Jelly Belly Research Report.

advertisement

IP Project 2014 - Jelly Belly Research Report.

Contents Page.

Page 2 – Jelly Belly History.

Page 4 – Consumers.

Page 5 – Secondary Market Research.

Page 8 – Competitors.

Page 9 – Questionnaire.

Page 13 – Jelly Belly Focus Groups.

Page 20 – SWOT Analysis.

Page 23 – References.

1

IP Project 2014 - Jelly Belly Research Report.

1. Jelly Belly History:

1.1. About : (1)

o A Family business created in 1869

o Jelly Belly was started by two brothers who

emigrated to America from Germany

o The name Jelly Belly was inspired by the rhyme

with Leadbelly, a 1920s blues singer.

o The company was born, and is still currently

based in, Los Angeles

o The first eight Jelly Belly flavours - Very Cherry,

Lemon, Cream Soda, Tangerine, Green Apple,

Root Beer, Grape and Liquorice are still some of

the most popular flavours made to this day.

o More exciting flavours like Chocolate Pudding

and Buttered Popcorn were introduced soon

after.

o Revenue: $190 million in 2012

o Employees: 725

o The company is produces more than 37 million pounds (17,000 tons) of

candy annually

o There are currently 50 "official flavours" of Jelly Belly and taking account of

the full range; there are actually 90 different flavours to choose from at any

one time.

o In 1967 Jelly Belly managed to catch the attention of the Governor of

California, Ronald Reagan. Throughout his time in office, the Governor ate

jelly beans and ultimately wrote that famous letter saying "we can hardly

start a meeting or make a decision without passing around the jar of jelly

beans."

o Blueberry flavour was created specifically for Ronald

Reagan’s presidential inauguration. And remains

incredibly popular.

o Jelly Belly were the first jelly bean in outer space.

o Jelly Belly is now a global favourite snack. It is the world's

number one gourmet jelly bean.

o Easter is the most popular time of year to eat Jelly Belly –

Christmas is the second most popular.

o Jelly Belly also sells candles and air fresheners as part of its

product line.

1.2. Trivia: (2)

o The number of Jelly Belly beans eaten this year would

circle the Earth 5.5 times.

o There are 1,680 Jelly beans produced per second (that’s as

long as a blue whale).

2

o There are 362,880 pounds of jelly beans produced per day (that’s as much

as 24 elephants).

o 14 billion Jelly Belly beans eaten this year.

o There are 5 billion Jelly Belly beans sold at

Easter.

o Favourite flavours by region:

o America: Very Cherry.

o Asia: Lemon Lime.

o Australia: Bubble Gum.

o Europe: Tutti-Fruitti.

o Middle East: Berry Blue.

o It takes 7-21 days to make a jelly bean.

o There are 74 other products in the Jelly Belly

range – including other sweets and chocolate.

o Jelly Belly are gluten free, peanut free, dairy free, fat free and vegetarian

friendly.

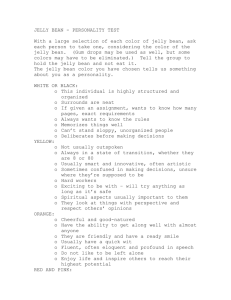

1.3. Advertising:

o Not widely advertised in Europe.

o Print and television campaigns aired in America tend to show off the wide

variety of available flavours.

o Slogan of “Get real. Get Jelly Belly” – emphasis on the company’s use of

natural ingredients.

o The advertising is quite positive and ‘kooky’ helping to mirror the brand

values. It appeals to families and children, with bright colours and fun fonts.

o A large part of their advertising comes from their Jelly Belly artwork – where

artists recreate portraits of famous paintings using only jelly beans. It is a

craze enjoyed all over the world.

3

2. Consumers:

2.1. Profile:

Jelly Belly's primary target audience is ABC1 adults aged 25+.

However age isn't set in stone as much, but it’s more about lifestyle. Their target

audience like the nicer things in life – they’d rather pay more for a better product than

feel that they’re getting a bargain on an inferior product. They tend to buy brands, but

they’re not brand victims – they just appreciate the best. They are opinion formers,

they love social media, and

they like being in the know and

they love to travel and the

challenge of trying new things.

Life is for living, enjoying,

tasting. They are well-off with

good jobs and a comfortable

life.

