yuan

advertisement

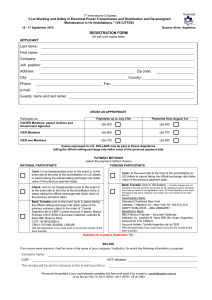

A SINGLE CURRENCY FOR THE GREATER CHINESE ECONOMIC AREA ─The EU Paradiam Reconsidered─ presented by Dr. Cherng-Shin Ouyang Research Fellow ouyang@cier.edu.tw Chung-Hua Institution for Economic Research 75, Chang-Hsin St.,Taipei, Taiwan Conference on The Economic and Security Situation after Taiwan’s Elections 23 September 2008 Organized by the Centre of East Asia Study, Institute of Political Studies, Polish Academy of Sciences, in collaboration with Warsaw School of Economics and the Taipei Economic and Cultural Office in Poland Sponsored by Taipei Economic and Cultural Office in Poland, and the National Sciences Council (ROC-Taiwan) CIER, Sept 2008 0 Glossary AFC Asian Financial Crisis EEC European Economic Community AMF Asian Monetary Fund EMCF European Monetary Cooperation Fund AMO Asian Monetary Organization EMS European Monetary System ASEAN Association of South East Asia Nations EMU European Monetary Union CAD Currency Areas Delimiting/demarcation ERM Exchange Rate Mechanism CBC Central Bank of China ESCB European System of Central Bank CBS Currency Board System EU European Union CCA Common Currency Area GCC Gulf Cooperation Council CCBGs Committee of Central Bank Governors GCEA Greater Chinese Economic Area CECA Closer Economic Cooperation Arrangement HKMA Hong Kong Monetary Authority CEPA Closer Economic Partnership Arrangement IMF International Monetary Fund DPP Democratic Progressive Party KMT Koumingtan EAMA East Asian Monetary Authority MERCOSUR Mercado común del Sur ECB European Central Bank MNCs Multinational Companies ECSC European Coal and Steel Community NAFTA North America Free Trade Agreement CIER, Sept 2008 1 Glossary NIEs Newly-Industrializing Economies NT$ New Taiwan Dollars OCA Optimum Currency Area OPEC Organization of Petroleum Exporting Countries PRC People’s Republic of China RMB renminbi SAR Special Administration Region SCA Single Currency Agenda SEZs Special Economic Zones WTO World Trade Organization CIER, Sept 2008 2 Contents 1- Introduction 2- The EU Paradigm in Perspective 2.1 A Brief History of EMU 2.2 Implications of the EMU 2.3 Future Prospect CIER, Sept 2008 3 Contents 3- Single Currency in East Asia or GCEA? 3.1 ASEAN-Plus 3.1.1 Monetary Cooperation :Phase 1 3.1.2 Monetary Cooperation: Phase 2 3.2 The Greater Chinese Economic Area 3.2.1 Axis-1 (China-Taiwan): Partly Suffocated 3.2.2 Axis-2 (Hong Kong-China): Vibrant As Ever 3.2.3 Axis-3 (Taiwan-Hong Kong): Unequal Dependence 3.3 ASEAN-Plus and GCEA: A Preliminary Comparison 3.4 Rebuilding Axis-1 CIER, Sept 2008 4 Contents 4- Scope for Trans-Adaptation of EMU 4.1 The Tyranny of the Petrodollar Standard 4.1.1 Two Forms of Transfer 4.1.2 Hedging for Profit or Risk Management? 4.1.3 The Petrodollar Standard 4.2 Divorcing from the Dollar World 4.2.1 Consensus Building 4.2.2 Slow or Fast Track? 4.2.3 Monetary Union Depend on Pay-Offs Simulations 4.3. Objective Convergence Criteria versus Political Economy 4.3.1 Similarity and Differences 4.3.2 Irrelevance of the EU Paradigm CIER, Sept 2008 5 Contents 5- The Way Ahead 5.1 EU Paradigm Modified 5.2 Trouble-Maker: The US Ultra-Liberalism 5.3 CAD Prior to OCA in System Switch 5.4 Final Remarks CIER, Sept 2008 6 Fig.1 Currency Areas in terms of Foreign Assets Holding EMU ¥ GCEA SF £ Dollar World CIER, Sept 2008 7 Proposed Currency Areas Western Africa underdeveloped infrastructure MERCOSUR closed economy, high volatility in capital flows, interest conflict over dollarization Gulf Cooperation Council Huge difference in country size and disagreement on the location of central bank NAFTA US insistence on a dominant role for the federal reserve system and US$ and Canada’s uneven economic geography ASEAN+3 (East Asia Minor) Adherence to the non-interference principle on domestic affairs, disagreement on the composition of a currency basket GCEA Political hindrance (Taiwan) One China, two systems (Hong Kong) CIER, Sept 2008 8 Footprint of Euro •ECSC (1951) •EU (1993) •EEC (1957) •The Stability and Growth Pact (1997) •EC (1967) •EMS (1979) •EMU (1999): 11 Member Eurozone, Dual Circulation •Whitle Paper on Completion of the Internal Market (1985) •EMU (2002): Single Currency •Single Market Act (1991) •Treaty of Maastricht (1991) •ECU (1992) CIER, Sept 2008 •25 Member EU (2004) •13 Member Eurozone (2007) •15 Member Eurozone (2008) 9 Characteristics of the EMU Broad-based experiment ever attempted through peaceful means Triggered by strong program architects and governmental commitment Carefully planned and forcefully implemented Developed from grass-root, expanded through consensus