What is a monopoly?

advertisement

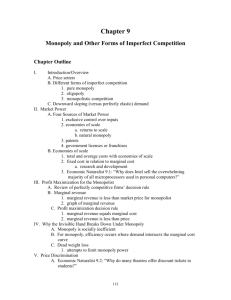

Chapter 4 Monopoly Outline. What is a monopoly? The profit maximising monopolist Price discrimination The efficiency loss from monopoly Public policy toward natural monopoly Definition of a monopoly A monopoly is a situation in which the market is served by only one seller, the product of which has no close substitute on the market. Examples: cinema, train tickets… The key factor that differentiates the monopoly from the competitive firm is the elasticity of demand facing the firm. Although this definition looks very simple, it is not that simple to apply in practice. Perfectly competitive firm: infinite Monopoly: finite One practical measure: examine the cross-price elasticity of demand for the closest substitute Five sources of monopoly Exclusive control over important inputs Examples: Perrier, DeBeers… Economies of scale: when the long-run AC curve is downward sloping the least costly way to serve the market is to concentrate production in one single firm: this is a natural monopoly. Five sources of monopoly (ctd) Patents: they confer the right to exclusive benefit from the invention to which it applies. Network economies: on many markets, a product becomes more valuable as the number of customers that use it increases. Costs: higher prices for consumers Benefits: they make possible many inventions that would not be so otherwise Example: telephones May give rise to a monopoly. Example: Microsoft Government licenses or franchising: in many markets, only those firms that get a license from the government can set up a business. Outline The profit maximising monopolist Price discrimination The efficiency loss from monopoly Public policy toward natural monopoly Total revenue Perfectly competitive firm: horizontal demand curve So, firm’s total revenue is given by The monopolist: Faces a downward sloping demand If he wants to sell more, he needs to cut his price Total revenue, total cost and economic Profit Marginal revenue The marginal revenue is the change in total revenue generated by a very small change in the amount of output produced. MR dTR dQ The monopolist will choose its production level in order to maximise its profit P = TR – TC Profit is maximum when: dP 0 MR MC dQ Marginal revenue (ctd) In the case of the monopoly firm, marginal revenue is always going to be less than the price. Marginal revenue (ctd) The monopolist wants to increase production from Q0 to (Q0 + DQ). Needs to lower its price from P0 to (P0 - DP) where DP > 0. The new total revenue is (Q0 + DQ).(P0 - DP) = P0Q0 + P0DQ - DPQ0 - DP DQ MR = (P0DQ - DPQ0 - DP DQ)/ DQ MR = P0 - (DP/ DQ).Q0 – DP MR = 60 – 10 – (10/50).100 = 30$ Marginal revenue and price elasticity The price elasticity of demand at a point (Q,P) is given by: DQ P . DP Q DQ P . 0 DP Q The marginal value is given by: MR P MR P DP .Q DP DQ DP .Q DQ P 1 MR P .Q P(1 ) Q. Marginal revenue and demand Notice that : When When When When = > = < ∞ 1, 1, 1, (for Q = 0), MR = P MR > 0 MR = 0 MR < 0 When the demand curve is a straight line P = a – bQ where a,b > 0 Then: TR = P.Q = aQ – bQ2 MR dTR a 2bQ dQ Marginal revenue and demand (ctd) The short-run profit maximisation condition MR = MC : The short-run profit maximisation condition (ctd) The profit-maximising mark-up: Given that: MR P(1 and 1 ) MR = MC It follows that: P P MC 1 MC P P The monopolist shut-down condition The monopolist should stop production when average revenue is less than average variable costs at any level of output Monopoly versus perfect competition Both choose an output level by weighing the benefits of expanding (resp. contracting) output against the corresponding costs Both compare MC and MR The main difference is that for the perfectly competitive firm, the marginal revenue is equal to the market price whereas for the monopolist, it is less than the price The output level chosen by the monopolist is lower than the output level chosen by the perfect competitor Monopoly versus perfect competition (ctd) Adjustments in the long run Outline Price discrimination The efficiency loss from monopoly Public policy toward natural monopoly Sales in different markets Suppose the monopolist has two completely distinct markets: what quantity should it sell and what price should it charge in both markets? Sales in different markets (ctd) The monopolist will charge a higher price in the market where demand is less elastic to price. P MC 1 P This is called third-degree price discrimination. This is feasible only when it is impossible for buyers to trade among themselves. If trading is feasible: arbitrage Example: train tickets Perfect discrimination First-degree