Intermediate Microeconomics

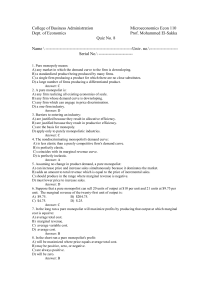

advertisement

Intermediate Microeconomics Monopoly 1 Pure Monopoly A Monopolized market has only a single seller. Examples? XM radio? Microsoft? Walmart in a small town? 2 Monopolies So what causes monopolies? Legal Constraints: e.g patents for new drugs Ownership of a fixed resource e.g. toll highway, land in a given area. Collusion e.g. several producers act as one (OPEC) Large economies of scale (natural monopolies) e.g. land line phone service, utilities, Google? Microsoft? 3 Monopolies Why are we concerned about Monopolies? 4 Implications of Monopoly Key to Monopoly: Seller is not a price taker! Specifically, since monopolist chooses market supply, it essentially picks a point on the market demand curve to operate on. This means that for a monopolist, equilibrium price is a function of the quantity they supply, so they effectively get to choose both i.e. choose where to operate on p(q) (“Inverse Demand Curve”) $ QD(p) or p(q) Q 5 Monopolist’s Problem In perfect competition, a firm wanted to choose a quantity to maximize profits, given it is a “price taker”. max π(q) = R(q) – C(q) = pq – C(q) To find profit maximizing q, we take derivative of π(q) and set it equal to zero, This gives p - MC(q*) = 0 “First Order Condition” (FOC) or equivalently, keep producing until MC(q*) = p Like any firm, a monopolist wants to choose quantity to maximize profits, but by doing so effectively chooses price as well. max π(q) = R(q) – C(q) = p(q)q – C(q) So what will be profit maximization condition for the monopolist? 6 Monopolist’s Problem $ c(Q) R(Q) = p(Q)Q q π(Q) 7 Marginal Revenue for Monopolist Profit max condition is always MR(q*) = MC(q*) (from FOC) For firm in perfect competition, firm is a price taker so MR(q) = p for all q. For monopolist: MR(q*) = [p’(q*)q* + p(q*)] Since p(q) is the inverse of the market demand curve, we know p’(q) < 0. Therefore, [p’(q)q + p(q)] < p(q), implying MR(q) < p(q) (i.e. marginal revenue from producing and selling another unit is less than price) What is intuition? Ex: Consider a Market Demand Curve: QD(p) = 400 – 5p What is Equation for the Inverse Demand curve? What is Equation for Marginal Revenue curve? Graphically? 8 Monopolist Behavior Consider a monopolist: Cost function given by C(q) = q2 + 8q + 20 Market Demand Curve of QD(p) = 400 – 5p. What will be equilibrium price and quantity? Graphically? 9 Profit Maximization and Demand Elasticity Recall that R(q) = p(q)q So MR(q) = p’(q) q + p(q) = p(q)[p’(q) q/p(q) + 1] Recall ε(p) = Q’(p) p/Q(p) = slope of demand curve times price divided by quantity So 1/ε = slope of inverse demand curve times quantity divided by price = p’(q) q/p(q) So MR(q) = p(q)[1/ε + 1] Recalling ε < 0, what does this tell us about output under a monopoly and demand elasticity, recognizing that Monopolist will choose q to equate MR(q) to MC(q)? 10 Profit Maximization and Demand Elasticity We can actually learn even more from elasticity. In competitive markets, firms produced until p = MC(q*) Alternatively, monopolist supplies until MR(q*) = MC(q*), or until: p(q*)[1/ε + 1] = MC(q*) Re-writing we get: p(q*) = MC(q*)ε /[ε +1] So how does monopoly “mark-up” depend on elasticity of demand? 11 Monopoly and Efficiency The key implication of a Pareto Efficient outcome is that all possible gains from trade are exhausted. Will this be true in a monopolized market? Consider first what it means for all gains from trade to be exhausted. Output is produced as long as marginal cost of last unit is less than what a consumer is willing to pay for that unit. How do we know this won’t be true under a profit maximizing monopolist? How would we see this graphically? 12 Taxing a Monopolist What if government imposes a tax on monopolist equal to $t/unit sold. Will this somehow increase efficiency? Consider again monopolist with MC(q) = 2Q + 8 that faces a demand curve such that MR(Q) = 80 – 2Q/5 We know that without tax, Q = 30 and p = 74 What will change with tax of t = $12? Graphically? 13 Entry If a monopolist is making all these economic profits, can this monopoly be maintained? Entry constrained by law (patents, patronage/political favors) Natural Monopoly - firm’s technology has economies-of-scale large enough for it to supply the whole market at a lower average cost than is possible with more than one firm in the market. Essentially very high fixed costs of entry. Examples? 14 Monopoly Policy Under natural monopoly it is best for one firm to supply whole market. To prevent inefficiencies of monopoly, there are a couple of strategies. Have government run/regulate industry. e.g. Utilities, postal service? Break-up monopolist Especially relevant when declining marginal cost structure due to high entry costs (e.g. software, drugs) Block mergers that could allow monopolies to form in the first place. Problems? 15