building Increasing ECB’s influence in world trade and finance Global turmoil-weathering power rises in commensurate with the EU aspiration to forward-looking perspective Growth of the euro-zone as a more cohesive shock absorber CIER, Sept 2008 10 Characteristics of the EMU Sustained by drive towards continuous deepening and widening The theory of the “optimal currency area” corroborated (Mundel/McKinnon) Closely following the five-stages thesis for integration (Balassa) Gradualism prevailed Visible hands play a large part Ad hoc policies become endogenous not exogenous variables throughout the integration process CIER, Sept 2008 11 Future Prospect EU integration breaks record on many fronts A monument or living paradigm! enlarged EU proper converted gradually into a more homogeneous and consolidated entity Post-911 dollar started its landslide as never before; traders dump the US dollar and dollar-denominated assets round the world, more so after spiraling oil price (2003) GDP of Eurozone (EU15)surpassed the US in 2007 CIER, Sept 2008 12 Future Prospect EU status would not have taken place without EMU: magic of the single currency agenda! €,An increasingly powerful reserve currency of the world The most fundamental change to the international monetary system since the collapse of the Breton Woods system Might rival dollar as the world's paramount international reserve currency, heyday of dollar hegemony is foredoomed CIER, Sept 2008 13 Single Currency in East Asia or GCEA? ASEAN-Plus(GI)has received more attention whereas GCEA ( GII )conspicuous less Level of market integration, ethnic-cultural homogeneity, geographical proximity, common heritage, GII substantially higher than that of GI Institutional framework for cooperation and goal-setting, GI on a higher level CIER, Sept 2008 14 Monetary Cooperation of ASEAN-Plus: Phase 1 Creating an internal market: Reacting against regional protectionism posed by EU and NAFTA in 1990s Reinforced at the Asian financial crisis (APC): to create the AMF Taiwan: access to multilateral groupings restricted to sovereign states CIER, Sept 2008 15 Monetary Cooperation of ASEAN-Plus: Phase 2 “Chiang Mai Initiative” reached by ASEAN +3 for maintaining exchange rates stability (2000), FTA concluded alternatively between ASEAN and China (2002), Japan (2003) and South Korea (2006), each on a different basis Signing of the ASEAN Constitution and the Economic Blueprint at the 13th ASEAN summit (2007) China prioritized by ASEAN as the contracting partner for FTA Building the institutional capacity to coordinate financial and monetary policies and to facilitate disclosure of information CIER, Sept 2008 16 The Greater Chinese Economic Area Axis-1 (China-Taiwan): Partly Suffocated Taiwan Mandatory regime on bilateral relations undergoes constant modifications KMT sought to resume talks with Beijing, failed due to top-down repetitive sabotages: 1990s De-sinocization mobilized by pan-Green separatists: 2000s~ China Adopts an open-door policy towards Taiwan and the world without discrimination Main Features Asymmetric integration and dependence: trade, investment, financial linkages Decade-spanning stagnation in development of bilateral ties entailing nothing but stalemate CIER, Sept 2008 17 The Greater Chinese Economic Area Axis-2 (Hong Kong-China): Vibrant As Ever Hong Kong A cosmopolitan trans-shipment hub Regional headquarters of the MNCs Survive the AFC upon first aid from Beijing Currency Board System (CBS) introduced in 1983 Largest direct investor in China Bilateral Ties: FTA Plus CEPA-1(2004) CEPA-2 (2005) CEPA-3 (2007) Main features Restructured and assimilated into the Zhu-river delta in southern China Single currency agenda contradicts the “one country two systems” dictum HKMA satisfied with the CBS CIER, Sept 2008 18 Monetary Cooperation of ASEAN-Plus: Phase 2 Axis-3 (Taiwan-Hong Kong): Unequal Dependence “Taiwan-Hong Kong” interdependence devoid of less man-made obstacles Taiwan depends more on Hong Kong than the other way round Hong Kong exploit as much arbitration charges as the extra transaction costs incurred on Taiwan by having to do business with mainland China indirectly The scope for bilateral convergence in monetary system considerably less than Axis-1 and Axis-2 CIER, Sept 2008 19 GI and GII: A Preliminary Comparison Formal integration in GI much higher than GII for the time being, in real terms GI lags substantially behind especially when contrasted against Axis-2 To close the gap: Axis-1has to be rehabilitated Evidences: GII is more or less a homogeneous entity Much less coordinating efforts are required in redressing