A Short Course in International Trade Law - US

advertisement

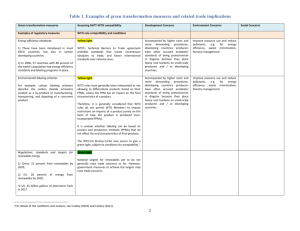

A SHORT COURSE IN INTERNATIONAL TRADE LAW Professor David A. Gantz University of Arizona, James E. Rogers College of Law Hanoi, August 2004 gantz@law.arizona.edu Sponsored by The U.S.-Vietnam Trade Council Education Forum usvtc@usvtc.org 1 I. Introduction Teaching int’l trade law is difficult: • Issues are complex • Too much material to cover adequately in a 3 • • hour one semester course There are constant important changes from year to year Case study is required for understanding of WTO’s Appellate Body, even for civil lawyers 2 I. Introduction, cont’d. Definition of international trade law (not the same as int’l commercial law) GATT/WTO History Basic Principles – GATT/WTO Exceptions to GATT/WTO Principles Art. XXIV, FTAs and the VBTA WTO Accession 3 I. Introduction, cont’d. Doha Development Round Rules of Origin and Customs Issues Trade in Agricultural Products Textiles and Clothing Trade Remedies – Dumping, Subsides, Safeguards WTO Dispute Settlement 4 I. Introduction, cont'd. Intellectual Property Trade in Services Standards and Phytosanitary Measures TRIMS Developing Countries and World Trade 5 II. GATT and the WTO WTO, with over 146 members, became effective in 1995 WTO replaces GATT, which governed world trade from 1947-1994 Marrakesh Agreement Establishing the WTO has various annexes: • • • • • GATT and other trade in goods agreements General Agreement on Trade in Services TRIPS Agreement Dispute Settlement Understanding Trade Policy Review Mechanism 6 GATT/WTO, cont’d. • Plurilateral Agreements (government contracts, civil aircraft, bovine meat, dairy products) All but Plurilateral Agreement are mandatory for all WTO Members WTO is an international organization Voting in theory may be by 2/3 vote, but in practice all decisions are by consensus 7 III. Core GATT Principles Unconditional Most Favored Nation Treatment (Art. I) Tariff Bindings (limit on tariff levels on product by product basis) (Art. II) Non-discrimination with regard to internal taxes and rules, regulations, etc. (Art. III) 8 III. Core Principles, cont’d. Requirement of transparency for traderelated laws, regulations, rulings, etc. (Art. X) Prohibition against most quantitative restrictions (quotas) (Art. XI) 9 IV. Exceptions Balance of payments problems (Arts. XII, XVIII) Special treatment of developing nations General exceptions (Art. XX) • Protection of public morals • Necessary to protect human, • animal or plant life or health Relating to trade in gold or silver 10 IV. Exceptions, cont’d. • Compliance with customs, competition, • • • • intellectual property and fair trade laws Products of prison labor Protection of national treasures of historical or archeological value Conservation of exhaustible natural resources Obligations under commodity agreements 11 IV. Exceptions, cont’d. Art. XX “chapeau” limits use of exceptions to situations where there is no arbitrary or unjustifiable discrimination or disguised restriction on international trade. 12 IV. Exceptions, cont’d. Actions a Member “considers necessary for the protection of its national security interests.” (Art. XXI) 13 V. FTAs, Customs Unions and RTAs Exception to MFN and other GATT obligations for FTAs and Customs Unions (Art. XXIV), with conditions: • Covers substantially all trade among • • members Elimination of barriers within a reasonable payment of time No increase in tariff or non-tariff barriers for non-members 14 V. FTAs, cont’d. Regional Trade Agreements (RTAs) have proliferated – nearly 300 notified to WTO US, Mexico, Canada, EU, now Japan and Korea, among those concluding RTAs ASEAN – AFTA NAFTA – North America 15 V. FTAs, cont’d. VBTA is not a “free” trade agreement, but contains some of same elements involving not only trade, but investment, services, transparency, business facilitation, safeguards VBTA requires important changes in Vietnamese legal system, courts, regulatory process, etc. 16 VI. WTO Accession WTO Rules permit any Member who wishes to negotiate bilateral agreement with prospective members Most favorable results of those agreements combined in a single WTO accession agreement Two thirds majority vote required for new members, but to date all accepted by consensus 17 VI. WTO Accession US, EU, Korea, Japan, China, Australia, etc. realize