Their ideal consumer is a

woman who has an affluent

lifestyle, they enjoy

confectionery and whenever

they pass into a store they specifically chose the product that they know is full of

flavour and is best for them, they don't always buy brands and don't stick to one

particular brand such as Cadburys they pick what they feel like and usually that will be

sweet and a mixture. She is a social leader in her friend group and has a large influence

on the groups actions. She is very fashionable and has a high disposable income, lives

in the city and has natural coloured hair. She enjoys life as it comes and doesn't think

too much about the future apart from sustainability within the environment, she isn't

vegetarian but she cares for the environment and animals. She has friends all over the

world as she likes to travel on holidays with her friends so she has various connections

and talks a lot via social media rather than texting. She is glued to her phone and isn't

able to leave the house without it. She has a very comfortable life and enjoys every

opportunity.

2.2. ABC1:

National Readership Survey (NRS) demographic categories

Social Grade

A

Social Status

upper middle class

B

middle class

C1

lower middle class

Occupation

higher managerial,

administrative or professional

intermediate managerial,

administrative or professional

supervisory or clerical, junior

managerial, administrative or

professional

From the National Readership Survey above, it's suggested that Jelly Belly are targeting

lower and upper middle class in western social groups. Their occupations range from

4

higher managerial to administrative job roles that are very demanding. This means that

would have less time to 'shop around' for what they were after and would know

exactly what they needed and wanted even before entering the store.

ABC1 consumers are likely to be ready to pay more for products compared to the

people in the lower social grade. ABC1 consumers are suggested to have been strongly

influencing when it comes to purchasing food for occasions such as social gatherings,

as they are more likely to be the hosts. This trend is not just based on higher affluence

but also on other factors such as a greater awareness of health issues and ethical

concerns relating to food. When looking further into spending habits online shopping

has been a very strong pushing force for increased spending on premium food products

such as Jelly Belly in comparison to its rivals. This suggests that they are likely to buy

brands that are seen as luxury rather than just a food brand. But recently trends show

that because of the economic crisis, manufacturers and retailers would find it harder to

charge a premium on top of the already inflated basic food prices as the ABC1

consumers would not really be willing to pay more. (3)

{See Appendix 1}

3. Secondary Market Research:

“Although chocolate confectionery accounts for more than two-thirds of the total

confectionery market by value, sugar confectionery grew at a faster pace than the

major sector for the second consecutive year. Gums and jellies, especially sour

variants, are increasingly popular.

Moreover, an influx in sharing formats and themed products have further boosted

sales in the sector. Fruit sweets are the largest subsector in the sugar confectionery

sector and experienced the highest growth of all subcategories in the total market.”

3.1. Confectionary Market Size (Total Market): (4)

o Between 2008 and 2012, the confectionery market in the UK grew year-onyear.

o Its value rose by 15.8% to £5.51bn.

o However, the growth rate fluctuated over the time period. It accelerated in

both 2010 and 2011, but slowed substantially in 2012.

o Accelerated growth is primarily down to price inflation, although confectionery

is undeniably popular in the UK.

o In spite of rising production costs, falling disposable incomes and campaigns

emphasising the importance of a healthy diet as part of a balanced lifestyle, the

confectionery industry continues to increase in value.

o This defiance is largely due to the fact that even under strained finances and

dieting plans, consumers still enjoy treating themselves to both chocolate and

sweets.

Table 3.1. The Total UK Market for Confectionery by Value by Sector at Current Prices

(£m at R.S.P) 2008-2012:

5

2008

2009

2010

2011

2012

Chocolate

Confectionary

Sugar

Confectionary

3,461

3.554

3,732

4,001

4,065

1,293

1,278

1,297

1,407

1,440

TOTAL

4,754

4,832

5,029

5,408

5,505

% Change

year-on-year

-

1.6

4.1

7.5

1.8

R.S.P — retail selling prices (4)

3.2. UK Confectionary Market:

o The subcategory includes some of Britain’s favourite confectionery, such as

M&M’S, Snickers, Maltesers and Kit Kats.

o The fruit sweets subsector is currently the fastest‑ growing segment in the

confectionery industry.

o Premium chocolates are also faring well as consumers spend time at home with

loved ones and are sharing and gifting confectionery.

