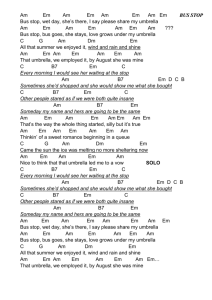

Document

advertisement

2008 Seminar on Reinsurance Reinsuring Commercial Umbrella Brian E. Johnson, ACAS, MAAA Agenda • Basic Review of Commercial Umbrella –Umbrella vs Following Form Excess –How is an Umbrella policy written and priced? • Discuss the more common ways an Umbrella portfolio can be reinsured –Quota Share (Cessions) –Excess of Loss –Things to consider Market Slide 2 Trends Basic Umbrella Review Sometimes a primary insurance company will write an excess liability policy. Excess liability policies take two main forms –Umbrella –Following Form Excess Both types of excess policies are written “on top” of underlying policy usually with a requirement that the insured maintain the underlying coverages. Other than where noted, these two coverages can be priced using similar methodologies. Slide 3 Basic Umbrella Review Slide 4 A Following Form Excess does just what it says. It follows an underlying policy and provides for additional limit. All the same coverages and exclusions on the underlying policy are applicable to the Following Form Excess policy. An umbrella policy is a little different. In addition to adding limits to an underlying policy (ies), it may “drop-down” to cover losses not covered by the underlying policy unless it is specifically endorsed to follow the underlying in coverage. An umbrella policy may also cover certain loss adjustment expenses not covered by the underlying policy (drop down coverage). Basic Umbrella Review Example of drop-down: Tatooine Cantina buys a $1M GL policy that excludes liquor liability. They also buy a $2M umbrella policy on top of it (attaching at $1M). The umbrella does not have the liquor exclusion. The bartender on duty continues to serve alcohol to a patron after he was visibly drunk. That patron gets into a bar fight and cuts off the arm of another customer, Bob. Bob sues Tatooine and wins $500K. Even though this loss is below the $1M retention, the umbrella “drops down” to pick up the loss. Slide 5 Basic Umbrella Review Slide 6 In commercial lines, excess or umbrella policies are priced by applying factors to the premium of the underlying policy. Manual or “net” premium could be used. These factors are derived from severity curves (ILFs) but include a load for the insurers’ profit and expenses. Typically the first $1M of Umbrella is priced as a percentage of the premium for the underlying lines (these are called umbrella factors). Additional layers are priced as a percent of the first $1M of umbrella or a percent of each preceding layer. Basic Umbrella Review Slide 7 In addition to the excess factors, there are usually minimum premiums per $1M in limit and/or policy applicable. Quite often, the underwriter also has some flexibility to apply discretionary credits/debits to the umbrella factors or final umbrella premium. An insurance company can write an umbrella policy over their own underlying policies or over another insurance company’s policies. (supported vs unsupported). Reinsuring an Umbrella Portfolio: Quota Share Slide 8 Typically reinsurance on umbrella policies is provided on a proportional basis. The quota share cession percentage can be the same for all limits or vary by layer. If there is enough credible information, a reinsurer pricing this business would be able to do an ELR analysis by trending umbrella premium and trending and developing umbrella losses. There will not be many losses in the layer. A loss ratio analysis based on experience rating would not be credible. Reinsuring an Umbrella Portfolio: Quota Share There are a few important things that must be considered in order to successfully experience rate an umbrella portfolio. – Historical individual umbrella losses with attachment point for every loss (also excess vs drop-down) and historical umbrella premium. – Underlying rate changes – Umbrella rate changes Changes in umbrella factors Changes in amount of discretionary pricing. – Excess loss development factors Slide 9 – Drift in limits distribution Reinsuring an Umbrella Portfolio: Quota Share Another way to estimate the profitability of an umbrella quota share (ELR) is to split the analysis into two pieces: – Using ground-up data, estimate the adequacy of the underlying premium – Estimate the adequacy of the umbrella factors in comparison to some industry or reinsurance company yardstick – The theory is that the ELR of the