Vietnam will be a major world trader, and thus are seeking many market-opening concessions Bilateral agreements have been reached to date only with Cuba; nearly 20 more remain 18 VI. WTO Accession In June, Vietnam significantly improved its accession offer: • Average bound tariff reduced from 22% to • • 18% Greater services market-opening Reduction in tariff rate quotas and other exceptions If all goes well, Vietnam could become a WTO Member during 2005 19 VII. Doha Development Agenda Efforts to Initiate new Round failed in Seattle in 1999, due to concerns of developing members and indecision in US and EU Doha round launched in November 1999, but progress to date has been minimal 20 VII. Doha, cont’d. Impasse at Cancun based on following still unresolved issues: • Inclusion of Singapore Issues (investment, • • • competition, transparency in government procurement, trade facilitation) Agricultural production and export subsidies Agricultural market access Extent to which developing countries will be expected to make new commitments 21 VII. Doha, cont’d. “Group of 20” led by Brazil, India, now exercises considerable leadership over many developing countries; unclear whether G-20 will be an effective negotiating force or simply a bar to further progress 22 VII. Doha, cont’d. US presidential election, changes in EU Commission (November) and recent accession of 25 new EU members (May) make progress in Doha negotiations unlikely before mid-2005 23 VIII. Rules of Origin/Customs Eventual WTO Agreement on NonPreferential rules will likely use the tariffshift approach In substance this is similar to U.S. principle of “substantial transformation” Uniformity in R/O important to facilitate world trade 24 VIII. R/O, Customs, cont’d. Preferential rules as in NAFTA and AFTA may use several approaches • Tariff shift • Wholly produced locally • Local content (50% - 60% in NAFTA, 40% • AFTA) Specific component, e.g., color TV picture tube 25 VIII. R/O, Customs, cont’d. Harmonized System, used by US, Vietnam and most other nations, provides uniformity of classification for more than 5,000 six digit commodity groups Uniformity facilitates trade and collection of customs duties 26 IX. Agricultural Trade Farmers are protected in every nation; highest levels of protection are in EU, US and Japan, but are also found in China, Brazil, India and Mexico, among others GATT 1947 contained many exceptions for agriculture, and did not effectively regulate agricultural product trade 27 IX. Agricultural Trade, Cont’d. Agreement on Agriculture reduces but does not eliminate agriculture subsidies • • • • Green box (non-distorting) subsidies aren’t significantly restricted Blue Box (less-trade-distorting) direct payments not tied to production – less restricted Amber Box (most restricting) tied to production, are reduced Export subsidies are significantly limited 28 IX. Agricultural Trade, Cont’d. After expiration of “Peace Clause,” agricultural subsidies are now restricted under SCM Agreement Agricultural subsidies prohibited if they exceed Members’ commitments under AoA Otherwise, actionable under SCM Agreement only if adverse effects are shown. 29 X. Textiles and Clothing For many decades, under Multi-Fiber Agreement, developed countries have imposed quotas on textiles and apparel from developing nations Under ATC, all such quotas will have been phased out as of January 1, 2005, although high tariffs may remain 30 X. Textiles/Clothing, cont’d. Although ATC strongly supported by country Members during Uruguay Round, many are now concerned Since China, India and a few other large producers are no longer subject to quotas, and are highly efficient producers, smaller, less efficient producers may not be able to compete. 