Sands Plants 1996 2001 2006 FOB Vancouver (US$/tonne) Figure 9. Sulphur closing inventories in Alberta and price US $/tonne Inventory (million tonnes) 20 million tonnes 45 40 35 30 25 20 15 10 5 1882 1898 – Expansion of railway network (coal and oil fired steam engines) and growth of population 1893 Coal remained “King Coal” until huge reservoirs of crude oil and natural gas were discovered 1904 1915 1926 1937 1948 1959 1970 Australian-Japan contract price for thermal coal ( Australian Bureau of Agricultural and Resource Economics - ABARE) 40 30 20 10 0 0 1981 1992 Subbituminous Bituminous Thermal Bituminous Metallurgical Australian-Japan contract price for thermal coal 2003 US$ per tonne Late 1990’s – mine closures and reduced coal exports due to depressed coal prices 1970’s – increase in coal-fired electric generation Late1960’s – Beginning of exports to Japan for steel industry 1960 – Steam rail era ends 1950’s – Crude oil and natural gas replace coal as energy source of choice 1952 – Beginning of change to diesel-electric trains Figure 10. Historical coal production and price 60 50 70 $US/bbl 65 60 55 50 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Figure 1.1 OPEC crude basket reference price 2006 Nov Dec 100 600 actual High 500 $US/bbl 400 60 Low 300 40 200 20 100 0 0 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 Figure 1.3 Price of WTI at Chicago $US/m 3 80 forecast 100 600 actual forecast High 80 $Cdn/bbl Low 400 60 300 40 200 20 100 0 0 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 Figure 1.4 Average price of oil at Alberta wellhead $Cdn/m 3 500 100 Cdn$/bbl 80 60 40 20 0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Figure 1.5 2006 Average monthly reference prices of Alberta crudes Light-medium Heavy Bitumen Figure 1.5 2006 average monthly reference prices in Alberta 12 actual forecast high 10 $Cdn/gigajoule 8 low 6 4 2 0 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 Figure 1.7 Average price of natural gas at plant gate 2016 150 actual forecast 125 $Cdn/MWh 100 75 50 25 0 2000 2002 2004 2006 2008 2010 2012 2014 Figure 1.8 Alberta Wholesale Electricity Prices 2016 Percentage 12 10 8 6 4 2 0 9.1 4.2 8.3 7.6 5.5 6.8 7.2 4.1 7.7 7.6 6.3 3.3 2.9 2.7 2004 2005 1.8 1.8 1998 1999 2000 2001 2002 2003 Real GDP growth Percentage 6.8 2.9 5.2 1997 12 10 8 6 4 2 0 7.2 7.3 6.6 5.0 1.6 1997 Unemployment rate 1.8 0.9 1998 5.8 5.8 6.4 2.7 2.6 4.7 4.2 2.2 4.0 2001 2002 Inflation rate 2003 4.4 2.2 2.8 1999 2000 2006 2.0 1.9 2004 2005 2006 Prime rate on loans 90 Cents 85 82.5 80 75 88.2 77.0 72.2 70 67.5 67.3 71.6 67.3 63.7 65 64.6 60 1997 1998 1999 2000 2001 2002 2003 2004 Exchange rate Figure 1.10 Canadian economic indicators 2005 2006 100 actual forecast billions of 1997$ 80 60 40 20 0 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 Non-conventional oil extraction and upgrading Conventional oil and gas extraction Pipelines, natural gas distribution, storage, electricity generation and transmission lines Petrochemicals Government Residential Business (non-residential/non-energy) Figure 1.11 Alberta real investment ATHABASCA 120.9 PEACE RIVER 4.3 26.6 COLD LAKE 47.6 Figure 2.7. Production of Bitumen in Alberta, 2006 103 m3/d In Situ Mined Bitumen 100% Percentage 80% 60% 40% 20% 0% 1997 1998 1999 2000 2001 2002 2003 Conventional crude oil & pentanes plus 2004 2005 2006 SCO & bitumen Figure 