Finances and uni - Bridge to Study

advertisement

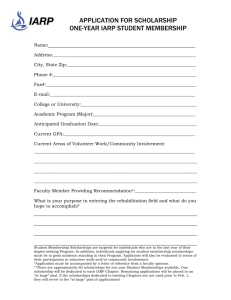

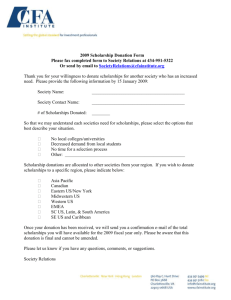

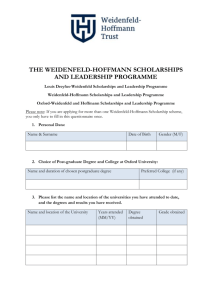

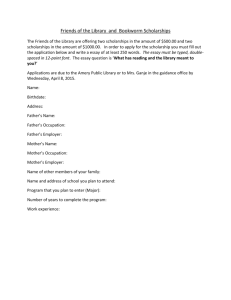

www.bridgetostudy.com.au Finances and Uni Students support themselves financially at university in a number of ways: Centrelink benefits Scholarships, bursaries and grants Part-time work HECS-Help University services which are free, or discounted Parental support where possible Income support for students There are a range of student income support payments provided by the Government to help students manage study costs. You may already be receiving one of these payments or may be applying for the first time. Common allowances for students include Youth Allowance, Austudy and ABSTUDY. Additional payments such as Education Entry Payments or other support payments may be available. If you are receiving a qualifying pension or payment and you are studying at university you may be eligible for Pensioner Education Supplements. All Government student income support payments depend on your age, personal circumstances and eligibility. You should talk to the Department of Human Services about which allowance is appropriate to you or visit www.humanservices.gov.au or www.studyassist.gov.au Government Scholarships Student Start-up Grant From 1 July 2015, new recipients of student payments (Youth Allowance, Austudy or ABSTUDY) can receive a Start-up grant of $1,025 for each six months of eligible full time study. For more information www.humanservices.gov.au or www.studyassist.gov.au Relocation Scholarship This scholarship is for eligible regional students on Youth Allowance and ABSTUDY enrolled (full-time) in an approved course who have to move to or from a rural location to attend uni. In 2015 students receive $4269 in their first year of study and $2135 in years 2 and 3, and $1067 in year 4 depending on the location of their family home, and course location. For more information visit www.humanservices.gov.au or www.studyassist.gov.au Scholarships Scholarships, bursaries and prizes come in all types: Merit-based scholarships i.e. based on academic achievement such as OP score or university GPA (Grade Point Average) Equity scholarships are provided by universities based on financial need. Apply for the Educational Access Scheme (EAS) when completing your QTAC online application and check each university website for Equity Scholarships Schemes and additional benefits. Scholarships with other criteria e.g. sporting, community service, rurality, Indigenous background, gender or area of study Scholarships with additional benefits e.g. internships, work experience, OS exchange Scholarships from community organisations Make sure you apply for everything. Find out about closing dates, eligibility and what forms/documents you need to complete. Tax is usually exempt from scholarship income. Part-time work Most students have a part-time job while they are studying. Students have flexible timetables and this allows for work in a range of industries. The trick is to balance work (up to 15hrs/wk) and study (40 to 48hrs/wk) so you don’t overload yourself. And remember your study needs to take priority. Where to find jobs Most universities have their own careers services that can help you realise your career aspirations with careers advice and counselling. They can also help you to prepare for job-seeking while at uni and once you graduate. Your university careers services will have people and resources to assist with writing resumes and preparing job applications and preparing for interviews. Careers Services will also connect you to careers fairs, graduate careers programs, internships, work experience, career mentoring and access to industry partners. Most universities also have some on-campus jobs for students so check out what is available at your university. Local newspapers and job websites advertise vacancies and most organisations have their own recruitment staff and job vacancy pages. Tips for managing part-time work Find a balance - don’t skip classes or over-commit to work Develop time management skills Consider jobs close to home or on-campus Consider adjusting study load around exam time or clinical practice blocks Know your rights in the workplace. Visit Fair Work Australia at www.fwa.gov.au Correct at February 2015 www.bridgetostudy.com.au HECS-HELP Course costs Many students choose not to pay their contribution to tuition fees up front and defer payments with a government HECSHELP loan. The tuition costs are divided by areas of study (bands) in the table below. Apart from textbooks, some courses may have additional costs such as uniforms, safety equipment, vaccinations, safety certificates, specialised equipment, field trips and so on. These additional costs are not covered by your tuition fees. Check with your university about any of these additional costs. 