Business Entities

advertisement

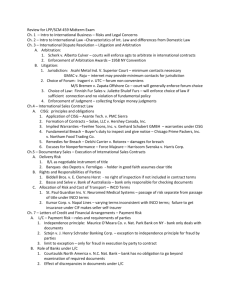

Diploma of Financial Services (Banking) FNSACCT404B Make Decisions in a Legal Context Part 1 (Lecture 1 to 8) Introduction Lecturer ◦ Name ◦ Contact details Prerequisites ◦ Australian Business Law – Principles & Practice, Pearson, NSW Pendleton, W. and Vickery, R, latest edition, ◦ Internet access ◦ Learner Guide ◦ Study discipline Unit Overview o In Make Decisions in a Legal Context, students develop the competency to work and make decisions within a legal context (covering areas such as the Australian legal system, property, contract and agency). Term dates & lecture timetable 2 Unit of Competency This unit requires the application of skills and knowledge required to make decisions within a legal context. The unit encompasses identifying the main roles and responsibilities of key bodies in the legal system, identifying compliance requirements and developing procedures to ensure compliance. The unit has application across all sectors of the financial services industry. Identify the main roles and responsibilities of the key bodies in the legal system The functions of the courts and other regulatory bodies are identified Implications of relevant legislation are identified and applied in regard to making decisions Implications of common law, including negligence and contract, employment law and business structures, are identified and applied in regard to making decisions 3 Unit of Competency Identify compliance requirements Requirements are interpreted accurately and within prescribed time limits Requirements are reviewed in a comprehensive manner Sources are constantly reviewed to remain informed of changes and amendments to statutes and finance industry requirements Develop procedures to ensure compliance Procedures are developed in consultation with others to address all the requirements to be met for compliance Compliance requirements are monitored to ensure that they are adhered to by the organisation Timetables to meet compliance requirements are established to align with statutory deadlines 4 Range Statement Courts and regulatory bodies may include: High Court Federal Courts State Courts Industrial Relations Court Australian Tax Office (ATO) Australian Securities and Investments Commission (ASIC) Stock Exchange Australian Consumer And Competition Commission (ACCC) Relevant legislation may include: Financial Transactions Reports Act Consumer Credit legislation Taxation Act, Trade Practices Act, Stamp Duties Act, Privacy Act Sale of Goods Acts 5 Range Statement cont. Sources may include: internet government publications industry journals industry networks Procedures may include: operations manuals internal control guidelines computer system documentation Compliance requirements may include: statutory requirements audits policy and procedures contracts 6 Learning & Assessment Guide Learning Outcome 1 Revise the role of courts, tribunals and other regulatory bodies in the legal system. Learning Outcome 2 Revise the activities of business associations and the process for the establishment of a sole trader, partnership, proprietary and public company. Learning Outcome 3 Explain the operation of agency and partnership law in South Australia. o Distinguish between the rights and obligations of principals, agents and third parties. o Identify factors to determine the existence of a partnership. o Explain the operation of partnership law in South Australia, including the rights and obligations of the partners. 7 Learning & Assessment Guide Learning Outcome 4 Recognise the relevance of tortuous liabilities in the business environment. 4.1 Explain and illustrate by example, the application of negligence in the context of: Negligent misstatement Occupiers’ liability Product liability Vicarious liability Highway authorities Economic loss Professional liability Reduction of liability 4.2 Risk is assessed and procedures are put into place to reduce liability. 8 Learning & Assessment Guide Learning Outcome 5 Describe and explain the formation, operation and termination of contracts as they affect business activities. 5.1 - Examine and analyse general business contract documents, particularly in relation to validity, form, retention of title and performance. 5.2 - Identify and explain the six essential elements of a valid contract: Intention to create legal relations Offer and acceptance Consideration and form Capacity Genuine consent Legality of purpose 5.3 - Explain how these elements of a contract relate to business decisions and transactions. 5.4 - Explain how a contract may be discharged and the remedies available. 5.5 - Identify the e-commerce implication for the law of contracts. 9 Learning & Assessment Guide Learning Outcome 6 Demonstrate an understanding of the concept of property and the nature of mortgages, including the rights and obligations of the parties. 6.1 Explain the operation of the Torrens Title system in South Australia. 6.2 Briefly explain the nature of mortgages, including the rights and obligations of the parties (including a guarantor) to a mortgage. Learning Outcome 7 Recognise the application of contractual principles to certain specialty contracts – leases, franchises and insurance. 7.1 Define a contract for lease, identify the elements necessary for a lease, and explain the South Australian law relating to business leases. 7.2 Define the franchise agreement and the relationship of franchisor and franchisee. 7.3 Briefly explain the purpose of the Franchising Code of Practice. 7.4 Demonstrate an understanding of insurance law and explain the common forms of business insurance. 10 Learning & Assessment Guide Learning Outcome 8 Recognise the application of contractual principles to employment contracts. 8.1 Describe the formation and operation of an employment contract. 8.2 Describe the reasons for termination of contracts. Learning Outcome 9 Demonstrate an understanding of workplace relations law. 9.1 Define: An award An enterprise agreement A certified agreement An Australian workplace agreement and explain the procedures for making them 9.2 Explain the dispute resolution process within the workplace relations system. 11 Learning & Assessment Guide Learning Outcome 10 Recognise and describe the statutory provisions and principles relevant to the sale of goods which accountants are required to apply in the course of business. 10.1 Define and differentiate between: Specific and unascertained goods Sale and agreement to sell Sale of goods and contract for work done and materials supplied 10.2 List the implied conditions and warranties in Sale of Goods legislation and recognise when such terms are excluded in the case of a sale being a “consumer sale”. 