2.8. Alberta crude oil and equivalent production 500 actual forecast 400 103 m3/d 300 Surface mining 200 100 In situ 0 1997 1999 2001 2003 2005 2007 2009 2011 Figure 2.9. Alberta crude bitumen production 2013 2015 80 8000 60 6000 40 4000 20 2000 0 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Producing Wells Production Figure 2.10. Total in situ bitumen production and producing bitumen wells Production (103 m3/d) Number of producing wells 10000 300 actual forecast 103 m3/d 200 Synthetic crude oil 100 Synthetic Crude Oil 0 1997 1999 2001 2003 2005 2007 2009 2011 2013 Figure 2.11. Alberta synthetic crude oil production 2015 60 50 million tonnes 40 30 20 Oil Sands Plants – Coke Inventory Synthetic Crude Oil 10 0 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 Figure 2.14. Alberta oil sands upgrading coke inventory 500 actual forecast 400 Nonupgraded bitumen removals from Alberta 103 m3/d 300 200 SCO removals from Synthetic CrudeAlberta Oil 100 Alberta demand (mainly SCO) 0 1997 1999 2001 2003 2005 2007 2009 2011 Figure 2.15. Alberta demand and disposition of crude bitumen and SCO 2013 2015 800 700 600 106 m3 500 400 300 Heavy 200 100 Light-medium 0 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 Figure 3.1. Remaining established reserves of crude oil 50 40 30 106 m3 20 10 0 -10 -20 -30 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Additions Revisions Figure 3.2. Annual changes in conventional crude oil reserves 25 20 106 m3 15 10 5 0 -5 -10 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 New waterflood Waterflood revisions Figure 3.3. Annual changes to waterflood reserves Total number of pools Initial reserves Remaining reserves (103m3) (103m3) (103m3) Figure 3.4. Distribution of oil reserves by size Initial established reserves (10 6 m3) 350 300 250 200 150 100 50 0 1970 1975 1980 1985 1990 Average Figure 3.5. Oil pool size by discovery year 1995 2000 Median 2005 1400 1200 Reserves (106 m3) 1000 800 600 400 200 ni an n M id dl e D ev o on ia pp e U M is si ss rD ev ip p el lo rm ia nB Pe Initial established reserves ia n y c si Tr ia s si c ra s Ju ac e Cr et w er Lo U pp e rC re t ac eo ou s us 0 Remaining established reserves Figure 3.7. Geological distribution of reserves of conventional crude oil 182 157 11 Fig. 3.8. Regional distribution of Alberta oil reserves (106 m3) 2006 Initial established reserves 2730.8 106 m3 2006 Remaining established reserves 250.1 106 m3 20 Remaining established oil reserves (10 6 m3) 1400 Year 1970 1200 1000 800 600 400 200 0 500 1000 1500 2000 2500 6 3000 3 Cumulative production (10 m ) Figure 3.9. Alberta’s remaining established oil Reserves versus cumulative production 3500 3200 Ultimate potential (3130) 3000 actual forecast 2800 Actual as of December 31, 2006 106m3 2600 2400 2200 2000 1800 1600 1970 1980 1990 2000 2010 2020 2030 2040 Figure 3.10. Growth in initial established reserves of crude oil 33 26 269 Figure 3.11. Alberta successful oil well drilling By modified PSAC area 2005 Wells Drilled = 2172 2006 Wells Drilled = 2146 21 222 Figure 3.12. Oil wells placed on production, 2006 by modified PSAC area Total wells = 1956 17.2 [109] 12.3 [77] 8.7 [55] Figure 3.13. Initial operating day rates of oil wells placed on production, 2006 by modified PSAC area m3/day/well [bbl/day/well] 6.3 [39] 11.5 [72] 5.0 [32] 7.6 [48] 160 140 103 m3/day 120 100 PSAC 