2015 Student Contribution Bands for Commonwealth supported places (CSP) Who else can help? Band Areas of study cost (pa) Band 3 Law, accounting, administration, economics, commerce, dentistry, medicine, veterinary science Mathematics*, statistics*, computing, built environment, other health, allied health, science*, engineering, surveying, agriculture Humanities, behavioural science, social studies, education*, clinical psychology, foreign languages, visual and performing arts, nursing* $10,266 Band 2 Band 1 $8768 $6152 * Bands are indicative only and subject to change via legislation. Visit www.studyassist.gov.au for more detail. Actual contribution may vary depending on units studied, and band for each unit. Loans are repaid through the tax system when students begin work. Students pay a percentage per week through tax depending on their earnings (see the table below). In 2013, the median annual starting salary for bachelor degree graduates under 25 years was $52,450 (www.graduatecareers.com.au). Repayment thresholds (2014-2015) Below $53,345 Nil $53,345 - $59,421 $59,422 - $65,497 $65,498 - $68,939 $68,940 - $74,105 $74,106 - $80,257 $80,258 - $84,481 $84,482 - $92,970 $92,971 - $99,069 $99,070 and above Repayment % rates Nil 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 8.0% If you can afford to pay your contribution in full at the beginning of each teaching period you may receive a small (5%) discount. You can make voluntary payments which may also attract a discount when repaying your HECS loan. Find out more about HECS-HELP visit www.studyassist.gov.au What other costs are there? Student Services and Amenities Fee This fee supports non-academic student services such as: health and welfare services employment and career advice including practical work experience while studying developing study skills outside academic courses orientation information and enriching campus life more accessible and flexible support services You can defer this payment via SA-HELP. Find out more at www.student.qut.edu.au/fees-and-finances/study-costs/ Most universities have a wide range of services to support students once enrolled. This may include: Special admissions schemes via QTAC for low-income, Indigenous, regional, Yr 12s and high achievers (see page 35 of the 2015 QTAC guide – www.qtac.edu.au). QTAC’s EAS (Educational Access Scheme) for applicants who have experienced difficult circumstances. Support for Aboriginal and Torres Strait Islander students including entry programs, tutoring, cultural support and scholarships Disability services for people with a disability, health condition or injury that may impact their study Counselling and health services Language and learning support for people from nonEnglish speaking backgrounds Scholarships Orientation programs Academic support such as peer mentoring, academic skills development and computer support Careers and employment services Accommodation services Medical clinics Student guild or student union services Still have unanswered questions? Choosing a degree and a university is a very personal decision. Here are some tips to help you make that decision: Do your research! Contact your preferred university for an Undergraduate Guide and Faculty Guide or go on-line Do your sums! What is uni going to cost you? This sheet has some good links to the relevant Government websites Ask questions. Go to an open day – most unis hold them between June and September. Talk to the staff and students at these open days about your course preferences Get some opinions. But remember they are just opinions! Find out about employment/career prospects in your fields of study by attending careers fairs, talking to employers and looking on-line at: www.myfuture.edu.au www.graduatecareers.com.au www.jobguide.deewr.gov.au Correct at February 2015