Faculty of Economics Thammasat University EE 312

advertisement

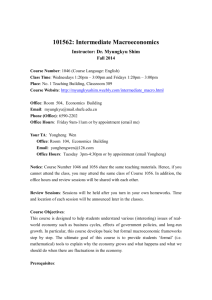

Faculty of Economics Thammasat University EE 312: Macroeconomic Theory Number of credits 4 Lecture Time Tuesday and Thursday 11.00-1:00 pm Lecture Venue Room 207 , Duean Building, Faculty of Economics, Thammasat University, Rangsit campus Instructor Bhanupong Nidhiprabha, Faculty of Economics Office: Room 222, Duean Building, Faculty of Economics Email: bhanupong.312@gmail.com Office hours: Tuesday and Thursday: 2:00 – 4.00 pm Or by appointment Course Description The objective of this course is to provide students analytical tools in macroeconomic to understand economic fluctuations. Throughout the class, experiences in various economies are utilized to illustrate the relationship between the real world and economic theories. It is expected that students would understand the consequences of changing international macro environment. Students should be able to analyze and evaluate fiscal, monetary, and exchange rate policy responses to shocks and world business cycle. Prerequisites: EE211, EE212 Course Evaluation Grading is based on midterm exam (30 %), and final exam (70 %). Class assignment and participation in class will count at the margin to help those who are on the border of two grades. Midterm Exam date: Thursday, March 5, 2015, 9:00-11.00am. Last day of the class: May 9, 2015 Final Exam Date: Monday, May 18, 2015: 9:00-12:00am 1 Textbooks Mankiw, N. Gregory. (2013) Macroeconomics, Palgrave Macmillan Krugman, Paul R. Maurice Obstfeld and March J. Melitz (2013) Pearson Global (Ninth) Edition. International Economics: Theory and policy Williamson, Stephen D. Macroeconomics, Fifth Edition. Pearson, (2014) Blanchard, Oliver and David R. Johnson (2013), Macroeconomics, Prentice Hall The 30 lectures and their corresponding reading requirements are the following: (1) Long-run and short-run AD AS: IS LM model, Mankiw, Chapter 10 (2) ISLM Application and the Great Depression, Mankiw, Chapter 11 (3) Search and unemployment,: Williamson Chapter 6 (4) Money and Business Cycle, Williamson Chapter 12 (5) Business Cycle Models with Flexible prices and Wages, Williamson Chapter 13 (6) New Keynesian Economics: Sticky Prices,Williamson Chapter 14 (7) Financial markets and expectations: Blanchard, Chapter 15 (8) Expectations, investment and consumption: Blanchard, Chapter 16 (9) Expectations, output, and policy, Blanchard , Chapter 17 (10) Inflation and unemployment tradeoff: Mankiw,Chapter 13 (11) Capital accumulation, population growth, and technology: Mankiw, Chapter 7 (12) Economic Growth: Malthus and Solow, Williamson, Chapter 7 (13) Income disparity among countries and endogenous growth, Williamson Chapter 8 (14) Deficit Finance, wealth tax Rosen, Harvey and Ted Gayer (2010) Public Finance, McGraw-Hill (15) Stabilization policy and public debt: Mankiw, Chapter 16 (16) Fiscal Policy: A summing up, Blanchard and Johnson, Chapter 23 (17) Monetary policy and capital flows, Mankiw (18) Monetary policy: A summing up: Blanchard, Chapter 24 (19) Exchange rate regimes: Blanchard and Johnson, Chapter 21 (20) ) Exchange rates: Asset Approach. Krugman Chapter 14 (21) Money, interest rates, and exchange rate , Krugman, Chapter 15 (22) Price levels and the exchange rate in the long run, Chapter 16 (23) ) Output and exchange rate in the short run Krugman, Chapter 17 (24) Fixed exchange rates and foreign exchange intervention Chapter 18 (25) Macroeconomic policy and Coordination under Floating exchange rates, Krugman Chapter 19 (26) Optimum Currency Area, Krugman, Chapter 20 (27) Financial Globalization: Opportunity and Crisis, Krugman Chapter 21 (28) Growth and Global Financial Crisis, Krugman Chapter 22 (29) Should policy makers be restrained? Blanchard, Chapter 22 (30) Epilogue: The story of macroeconomics, Blanchard, Chapter 25 2