o The market niche created by the demand for premium variants as consumers

treat themselves to affordable luxuries.

o Since the recession started, bitesize products in both single-serve and sharing

formats have established themselves in the confectionery market and now

account for 9.5% of confectionery sales, as reported on 25th May 2012.

o Over the past year, novelties have also gained importance in the market. They

add excitement by bringing a fun factor through shapes, not only during

holidays, but also during sports and royal events, in addition to everyday life.

o The rise in novelties reflects the focus of innovation in the confectionery

industry in the UK. The market is mature and saturated with products. Brands

are well‑ established and consumers tend to be loyal to them.

o To maintain dynamism in the market, manufacturers are introducing new

versions of existing confectionery, which consumers are eager to try.

o In addition, over the past 12 months, there has been an influx in smaller

formats. This is one of the most important trends in the confectionery market

for multiple reasons.

o Consumers are making packed lunches to save money and eating on-the-go due

to their hectic lifestyles. (4)

3.3. Sugar and Chocolate Confectionary Data:

o In 2012, the confectionery market grew by 1.8%.

o On 15th December 2012, The Grocer reported that sugar confectionery volume

sales fell by 1.3% in 2012, while volume growth for chocolate confectionery was

relatively flat, rising by 1.4%.

o In addition, according to another article by The Grocer that was published on

9th June 2012, there was an increase in promotional activity in the chocolate

market, with the number of deals up from 6,152 to 7,191, meaning that the

typical saving has raised from 26.9% to 29.1%.

6

o Confectionery manufacturers are operating in tough market conditions; still,

the industry remains resilient.

o In 2011 and 2012, the sugar confectionery sector grew at a faster pace than

that of chocolate confectionery.

o The mints subsector is the sole product category to have experienced a decline

in value over the course of the year. (4)

Figure 3.3. The Total UK Market for Confectionery by Value by Sector

at Current Prices (£m at R.S.P) 2008-2012:

This gives you an idea of the size and scale of the market in the UK.

R.S.P — retail selling prices (4)

7

4. Jelly Belly Competitors

4.1. Competitors in Europe:

o Top 5 European confectionary brands

1st Nestle.

2nd Ferrero Group.

3rd Perfetti Van Melle.

4th Haribo.

5th Lindt and Sprungli.

4.2. Nestle:

o Multinational food and beverage company founded in 1866 in Switzerland.

o Its products are baby food, bottled water, breakfast cereals, coffee,

confectionery, dairy products, ice cream, pet foods, and snacks.

o Largest Food Company in the world measured by revenues.

o Known as the worlds leading nutrition, health and Wellness Company. (5)

4.3. Ferrero Group:

o An Italian manufacturer of chocolate and other confectionery products such as

Ferrero Rocher, Pocket Coffee, Mon Chéri, Giotto, Confetteria Raffaello coconut

cream candy, Hanuta chocolate hazelnut-filled wafers, the Kinder line of

products, as well as the Tic Tac breath mints.

o Founded by confectioner Pietro Ferrero in 1946 in Italy.

o In 2011 they introduced a line of frozen products called ‘Gran Soleil’. (6)

4.4. Perfetti Van Melle:

o Italian global manufacturer of confectionery and gum founded in 2001.

o The third largest confectionery manufacturer in the world after Mondelēz

International (owners of Cadbury) and Mars, Incorporated (owners of Wrigley).

o Distributes products in over 130 countries. (7)

4.5. Haribo:

o German confectionery company, founded in 1920 by Johannes.

o Created the first gummy candy in 1922.

o Has over 37 different products in the UK.

o 9 different products in U.S.A. (8)

4.6. Lindt and Sprungli:

o Luxury Swiss chocolate and confectionery company founded in 1845.

o Known for its ‘gold bunny’ during seasonal periods such as Christmas and

Easter, 2 pink bunnies for valentines.

o Main product is a type of chocolate produced by lindor, which is characterized

by a hard chocolate shell and a smooth chocolate filling.

o Sells a variety of ‘block chocolate’ that incorporates different flavours. (9)

8

4.7. UK’s Top 10 Product list: (10)

o Starmix.

o Tangtastics.

o Super mix.

o Chamallows.

o Goldbears.

o Jelly babies.

o Strawbs.

o Wine Gums.

o Pontefract Cakes.

o Sour Cherries.

