The busINess of Disaster

advertisement

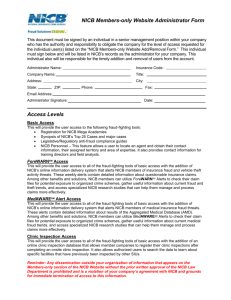

What you don’t know about disaster… could hurt you…. Prof Marty Steffens, University of Missouri STAGES OF DISASTER PREPAREDNESS DISASTER RESPONSE RECOVERY REMEDIATION Most disasters happen in seconds Everyone covers quick onset disasters, like floods, tornadoes, hurricanes and earthquakes. But reporters ignore the economic impact of “slow onset” disasters, such as heat and cold spells, winter storms, droughts, widespread crop disease or flood cycles. In the NOAA list of billion-dollar weather-related disasters, the 1988 drought and heat spell caused damages of $66 billion in the Midwest. To access the list: www.ncdc.noaa.gov/oa/reports/billionz.html Biggest loss is property The biggest damage often is not flattened homes and buildings. It’s the loss of commerce when cash registers are silent and cash flow pulls the business down the drain. It’s business interruption caused by floods, ice storms or even closed roads that catches business owners unaware. During the Sept. 11 disaster, the cost of lost business surpassed building damage. United Airlines claimed a $1.2 billion loss, not from its two lost aircraft, but from loss of business for the three-day stoppage of air travel. Other communities, like Chicago and Clark County-LasVegas, also filed suit against their insurance companies for not covering massive losses incurred by their municipal airports during the stoppage. The loss of landing fees and concession were part of the billions lost by the travel industry in late 2001 and 2002. NYTimes series on SANDY and businesses Today’s disasters are worse due to higher property values Somewhat true. If 1906 earthquake that flattened (and burned) much of San Francisco were to happen today, the damage to the now-larger city would exceed $120 million. However, improved building codes have reduced damages in many earthquake-prone communities. For example, Seattle suffered a 6.8 magnitude quake in February 2001, with damages about $2 billion, far less than the $40 billion in damages and 51 deaths caused by 6.7-magnitude Northridge earthquake in Los Angeles in 1994. Seismologists say Seattle was spared because its quake was deeper than the deadly shallow one that usually strikes California fault lines. “Without the improved seismological science and improved building codes, I think the situation would have been much more deadly," said Butch Kinerney, spokesman for the U.S. Geological Survey. Most buildings constructed in Seattle over the past 25 years or so were built to a uniform code designed to withstand strong earthquakes. Disasters are well, obvious Sometimes not. Geomagnetic solar storms cause massive outages of electricity. According to NOAA, solar disruptions can also wreak havoc on communication and disrupt air and space transportation, in total costing industry billions a year in losses. Traffic accidents, certainly not seen as disasters, are as a group a disastrous situation in the U.S. The year 2005 saw an increased number of deaths; some 43,220 persons were killed in traffic accidents – far more that the total killed by Katrina and other natural disasters in that same year. Nearly 1 in 6 traffic deaths were directly attributable to weather conditions. For more studies, contact the American Automobile Assn. Disasters don’t discriminate While it’s true that Mother Nature doesn’t discriminate, the ability to recover from disaster depends on two factors: Insurance and income. Tornadoes and other disasters can have a strong economic impact according to gender, race, and income, according to studies by the University of South Carolina. The first to lose their jobs after a disaster are hourly service workers. Also, women living alone are also more likely to move rather than rebuild, as are non-English speaking populations. Renters don’t return, and absentee landlords are more likely not to rebuild. Contact: the has done research on poverty and vulnerability; they can also talk about agriculture damage. Who gets hurt the most? Unskilled laborers with little savings. People who didn’t have the means to get out. People at the bottom of the income bracket. Disasters are bad economic news Not always. While casualties linger in a community’s memory, disaster often has a silver lining. In 2002 residents of St. Joseph, Mo., suffered extensive roof and auto damage because of a massive ice storm that hit Kansas City and the surrounding area. But editors at the St. Joseph News-Press noticed something in the weeks following the storm. They were witnessing the so-called “hot-tub” effect. When insurance money rolled in to replace roofs, homeowners took the opportunity to upgrade their property – adding accouterments such as backyard spas or a deck. (Personal interview, 