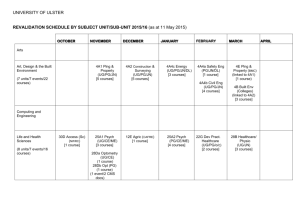

Hot Topics – Revenue

advertisement

Management Development Program Business of Healthcare at BMC Session Objectives ▪ By understanding the business side of BMC, participants will be better able to: – Connect their management roles to the overall business goals of BMC – Explain how changes to the market and business environment affect BMC – Improve our ability to respond to changes in the business environment. – Increase employee engagement with the use of tools to better communicate business operations to your teams 1 Session Outline • • • Introduction, Session Objectives and Outline Hospital Facts and “Hot Topics” o How does BMC make money? o Patient and Revenue Cycles Volume, Volume, Volume! 2 Hospital Facts and Hot Topics 3 Hospital Types Hospitals are registered with the American Hospital Association as one of the following types: General Provide patient services, diagnostic and therapeutic, for a variety of medical conditions. Boston Medical Center is a “General” Acute Care Hospital. Specialty Provide diagnostic and treatment services for patients who have specified medical conditions, both surgical and nonsurgical Rehabilitation and Chronic Diseases Provide diagnostic and treatment services to disabled individuals requiring restorative and adjustive services Psychiatric Provide diagnostic and therapeutic services for patients who require psychiatric-related services 4 Hospital Types Hospitals are organized as Public hospitals • In general, public hospitals provide substantial services to patients living in poverty. • Federal hospitals serve specific purposes or communities • Public hospitals are often funded in part by a city, county, tax district, or state. Private, not-for-profit hospitals • Are nongovernment entities organized for the sole purpose of providing health care. Roughly 87 percent of nonfederal community hospitals are not-for-profit. In return for providing charitable services, these hospitals receive numerous benefits, including exemption from federal and state income taxes and exemption from property and sales tax. Boston Medical Center is a private, not-for-profit hospital. Private for profit hospitals • The remaining nonfederal community hospitals are investor-owned, which means that they have shareholders that may benefit from profits generated by the hospital. Forprofit hospitals do not share the charitable mission of not-for-profit hospitals (though many do provide some charity services), and they must pay taxes. 5 Boston Medical Center Hospital Facts Sheet Staffed Beds: Medicine/Surgery Obstetrics/Gynecology Intensive and Coronary Care Neonatal Intensive Care Nursery Pediatric Intensive Care Pediatrics Rehabilitation* Total Average Length of Stay Medical/Surgical Newborn (Includes NICU) Occupancy Rate (Staffed Beds) FY12 306 47 58 21 34 6 30 9 511 4.73 4.73 70.6% FY13 300 32 58 22 34 6 30 0 482 4.95 4.66 75.9% FY14 300 32 58 22 34 6 30 0 482 Patient Activity: Discharges Outpatient Clinic Outpatient Ancillary Emergency Room Ambulatory Surgery Outpatient Observation Total Employees: Hospital FTEs FY12 26,132 656,940 243,528 129,714 28,382 8,126 1,092,822 FY13 26,035 681,177 189,745 129,783 27,840 7,792 1,062,372 FY14 26,119 720,132 206,297 128,839 29,406 7,928 1,118,721 4,506 4,573 4,767 5.29 4.60 79.2% * Rehab unit closed 7/1/2012; FY12 reflects 9 months of operation 6 Hot Topics – Revenue How does BMC make money? 