4.8. America’s Top 10 Product list: (11)

o Gold-Bears.

o Happy Cola.

o Twin cherries.

o Peaches.

o Sour S’ghetti.

o Raspberries.

o Smurfs.

o Frogs.

o Juicy Gold bears.

o Rattle Snakes

5. Primary Research:

5.1 Questionnaire:

o Question 1: How often do you buy branded confectionary?

From this question it is clear that the bulk of our respondents purchase branded

confectionary fairly regularly. This is great news for Jelly Belly as it means their

potential consumers may purchase their brand on a frequent basis.

o Question 2: What kind of confectionary do you buy?

Question 2 poses a potential problem for Jelly Belly, as over half our

9

respondents prefer to spend their money on chocolate rather than sweets. This

suggests that Jelly Belly’s advertising would need to address this problem.

o Question 3: What is your favourite branded confectionary?

This question suggests that Cadbury’s is potentially one of Jelly Belly’s biggest

competitors out of the choices given. This is a threat as Cadbury’s is a massively

popular and well-known brand. Despite this Jelly Belly is a big brand in its own

right.

o Question 4: Does the price ever effect your choice of confectionary?

61% of the respondent said that yes, price does influence their buying decision

in terms of confectionary. Jelly Belly’s advertising will have to persuade

consumers that their product is worth them parting with their money.

o Question 5: If yes to question 4, why?

In general, most respondents said prices effects their purchase habits as many

of our respondents are students. The bulk of people suggested that they only

buy confectionary when it’s on offer. Many respondents also said if there was

an unbranded version of the same product, they would go for the cheaper on as

10

they believe, in terms of confectionary, that they taste similar. A common

theme throughout the answers was that people don’t want to pay a lot for

sweets, as they could be spending the money on more ‘useful’ items. In

summary, it is suggested by most respondents that if it is a good deal they are

likely to purchase. When looking at each respondent’s answers, it is apparent

that the ages 55+ respondents aren’t bothered by price.

o Question 6: Have you ever heard of Jelly Belly?

72% of respondents said that they have heard of Jelly Belly. This is good news as

Jelly Belly can focus on selling the product through their advertising rather than

focusing on brand awareness.

o Question 7: Have you ever seen any Jelly Belly advertising?

Almost every respondent has never seen any Jelly Belly advertising. This may be

because it is an American Brand; as most of our respondents are British, and

there is little JB advertising in the UK this could be the reason why the

percentage is so high. These results do show however that Jelly Belly may need

to do some advertising in more countries.

o Question 8: If YES to question 7, where and what was it?

Since 90% of respondents had never seen JB advertising, there are very few

answers. People who have seen some advertising said they had seen it on TV,

online and in sweet shops.

11

o Question 9: Do you see JB as a fashionable/luxury brand or just a food brand?

o Surprisingly, over half of respondents said they see JB as just a food brand. This

is a surprise as Jelly Belly is a fairly pricey confectionary choice.

o Question 10: Would you rather see JB advertising via social media, traditional

media or ambient media?

These results are fairly close, however social media is the most popular choice.

This is not surprising as social media has become so popular in recent years;

almost everyone uses it. This is great for Jelly Belly as social media is with

people all the time, e.g. via smartphones, therefore they can potentially

advertise to consumers all the time.

o Question 11: What is your gender?

This question tells us that the bulk of our respondents are female.

o Question 12: How old are you?

From this we can see most of our respondents are aged between 19 - 24.

Q

12

o Question 13: What is your nationality?

This shows us that 84% of respondents are British.

5.2. Jelly Belly Focus Groups:

Focus Group One

Focus Group Leaders: Katherine Sellwood, Jasmine Barton & Sara Burton.

Date: 19th February 2014.

Time: 16:00.

Group Notes:

Seven people showed up and they were aged between 19 and 25.

Logo Test

The first topic was taking about logos and what logos they recognised, our research

found that everyone recognised the Jelly Belly, Cadburys, Haribo, Rowntree’s and Mars

13

but aside from one didn't recognise the Naturals logo of confectionery. One person

didn't recognise the Nestle logo.

We then asked if they were to walk into a shop, which of these brands were they more

likely to buy and why; they responded with Haribo and Cadbury because they knew

that when they bought them, they knew how it would taste and they are more likely to

enjoy them.

