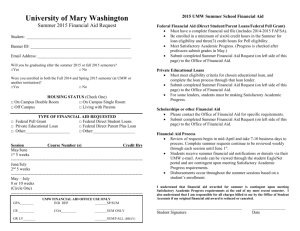

Application for Financial Aid

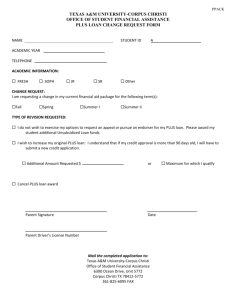

advertisement