7 Hospital Revenue Terminology Typically, hospitals get their revenue in a variety of ways: • By providing medical services • For nonmedical services • Through donations and grants from individuals, foundations, or the government • Through gains on investments Hospitals group the way they make money into three different categories: • Operating Revenue: delivery of patient care • Other Operating Revenue: nonpatient care activities • Non-Operating Revenue: peripheral business activities 8 Hospital Revenue - Payers • To understand how hospitals generate revenue for patient services, it is important to understand the “payers” in the healthcare industry. • Public payers include federal and state governments— which fund Medicare and Medicaid • Private payers are insurance companies. • Finally, there is the uninsured population, which includes people who are expected to pay for their own health care, unless they qualify for “charity/free care” as defined by the hospitals internal policies. 9 Patient Demographics Highlights: • BMC’s payor mix is substantially different from other hospitals • 81% of BMC revenue comes from governmental sources • Governmental rates of payments are generally not negotiable • Any payments shortfalls are magnified by BMC’s payor mix 10 Acute Hospital Financial Performance, by Hospital System: FY11 Highlights: • Partners and Care Group hospital systems make up 52% of the entire profit in the state. • Mass General Hospital alone makes up 24% of the entire profit in the state. • BMC had the largest loss for an individual hospital in the state. • Steward Health Care System (10 hospitals) had the largest combined loss in the state. 11 Hot Topics – Patient and Revenue Cycles Patient/Revenue Cycle 12 Revenue Cycle Overview CLINICAL DOCUMENTATION CODING & CHARGE CAPTURE HIM, CODING CLAIMS EDITING SUBMISSION UTILIZATION REVIEW / CASE MGMT FINANCIAL COUNSELING THIRD PARTY COLLECTIONS Patient Care COPAYMENT COLLECTION PAYMENT POSTING DENIALS / AUDIT MGMT REGISTRATION PREREGISTRATION CONTRACT MGMT SCHEDULING 13 The Changing Economy Revenue Related Challenges: ▪ Reduction/Lag in Governmental Dollars Owed to BMC ▪ Governor’s Budgetary Powers ▪ Future Years Not Yet Secured ▪ Reduced Demand for Healthcare, Fewer Elective Procedures ▪ Changes to insurance reimbursements: tiers and pay for performance ▪ Change from fee-for-service to payment for population management 14 Volume, Volume, Volume! 15 Types of Patient Volume Category Patients in Beds Inpatients in Beds Inpatient Discharge Outpatients in Beds Observation Bedded Outpatient Definition Admission to a hospital bed for inpatient care Admission to a hospital bed for observation, typically <24 hours, but may stay longer Admission to a hospital bed for extended recovery after an outpatient procedure (OR, Cath Lab, etc.) Other Outpatient Services Clinic Visit Doctor's office visit - may also include minor procedure Emergency Room Treated in the Emergency Department and released to home Surgical Day Care Operating Room, Cardiac Cath, EP Lab, Endoscopy or other significant outpatient procedure. Other Outpatient Services Radiology (MRI, CT, US, Xray, etc.), Cardiology (EKG), PT/OT, Lab, etc.) Outpatient Pharmacy Outpatient Retail Pharmacy Bedded outpatients: BMC typically receives payment for the procedure (SDC) but no added payment for the care on the inpatient nursing unit. 16 Annual Inpatient Discharge Trend FY08 - FY15 Annual Inpatient Discharge Trend 6.00% 4.9% 4.00% 2.8% 2.5% % Growth / (Decline) 2.00% 0.1% 0.1% 0.00% -0.4% -2.00% -4.00% -4.3% -6.00% -8.00% -10.00% -9.9% -12.00% FY08 FY09 FY10 FY11 FY12 FY13 FY14 Projected FY15 Budget Period Fiscal Year Discharges FY08 29,357 FY09 30,179 FY10 30,215 FY11 28,917 FY12 26,060 FY14 FY15 FY13 Projected Budget 25,959 25,986 26,632 Highlights FY15 IP discharges are projected to grow 646 discharges (or 2.5%) to 26,632 from FY14 projection of 25,986 FY14 IP discharges are projected to increase 0.1% from FY13 associated with strong inpatient Medicine discharge volumes 17 Boston Organization of Teaching Hospital Financial Officers (BOTHFO): December 2014 Volume Report