8 80 PSAC 7 PSAC 5 60 PSAC 4 40 PSAC 3 20 PSAC 2 PSAC 1 0 1997 1998 1999 2000 2001 2002 2003 2004 2005 Figure 3.14. Conventional crude oil production by modified PSAC area 2006 250 40000 200 30000 150 20000 100 10000 50 0 Production (10 3 m3/d) Number of wells 50000 0 1973 1977 1981 1985 Producing wells 1989 1993 1997 2001 2005 Production Figure 3.15. Total crude oil production and producing oil wells 200 20000 160 15000 120 10000 80 5000 40 m3/d Number of wells 25000 0 0 0.0-2.0 2.1-5.0 5.1-8.0 8.1-20.0 20.1-50.0 50.1-100.0 100.1+ 3 Production category (m /d) Producing wells Average rate Figure 3.16. Crude oil well productivity in 2006 160 Production (103m3/d) 140 120 100 Pre-1997 6% 80 11% 7% 40 7% 4% 4% 5% 2% 3% 5% 20 45% 60 0 1997 1998 1999 2000 2001 2002 2003 2004 2005 Figure 3.17. Total conventional crude oil production by drilled year 2006 % of total production from oil wells 4000 thousand barrels per day 3500 3000 Texas onshore 2500 2000 1500 Alberta crude oil 1000 500 Louisiana onshore 0 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 Figure 3.18. Comparison of crude oil production $100 5000 forecast 4000 $80 3000 $60 2000 $40 1000 $20 $0 0 1997 1999 2001 2003 2005 2007 Wells placed on production 2009 2011 2013 2015 WTI @ Chicago Figure 3.19. WTI crude oil price and well activity US$/bbl Number of wells actual 180 actual forecast Production (103m3/d) 150 120 Heavy 90 60 30 Light-medium 0 1997 1999 2001 2003 2005 2007 2009 2011 Figure 3.20. Alberta daily production of crude oil 2013 2015 35000 Refinery capacities (m3/d) 30000 25000 20000 15000 10000 5000 0 Imperial Edmonton Petro-Canada Edmonton Shell Scotford Husky Lloydminster Parkland Bowden Figure 3.21. Capacity and location of Alberta refineries 180 actual forecast 150 103m3/d 120 90 Crude oil removals from Alberta 60 30 Alberta demand 0 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 Figure 3.22. Alberta demand and disposition of crude oil 600 actual forecast 500 103m3/d 400 Non upgraded bitumen 300 SCO 200 100 Pentanes plus Heavy 0 1997 Light-medium 1999 2001 2003 2005 2007 2009 2011 2013 Figure 3.23. Alberta supply of crude oil and equivalent 2015 100% actual forecast Percentage 80% 60% 40% 20% 0% 1997 1999 2001 2003 2005 2007 2009 Conventional crude oil & pentanes plus 2011 2013 2015 SCO & bitumen Figure 3.24. Alberta crude oil and equivalent production 18 16 actual forecast 14 109 m3 12 10 8 6 4 2 0 2005 2007 2009 2011 2013 2015 Figure 4.4 Coalbed methane production forecast from CBM wells 180 160 140 109 m3 120 100 80 60 40 20 0 1974 1979 1984 Additions 1989 1994 1999 2004 Production Figure 5.1. Annual reserves additions and production of conventional marketable gas 2000 1600 109 m3 1200 800 400 0 1975 1980 1985 1990 1995 2000 2005 Figure 5.2. Remaining conventional marketable gas reserves 140 120 100 109 m3 80 60 40 20 0 -20 1999 2000 New 2001 2002 2003 Development 2004 2005 2006 Revisions Figure 5.3. New, development, and revisions to conventional marketable gas reserves Total number of pools Initial reserves Remaining reserves (106m3) (109m3) (109m3) Figure 5.5. Distribution of conventional gas reserves by size Established reserves (10 6 m3) 350 300 250 200 150 100 50 0 1965 1968 1971 1974 1977 1980 1983 1986 1989 1992 1995 1998 2001 2004 Average Median Figure 5.6. Conventional gas pools by size and discovery year 2000 1200 800 400 ni