Using Brand Strategy

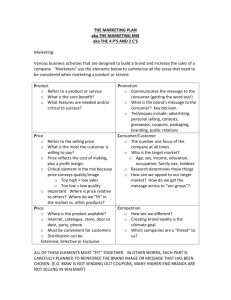

advertisement

Using Brand Strategy to Increase Stock Price Chuck Pettis (Author of TechnoBrands) Brand-Solutions, Inc. 225 105th Ave. SE Bellevue, WA 98004 (425) 637-8777 cpettis@brand.com © 2000 Brand-Solutions, Inc. To Be Covered Proven brand strategies for increasing stock price and profitability Effective brand strategies for dot-com companies What is a Brand? A trademark: a brand name and logo A Trustmark Most simply, a promise to the customer Perceptual – exists in the minds & hearts of your customers, employees, and suppliers What is a Brand? The proprietary visual, rational, emotional and cultural image surrounding a company, organization, product, or person The Purpose of a Brand Assumes a quality product and marketing DIFFERENTIATE Provides springboard for new products and acquisitions Enduring profitable growth Increased perceived value = premium pricing Soda Coca Cola $2.59 Safeway Select $1.59 Price difference $1.00 When You go to a Restaurant…. Guest: “Can I have a Coke? Server: “You bet. Is a Safeway Select OK with you?” The Purpose of a Brand Brand Strategy & Stock Price “The big thing is that brand equity and the strategies to build it matter. Brand strategy does influence the financial performance of any company.” Robert Jacobson, leading brand researcher & chairman of University of Washington Marketing Department Research shows that improvements in brand strategy programs produce positive stock market return See Morgan Stanley reports on www.brand.com Elements of Brand Strategy The major elements for measuring and building brand equity: Brand identity: brand name, brand associations, messages, images, symbolism Brand name awareness Perceived quality Brand extension potential Brand loyalty/switching Proprietary brand assets (trademarks, patents, etc.) A brand strategy is a plan to measurably improve each element of brand equity Customer-Based Brand Identity & Stock Price The entry point for all brand strategy activities is brand identity development You have to know the most compelling category descriptor, purchase factors/selling messages, organizational values, etc., and then link the brand identity to operations In 1995, Sun Microsystems was seen as a manufacturer of technical workstations and wanted to reposition itself as a maker of computers and servers for corporations Brand-Solutions conducted research to identify the top purchase factors for business servers, benchmark Sun’s brand equity, and to select the best brand name In April, 1997, Sun Ultra Enterprise Servers were introduced using the brand name and brand identity Brand-Solutions recommended After the introduction, all analysts issued “Buy” recommendations and Morgan Stanley predicted the stock would climb to $70. In two weeks, the stock went from $47 to $67. Sun’s success in repositioning itself is confirmed in the headline of an article in the August 19, 1997, Wall Street Journal: “Sun Microsystems Goes on a Roll, Astonishing Many: Computer Maker Reinvents Itself, Stressing Servers for Big Corporations.” Packet Engines: Gigabit Performance, Enterprise Reliability Alcatel Acquires Packet Engines for $325M When Do You Sell? The King of Gigabit Ethernet reckons he missed out on a $3 billion IPO by selling Packet Engines too early Keep an eye out for Bernard’s newest company, World Wide Packets! (www.worldwidepackets.com) Simon: The Brand Simon – The leading developer and manager of shopping malls in the US. 1999 – Not known by shopping center shoppers. No mall management category existed. 3/1/99 – Branding campaign begins – “Simon. Simply the best shopping there is.™” Brand strategies are based on a carefullyresearched, shopper-based brand identity. Simon: The Brand 1/1/2000 – 53% of shoppers recognize and understand the Simon Brand. Simon “owns” the mall category. Annual sales/sq.ft. of $377 vs. industry average of $340. “Simon has been able to use its branding concept to drive revenues and improve operating margins.” – Robert L. Levy, Sr. Real Estate Analyst Brand Extension & Stock Price Brand Extension Examples: The Gap Baby Gap + Gap Maternity + Gap Kids Nokia: mobile phones IP networking Purpose of Brand Extensions Launching new brands is expensive Good trademarks may be hard to find Strong competition for distribution Gain quick acceptance of new products Danger: If you introduce a defective product or a product that is too far afield from the product category, you can risk failure Brand Extension & Stock Price (High Brand Awareness + Positive Brand Attitude) + Brand Extension = 2% to 9% Stock Price Increase Consumers value new products with well-established brand names because they quickly convey the brand’s attributes and reinforce a sense of trust. Brand extensions save the company marketing costs and generate higher revenues more quickly than new brands. Extensions of brand with very low brand awareness and esteem also provide a positive return because