The Power of Buyers, Suppliers and Substitutes The Economics of

Strategies for Responding to

Buyer Power

MANEC 387

Economics of Strategy

David J. Bryce

David J. Bryce © 2002

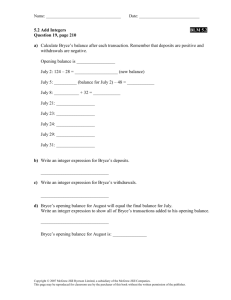

Summary of Last Few Sessions

• Buyers have power relative to sellers when demand curves are flat

• Firm demand curves are flat when many alternative product options are available to buyer—which limits pricing flexibility and drives down profit

• A change in price could either increase or decrease total revenue

• A decrease in price will enhance the available satisfaction a consumer can get from a good, while an increase in price will decrease the available satisfaction

David J. Bryce © 2002

The Structure of Industries

Threat of new

Entrants

Bargaining

Power of

Suppliers

Competitive

Rivalry

Threat of

Substitutes

From M. Porter, 1979, “How Competitive Forces Shape Strategy”

David J. Bryce © 2002

Bargaining

Power of

Customers

What can be done to neutralize the bargaining power of buyers?

1. Differentiate product or service so that it uniquely responds to only certain buyer needs

2. Create demand for complementary goods that require your product or service as an exclusive input

3. Discriminate on price among buyers—charge different buyers a different price for your product

4. Narrow the options of the buyer through market consolidation or exclusive alliances

5. Find new types of buyers and/or alternative uses for your product

6. Create switching costs for your buyers

7. Price at or below marginal cost and produce large quantities so that your product floods the market and attracts loyalty, dependence, and dominant market share; then restrict supply and raise price (risky)

David J. Bryce © 2002

1. Differentiate Product

• Recall from last session that consumer preferences vary

• If a firm can uniquely satisfy the preferences of some particular group, it creates a steeper demand curve and more flexibility in its pricing

• By differentiating, the firm may, in effect, create a “monopoly” within some particular consumer segment

David J. Bryce © 2002

Example: Differentiate Product

• “Big Bertha”

Golf clubs

• Wide hitting face and superb balance appeal to less proficient golfers p q

Demand for

Big Berthastyle clubs

Demand for all golf clubs

David J. Bryce © 2002

2. Create Demand for Complementary

Goods

• Complementary goods are those that work together with other products or services to create joint value

• Example: Sign exclusive joint agreements with complementary product companies or create new goods outright and then help to stimulate demand for that good; or

• Make your good or service an exclusive input into the production of another good or service and create demand for that good

David J. Bryce © 2002

Example: Complementary Goods

Strategy

• Nutrasweet brand on diet colas helped to sell more cola and create demand for Nutrasweet

• “Intel inside” campaign in which Intel’s brand is stamped on complementary goods, thus creating demand for those goods and selling more chips

• NextelDirect – Motorola cell phone walkie-talkie features are valuable only in the presence of complementary direct connect services; sell more phones by creating demand for the walkie-talkie service; Sell the service by creating networkexclusive phones with Motorola

David J. Bryce © 2002

3. Price Discrimination

• Price discrimination is charging a higher price to consumers with higher willingness to pay

– First degree: price equals willingness to pay for every consumer – firm extracts all consumer surplus

– Second degree: different prices for different quantities

– Third degree: different prices for different consumer groups

• In practice, segment consumers by elasticity of demand

– raise price for inelastic customers; lower price for elastic customers

– Auctions, purchasing a car

– Airlines, hotels

– First adopters vs. later ones

David J. Bryce © 2002

Segmenting Customers by

Differences in Price Elasticity

David J. Bryce © 2002

The Opportunity of Consumer Surplus

• Consider the demand curve as an ordering of consumers from highest to lowest willingness to pay

• Buyers to the left of market clearing demand (Q*) paid less than they were willing – can we charge them more?

• Area between the demand curve and the market clearing price (P*) is

“consumer surplus.”

David J. Bryce © 2002

Demand

P*

Consumer

Surplus

Supply

Q*

Value of Price Discrimination:

Some Calculations

• With demand curve

Q(P)=100-P and no price discrimination, the firm sells

70 units at $30 for $2100 revenue.

• With price discrimination, the firm sells 30 units at $70 and

40 units at $30 for $3300 revenue.

• As long as the cost of implementing price discrimination is less than

$1200, profits are increased.