an n M id dl e De vo on ia rD ev Up pe M is si ss ip p llo rm ia nBe Pe Initial marketable reserves ia n y c si Tr ia s si c ra s Ju ac e Cr et we r Lo rC re t ac eo ou s us 0 Up pe 109 m3 1600 Remaining marketable reserves Figure 5.7. Geological distribution of conventional marketable gas reserves 2000 1600 1200 109 m3 Sweet natural gas 800 400 Sour natural gas 0 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 Figure 5.8. Remaining conventional marketable reserves of sweet and sour gas 2006 35 30 80% 40 90 60% 100 50 60 40% 20% 25 Percentage of component 10 35 15 10 100% 0% Methane Ethane Removed at field plants Propane Butanes Removed at straddle plants Pentanes plus Marketable gas Figure 5.9. Expected recovery of conventional natural gas components 7000 6000 Ultimate potential based on 2004 study 109 m3 5000 4000 3000 Remaining reserves 2000 1000 0 1973 Production 1976 1979 1982 1985 1988 1991 1994 1997 Figure 5.11. Conventional gas ultimate potential 2000 2003 2006 4500 4000 Gas in place (10 9 m3) 3500 3000 2500 2000 1500 1000 500 0 Upper Cretaceous Lower Cretaceous Ultimate potential Jurassic Triassic Mississippian Devonian Discovered gas in place Figure 5.13. Conventional gas in place by geological period 14000 12000 Number of wells 10000 8000 6000 4000 2000 0 1996 1997 1998 Drilled 1999 2000 2001 2002 2003 2004 2005 2006 Connected Figure 5.15. Successful conventional gas wells drilled and connected 200.0 180.0 % of total production 160.0 140.0 109 m3 120.0 PSAC 8 2% PSAC 7 PSAC 6 4% 3% PSAC 5 12% PSAC 4 4% PSAC 3 20% PSAC 2 39% PSAC 1 6% 100.0 80.0 60.0 40.0 20.0 Gas from oil wells 0.0 1997 1998 1999 2000 2001 2002 2003 2004 2005 10% 2006 Connection year Figure 5.18. Marketable gas production by modified PSAC area 120000 250 200 80000 150 60000 100 40000 50 20000 0 0 1990 1992 1994 1996 Producing wells 1998 2000 2002 2004 2006 Production Figure 5.19. Conventional marketable gas production and number of producing wells Production (10 9 m3) Number of producing wells 100000 70000 400 300 50000 40000 200 30000 20000 100 10000 0 0 0.0-2.0 2.1-5.0 5.1-8.0 8.1-20.0 20.1-50.0 50.1-100.0 Production category (10 3m3/d) Producing wells Average rate Figure 5.20. Natural gas well productivity in 2006 100.1+ Production (10 3 m3/d) Number of producing wells 60000 200 180 Production (109m3) 160 12 140 1997 16 120 12 Pre - 1997 100 9 6 80 6 5 4 3 3 60 40 24 20 Gas from oil wells 0 1997 1998 1999 2000 2001 2002 2003 2004 2005 Connection year Figure 5.21 Raw gas production by connection year 2006 % of total production from gas wells 12 10 Tcf 8 Texas onshore 6 4 Louisiana onshore 2 Alberta 0 1956 1961 1966 1971 1976 1981 1986 1991 1996 2001 Figure 5.22. Comparison of raw natural gas production 2006 25.0 Productivity (103 m3/d) 20.0 15.0 10.0 5.0 0.0 1997 1998 1999 2000 2001 2002 2003 2004 2005 Alberta Alberta excluding PSAC Area 3 PSAC Area 3 (Southeastern Alberta) Figure 5.23 Average initial natural gas well productivity in Alberta 20000 $10 forecast 16000 $8 12000 $6 8000 $4 4000 $2 0 $0 1997 1999 2001 2003 2005 New well connections 2007 2009 2011 2013 2015 Alberta plant gate price Figure 5.24. Alberta natural gas well activity and price $Cdn/GJ Number of wells actual 200 7.1 forecast 150 5.3 100 3.6 50 1.8 0 0 1997 1999 2001 2003 2005 2007 2009 2011 2013 Figure 5.25. Conventional marketable gas production 2015 Tcf 109m3 