31 X. Textiles/Clothing, cont’d. Problem is particularly serious for small producers in Caribbean, Central America and Sub-Saharan Africa Vietnam remains subject to U.S. quotas until she becomes a member of WTO, adversely affecting competitive position in world textile market 32 XI. Trade Remedies Safeguards GATT, Art. XIX contains “escape clause” permitting reimposition of tariffs or quotas as a result of increasing imports causing serious injury to domestic producers Such language found in GATT 1947 and most other trade agreements 33 XI. Safeguards, cont’d. Another requirement is “unforeseen circumstances,” unexpected surges as a result of tariff concessions, which is difficult to prove. WTO Agreement on Safeguards provides detailed procedural and substantive requirements for initiation of safeguard measures 34 XI. Safeguards, cont’d. Many countries, such as US, exempt FTA partners from global safeguards, although WTO Appellate Body has made this very difficult. Developing country exports are exempted if a country represents under 3% of total exports, or developing countries in the aggregate, under 9% 35 XI. Safeguards, cont’d. US – Steel Safeguards confirmed that only increased imports throughout the period of investigation would be sufficient justification for safeguards. FTA members who were major producers– Mexico and Canada– could not be excluded if their imports were covered in the investigation 36 XI. Safeguards, cont’d. Difficulties with regard to showing that imports were cause of serious injury, FTA issues, unforeseen circumstances, makes a WTO legal safeguards action by Member nations unlikely. U.S. has special safeguards for “market disruption” for NMEs; lower standard 37 XII. Trade Remedies - Dumping Dumping most common of trade remedies; over 100 WTO Members have AD laws, as does Vietnam Most common users are US, India, EU, Australia and Argentina To impose AD duty, domestic industry needs to show dumping, and material injury 38 XII. Dumping, cont’d. WTO AD Agreement defines dumping as price discrimination between foreign and domestic markets More logical focus on sales below production cost, or predatory pricing, is not used AD laws best seen as a safety valve for freer trade worldwide 39 XII. Dumping, cont’d. Normal Value (NV) (usually price in home market) compared to Export Price (EP) If EP is lower than NV, difference is dumping margin, with de minimis level of 2% AD Agreement provides detailed procedural protections and substantive rules for national investigating authorities 40 XII. Dumping, cont’d. Under AD Agreement and national laws, various adjustments are to be made to NV and EP so as to provide a “fair comparison.” Adjustment for freight, circumstances of sale, differences in merchandise are designed to result in a fair comparison at the “ex factory” level 41 XII. Dumping, cont’d. Non-Market economy countries, such as Vietnam and China, are treated differently US, EU assume that various materials and production costs (input data) are not set by market forces, but through government decisions, and are therefore untrustworthy 42 XII. Dumping, cont’d. Instead, Commerce (or the Commission) uses a “surrogate,” normally a market economy country such as India or Bangladesh that is a significant producer of the product, and is at a similar level of development In theory this seems reasonable, but the lack of detailed public data from producers in the surrogate country permit Commerce to make many assumptions or adjustments that may be adverse to NME country producers. 43 XII. Dumping, cont’d. China, in its Accession Agreement with the United States, accepted the concept of NME treatment for 15 years! US and China had recent discussions as to how China can become a market economy for AD purposes (like Russia) but it likely will take many years to change 44 XII. Dumping, cont’d. Commerce initially determined that Vietnam would be given NME treatment as part of Basa/Catfish, based on: • • • • • • • Government intervention in economy Non-convertibility of dong Controls on foreign investment and investors Use of government pricing committees Discriminatory treatment of SOEs Restrictions on private land ownership Weak rule of law 45 XII. Dumping, cont’d. While the surrogate approach is used for NV, Vietnamese (and most Chinese), exporters have been given “separate rates” for determining EP This is based on Commerce determination that the exporters determine selling prices without government direction or interference. 46 XII. Dumping, cont’d. In BASA/Catfish, Commerce used input data from India and Bangladesh, and found margins of approximately 36-64% The US International Trade Commission found material injury, based on the significant increases in Vietnamese imports over three years, and lower prices in the U.S. market 47 XII. Dumping, cont’d. While small producer countries are exempt from AD injury findings if they have imports which are less than 3% individually or less than 7% in the aggregate (Art. 5.8), Vietnam was responsible for a far larger share of total U.S. imports. 