umbrella policy would be affected by both the adequacy of the underlying premiums and excess factors. Slide 10 Let’s illustrate this with an example. Reinsuring an Umbrella Portfolio: Quota Share Cortana Re has been given a chance to reinsure a book of commercial umbrella business written by Covenant Insurance. Covenant writes either $1M limit or $2M limit umbrellas over their own $1M GL policies. You have the following information about the account. You also use a pareto distribution to develop the following limited severity curve. Estimate the ELR on the Umbrella portfolio. ERL on Covenant's GL policies: Umbrella factor for 1st Mill: Umbrella factor for 2nd Mill: % umbrella policies at 1M: % umbrella policies at 2M: Slide 11 Limit 1,000,000 2,000,000 3,000,000 75% 20% of underlying $1M policy 75% of 1st Mill of umbrella 40% 60% Avg Sev 16,000 19,084 21,555 Reinsuring an Umbrella Portfolio: Quota Share Essentially the Umbrella factors are the ratio of umbrella premium to underlying premium: premumb premund Using your severity curve, you promulgate an excess loss factor for each layer: lossumb lossund Slide 12 Reinsuring an Umbrella Portfolio: Quota Share A ratio of the two factors (umbrella adequacy factor) multiplied by the underlying ELR equates to the umbrella loss divided by the umbrella premium. lossumb lossund lossund X premund lossumb = premumb premumb premund Slide 13 Using a simple Excel spreadsheet you can estimate the weighted average adequacy factor and ELR for an umbrella portfolio. Reinsuring an Umbrella Portfolio: Quota Share (1) (2) (3) (4) (5) (6) (7) (8) Slide 14 (1) (2) (3) (4) (5) (6) (7) (8) 1,000,000 1,000,000 xs xs Underlying 1,000,000 Umbrella layer: 1st 2nd GL ISO % of underlying: 19.3% 12.9% ISO Total Limits: 19.3% 32.2% Cortana % of underlying: 20.0% 15.00% Cortana Total Limits: 20.0% 35.00% Umbrella Limits Dist: 40.0% 60.0% Umbrella Adequacy Factor: 93.3% ERL on Covenant's GL policies: 75.0% Umbrella ELR: 69.9% Based on ISOTruncated Pareto with client specific exposure distribtions Cumulative of (1) Given Cumulative of (3) Given = wtg average of (2) / wtg average of (4) Given = (6) x (7) Reinsuring an Umbrella Portfolio: Quota Share Slide 15 In practice, umbrella policies are typically written over multiple underlying coverages (i.e. GL, AL, and EL). The analysis for these situations is the same with multiple underlying ELRs and umbrella factors. Reinsuring an Umbrella Portfolio: Quota Share Umbrella layer: GL ISO % of underlying: CAL ISO % of underlying: Avg ISO % of underlying: XYZ % of underlying: Premium Dist: Umbrella Adequacy Factor: GL L&ALAE Ratio: AL L&LALAE Ratio: Avg. AL/GL L&ALAE Ratio: UMB ELR on 1st $5M: Slide 16 1,000,000 xs Underlying 1st 13.17% 11.08% 12.60% 16.01% 58.37% 73.2% 72.2% 91.1% 77.4% 56.6% 1,000,000 xs 1,000,000 2nd 3.93% 3.91% 3.93% 8.01% 22.14% 1,000,000 xs 2,000,000 3rd 2.29% 2.22% 2.27% 4.00% 7.54% 1,000,000 xs 3,000,000 4th 1.55% 1.48% 1.53% 2.00% 3.38% 1,000,000 xs 4,000,000 5th 1.14% 1.07% 1.12% 1.00% 8.57% Reinsuring an Umbrella Portfolio: Quota Share Some things to consider if using this method: –You must consider the proper method to load for excess ALAE versus ground-up ALAE –You must factor in the effect of discretionary pricing You must also factor in the effects of the minimum premiums. –The “actual” excess factor obtained because of your minimum premiums may be far greater than the filed excess factors. –This is sometimes very hard to do because it requires the cedant to keep premiums by layer in the system. Slide 17 Reinsuring an Umbrella Portfolio: Quota Share The reinsurer must also be very aware of shifting limits (or attachment) points. – Some layers may be more or less adequate than others. – A shift to higher or lower limit umbrella policies may affect the adequacy factor. Slide 18 Once an ELR is determined the reinsurer can determine what commission can be paid the cedant. There must also be some consideration what load to add for “drop-down” coverage. Reinsuring an Umbrella Portfolio: Excess of Loss Another way to reinsure an umbrella portfolio is reinsure it on an excess of loss basis. This type of treaty can come in two varieties: – A cedent decides to include their umbrella portfolio into their mainframe XOL treaty. Typically the limit and attachment points are with respect to first dollar i.e. $5M xs $1M – A cedent who writes unsupported umbrellas may choose to keep a