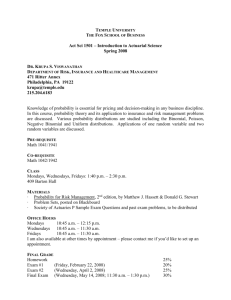

Document

advertisement

Risk Management Special Interest Group Developing the Profession’s Risk Management Vision Tuesday, 17th April 2007 Overview Introductions and Overview Purpose of This Evening Guest Speaker RMSIG Questionnaire Feedback The Big Question (Hopefully) The Big Idea Refreshments Overview Introductions and Overview Purpose of This Evening Peter Vipond, ABI RMSIG Questionnaire Feedback The Big Question The Big Idea Refreshments 18:00 18:10 18:15 18:30 19:00 19:29 19:30 Purpose of This Evening Against the background of a changing environment for actuaries, explore the role that risk management1 might play in our future2 and identify what the profession3 should do to make this happen. 1. 2. 3. hereafter “RM” and vice versa initially through the RMSIG Guest Speaker Peter Vipond, ABI RMSIG Questionnaire Profile of Respondents ~270, thank you! RM Events What Actuaries Need to Learn Risk Management Taxonomy Research Education Participant Profile By Practice Area 39% Life Insurance 14% General Insurance 12% Pensions 7% Investment 5% Banking 18% Other 4% did not specify Majority looking to apply RM knowledge in existing practice area Most did not specify an RM affiliation 3% PRMIA 3% GARP 6% FIRM 4% CFA 5% SoA RM Section 12% Other(?) RM Events - format Most are interested in attending RM events in 2007 On average participants would like to see 3 networking evenings 1 half day seminar 1 full day seminar, but no 2-3 day conferences in 2007 On average participants likely to attend a generic RM event, but unlikely to attend a life, pensions, general insurance or investment event Several from overseas, so unlikely to be able to attend One participant commented “Half-day seminars are likely to require a full-day for travelling etc and therefore fuller days are more attractive from the perspective of timeeffectiveness.” RM Events - topics “Assessment of the risk arising from low frequency but extremely high impact events.” “Best practice risk management framework - organisational and committee structures.” “Introduction to risk management benefits, terminology and tools.” “In-house Hedge programs for options embedded in insurance liabilities”, also adding, “in Canada have already implemented certain hedge strategies in the asset-liability management. These companies may be doing so relatively quietly and reaping the rewards of competitive advantage.” “Would like to see discussions on how we can apply risk management techniques in a wider context and in other areas of the financial services industry such as in a start-up situation, managing joint-venture or channel risks, and enterprise risk management.” What Actuaries Need to Learn Most participants agree that actuaries need to learn the language of risk management learn new risk management concepts, and learn new risk management techniques Key Areas Market Risk many responses around corporate finance, hedging, Value at Risk, techniques used by investment banks ERM (Enterprise Risk Management) applying processes to measure and manage risk across a whole business Operational Risk Strategic Risk What Actuaries Need to Learn “Just need to have a wider appreciation….the issues are wider than the existing solution.” “The key concept is to evaluate the risk for reward trade-off for the business that your company underwrites……risk management is not about eliminating risk.” also, “[need to develop a] proper pricing regime that keys on an 'appropriate' return on capital metric…. [a] risk management framework is of no use if it simply logs potential problems.” “The management of demographic risks (mortality, morbidity, longevity) are areas within life insurers, where actuaries can taking a leading role in developing risk management techniques and practices.” RM Taxonomy Most agreed that an RM taxonomy useful for the RMSIG 52% said willing to contribute to development Of those whom commented, most noted that there was already a well developed taxonomy which we should build from References to CAS, GARP and RAMP Several also referred to Solvency II or Basel II papers RM Taxonomy General feeling “Don’t reinvent the wheel, but reach out to others who are ahead” One participant commented “My experience, to date, acting as an expert witness is that many of the Risk Management concepts (and consequently techniques)…..are flawed because they have been based on false assumptions. I believe that if actuaries learnt the language, concepts and techniques they could add enormously to the risk management industry” Research Not a great many research ideas Some pleas to disseminate research already done by others and for education rather than new research Some support for research into copulas tail risk e.g. correlations in extreme conditions, identifying 99.5% level risks operational risk One participant commented “Crucial decision is whether the profession attempts to position itself as a force in wider risk management or in financial risk management. Experts in financial risk management who are very comfortable with wider risk management is a possible sale. We ought to be keepers of market leading financial risk models.” Education Useful role for the RMSIG to fulfil Educational requirements for fellowship should have more RM material Qualification should be expanded so as to encompass the bulk of the RM concepts and techniques in use within the financial services and corporate sector Some suggested inclusion of an ST subject, not a compulsory subject Several comments about linking to/integrating with other bodies PRMIA and CFA mentioned, as well as SOA Split of opinion more technical material (e.g. copulas, financial economics), against ensuring better general understanding of the nature of risk past disasters the techniques available for managing risk, and how to communicate it Delivery Mechanisms To Qualified Actuaries CPD events (6/10) Informal provision (5/10) through distance learning and e-based learning Formal provision (5/10) in addition to qualification requirements through distance learning, short courses and e-based learning leading to recognised certificates and/or accreditation Delivery Mechanisms To Future Actuaries CPD events (5/10) Informal provision (6/10) through distance learning and e-based learning Formal provision (6/10) in addition to qualification requirements through distance learning, short courses and e-based learning leading to recognised certificates and/or accreditation Additional Education Material for RM Most willing to contribute to the identification of additional material to better equip actuaries for work in RM A slight majority of participants were willing to contribute to the development of the identified additional education material Several specific ideas for material CFA courses information from FIRM, GARP and PRMIA (including research) references to University courses. Some suggested producing a guide to existing resources or having an RM section in the Actuary Purpose of This Evening Against the background of a changing environment for actuaries, explore the role that risk management1 might play in our future2 and identify what the profession3 should do to make this happen. 1. 2. 3. hereafter “RM” and vice versa initially through the RMSIG Conclusions Times have changed RM is relevant to actuaries Actuaries are relevant to RM RMSIG is here to improve that relevance You have told us what RMSIG should do next Thank You