2004)Communities that have suffered flood damage, such as St. Louis in 1996, have used the damaged area to rethink and redesign downtown areas. Jonathan Selden, a reporter for the Austin Business Journal used city records to find local businesses that benefited to the tune of $2.5 million from relocated hurricane Katrina victims. He found a local carpet-cleaning firm that beat out national firms for emergency cleanup duties; but he also found a Texas company that was paid $15,430 to provide underwear to evacuees. (Issue of Oct. 28-Nov 3, Austin Business Journal) Short-term Impact Complete dispersion of the population to other regions from the hardest hit parishes. Recovery Expenses actually give a windfall profit to surrounding areas as reporters, non-profit aide workers and insurance claim money surges into the area while residents compete for space. Short -term Impact Residents scattered throughout surrounding parishes that were not as damaged People scattered farther than just out of their parishes The question remains will they return? Who gets hurt the most Ex: St. Bernard Parish - hardest hit areas Decrease in the number of available Jobs for permanent residents Decrease in pay for those Jobs available Increased dividend and interest income for the area as a percentage of Income Did Katrina cause an overall US economic slowdown? Housing starts continued to increase in the US and building prices increased as materials were diverted to the devastated areas However, largely the US economy continued its growth after Katrina and the effect of the Storm did not cause a downturn Comparison Study: Hurricane Andrew Hardest hit area: Homestead, FL Surrounding areas that benefited: Miami, Ft. Lauderdale People hardest hit: unskilled laborers, migrant farmers Did the economy of Homestead ever recover? Homestead, FL 2007 Census Figures fell between 1990 and 2000 Most of the original population never returned by 2000 The surrounding economies felt a recovery boom after Hurricane Andrew Since 2000 the population has begun to grow as Miami crowds people back into Homestead. Do we become more resilient after disasters occur? Building codes become more strict after disasters occur Insurers reassess their losses due to large disasters like Katrina and premiums rise accordingly Underwriting becomes stricter and more accurate in times immediately following disasters Useful databases NOAA University of South Carolina Hazards Research Lab, (803) 777-1699. The Hazard Research Lab http://www.cla.sc.edu/geog/hrl Census Bureau’s OnTheMap Emergency GeoPlatform.gov Longterm Economic Impact on St. Bernard Parish Most of the unskilled labor population won’t return The area’s economy will disperse and assimilate to surrounding areas As space runs out in New Orleans St. Bernard may be rebuilt after more than a decade. Interesting facts 9 of 10 Americans live where there is a moderate to high risk of deadline disasters – wildfires, hurricanes, floods, tornadoes, volcanoes, earthquakes, wind damage and terrorism. Continued migration to coastal and Southern cities Do we become more Resilient after disasters occur? Hurricane risk in the areas remains the same People rebuild when the memory of a tragedy is forgotten. Even insurance companies lower premiums once markets calm and competition for business resumes Consumers and Fraud Price gouging Fraudulent contractors Insurance scams Government aid scams Online fraud Auto fraud Arson Disaster fraud Even before the mass problems caused by the 2005 hurricane season, Susan Lundine (2006), a reporter for the Orlando Business Journal, scoured Florida insurance records to detail claims from the batch of hurricanes that crisscrossed the state a year earlier in 2004. That year, hurricanes Charley, Frances, Ivan and Jeanne crisscrossed the state, resulting in 1.7 million insurance claims. Lundine, shifting through records filed by insurers with the state of Florida, found that homeowners who lived in 12 counties on Florida’s east coast, 370 miles from where Ivan made landfall on Sept. 13, 2004, claimed more than $65 million in damages from that storm – even though it didn’t touch their area. She found a homeowner in Melbourne, Florida, who claimed damage from Frances, showing a photo of his ruined home. In fact, the home was under renovation – not damaged by that Category 4 storm that hit August 13. Check out insurance commissions Like Lundine’s project, the key to reporting this issue lies at the various state insurance commissions, where fraud is reported. Also, the Insurance Information Institute (www.iii.org) is a good place for getting tips on current schemes and enforcement. Other good sources are the Insurance Informatlion Institute, www.iii.org, and the non-profit National Insurance Crime Bureau, which has a special section on