fixed retention on every umbrella regardless of the attachment. Slide 19 One of the biggest concerns is how a shift in limits or attachment points could change the expected loss in your reinsured layer. Reinsuring an Umbrella Portfolio: Excess of Loss Let’s start with a scenario where every umbrella has the same attachment point, limits vary and the excess of loss cover is $4.0M xs $1.0M from the ground: Limited Prem Limit Attachment Distr. XS Factor Limit Severity 500,000 18,147 4,500,000 1,000,000 25.0% 95.3% 1,000,000 21,623 1,500,000 1,000,000 10.0% 100.0% 3,000,000 1,000,000 35.0% 100.0% 1,500,000 23,604 5,000,000 1,000,000 30.0% 91.5% 2,000,000 24,946 Wavg: 96.3% 2,500,000 25,940 3,000,000 26,719 3,500,000 27,353 4,000,000 27,884 4,500,000 28,338 5,000,000 28,733 5,500,000 29,081 6,000,000 29,391 Given an umbrella ELR of 65% the rate we would charge would be 63% plus load. Slide 20 Reinsuring an Umbrella Portfolio: Excess of Loss Slide 21 Reinsuring an Umbrella Portfolio: Excess of Loss Let’s look at a scenario where the umbrella attachment points and limits vary and the excess of loss cover is $4.0M xs $1.0M with respect to the ground: Prem Limit Attachment Distr. xs factor 4,500,000 500,000 25.0% 1,000,000 1,500,000 10.0% 100.0% 3,000,000 1,500,000 35.0% 100.0% 1,500,000 3,000,000 30.0% 100.0% Wavg: 91.8% Slide 22 67.2% =(28733-21622)/(28733-18147) Reinsuring an Umbrella Portfolio: Excess of Loss Slide 23 Reinsuring an Umbrella Portfolio: Excess of Loss Let’s look at a scenario where the umbrella attachment points and limits vary and the excess of loss cover is $4.0M xs $1.0M with respect to the umbrella: Prem Limit Attachment Distr. xs factor 4,500,000 500,000 25.0% 1,000,000 1,500,000 10.0% 3,000,000 1,500,000 35.0% 50.7% =(28338-25939)/(28338-23604) 1,500,000 3,000,000 30.0% 28.0% =(28338-27884)/(28338-26718) Wavg: 38.3% Slide 24 48.4% =(28733-23604)/(28733-18147) 0.0% Reinsuring an Umbrella Portfolio: Excess of Loss Slide 25 Reinsuring an Umbrella Portfolio: Excess of Loss In order to properly rate the XOL on umbrella business the reinsurer will need data that may not be readily available from the cedant. –A matrix distribution of limits by attachments –Historical information on how limits and attachments have shifted over time A shift in the limits or attachment points could make the average expected loss cost increase or decrease significantly. In some cases it may make more sense to charge a schedule of rates which vary by attachment and limit as opposed to a single rate. Slide 26 Reinsuring an Umbrella Portfolio: Excess of Loss The reinsurer may also want to rethink the appropriate load (for parameter risk) needed to write this type of cover. Using an XOL load typically used when reinsuring primary policies may not be appropriate. There must also be some consideration what load to add for “drop-down” coverage. Slide 27 Reinsuring an Umbrella Portfolio: Market Trends Like the rest of the market the rates have been decreasing. – Decreasing manual rates – Decreasing discretionary mods – Decreasing umbrella factors – Increased use of umbrella credits – Umbrella on E&S business hit the hardest Slide 28 More companies trying to purchase auto carve-outs for their umbrella portfolio. Companies are looking at the option of moving from an umbrella quota share to an XOL. Reinsuring an Umbrella Portfolio: Market Trends Continued deterioration of terms and conditions – Little to no referral guidelines – Decreasing minimums per million Slide 29 Increase in the umbrella limits primary companies are willing to write. More primary companies are willing to attach higher (write the excess umbrellas as opposed to lead umbrella) where it is perceived rates per million are more adequate. Increase in the number of companies willing to offer SAM in the umbrella for certain classes (i.e. social services) Reinsuring an Umbrella Portfolio: Market Trends More risks, typically written in the E&S markets, are being written in the standard umbrella market at standard umbrella rates. Actuaries and UWs need to make sure they understand the underlying umbrella form. – While there is a standard ISO form most companies use a hybrid form – Recently the umbrella forms have been broadening Slide 30 Actuaries should also make sure umbrellas are properly endorsed to reduce the chance of dropdown coverages (i.e. a driver is excluded on the underlying but not on the umbrella)