Medium-Term Fiscal Program 2004

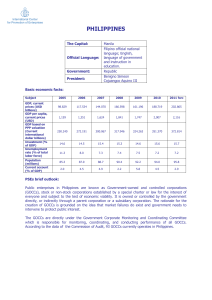

advertisement

MEDIUM-TERM FISCAL PROGRAM Secretary Emilia T. Boncodin Department of Budget and Management Presentation to GOCCs/GFIs September 15, 2004 Heroes Hall, Malacañang POLICY OBJECTIVES Balance the national government budget in 6 years Reduce CPSD to GDP ratio to 3% in 6 years Reduce Public Sector Debt to GDP ratio to 90% in 6 years National Government Fiscal Position 1986-2004 (Percent of GDP) Aquino 22.0 Ramos Expenditure Estrada Arroyo Revenue 20.0 18.0 16.0 14.0 12.0 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Expenditure Revenue 18.1 17.6 13 17 18.6 20.2 19.8 19.1 19.1 18.9 18.4 18.6 19.4 19.2 19.8 19.3 19.6 19.6 19.2 18.4 15.1 14.1 16.5 16.8 17.7 18 17.7 19.9 18.9 18.9 19.4 17.4 16.1 15.3 15.3 14.1 14.6 14.8 National Government Deficit 1986-2004 (percent of GDP) Aquino Ramos Estrada Arroyo 2.0 1.0 0.0 -1.0 -2.0 -3.0 -4.0 -5.0 -6.0 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Def icit -5.1 -2.4 -2.9 -2.1 -3.5 -2.1 -1.2 -1.5 1.0 0.6 0.3 0.1 -1.9 -3.8 -4.0 -4.0 -5.3 -4.6 -4.2 GOCCs Deficit (14 MNFGCs) 1986-2004 P billion Aquino Ramos Estrada Arroyo 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 -60.0 -70.0 -80.0 -90.0 -100.0 -110.0 -120.0 -130.0 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Def icit -6.8 0.3 2.9 -3.0 -19.1 -7.4 -10.7 -25.6 -9.7 -1.3 -11.2 -17.2 -38.0 -4.6 -19.2 -24.5 -46.4 -65.3 -125. PUBLIC SECTOR DEBT TO GDP RATIO 200 150 132.91 115.15 123.16 113.7 103.01 110 130.4 121.5 110.75 100 63.9 60.8 135.6 53.2 55.65 56.14 59.64 1996 1997 1998 1999 65.49 65.67 2000 2001 71.1 78.03 50 0 1994 1995 PUBLIC SECTOR DEBT Source: BTr, NSCB 2002 2003* NG DEBT * As of Sept. 2003 ACTION PLAN Deficit Targets, 2004-2010 (Percent of GDP) 8 7 6.7 6 6 6.0 4.6 5 4 3 3.9 3 4.2 3.6 2.9 2 3.0 2.1 1 0 1.2 0 2004 2005 2006 2007 2008 NG Deficit CPSD 0.2 2009 2010 Debt Targets, 2003-2010 (percent of GDP) 160 140 135.6 120 100 90 80 60 78 58 40 20 0 2003 2004 2005 2006 NG Debt 2007 2008 PS Debt 2009 2010 SPECIFIC MEASURES: Measures to Address Fiscal Problem 1. National Government Revenues Expenditures Debt Management 2. Government-owned and/or Controlled Corporations/Government Financial Institutions Rate Adjustment Rationalization Streamlining Compensation Privatization/Outsourcing Debt Guarantee 3. Local Government Units IRA Adjustment REVENUE PROGRAM NG REVENUES, 1986-2004 (percent of GDP) 18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 TAX NON-TAX TAX REVENUES,1986-2004 Ratio to GDP BIR BOC OTHER OFFICES 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 14.0 13.0 12.0 11.0 10.0 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 - NG REVENUES, 2004-2010 (Percent of GDP) 20 16.2 16.7 16.9 14.5 15 14.6 10 5 15.3 15.7 17.9 18.1 18.5 16.78 17.24 17.64 12.8 1.7 0 2004 1.4 1.6 2005 2006 Tax 1.2 2007 Non Tax 1.1 2008 Total Revenues 0.9 2009 0.9 2010 TAX REVENUES, 2004-2010 (Percent of GDP) 16.0 11.7 12.3 12.6 2.4 2.8 2.9 3.0 0.2 0.2 14.0 12.0 13.7 14.0 3.3 3.4 3.5 0.1 0.1 0.1 13.4 10.3 10.0 8.0 6.0 4.0 2.0 0.0 2004 2005 0.2 2006 BIR 0.1 2007 BOC 2008 Other Offices 2009 2010 ACTION PLAN: Revenues A. Improving Administrative Efficiency 1. 2. 3. B. Periodic adjustment of fees and charges Improve enforcement mechanisms to increase collection efficiency: BIR: Computerization/Automation of operating system; Enhancement of Audit Program; Intensified enforcement procedures; Conduct taxpayer compliance verification drive. BOC: Modernization of information systems and technology; Create Task Force Anti-Smuggling; Strengthening of Internal Audit Service; Purchase of Container X-rays for ports Rate Adjustment Privatization ACTION PLAN: Revenues B. Proposed Legislative Measures 1. Gross income tax system for corporation and self employed 2. Indexation of the excise tax on sin products 3. Increase excise tax on petroleum products 4. Rationalize fiscal incentives Php B 16.8 7.0 29.7 5.0 ACTION PLAN: Revenues Php B 5. 