actual 14000 actual forecast 12000 10000 106m3 8000 6000 4000 2000 0 1997 1999 2001 2003 2005 Process gas from upgrading bitumen 2007 2009 2011 2013 2015 Gas from bitumen wells Figure 5.26. Gas production from bitumen upgrading and bitumen wells used for oil sands operations 250.0 actual forecast 200.0 109m3 150.0 100.0 50.0 0.0 1997 1999 2001 2003 2005 Conventional marketable gas Process gas from upgrading bitumen 2007 2009 2011 Coalbed methane Gas from bitumen wells Figure 5.27. Total gas production in Alberta 2013 2015 2000 1500 106m3 1000 500 0 -500 -1000 -1500 Jan Feb Mar 2004 Apr May Jun Jul 2005 Aug Sep Oct Nov Dec 2006 Figure 5.28. Alberta natural gas storage injection/withdrawal volumes 60.00 actual forecast 50.00 Reprocessing plant shrinkage Transportation 109 m3 40.00 Electricity generation 30.00 Other industrial Industrial - petrochemical 20.00 Industrial – oil sands 10.00 Commercial Residential 0.00 1997 1999 2001 2003 2005 2007 2009 2011 2013 Figure 5.31. Alberta marketable gas demand by sector 2015 400 109 m3 300 200 100 0 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Figure 5.32. Historical volumes “available for permitting” 30 forecast actual 25 109 m3 20 In Situ Cogeneration 15 In Situ 10 Mining and Upgrading Cogeneration 5 Mining and Upgrading 0 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 Figure 5.33. Purchased natural gas demand for oil sands operations 35 actual forecast 30 109 m3 25 20 Purchased gas 15 Produced gas from bitumen 10 Process gas from upgrading* 5 0 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 Figure 5.34. Gas demand for bitumen recovery and upgrading * Some 1.0 109m3 of process gas not shown on this chart is used for electricity generation (2007-2016). Process Gas for Electricity Cogeneration 40 actual 35 forecast 109 m3 30 25 Purchased Gas for Electricity Cogeneration 20 Purchased Gas for In situ Recovery Produced Gas from Bitumen Wells for In situ Recovery 15 10 Process Gas for Mining/Upgrading 5 Purchased Gas for Mining/Upgrading 0 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 Figure 5.35. Total Purchased, Process and Produced Gas for Oil Sands Production 250.0 10.7 actual forecast 7.1 150.0 5.3 100.0 3.6 50.0 1.8 Tcf 109m3 200.0 25% 24% 28% 36% 44% 0 0.0 1997 1999 2001 Residential demand 2003 2005 Commercial demand 2007 2009 2011 Other Alberta demand 2013 2015 Alberta gas removals Figure 5.36. Total marketable gas production and demand 150 Liquid volume (10 6 m3) 120 90 60 30 0 Ethane Propane Reserves Butanes Pentanes Plus Annual production Figure 6.1. Remaining established NGL reserves expected to be extracted from conventional gas and 2006 annual production Established reserves (10 6 m3) 250 200 150 100 50 0 1994 1995 1996 Ethane 1997 1998 1999 Propane 2000 2001 2002 Butanes 2003 2004 2005 2006 Pentanes plus Figure 6.2. Remaining established reserves of conventional natural gas liquids Alberta Gas & NGL Market R Other Canadian Markets Battery Battery Gas Pools Raw Gas R Field Plants Marketable Gas R Straddle Plants - NGL Mix - Ethane - Propane - Butanes - Pentanes Plus US Markets Sulphur Alliance High Pressure Pipeline Chicago, IL - Oil Pools NGL Mix Ethane Propane Butanes Pentanes Plus Crude Oil Refineries Extraction Plant - Ethane - Propane - Butanes - Pentanes Plus Fractionation Plants - Ethane - Propane - Butanes - Pentanes Plus Propane