intraregion differences along Axis-1 and Axis-2 Disparities in income and development levels are reducing rapidly CIER, Sept 2008 20 Rebuilding Axis-1 Post-election easing of age-old cross-Strait tensions Taipei has taken the initiative for reapprochment The rationales: to recoup the incalculable economic losses arising from the “suicidal” mainland China policies in the past The new orthodox: reversing the past wrong-doings in a spirit of calculated and outgoing pragmatism CEPA-like FTA to be negotiated with Beijing considered a priority SCA cannot be excluded in the medium run as long as both the objective and subjective conditions are met CIER, Sept 2008 21 Scope for Trans-Adaptation of EMU Motives for monetary union: (1) guard against the threat of financial crisis, (2) to enhance total welfare of the region concerned The aborted East Asian model is reflective of the first and relatively modest objective The EU model shows more characteristics of the second For GCEA: ongoing crisis (a system- or mega-crisis) is of an utterly different specie Those that have been taken hostage within reach of the crisischain start to look for emergence exit EU, sheltered by a dense wall of euro-dominated internal market exhibits greater resilience The critical questions: how are we to characterize the current crisis? Secondly, what is the scope for trans-adaptation of the EU paradigm to the GCEA? CIER, Sept 2008 22 Tyranny of the Petrodollar Standard Current crisis: categorically diverse in origin and manifestation Crisis syndrome: plummeting US dollar, oil crisis, sub-prime mortgages, food shortages, inflation, climate changes, etc. Causally related and in one way or the other Against which conventional wisdom is powerless to diagnose or to rescue: APC pales by comparison Has little to do with trade cycle nor that of speculative attacks on particular victims But one of irremediable sclerosis that derives overwhelmingly from the intrinsic weakness of human brain in system design and maintenance (US ultra-liberalism) In the monetary-financial sphere there is singularly one origin-the US economy, principally the discredited dollar standard CIER, Sept 2008 23 Forms of Wealth Transfer Dollar tyranny delivers shock waves across the globe amounting to imposition of compulsory tax on ROW Causes: the 911 attack, deteriorating US economic fundamentals, credibility deficit of Bush administration Out of benign or vicious neglect: the Fed/US Treasury choose to do nothing! Burden sharing and diversification, dollar weakness entails enormous wealth transfer in two parts: stock and flow/visible and invisible CIER, Sept 2008 24 Forms of Wealth Transfer Visible Impacts Stock: wealth position of creditors nations dwindles (Major victims: China, Japan, OPEC, and the Asian NIEs) Flow: US to print fiat currency and exports inflation to oil consumers by keeping dollar cheap while draining resources backwardly CIER, Sept 2008 25 Forms of Wealth Transfer Invisible Impacts exchange rate manipulation (viciously neglected!) To reap and manage creditors assets according to the terms dictated by the Fed! Dollar-anchored Central Banks (CBC) deprived of policy autonomy Hypothesis awaits verification: game-based economic warfare in disguise staged by the US without declaration! Dollar intrigue has positioned the US in a superior bargaining lever (70% of world trade invoiced in dollar) CIER, Sept 2008 26 Hedging for Profit or Risk Management? Exchange rate risks and losses rise against dollar volatility (slide) Losses are greater the more exported products are priced in dollar and sourcing of intermediate inputs priced in non-dollar Chaos evidenced throughout chain-linked turmoil in crude futures, the housing mortgages and other financial derivatives traded in US dollar. Critics bypass the more significant role of the derivatives markets Drawing the borderline demarcating the role of financial derivatives market between risk-hedging and speculative gains: a barometer for diagnosing the world financial health US monetary-financial authority, again, choose to neglect! CIER, Sept 2008 27 The Petrodollar Standard World monetary-financial system in chaos in post-Bretton Woods era Causes of world financial crisis still to be explored in depth but in origination crude oil denominated in US dollar (dating from 1973) is considered decisive in crisis contagion CIER, Sept 2008 28 Divorcing from the Dollar World For GCEA, divorcing from the dollar world towards a “common currency area” is a priority for engineering a paradigm shift Officially, the SCA is not an object of immediate concern for Beijing and Taipei Switching