When asking what the focus group thought about Jelly Belly, the predominant

response was "Quality" they see that Jelly Belly is the top of the league for Jelly beans.

However they often chose the other products as they were looking for “quantity”

rather than “quality”; this could be due to them being students therefore they do not

have as much spare money to use for treats like Jelly Belly.

Jelly Belly Advertisement

We then went on to ask what they thought of current and previous TV advertising

campaigns and found that with the “Get real. Get Jelly Belly.” James said that he didn't

like the feel of it, it was too short and that they couldn’t recognise what it was trying to

reflect. It was also said they didn't like the American accent as it seemed

condescending.

The second TV ad we showed was “Share the love”, we received comments that it was

great for kids with the use of colour and excitement, but personally they didn't like it

and they felt it wasn't for them, the accent comment came up again and they liked it

because there was more of a story instead of a plain message.

The third was the “Snowman” advert; they found it boring and plain without any

excitement but found it was the best of the three. The strap line didn't reflect what

14

was happening and therefore made it more confusing. Overall it didn't make them

want to go out and buy the product as it felt more like a gift opportunity.

Jelly Belly Print Campaigns

We then asked them about their print campaigns; we found that with the first

reflection of fruit print they thought it was clever, straight to the point and quirky. It

wasn't too complicated. On the other hand, with the lollipop poster they found that it

involved too much thinking for them to work out; some found this good and some

found this too much (advertising students preferred it!)

The watermelon print was seen as "cute" but James didn't understand it, to them it

more looked like pizza so the art direction wasn't too successful. Although, with the

older Easter style print we found that they preferred the clear nicer message of

simplicity rather than complicated witty print.

Taste Test

Finally we went into the taste test; we gave them a choice between ASDA's own brand

vs. Jelly Belly's jelly beans and we found that out of the group of 7, 4 people enjoyed

the Jelly Belly the most because "it was crunchy, juicy, variety of flavours, brighter", "a

lot more appealing to the eye, taste nicer and because they are more colourful",

"brighter, more attractive, stronger, more pleasant taste" and "better flavour."

Alongside with the three group leaders, we also enjoyed Jelly belly more because of

the burst of flavour in comparison than ADSA, along with the larger variety of flavours

with the option to purchase flavours individually. However James didn’t like a Yellow

Jelly Belly bean, which he said “ruined tasting it for him”. But when he tried a few

beans at the same time, he loved the taste of all of the vibrant flavours together and

made a comment about having small "shot" doses of jelly belly to get all flavours

together, combining them, and not individually.

In terms of the ASDA’s own brand; with the 3 who favoured it - no body made the point

of writing why – so we assume that they didn’t feel too strongly enough to make a

comment.

15

Focus Group Two

Focus Group Leaders: Eleanor Potter, Lauren Chamberlain, Suzie Lemos

Date: 20th February 2014

Time: 09:00

Notes:

6 people showed up, who were aged 19 and 20 and 23 – 50 years.

Logo Test:

The first section was showing arrange of different brand logos to see what the focus

group recognised. Jelly Belly, Cadbury’s, Haribo, Rowntree’s and Mars were recognised

instantly; people had to think about Nestle before saying what it was but only 1 person

identified The Natural Confectionary brand but others had seen the logo but couldn’t

say what it was.

After identifying the brands, we ask the focus group what would may them repeatedly

buy these brands – the taste, texture, packaging, the name? One member of the focus

group spoke about the different tastes between of vegetation Haribo and normal

Haribo; the texture was rubbery and put them off Haribo after trying them. Cadbury’s

was said to be a recognisable brand that they associated with purple, making it an

identifiable brand to buy all the time. All members said the same about Mars. The

Natural Confectionary brand was seen as a healthy sweet brand because of the

‘Natural’ in the title and the no artificial colourings stamp on it – making more people

want to buy that particular brand.

16

Jelly Belly was associated with an ‘artificial look’ yet ‘quality confectionary’ which is less

appetising; it was seen as ‘a treat rather than an everyday sweet’. 2/3 of the focus

group said that they knew of the Jelly Belly brand but never see it in shops, other than

‘one-off’ American Candy shops. Said to be more of an American brand rather than

British, as it isn’t seen as often over here. Members of the focus group said that they

wouldn’t buy jellybeans if they had a varied choice of sweets.