6. 7. 8. General Tax Amnesty with Submission of SAL Lateral Attrition System Franchise Tax on Telecommunications to replace VAT Two-Step Increase in the VAT rate na na 5.0 19.9 EXPENDITURES NG Expenditures to GDP, Philippines 25.0 20.0 15.0 10.0 5.0 0.0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Expenditure Capital Outlays Source: DBM BUDGET FLEXIBILITY MARGINS OTHERS 13% PS INFRA 33% 6% OTHERS IRA 23% PS 16% 37% PS OTHERS 27% 29% INFRA INTEREST 10% 32% IRA 14% INTEREST 16% 1997 INFRA 9% IRA INTEREST 7% 28% 1992 2004 Personal Services, Selected Asian Countries (Percent of GDP) 7.0 6.6 5.9 6.0 5.2 5.3 5.0 4.0 3.0 1.8 2.0 1.0 0.0 Philippines 2001 Indonesia 1997 Malaysia 1997 Thailand 2001 Singapore 2001 Personal Services, Selected Asian Countries (Percent of Tax Collections) 60 50 40 30 20 10 0 1995 1996 1997 1998 1999 2000 2001 Philippines 35.3 36.8 41.9 47.6 47.0 49.0 48.8 Thailand 31.5 30.5 33.7 42.2 45.2 42.6 40.9 Singapore 29.2 29.5 30.5 34.3 32.9 31.0 34.1 Philippines Thailand Singapore Capital Outlays, Selected Asian Countries (Percent of GDP) 12 10 8 6 4 2 0 1995 2001 Philippines 3.7 2.9 Malaysia 4.7 10.2 Thailand 5.4 4.4 Singapore 3.7 5.8 Vietnam 5.3 8.1 Philippines Malaysia Thailand Singapore Vietnam Expenditure Targets, 2004-2010 (Percent of GDP) 7.0 6.0 5.0 4.0 3.0 2.0 Interest Payments Personal Services 1.0 Capital Outlays 0.0 2004 2005 2006 2007 2008 2009 2010 Interest Payments 5.8 5.9 5.6 5.1 4.7 4.2 3.7 Personal Services 6.2 5.7 5.5 5.3 5.1 5.0 4.8 Capital Outlays 2.0 2.5 2.7 3.0 3.4 3.9 4.0 ACTION PLAN: Expenditures Administrative Measures A. Issuance of Economy Measures Administrative Order to be issued by PGMA directing cost-reduction program on utilities, supplies, travel, etc. Action Plan…Administrative: Expenditures B. Rationalization of Personal Services 1. Objectives Deactivation of functions no longer relevant Consolidation/rationalization of duplicating functions Strengthening of important functions 2. Mechanics Voluntary but time-bound separation opportunity but with option to (1) remain in government service; or (2) be separated with incentives Action Plan…Administrative: Expenditures C. Improvement of Management and Control of GOCCs EO to improve governance of GOCCs/Other Government Corporate Entities (OGCEs) Improve operational responsibility of supervising departments/agencies over GOCCs/OGCEs attached to them Impose moratorium on establishment of subsidiary GOCCs pending assessment of operations of all subsidiary GOCCs Privatization/Outsourcing Action Plan...Administrative: Expenditures D. Fully implement devolution provision of the LGU Code MFC to be primary conduit for funds (except IRA and mandated shares to LGUs) E. Increase social safety net program within the budget F. Transfer to the General Fund of all balances of dormant accounts ACTION PLAN: Expenditures Legislative Measures A. Enactment of Fiscal Responsibility Bill Reduce public debt to more manageable levels by imposing debt cap No new expenditure without new revenue measure Action Plan...Legislative: Expenditures B. Rationalize government retirement and pension schemes Suspend RA 1616: All retirement paid by GSIS Select veterans’ benefits that can be reasonably funded Make pension benefits commensurate to premium contributions Action Plan...Legislative: Expenditures C. Rationalize government compensation system Simplify position classification Simplify compensation structure and implement performance-based compensation system Rationalize compensation of board members and corporate officers D. Remove automatic guarantee provisions in certain GOCCs DEBT MANAGEMENT ACTION PLAN:Debt Management 1. Bond exchange to lengthen debt maturity 2. Make more use of ODAs than commercial borrowings 3. Debt cap 4. Limit borrowings to high priority import projects