from one system to a qualitatively different one is a multi-faceted and dynamic process of path searching and selection System-switch involving more than one economy has to coordinate the decisions and efforts of all relevant participants As a comparison, the euro-propelled EU expansion is a musclebuilding process, whereas for the GCEA crisis- insulation is more decisive CIER, Sept 2008 29 Consensus Building Contacts and resolution of issues on cross-Strait flows and cooperation resurface after power switch The proposed CECA pact with Beijing signals an advance among others for cementing bilateral It is high time to examine the claimed merits for establishing a yuan-bloc The case is much simpler for launching the common currency in Hong Kong Throughout the negotiation process tripartite consensus- building is indispensable CIER, Sept 2008 30 Slow or Fast Track? Choice between slow and fast track in monetary union is preconditioned, weighted by decision-makers’ preferences The Mundell-Balassa model has often been employed as the orthodox blueprint for monetary integration processes (hailed as the economist approach in the EU) The EU model is unique; the validity of this model cannot be duplicated without modifications In the case of GCEA the fast track would be the more credible (hailed as the monetarist approach) with crisis-circumventing as the top priority Owing to the disproportionate weights of the GCEA-trio the proposed SCA is supposed to share greater resemblance with Slovenia’s entrance into the Eurozone CIER, Sept 2008 31 Monetary Union Depend on Pay-Offs Simulations Decision to move towards a yuan-bloc conditional upon differences in the outcome of simulated intertemporal pay-off to the GCEA-trio in question Two sets of criteria are employed for assessing differences in the outcome: i.e. visible and invisible wealth transfer Three scenarios may be envisaged depending on the extent according to which the avowed decision is endogenous to the transfer processes: high, medium, and low In the extreme (highly endogenous) case, creation of the yuanbloc would trigger worldwide massacre of the dollar assets of which China, boasting huge dollar assets, becomes a major victim of its own decision CIER, Sept 2008 32 Monetary Union Depend on Pay-Offs Simulations Concurrent with downsizing of the dollar world panic sale-off would drive the global economy to the brink of collapse A dilemma in decision-making arises henceforth which is clearly undesirable but one that was not a problem for the EU It seems illegitimate to contend that the polar opposite (low endogenous) scenario is more likely The intermediate scenarios cannot be ruled out a priori CIER, Sept 2008 33 Objective Convergence Criteria versus Political Economy EU economic and monetary integration: highly politically motivated EU was not an OCC but a quasi-OCC up to the time when Single Market was formed in 1993 Evidences: greater intra-community convergence in terms of comovement dynamics over the interval 1966~79 and 1979~92: Cross-country correlation in employment growth grew from 0.49 to 0.63 Intra-country correlation decreased from 0.33 to 0.13 while that between selected sub-regions (e.g, Italy and Germany) increased from -0.09 to 0.23 EU expansion: picking accession candidates for widening CIER, Sept 2008 34 Similarity and Differences: EU and GCEA Similarity (hypothesis): Along axis-1 and axis-2: cross-Strait economic co-movements greater between sub-regions than broad economy Absorption (akin to EU-widening after 2004): small parts (Taiwan and Hong Kong) being subsumed and assimilated (hypothesis to be rectified) into PRC instead of reciprocal assimilation between equal partners Differences (hypothesis): Along axis-1 and -2: GCEA based on disparate weight and greater interGCEA division of labour of the trio (in contrast to the oligopolistic power structure and greater intra-EU division of labour) Motives for building the yuan-bloc: to disengage from the dollar world Rationale: ascertaining “boundary conditions” for building the yuan-bloc prior to fulfillment of the objective criteria furnished by the process leading to the EMU CIER, Sept 2008 35 Relevance of the EU Paradigm The schematic relevance of the EU paradigm to GCEA can be examined through two perspectives: that of the continued eastward expansion of the EU and the assumed non- optimality of the dollar-based GCEA. Geopolitical considerations prevail over economic rationales in post-2004 EU expansion. As a corollary, non-optimality of the dollar-based GCEA has two dimensions. Dimension 1(hypothesis): to prove that the dollar standard adopted