Jelly Belly TV Advertisements:

Firstly, we asked if any of the focus group had seen or heard of anything TV advertising

campaigns of Jelly Belly. No one had seen or heard of any recent or past Jelly Belly TV

advertising, they referred to it as being an America brand.

The first of the three TV advertisements, no one had ever seen but Louise Woodruff

and Charlotte Keyworth both said that the American accent felt daunting because the

American and British cultures are so different; making it seem very pressurising. The

Jelly belly TV Advert was: “Get Real. Get Jelly Belly.”

In the second advertisement “Share the Love” the strong American accent comment

came up again, making it daunting but they felt that the message came across a lot

clearer than the one before because it was more enjoyable to watch and understand

what Jelly Belly is about.

In the third, TV advert “Snowman”; they found it exciting because it was Christmas

orientated and said that this would be appropriate for Jelly belly because they see it as

a brand that you would give as a gift – not just buy for yourself. All members said that

didn’t have the craving desire to go out and buy the brand straight away.

Jelly Belly Print Advertisements:

The print advertisements were favoured over the TV adverts because they were clearer

to understand and they had a ‘straight to the point’ message appose to the over

daunting American accent TV adverts.

The first print advert “Get Real. Get Jelly Belly.” was said first glance to be boring but

after looking at it for a few minutes they saw the mirrored fruit at the bottom of each

Jelly Belly. All members said that this was an effect campaign but it took to long to see

what the message was trying to say about Jelly Belly but still preferred it to the TV

adverts.

The watermelon advert “All that in a Belly.” was the favourite out of the print adverts

as they said it was unusual but creative to how the message came across as the

consumer. At first glance, 2 members thought that it was a pizza but quickly changed

their minds because properly looking; this makes it an unsuccessful advert because the

art direction didn’t capture what Jelly Belly wanted.

The “Lollipop” and “Easter” advert were seen as boring, unsatisfying and confusing to

understand because they didn’t make the members want to go and buy Jelly Belly like

17

an advertisement should. The “Lollipop” advert they didn’t understand at all. The

“Easter” advert was seen as childish and un-promotional towards Easter.

Taste Test:

Finally we did the Taste test; we used Tesco’s own brand jelly beans vs. Jelly Belly’s jelly

beans. When they took part in the taste test we made everyone close their eyes so the

test was fair to both brands. We find out that 2 members favoured Jelly Belly over the

Tesco’s own brand because they were “better tasting, the taste would last in your

mouth longer and they could guess the fruity flavours”. Jelly Belly, was a more

appealing product but they associated it with a “very artificial-looking product because

of its shiny coating” but they said the “brighter colours, made them a lot more

attracted to the product”.

Louise Brewer favoured the Tesco’s own brand over the Jelly Belly because they were

“more reasonable and nicer favours” she also preferred the texture of the product over

the Jelly Belly’s were to “crunchy”. In terms of aesthetics, Tesco’s own brand didn’t

have the same eye catching attention that the Jelly Belly jelly beans did but they said

they would still buy the product because of the difference in the price range.

Packaging:

Jelly Belly’s jelly bean packaging was favoured over Tesco’s own brands because they

like the idea that they can identify which jelly bean is what flavour and they referred to

it as an “old-school way of buying sweets” making them think of their childhood and

why they picked them.

18

Tesco’s own brand was seen as a “traditional packaging” but they could see why it

stood out as the green was attractive to them as consumers but the idea of how you

buy Jelly Belly and the way you picked them, appealing to them a lot more than just

buying a plan old packet of jelly beans.

Conclusion of Focus Groups:

Overall, Jelly Belly seemed to be the better quality and tastier brand that the two focus groups

preferred, compared to ASDA’s and Tesco’s own brand of jelly beans. We found that Jelly

Belly’s advertising, both TV and print weren’t recognised and were found to daunting,

especially with the strong American accent in TV. The print advertisements art direction didn’t

come across clear enough to the group for them to want to go out and buy them as both group

found it hard to understand and got confused. As for the taste testing, both groups agreed that

Jelly Belly had the “better quality and taste” because they were “Juicy, longer lasting taste and

bursting with flavour” but all said that they would rather have Jelly Belly as a gift than just a

regular, everyday treat.