or perfect discrimination is a situation in which each unit of product is sold at each customer at the highest price the customer is willing to pay for it. Perfect discrimination (ctd) How much output will the monopolist produce? Second-degree price discrimination It is a practice according to which sellers do not post a single price but a schedule along which price declines with the quantity one buys . The hurdle model of price discrimination It consists in inducing the most priceelastic buyers to identify themselves. The seller sets up a hurdle an offers a discount to those buyers who jump over it. The underlying idea is that those buyers who are most sensitive to price will be more likely than others to jump the hurdle Examples. The rebate included in a product package. Airlines offering restricted fares Outline The efficiency loss from monopoly Public policy toward natural monopoly The lost surplus The deadweight loss If the firm would behave like a perfect competitor, the whole triangle above the LAC curve would be consumer surplus If the firm perfectly discriminates, the whole triangle becomes producer surplus If the firm is a non-discriminating monopolist, part of the consumer surplus is lost . This is the deadweight loss from monopoly Outline Public policy toward natural monopoly Fairness and efficiency objections How does monopoly compare with alternatives? Let's consider a technology in which total costs are given by: TC = F + MQ There are 2 main objections to the equilibrium reached by the monopoly The fairness objection: the producer earns a profit which is higher than it would under perfect competition (P). The efficiency objection: the price is above the marginal cost loss in consumer surplus (S). State ownership and management One solution in that case is to have the state take over the industry. Advantage: the government is not as much constrained as a private firm. Can set the price equal to the marginal cost and absorb the corresponding economic losses out of general tax revenues. Drawbacks: it often reduces the incentives for cost-conscious efficient management, thus generating X-inefficiency. State regulation of private monopolies The most frequent regulation consists in setting a price that allows the firm to earn a pre-defined rate of return on its invested capital. Ideally this rate of return should allow the firm to recover exactly the opportunity cost of its capital be equal to the competitive rate of return on investment. However, in practice, regulatory commissions lack information on what the competitive rate of return should be. Exclusive contracting for natural monopolies Accept that the product be produced by only one firm but to create strong competition in order to determine who will be the supplier. Specify in detail the service that is wanted and then call for private companies to make bids to supply this service. This should be better than state management in terms of keeping cost down if X-inefficiency is lower in private than in public firms. But the advantages of such systems are often more apparent than real. Antitrust laws The most famous antitrust laws: The Sherman Act (1890). It makes it illegal to "monopolise or attempt to monopolise any part of the trade or commerce among the several States". The Clayton Act (1914) prevents companies from buying shares in a competitor where the effect would be to "substantially lessen competition or create monopoly“ The U.S. Justice Department prohibits mergers between competing companies whose combined market share would exceed some predetermined fraction of total industry output. Laissez-faire policy A last possibility for dealing with natural monopolies is laissez-faire, or doing nothing. The main objections to this policy are those with started with, namely the fairness and efficiency objections Efficiency objection: the monopolist charges a price above the marginal cost which excludes many potential buyers from the market. But in the case of a two-price monopolist, the deadweight loss is limited The more finely the monopolist can partition her market under the hurdle model, the smaller the efficiency loss will be. Laissez-faire policy (ctd) Laissez-faire policy (ctd) The fairness problem: It consists in the fact that the monopolist transfers resources from consumers to firms. Raises a distributional problem One argument in favour of the hurdle model of price discrimination is that most of the profit earned by the monopolist comes from the high price elasticity consumers Overall, each of the policy options for dealing with natural monopolies has problems. None completely eliminates the problem of having only one producer serving a market.