they have high upside potential and little downside risk. Vicki Lan and Robert Jacobson, “Stock Market Reactions to Brand Extension Announcements: The Effects of Brand Attitude and Familiarity,” Journal of Marketing, January, 1995. Announcements of Advertising Slogans & Ad Changes and Stock Price On average, 1% increase in market cap after announcement Resulted in an expected increase in firm’s annual profit of $6-8 million Conclusion: Publicize ad changes carefully and appropriately Lynette Knowles Mathur and Ike Mathur, Journal of Advertising Research, Jan/Feb 1995 Increased Perceived Quality & Stock Price Quality is a function of trust and customer satisfaction with the brand Increased perceived quality = increase in stock return “Quality” brand building for 34 major US corporations did pay off where it really counts – for the shareholder David A. Aaker and Robert Jacobson, “The Financial Information Content of Perceived Quality,” Journal of Marketing Research, May 1994. The First Intel Inside Ad New Company Brand Name & Stock Price In most cases, name changes signal improved profit performance and increase stock price (+.44%). A change in company brand name says to the market, “We have changed our company (i.e., brand strategy, management, organization, product offerings) and those changes are for the better.” Both cosmetic name changes (e.g., Paine Webber to Paine Webber Group) and radical name changes (e.g., Consolidated Foods to Sara Lee) signal a change in the firm’s activities. Dan Horsky and Patrick Swyngedouw, “Does it Pay to Change Your Company’s Name? A Stock Market Perspective,” Marketing Science, Fall, 1987. Name Change: InfoSpace.com to InfoSpace InfoSpace Stock Price 300 290 280 261.1 270 260 250 240 230 220 210 225.3 259.8 259.5 253.5 238 218.1 217 200 2/25 2/26 2/27 2/28 2/29 3/1 3/2 3/3 March 1 Press Release 3/4 3/5 3/6 3/7 Brand Attitude, ROE & Stock Price Brand attitude = % positive company opinion minus % negative opinion In high-tech markets, change in brand attitude helps predict future business performance and leads accounting ROE, by 1-2 quarters ROE, in turn, influences stock return/price David A. Aaker and Robert Jacobson, “The Value Relevance of Brand Attitude in High-Technology Markets,” April 2000 article to appear in future issue of The Journal of Marketing Research. Brand Attitude, ROE & Stock Price Drivers of Brand Attitude Visible, dramatic new products increase brand attitude Product problems decrease brand attitude Competitor actions: e.g., aggressive comparison advertising Highly visible changes in top management (CEO) Legal actions & lawsuits Note: Major advertising initiatives are not linked to substantial movement in brand attitude. David A. Aaker and Robert Jacobson, “The Value Relevance of Brand Attitude in High-Technology Markets,” April 2000 article to appear in future issue of The Journal of Marketing Research. Sears Builds Brand Equity from the Inside-Out Employee satisfaction and attitudes about their job and the company predict Employee behavior in front of customer predicts Likelihood of customer satisfaction, retention and recommendation predicts Superior financial performance and revenue growth “Bringing Sears Into The New World,” Fortune Magazine, October 13. 1997. Lessons in Dot-com Brand Building How Amazon.com built a corporate reputation and a strong on-line presence on the Internet… (And why barnesandnoble.com and CDNow did not) Violina R. Rindova and Suvesh Kotha, “Building Reputation on the Internet: Lessons from Amazon.com and its Competitors,” revised September 1999. Brand Equity & Reputation Brand Equity The added value provided to a product or company by its brand identity The set of associations and behaviors that increase or decrease the value of the brand compared to its asset value alone Reputation The general estimation in which a person is held by the public The state or situation of being held in high esteem How Amazon.com Built a Corporate Reputation and a Strong On-line Presence on the Internet… Corporate reputation or “brand equity” is one of the few resources that provides a firm with sustainable competitive advantage. Reputation is an asset to be created, nurtured and exploited. Reputation building – a flow of orchestrated strategic actions and signals interpretable in the market place Reputational stock = (media visibility + positive media mentions) On the Internet, reputation: Is of greater importance in purchasing decisions than direct comparisons of competitive products Is a mechanism for generating sales Amazon did many more strategic actions and more actions earlier than bn.com and CDNow Violina R. Rindova and Suvesh Kotha, “Building Reputation on the Internet: Lessons from Amazon.com and its Competitors,” University of Washington Business School, Revised September 1999. Internet Reputation & Brand-Equity-Building Strategies 1. Create balanced symbolic communications – diverse, yet consistent. Balance novelty and