48 XII. Dumping, cont’d. In Shrimp, Commerce found preliminary AD margins of 12.11% to 19.60% for most Vietnamese producers, although a group of others received 93.13% margins A Bangladeshi company was used as the surrogate for most input prices 49 XII. Dumping, cont’d. Final AD determination could result in higher or lower margins, after verification in Vietnam and a hearing in Washington If final AD margins are found, likely that USITC will find material injury, as Vietnam source imports (and those from five others, China, Brazil, Ecuador, India, Thailand) are rapidly increasing, while the U.S. domestic producer market share is decreasing. 50 XIII. Trade Remedies – Subsidies US doesn’t bring countervailing duty (CVD) actions against NMEs US may nevertheless bring WTO actions against Vietnam (once Vietnam is a member) in WTO DSB against Vietnam’s prohibited or actionable subsides under Parts II and III of SCM Agreement 51 XIII. Subsidies Subsidy defined (Art. 1 of SCM Agreement) as financial contribution that confers a benefit on recipient Actionable or “yellow light” subsidies are domestic subsidies that are “specific” and cause injury, “nullification or impairment” or serious prejudice. (Arts. 5,6) 52 XIII. Subsidies Export (“Red Light”) subsidies are prohibited under Art. 3 except for least developed developing countries. Certain subsidies (Art. 8) were from 1995-2000 specifically excluded; “Green Light” subsidies were certain environmental, regional and R&D subsidies. 53 XIII. Subsidies Developing countries, including Vietnam once Vietnam is a member and no longer treated as an NME, receive certain benefits: • Excluded if their exports are 4% or less of • • import value, 9% or less in aggregate 2% de minimis level instead of 1% Grace periods for export subsidies (now expired) 54 XIV. WTO Dispute Settlement WTO arguably most successful international dispute settlement mechanism in world history, under WTO’s Dispute Settlement Understanding (DSU) 309 cases filed as of March 2004, with 77 adopted panel or Appellate Body Reports, at least 43 settled cases, most of rest are pending or inactive 55 XIV. WTO Disputes, cont’d. Both developed countries and developing nations have been claimants and respondents (66% to 33% more or less) Process under direction of Dispute Settlement Body (DSB) contemplates mandatory consultations, option of conciliation, and then binding WTO panel process 56 XIV. WTO Disputes, cont’d. Prior to 1995 GATT dispute settlement was unsatisfactory. New system makes major improvements: • • • Strict time limits for cases, so serious delays are rare Appellate Body (AB) reviews legal issues in interest of consistency Panel/AB decisions are automatically adopted in absence of consensus not to adopt (never to date) 57 XIV. WTO Disputes, cont’d. Panelists are chosen from Member rosters, government or private persons with trade expertise, not nationals of the disputing parties Panel accepts briefs, holds one or more hearings, renders interim and then a final decision, usually within about 12 months 58 XIV. WTO Disputes, cont’d. Panel decision may be appealed on issues of law only to AB; about 2/3 of cases go to AB AB is standing group of seven members chosen for four year (once renewable) terms AB decisions are usually based on strict textual reading of covered agreements, following VCLT Arts. 31-32 for interpretation 59 XIV. WTO Disputes, cont’d. AB process almost always concluded in 3 months DSB normally adopts decision within a month or less Thus, total DSB process takes 16-20 months in normal circumstances 60 XIV. WTO Disputes, cont’d. Losing Member has three choices: • Comply with DSB decision (recommended) • Negotiate compensation with prevailing party • Accept retaliation (trade sanctions through higher tariffs) from prevailing Member, as approved by DSB 61 XIV. WTO Disputes, cont’d. Implementation has been the rule, but there have been exceptions resulting in trade sanctions: • EU – Growth Hormones • EU – Bananas • US – 1916 Antidumping Act • US – Byrd Amendment • US – Foreign Sales Corporations 62 XIV. WTO Disputes, cont’d. Problems with DSB include: • Difficulties for small countries to use trade • • • • sanctions against large countries Lack of transparency of panel/AB process Costs of litigation