BIDMC BMC BWH Children's DFCI Lahey MGH St. E's Tufts Total Total Excl. BMC Discharges (3 Months) FY15 YTD FY14 YTD Discharges Discharges % Change 9,669 8,442 14.5% 6,409 6,521 -1.7% 11,479 11,639 -1.4% 3,939 3,862 2.0% 245 305 -19.7% 5,285 5,206 1.5% 13,586 13,162 3.2% 3,221 3,270 -1.5% 4,375 4,533 -3.5% 58,208 56,940 2.2% 51,799 50,419 2.7% Patient Days (3 Months) FY15 YTD FY14 YTD Patient Days Patient Days % Change 51,341 45,111 13.8% 31,215 31,146 0.2% 65,453 65,539 -0.1% 27,609 26,683 3.5% 2,562 2,462 4.1% 26,106 25,256 3.4% 77,370 77,958 -0.8% 16,128 15,340 5.1% 23,670 23,698 -0.1% 321,454 313,193 2.6% 290,239 282,047 2.9% Highlights As of December of FY15, BMC’s inpatient discharges were down 1.7% for the year while the average for other BOTHFO hospitals was up 2.7%. 18 Market Forces are Leading to Lower Inpatient Volumes Stricter Requirements for Inpatient Admission • Changing technology and requirements for inpatient admission resulting in more observation and surgical day care patients Care Management Medical home model leading to lower admission rates from Medicine and Family Medicine Reduced readmission rates due to penalties (Medicare, Medicaid) Efforts to limit Emergency Room usage Competitors New emergency rooms and service guarantees from other Boston ER’s, along with efforts to attract specific patient populations (Carney marketing to Vietnamese patients). Falling ER volume (walk-ins, ambulance and trauma) from BMC’s core market areas. Competitors consolidating referral networks and cutting out BMC For example: New Steward arrangement with Partners for trauma care Rate differentials make it difficult for BMC to grow its network Financial Pressures on Patients The economic downturn, combined with increased prevalence of high-deductible health plans, results in fewer elective procedures 19 The Right Care…no more, no less Can only work if there is volume! Patients can be divided into 4 groups based on the “front door” they use to arrive at BMC: Emergency Walk-In & Other Emergency Ambulance 10,000 9,600 9,380 9,600 9,223 9,200 9,200 8,993 8,800 8,800 8,341 8,400 8,400 7,888 8,000 7,977 7,972 7,600 Actual 8,034 Actual 8,000 7,383 7,600 Budget 7,200 7,090 7,200 6,996 6,800 6,800 2010 2011 2012 2013 2014 6,400 2010 Elective BMC/CHC 2012 2013 2014 5,800 9,600 5,400 9,200 5,000 8,800 8,000 2011 Elective Non-BMC/CHC 10,000 8,400 Budget 6,908 4,600 7,815 7,929 7,789 7,350 7,600 Budget 7,590 7,200 7,431 2011 2012 2013 4,200 3,940 3,800 3,709 3,279 3,400 3,539 2014 Actual 3,506 Budget 3,287 3,000 6,800 2010 Actual 2,600 2010 2011 2012 2013 2014 20 Emergency Admissions -- Volume vs Budget January 2013 to December 2014 Emergency admissions in FY15 are down 5.6% from budget (221 discharges) and 4.3% from prior year. ED admissions account for 72% of the total inpatient variance to budget. Emergency Admits: FY15 Bud FY15 Act % Var 3,945 FY14 Act 3,724 FY15 Act -5.6% % Growth 3,890 3,724 -4.3% Inpatient Discharges Emergency Admits 1,500 Actual 1,400 Budget 1,380 1,351 1,337 1,332 1,325 1,297 1,300 1,215 1,250 1,265 1,266 1,251 1,278 1,287 1,265 1,271 1,230 1,261 1,200 1,243 1,244 1,167 1,134 Dec-14 Oct-14 Sep-14 Aug-14 Jul-14 Jun-14 May-14 Apr-14 Mar-14 Feb-14 Jan-14 Dec-13 Nov-13 Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 May-13 Apr-13 Mar-13 Feb-13 1,000 Jan-13 1,122 1,111 1,108 Nov-14 1,100 21 Monthly Walk-in Volume Trend Walk-in volume has been decreasing since June 2014 (on average 511 visits per month for the last 7 months). Walk-in Volume by Month 9000 8000 7000 Volume 6000 5000 4000 3000 2000 1000 0 2013 2014 Jan 8087 7722 Feb 6387 6817 Mar 7757 7948 Apr 7671 7795 May 8450 7965 Jun 7951 7440 Jul 8275 7072 Aug 8056 7402 Sep 7757 7308 Oct 7868 7279 Nov 7041 6113 Dec 7392 6513 22 Questions? 23 Wrap-Up 24 Thank You!