Butanes Figure 6.3. Schematic of Alberta NGL flows Dry Gas Alberta Border Dry or rich gas NGL Mix Spec product Rich gas R Point royalties collected Figure 6.4. Ethane supply and demand 103m3/d 100 Actual Forecast 80 60 40 20 0 1997 1999 2001 T otal Demand * excludes solvent f lood volumes 2003 2005 Alberta Demand* 2007 2009 2011 2013 2015 Potential Supply from Conventional Gas Figure 6.5. Propane supply from natural gas and demand 40 103m3/d Actual Forecast 30 20 10 0 1997 1999 2001 2003 2005 Supply * excludes solvent flood volumes 2007 2009 2011 Alberta Demand* 2013 2015 Figure 6.6. Butanes supply from natural gas and demand 103m3/d 25 Actual Forecast 20 15 10 5 0 1997 1999 2001 2003 2005 Supply * excludes solvent flood volumes 2007 2009 2011 Alberta Demand* 2013 2015 Figure 6.7. Pentanes supply from natural gas and demand for diluent 103m3/d 40 Actual Forecast 30 demand met by alternative sources and types of diluent 20 10 0 1997 1999 2001 2003 2005 Supply * excludes solvent flood volumes 2007 2009 2011 Alberta Demand* 2013 2015 10 actual forecast 8 Refining and upgrading 106 t 6 4 2 Sour gas 0 1997 1999 2001 2003 2005 2007 2009 Figure 7.1. Sources of sulphur production 2011 2013 2015 Production (million tonnes) 8 6 4 2 0 1966 1971 1976 1981 1986 1991 1996 2001 2006 Figure 7.2. Sulphur production from gas processing plants in Alberta 1000 800 103 t 600 400 200 0 2003 Syncrude 2004 2005 Suncor Figure 7.3. Sulphur production from oil sands 2006 Shell 5000 4000 103 t 3000 2000 1000 0 Australia 2003 Brazil China 2004 New Zealand South Africa 2005 Figure 7.4. Canadian sulphur offshore exports Others 2006 9 actual 8 forecast Production Stockpile Withdrawal 7 Stockpile millions of tonnes Total Demand 6 Removed from Alberta 5 4 3 2 1 Alberta demand 0 1997 1999 2001 2003 2005 2007 2009 2011 Figure 7.5. Sulphur demand and supply in Alberta 2013 2015 50,000,000 40,000,000 Bituminous metallurgical tonnes 30,000,000 Bituminous thermal 20,000,000 10,000,000 Subbituminous 0 1874 1885 1896 1907 1918 1929 1940 Figure 8.1 Total coal production 1951 1962 1973 1984 1995 2006 50 actual 45 forecast million tonnes 40 35 30 Metallurgical bituminous 25 Thermal bituminous 20 Subbituminous 15 10 5 0 1997 1999 2001 2003 2005 2007 2009 2011 Figure 8.3 Alberta marketable coal production 2013 2015 20 actual forecast Thousand MW 15 10 5 0 1998 2000 Coal 2002 2004 2006 Natural Gas 2008 2010 Hydro 2012 2014 2016 Other Figure 9.1. Alberta electricity generating capacity 100 actual forecast Thousand GWh 75 50 25 0 1998 Coal 2000 2002 2004 2006 Natural Gas 2008 2010 Hydro Figure 9.2. Alberta electricity generation 2012 2014 2016 Other 3000 2500 GWh 2000 1500 1000 500 0 1997 1998 1999 2000 2001 2002 2003 Deliveries Figure 9.3. Alberta electricity transfers 2004 2005 Receipts 2006 100 actual forecast Thousand GWh 75 50 25 0 1998 2000 Industrial Commercial 2002 2004 2006 2008 2010 2012 2014 2016 Industrial on site Residential (including agriculture) Figure 9.4. Alberta electricity consumption by sector 30 actual forecast 25 Potential generation Thousand GWh Demand 20 15 10 5 0 1998 2000 2002 2004 2006 2008 2010 2012 2014 9.5. Alberta oil sands electricity generation and demand * Industrial – oil sands historical data on electricity demand was estimated using an assumption of 10 kWh/bbl for in situ oil sands projects that do not operate cogeneration units. 2016