Price

70

30

Q(P)=100-P

30 70

Quantity

David J. Bryce © 2002

Example: First Degree Price

Discrimination

• Auctions tend to collect all available consumer surplus when there are many bidders

• Car buying market generally prices high and then “bargains” down to the amount the consumer is willing to pay

David J. Bryce © 2002

Example: Second Degree Price

Discrimination

• Volume discounts—different unit prices depending on how much is purchased

– Costco “large size” packaging

– Buy 10 get 1 free punch cards

– “Supersize” in Fast Food

– Wood pegs volume discounts (see next)

David J. Bryce © 2002

David J. Bryce © 2002

Example: Third Degree Price

Discrimination

• Airlines have a different ticket price depending on how long before a flight a person books; price rises dramatically as flight date approaches

– Three weeks or greater advance purchasers tend to be private travelers more likely to shop on price

– Last minute purchasers tend to be business travelers with deeper pockets

David J. Bryce © 2002

Requirements for Successful Price

Discrimination

1. Identify and segment customer groups by elasticity – inelastic customers are not eager to reveal their elasticity

2. Prevent inelastic customers from purchasing at the lower price

3. Prevent arbitrage by elastic customers – purchasing at the lower price and reselling to inelastic customers

4. Provide premium features or services that cost less than the price premium

(legally, you must show cost differences to justify the price differences)

David J. Bryce © 2002

4. Narrow the Options of the Buyer

• Since many options available to buyers diminishes a seller’s flexibility, one strategy is to limit buyer’s options

• How?

– Buy, merge, or align with your competitor(s), supplier(s), or customer(s)

– Lobby the government to impose preferential treatments for your products over foreign competitors or to impose import restrictions on competitor’s products

David J. Bryce © 2002

Example: Narrow Buyer Options

• OPEC is the classic case: Numerous sellers of oil who create multilateral agreements among themselves to weaken the power of buyers

• AOL-Time Warner merger – eliminates buyer’s entertainment alternatives for each of Time Warner and

AOL and instead pools all alternatives under one “roof”

• Fruit cooperatives – consolidate the produce supply of many farmers to limit the power of buyers to extract price concessions from individual farmers (government sanctioned)

• Merck-Medco – Merging with a buyer: Merck buys Medco to mitigate the impact of pharmacy benefit management

(PBM) practices on its business, effectively placing itself in control of these practices and neutralizing some PBM power

David J. Bryce © 2002

Example: Narrow Buyer Options

• Korean Beef industry in 1980s: Farmers lobbied the government to reject foreign beef imports; the market price of Korean beef rose to $14 per pound

• US Shrimping Industry: Encourage the government to place tarriffs on imported shrimp from China

David J. Bryce © 2002

5. Find New Types of Buyers

• Find alternative uses for your product that are fundamentally new or different; i.e. they appeal to an entirely new customer group

• This reduces the total influence that any one group of customers has in the business and thus reduces their power

David J. Bryce © 2002

Examples

• Synthetic diamonds used in drill bits are now applied in artificial joints

– New entry into drill bits was giving power to buyers

– New medical device customers (for artificial joints) reduce the effects of drill bit customer power

David J. Bryce © 2002

6. Switching costs

• By creating costs to switch from your product to another, you lock-in buyers to repeated purchases and lower their power

• The price of a potential alternative product must then be lower than the price of your product plus the switching cost

David J. Bryce © 2002

Examples

• Ink for Inkjet printers—customers are locked into ink cartridge types based on their printer purchase; therefore, manufacturers price cartridges high since they have a monopoly in their type of ink cartridge

• Games for Nintendo—Same effect as for ink; once the game console is purchased, customers are locked into Nintendo games; the high prices for games demonstrate this fact

• Cell phone companies impose a contract period of a year (minimum) and impose a high cost for early withdrawal

• We will study more about the theory of lock-in and switching costs in a later session

David J. Bryce © 2002

7. Play the Demand Game

1. Price at or below marginal cost (your cost must be lower than competitors) and produce large quantities, essentially foregoing profit in early periods

2. Your product attracts loyalty, dependence, and dominant market share; competitors leave the market

3. Then restrict supply and raise price

– Risky if loyalty and dependence does not develop or if this loyalty is based only on price

– Works best in the presence of consumer switching costs and/or in standards races

David J. Bryce © 2002

Examples: Play the Demand Game

• Microsoft operating systems pricing strategy;

MSDOS, Windows (succeeded)

• Similar pricing strategy for Netscape (failed),

Adobe Acrobat (succeeded), others

• Honda’s US entry strategy in motorcycles

(succeeded)

• Hyundai’s US entry strategy in automobiles

(failed)

Note: Success or Failure in terms of after-the-fact market share

David J. Bryce © 2002