familiarity. Amazon.com – a metaphorical link to Earth’s largest river Dot-com name = Internet-based A compelling story – not limited to one product category “Store” symbolism – e.g., shopping cart Ads use physical symbols to represent the huge size of product selection Violina R. Rindova and Suvesh Kotha, “Building Reputation on the Internet: Lessons from Amazon.com and its Competitors,” University of Washington Business School, Revised September 1999. Internet Reputation & Brand-Equity-Building Strategies 2. Take Competitive Actions Use symbolic counter-moves and signals to competitive actions (e.g., match Barnes & Noble price cuts) by attacking, defending and disseminating knowledge Redefine the industry paradigm: Barnes & Noble’s motto of “The world’s biggest bookstore” vs. Amazon.com positioning itself as “The Earth’s largest bookstore.” Violina R. Rindova and Suvesh Kotha, “Building Reputation on the Internet: Lessons from Amazon.com and its Competitors,” University of Washington Business School, Revised September 1999. Internet Reputation & Brand-Equity-Building Strategies 3. Build close and communal relationships and participate in networks that increase reach and leverage reputation Many personalized, one-on-one messages and services – automated, free-of-charge Grassroots associates program Proactive Investor Relations communications Borrow reputation from VC firm – Kleiner, Perkins, Caufield & Byers Invite customers to talk with one another Know customer preferences Provide many opportunities for interaction, conversation and sociability Violina R. Rindova and Suvesh Kotha, “Building Reputation on the Internet: Lessons from Amazon.com and its Competitors,” University of Washington Business School, Revised September 1999. An Inductive Model Of Reputation Building On The Internet Through Strategic Actions naming diversity and consistency of symbols story retail facade symbolic actions balance of novelty and familiarity advertising lawsuits price cutting competitive actions close relationships personalization participation in networks reputational stock redefining industry paradigm capacity expansion community positioning relational actions aggregation of traffic and information reputation borrowing and lending Violina R. Rindova and Suvesh Kotha, “Building Reputation on the Internet: Lessons from Amazon.com and its Competitors,” University of Washington Business School, Revised September 1999. Reputation & Internet Success Reputation/Brand Equity building activities are one of the key determinants of competitive success for Internet firms “Reputation Building and Firm Performance: An Empirical Analysis of the Top-50 Pure Internet Firms,” Suresh Kotha, Shivaram Rajgopal and Violina Rindova, University of Washington Business School, November 1999. Reputation & Internet Success 1. Marketing Investments in Reputation Create brand awareness & signal your true character as a quality producer Advertising Customer service Affiliate programs The more an Internet firm invests in reputation by committing resources to marketing and advertising, the higher will be its market value The impact lasts for two – three quarters. Therefore, continuity is important. “Reputation Building and Firm Performance: An Empirical Analysis of the Top-50 Pure Internet Firms,” Suresh Kotha, Shivaram Rajgopal and Violina Rindova, University of Washington Business School, November 1999. Reputation & Internet Success 2. Borrow reputation from VC firm reputation to increase market value & sales growth 3. Media Exposure/“Buzz” Major newspaper/magazine press releases articles higher market value & sales growth Impacts last for one quarter and are more short-lived than marketing investments “Reputation Building and Firm Performance: An Empirical Analysis of the Top-50 Pure Internet Firms,” Suresh Kotha, Shivaram Rajgopal and Violina Rindova, University of Washington Business School, November 1999. InfoSpace – Master of “Buzz” Brand Strategy Secrets for Increasing Stock Price 1. Carefully research, define & execute on your company & product brand identities. 2. Know the top-ranked reasons buyers purchase your brand. Internal opinions usually don’t match what customers actually want. 3. Link the brand to operations. 4. Track the level of brand awareness & positive/negative esteem to predict future business performance. Brand Strategy Secrets for Increasing Stock Price 5. Track employee and customer satisfaction to produce superior financial performance. 6. Avoid “brand-name-itus.” Centrally manage new brand name and brand extension decisions. 7. Develop & execute on-going programs for raising perceived quality to earn the associated increase in stock return. 8. Publicize brand strategy news within the investment community. Thank You! Good luck with your brand strategy programs! If you would like help developing a brand identity and brand strategies for your company, contact Chuck Pettis at BrandSolutions, Inc. at cpettis@brand.com or (425) 455-8601.