19

6. SWOT Analysis:

STRENGTHS:

o 6.1. “Taste Quality”:

As seen in the feedback from our focus groups, Jelly Belly is recognised

as a quality brand with being preferred by the majority and was

described with words/phrases such as; “crunchy”, “juicy”, “more

attractive”, “better flavour” and a “more pleasant taste”.

o 6.2. Variety of Flavours:

They have 50 official flavours giving the audience a wide variety to

choose from, this allows Jelly Belly to appeal to a wide target audience

with everyone having different preferences and tastes. They also vary

this “official 50” by dropping and adding new flavours, some of these

come from employees at Jelly Belly but they also take suggestions from

consumers as well. However they also have a “feature flavours” which

are 10 flavours that are always in the official 50 flavours. They include:

Lemon lime.

Cappuccino.

Very Cherry.

Orange Juice.

Strawberry Jam.

Sizzling Cinnamon.

Top Banana.

Blueberry.

Juicy Pear.

Green Apple.

o 6.3. Range of Products:

Firstly, the fact that you are able to purchase flavours individually or pick

a selection of your own; enables people to pick their favourites and

avoid flavours which they don’t like creating a personalised selection for

the customer. They also have a selection of assorted flavours such as:

20 Assorted Flavours (the most popular flavours).

Sour Mix.

Fruit Bowl Mix.

Tropical Mix.

Smoothie Mix.

Ice Cream Parlour Mix.

They also have “Sports Beans” selections, that are packed with the

nutrients needed to “blast your way through any athletic endeavour”,

which include:

Orange.

Raspberry.

Lemon Lime.

20

Fruit Punch.

Assorted Flavours.

Extreme Cherry.

Extreme Watermelon.

They also have a “No Added Sugar” assortment bag for people looking

for a healthier option.

Jelly Belly don't just do confectionery, they have more products such as:

Scented Candles (of the Jelly Belly flavours).

Scented Phone Cases.

Scented Laptop Sleeve.

Earphones.

Mini Speakers.

Car Air Fresheners.

Toiletry Sets.

Lip Balm.

Mugs.

Gift Cards.

Petite Bean Machine/Jelly Bean Dispensers.

Uno Game.

Key Rings.

Money Tins.

And more.

With this number and range of products they are appealing to a large audience on

different levels rather than just for sweets.

WEAKNESSES:

o 6.4. Price:

The price being on the higher end of the confectionary market means

that they use a premium pricing strategy; this isn’t very effective with

the recent economy as everyone is trying to save money whether they

are upper or lower class.

This was also mentioned during the focus groups as a reason why they

chose their competitors over Jelly Belly, as they were looking for a larger

quantity for the price rather than quality. However they still recognised

Jelly Belly as a quality brand.

o 6.5. Stocklists:

Jelly Belly cannot be purchased in all stores although it states on their

website that, “Jelly Belly jelly beans can be purchased at most Waitrose,

Sainsbury, Tesco and Morrison outlets.” Along with this they include a

store finder which allows you to put your postcode in and search for the

closest stores to you that sell Jelly Belly.

21

OPPORTUNITIES:

o 6.6. Developing even more flavours:

Jelly Belly can constantly develop more flavours for the jelly beans which

they can test on the customers, these are also known as the “Rookie

Flavours” on their website. This will keep the flavours lively and the

customers interested in their products.

o 6.7. Expanding for Jelly Belly to be sold in more countries:

Currently Jelly Belly are sold in 55 countries around the world, this leaves

a lot more countries such as Turkey and Finland which could be potential

customers to the Jelly Belly Company.

THREATS:

o 6.8. Competitors:

In the confectionary market there are many competitors so Jelly Belly

would not just be keeping up with other companies that manufacture

jelly beans but also all other sweets and chocolate companies.

o 6.9. Recession:

With the current economic state, coming out of a recession, people are

trying to save money where they can whether they are upper or lower

class. This means that they will not have as much spare money to spend

on premium treats like Jelly Belly when they could purchase a cheaper

alternative.

THREATS INTO OPPORTUNITIES:

In terms of competitors, Jelly Belly can look at their competitors

advertisement methods and examine what is being successful and what

could be improved. They can then apply this information to their own

advertising methods.

22

7. References:

1.

2.

3.