disaster fraud on its website, www.nicb.org. Govt aid fraud According to a 2006 report from the New York Times (Lipton 2006), a hotel owner in Sugar Land, Texas, was charged with submitting $232,000 in bills for phantom victims. More than 1,000 prison inmates across in Gulf State also tried to collect more than $10 million in rental and disaster-relief assistance. An Illinois woman was charged with trying to collect federal benefits by claiming she watched her two daughters drown in the rising New Orleans waters. Prosecutors say the children did not exist. The size of the fraud brought a comment from Sen. Susan Collins (R-Maine), chairwoman of Homeland Online ‘giving’ fraud It had its birth in the huge outpouring of aid collected in the wake of the 2004 tsunami that devastated Southeast Asia. Just two weeks after the disaster, as millions of people were logging onto website to donate via credit cards, federal agents arrested a Pittsburgh man who was using the name of an Oregon charity to scam generous Americans. The man, an unemployed painter, sent more than 800,000 emails, asking for aid relief. He told agents that he thought it was okay to keep the money if he actually did donate some funds. For guidance, the Better Business Bureau maintains a Wise Giving Alliance that voluntarily grades 500 charities on their governance, giving, spending and how much information about its operations it discloses to the public. (See box on www.give.org). Consumer Reports WebWatch also gives tips for avoiding online charity scams. Check out the tips at www.consumerwebwatch.org. National Insurance Crime Bureau In the swarm of 2005 hurricanes, the National Insurance Crime Bureau (NICB) sent teams to the affected states to help identify and catalog flooded vehicles and boats. A database was created by this joint effort between insurers, state fraud investigators and the NICB in which vehicle identification numbers (VINs) and boat hull identification numbers (HINs) from flooded vehicles were made available to law enforcers, state fraud bureaus, insurers and state departments of motor vehicles. The database, which was developed and is still maintained by the NICB, is online and can be accessed by the general public. Initially, the database identified potential fraud of more than $11 million. As a solution to the flooded vehicle problem, one auto insurer decided to crush its insured vehicles that were flooded. By the end of 2006, there were 309,000 vehicles in the database, of which 200,000 cars and trucks had been cleaned and resold. About 10,000 of those vehicles were moved to other states and had titles that did not disclose that the vehicles had been flooded. Planning ahead Go to the experts. Weather and seismological forecasters often meet with insurers to assess the level of risk. Often those conferences can make good articles, as well as provide documents and sources in time of crisis. In July 2006, scientists with the Northeast Hurricane Project met with insurance executives for the first time ever to unveil computer models with a startling doomsday prophecy. If a Category 3 hurricane with significantly less strength than Katrina hit the coast of central New Jersey, damage would top $200 billion and cripple the U.S. economy for years. The combination of weather conditions and concentration of high-priced coastal real estate would make a direct hit on the beach communities and industrial New Jersey the most expensive storm in U.S. history – damage that would eclipse the cost of September 11 and Hurricanes Katrina and Rita combined. "The risk is increasing and it's increasing every year," catastrophe risk analyst Karen Clark said at the time. Clark is the president and CEO of AIR Worldwide. The Boulder conference Experts on all types of disaster meet each June in Boulder, Colo., as part of the University of Colorado’s Natural Hazards Center’s annual meeting. The conference is rich with researchers, scientists, emergency workers, risk analysts and insurers, who use economic models to estimate potential damages and risks. University of South Carolina According to USC’s Hazards and Vulnerability Research Institute, 9 of 10 Americans live in places with a moderate to high risk of deadly disasters, such as wildfires, hurricanes, flooding, tornadoes, volcanoes, earthquakes, wind damage and terrorism. That’s due to continued migration to coastal and Southern cities. http://webra.cas.sc.edu/hvri/research/nsf2000.aspx, Other resources Other fraud resources are the Tampa-based Institute for Business and Home Safety, which gives online tips for consumers to assist with mitigating losses from all ranges of disasters, at www.ibhs.org. Also, the International Association of Insurance Fraud Agencies gives a good overview of other issues facing the industry at www.iaifa.org.