in current GCEA-trio cannot be sustained (is nonoptimal); this may be verified by subdividing the wealth transfer effect into a “visible” and “invisible” part (see §4.1.1), both in terms of “stock” and “flow” by tracing associated changes in the macroeconomic variables of the GCEA-trio as against the dollar world CIER, Sept 2008 36 Relevance of the EU Paradigm Deminsion-2 (hypothesis): to characterize the “boundary conditions” (i.e. threshold conditions demarcating one currency area from the other) by two methods: (1) the method of reductio ad absurdum along the three axes with respect to the US economy, respectively, and (2) the method for ascertaining the requirements for upholding the yuan-bloc Addendum: there is no need to wait for RMB being made convertible internationally for introducing yuan as the common currency in GCEA; regionally convertible would suffice CIER, Sept 2008 37 The Way Ahead: EU Paradigm Modified For many regional groupings on the pipeline creation of a region-based monetary union remains an attractive but distant luxury Following the launch of euro revived interests and aspirations to the SCA duly followed throughout the world but mostly confined to thought experiments Being a more compact and homogeneous entity the GCEA looks fit to initiate the project with less visible hindrance compared to ASEAN-plus However, to divorce from the crisis-plagued dollar world the EU paradigm will have to be modified In the same spirit this paper seeks to identify the prospect of similar design for the GCEA CIER, Sept 2008 38 The Way Ahead Trouble-Maker: The US Ultra-Liberalism Source of trouble: world financial crisis originates almost exclusively from the US Ultra-liberal capitalism: in genesis current crisis is totally different from that characterized by market disequilibrium, financial speculation, or trade cycle Triple crisis in one: globalized US terrorism consists of oil, housing, and financial derivatives--each having a life cycle of its own emanating from a built-in system sclerosis exacerbated by decades-spanning twin-deficits (plus the credibility deficit of US Administration) Burden diversification: unable to survive on its own US decisionmakers have opted for an easy way out, to export home-grown disaster abroad CIER, Sept 2008 39 The Way Ahead Trouble-Maker: The US Ultra-Liberalism Disengage from the dollar world once for all: it is feared that the US-germinating crisis will acquire a permanence of its own and resurrect in transformed form in one way or the other in the future Means for doing so: a fundamental switch in monetary system CIER, Sept 2008 40 The Way Ahead: CAD Prior to OCA in System Switch Framework for conducting system switch analysis (separated by boundary/threshold criteria of two currency regimes): static and dynamic Comparative static (temporal equilibrium) Two forms of decision rule (hypothesis) put forward in this paper First rule in system switch (A): (CAD-based) net inter- regional transfer accrued to the OCA in question is positive Second rule in system switch (B): net intra-regional transfer accrued to the OCA in question is positive Third rule (C): conventional OCA theorem (Balassa-Mundel) CIER, Sept 2008 41 The Way Ahead: CAD Prior to OCA in System Switch Application of the first rule for GCEA: net simulated (static) potential losses (gains) after transition by adhering to the dollar standard is greater (less) than that by adopting the yuan standard Priority in use of decision rules based on set theory: C⊂B⊂A System switch pays provided it can be validated by the results of simulation conducted for each of the GCEA-trio Addendum (omit) Dynamic (intertemporal equilibrium) Invisible output-impact transfer due to changes in the degree of policy autonomy) CIER, Sept 2008 42 Final Remarks Ranking in hierarchical order, CAD is the fundamental whereas OCA the secondary criteria in ascertaining the boundary conditions separating members from non-members of a monetary union A monetary union is not just an emergency exit but a more durable artificial construct aimed at weathering the storm of future crisis; the disproportionate size of the GCEA-trio compared to that of the EMU suggests that considerably less coordinating efforts are involved in creating the yuan-bloc The yuan-bloc is created in three consecutive steps but a quick fix is preferred A multi-polar world is not feasible without yuan being made a key international reserve currency A handsome amount of arguments and contentions presented in this essay are subject still to empirical verifications CIER, Sept 2008 43 Thank you for your attention! CIER, Sept 2008 44