4.

www. jellybelly-uk.com [Viewed: 18/02/2014]

www. jellybelly.com [Viewed: 18/02/2014]

http://www.abc1demographic.co.uk/ [Viewed: 19/02/2014]

https://www.keynote.co.uk/marketintelligence/view/product/10790/confectionery?utm_source=kn.reports.brows

e

5. (http://www.nestle.co.uk/aboutus)

6. (http://www.ferrero.com)

7. (http://www.perfettivanmelle.com/about_history_vanmelle.htm)

(http://www.euromonitor.com/perfetti-van-melle-group-in-packagedfood/report)

8. (http://haribo.bg/en/)

9. (http://www.lindt.com/swf/eng/chocolate-gift/)

10. https://www.haribo.com/enGB/products/haribo.html)

11. (https://www.haribo.com/enUS/products/haribo.html)

8. Appendix 1:

When looking into the countries such as Turkey and Finland that Jelly Belly are looking

to expand too; we found that "Allaboutturkey" there are some basic target audience

figures:

2.4. Age structure:

o Total population:

male 38,473,360 (50.2%) - female 38,194,504 (49,8%) (as of January

2014)

0-14 years: 24,6% , total of 18,849,814 (male 9,691,297; female

9,187,285) (January 2014)

15-64 years: 67.7% , total of 51,926,356 (male 23,655,657; female

23,288,033) (January 2014)

65 years and over: 7.7% , total of 5,891,694 (male 2,150,103; female

2,850,072) (January 2014)

o Median age:

Total 30.4 years (male: 29,8 years; female: 31 years).

More than half of the population is under the median age (as of January

2014)

o Population growth rate:

1.37% in 2013 (1.45% in 2010 & 2,11% in 1927)

Under 15 years: 1.05 male(s)/female

15-64 years: 1.01 male(s)/female

65 years and over: 0.75 male(s)/female

2.5. Communications:

o Mobile GSM Phones:

113 million as of February 2011 (63,9 million in June 2008).

23

o Radio broadcast stations:

36 National, 102 Regional, 955 Local, a total of 1,093 (2005)

o Radios:

19.4 million (1997 est.)

o Television broadcast stations:

24 National, 17 Regional, 218 Local, a total of 259 (2005)

o Internet hosts:

16.874.100 in 2009 (355,215 in 2004).

o Internet users:

Approximately 35 million in 2013 (20 million in 2008, 8.5 million in 2005,

5.5 million in 2003)

These figures suggest that the Turkish society consists of mainly 25 - 30 which falls into

Jelly Belly's ideal target audience, and this number is set to increase by 1.37% which

means that turkeys consumer market is successful and is unlikely to crumble with the

recent recession. This age range has a large disposable income with unemployment

being low which means they would be able to enjoy the better things in life.

2.6. Confectionary market in terms of consumers:

When looking specifically into the confectionary market for turkey market reports

suggested that the market for Confectionery in Turkey increased between 2002-2007,

growing at an average annual rate of 2.7%. The leading company in the market in 2007

was Ulker Group. The second-largest player was Cadbury Schweppes plc with Tayas

Gida in third place.

2.7. Finland Confectionary Target Audience

According to Statistics Finland's statistics on population structure, nearly every tenth of

the persons aged 25 to 34 living permanently in Finland at the end of 2012 were of

foreign origin. In the Greater Helsinki region, the corresponding proportion at the end

of 2012 was nearly one-fifth.

o Population (2013 est.): 5,266,114 (growth rate: 0.06%);

Looking into Finland, their average and highest percentage of society is between 25 34 and those are suggested to be the most affluent and well paid especially with a

large proportion of those being involved in the arts. However Finland's growth is

exceptionally lower than Turkey's and it suggests that there isn't much room to be able

to penetrate the market at a suitable rate for Jelly Belly.

2.8. Consumers' own and Finland's economy:

In November, 33 per cent of consumers believed that Finland’s economic situation

would improve in the coming twelve months, while 26 per cent of them thought that

the country’s economy would deteriorate. Twelve months earlier the corresponding

proportions were 21 and 38 per cent.

In all, 25 per cent of consumers believed in November that their own economy would

improve and 13 per cent of them feared it would worsen over the year.

Consumers' expectations concerning their own and Finland's economy in 12 months'

time

24

25