before DSB Treatment of non-member (NGO) briefs Inability of WTO Members to effectively supervise AB because of consensus voting requirements 63 XV. Intellectual Property TRIPS Agreement is comprehensive treatment of IP issues TRIPS initially was favored by developed nations, who are highly competitive in high technology exports TRIPS opposed by developing world, due to enforcement problems and concerns over pharmaceutical products 64 XV. TRIPS, cont’d. Major elements of TRIPS: • National treatment • Obligatory accession to IP treaties • Minimum standards for registration of patents, • • trademarks, etc. Minimum standards for local enforcement against piracy, including criminal penalties Binding WTO dispute settlement 65 XV. TRIPS, cont’d. Developing countries received special grace periods for TRIPS implementation: • Until 2000 for most developing countries • Until 2005 for least developed countries 66 XV. TRIPS, cont’d. US 301 and Special 301 remedies– used largely against IP violations– arguably aren’t really necessary now US has option of seeking enforcement of IP/TRIPS rules in DSB, and imposing sanctions if responding Member does not comply For not WTO members, such as Vietnam, Section 301 actions are a serious risk 67 XV. TRIPS, cont’d. Section 337 mechanism– used to bar entry of goods to US that violate a US patent– still under use Law requires an extensive and costly administrative proceeding before USITC Prevailing party can obtain exclusion order, or cease and desist order 68 XVI. General Agreement on Trade in Services Objective of GATS is to apply GATT principles for trade in goods to trade in services Area is of major importance to US, EU, Japan, Canada, because they are more competitive in services worldwide than in manufacturing. 69 XVI. GATS, cont’d. GATS has broad but not universal coverage: • MFN treatment is complete • Transparency is required • National treatment depends on individual • Member schedules Degree of market access can be limited in schedules, e.g., 49% ownership for foreign banks 70 XVI. GATS, cont’d. Financial services negotiations completed in Dec. 1997; 104 Members made at least some market opening commitments, representing 95% of trade in financial services Commitments generally reduce regulatory requirements, grandfather existing operations 71 XVI. GATS, cont’d. US GATS obligations are incorporated by reference in VBTA Telecommunications services negotiations concluded in Feb. 1997; 69 governments made commitments; again, 95% of global telecommunications market is covered. 72 XVI. GATS, cont’d. Negotiations are continuing to achieve “progressively higher level of liberalization” as specified in GATS, art. XIX:1 Significant progress awaits success of Doha Round in other areas. 73 XVII. Standards and Sanitary/Phytosanitary Measures Technical Barriers to Trade (TBT) Agreement designed to preserve Members’ ability to implement standards, without their unjustified use to restrict trade In most instances, national standards are to be based on agreed international standards. 74 XVII. TBT/SPS, cont’d. Disagreements subject to WTO dispute settlement SPS Agreement deals with protection of “human, animal and plant life or health from risks” of pests, diseases, additives, etc. National measures must meet these health related goals, avoid protectionism 75 XVIII. Trade-Related Investment Measures TRIMs Agreement is limited, compared to bilateral investment treaties and similar comprehensive agreements Effectively applies only to “performance requirements” and imposes certain transparency requirements 76 XVIII. TRIMS, cont’d. Examples of prohibited performance requirements (TRIMS Annex) include: • • requirements to use domestic parts and components for local manufacturing, over imported materials Permitting export volumes based on the volume of local production 77 XIX. Developing Countries and World Trade Special treatment under the WTO is given to developing countries: • Arts. XXXVI-XXXVII of GATT, “Trade and • • Development” Higher de minimis levels under AD Agreement, SCM Agreement, Safeguards Agreement “Enabling Clause” permitting discrimination for Generalized System of Preferences, AGOA, etc. 78 XIX. Developing Countries, cont’d. • Doha Development Agenda may bring “special and differential treatment” for developing countries, if and when negotiations are concluded. 79