12 Learning & Assessment Guide Learning Outcome 11 Describe and explain the principles of consumer protection legislation as it applies to contract law and specifically the rights and duties in relation to contracts with “consumers”. 11.1 - Recognise the significance of the Trade Practices Act for consumer protection law and specifically apply the provisions of the Act in relation to: Unfair practices Implied conditions and warranties Remedies under the Act Rights against manufacturers and importers The role of the Australian Competition and Consumer Commission 11.2 - Explain the operation of other statutes and common law relating to ecommerce, retailers and manufacturers. 11.3 - Explain risk management procedures which may be used in the workplace to minimize liability. 13 Learning & Assessment Guide Learning Outcome 12 - Describe the operation of the Trade Practices Act in relation to restrictive trade practices. 12.1 Differentiate between the roles of the Australian Competition and Competition Council and the Federal Court. 12.2 Describe the practices prohibited under Part IV of the Trade Practices Act. 12.3 Outline the enforcement procedures for breaches of the restrictive trade practices provisions of the Trade Practices Act. 12.4 Explain risk management procedures which may be used in the workplace to minimize liability. Learning Outcome 13 - Explain the types of legal protection available for intellectual property. 13.1 Define copyright, design, patent and trade mark. 13.2 Outline the processes for protection of intellectual property. 13.3 Briefly describe the remedies for breach of intellectual property legislation. 13.4 Explain “passing off”. 13.5 Discuss the elements in a common law action of breach of confidence in relation to confidential information. 13.6 Identify the e-commerce implication for the law regarding intellectual property. 14 Learning & Assessment Guide Learning Outcome 14 - Explain effective methods of debt collection. Learning Outcome 15 - Explain the effect of bankruptcy. 15.1 Outline the procedures when someone becomes bankrupt. 15.2 Explain the consequences of bankruptcy. 15.3 Briefly describe the alternatives to bankruptcy. Learning Outcome 16 - Formulate procedures to ensure compliance with applicable business law and to continually review legislation requirements. Identify sources of information: Websites Newsletters Industry journals Media releases Legislation Note: Learning Outcome 16 should be covered throughout the subject. 15 Assessment Summative 2 unsupervised assignments to cover all learning outcomes (may be provided as one assignment) 2 open book supervised assessments (may be provided as one assessment) Formative Learning and group work activities Application of case study principles to learning and group work activities 16 Grading Fail A grade for not meeting all performance criteria. Does not demonstrate competence in all performance criteria in the unit. Pass A grade for meeting all performance criteria. Demonstrates competence in all performance criteria in the unit (including employability skills) Credit A grade for consistent judgement and application of theory and concepts. To be awarded a credit grade, the student must meet the criteria for pass, and further: Appropriately relate the performance criteria to work situations and workplace standards Meet all specified deadlines Work with limited supervision Assignments/assessments require no more than minor amendments only. Distinction A grade for consistent excellence in the areas of originality, attitude and independent application. To be awarded a distinction grade, the student must meet the criteria for pass and credit grades, and further: Demonstrate original and independent application of theory and practice Demonstrate initiative and outstanding attitudes, approaches to learning and motivation Where appropriate work with and lead a study group or demonstrate outstanding consultation skills Assignments/assessments require no amendments 17 Timetable Week 1 and 2 Topic Revision of courts, tribunals and other regulatory bodies Revision of business entities Agency and partnership law 3 Negligence 4,5,6 and 7 Contracts – Formation, elements, discharge and remedies for breach 8 Property law, leases, franchises and insurance Case Study assignment 9 Employment contracts Workplace relations law Give out presentation to students 10 Sale of Goods Act 11 Consumer protection 12 Presentations Business and e-commerce transactions 13 Restrictive trade practices 14 Intellectual property 15 Debt collection and bankruptcy 16 Supervised assessment 17 Corrections/resits 18 Lecture 1 Revision Legal System Business Entities Introduction to Agency & Partnership Law 19 Key Terms Act of Parliament/Statute Law/Legislation Arbitration (binding) Civil Law Committal Hearing Common law (precedents, legal principle) Conciliation (non binding) Delegated Legislation Equity (remedies eg injunction, account of profits) Australian Legal System http://www.fedcourt.gov.au/aboutct/about ct_videos.html#justice Court Hierarchy High Court of Australia Full Court Single judge State Supreme Courts Courts of Appeal/Full Courts State Supreme Courts Single judge Intermediate courts District Court Magistrates Court Courts and tribunals of specialist jurisdiction (EO), Residential Tenancies) State Court Hierarchy High Court of Australia Full Court Single judge Supreme Court Appellate Jurisdiction Supreme Court Single judge District Court Crim & Civil Magistrates Court - General Claims ($6K - $40K) ($80K PI) - Minor Claims (up to $6K) Courts and tribunals of specialist jurisdiction The Adversarial System 2 parties to dispute (plaintiff/defendant/appellant/respondent) Caseflow management (directions/status hearings, conciliation/settlement conference) Independent and impartial judge (jury if criminal) (separation of powers) Witnesses (in chief and cross examination), expert witness only for opinion Burden of proof Standard of proof (criminal, civil) In Court http://www.fedcourt.gov.au/aboutct/about ct_videos.html#courtroom Courts administration http://www.courts.sa.gov.au/ District Court Act Supreme/District Court Rules Magistrates Court Rules Practice directions ADR Abandon the Claim (each party may bear own costs) Out of Court Settlement Ombudsman – report on conduct of government bodies towards public Conciliation / Mediation – 3rd party facilitates resolution – non legal - usually non binding Arbitration – commercial/employment disputes – legally qualified ‘umpire’ Commissions and Tribunals ◦ e.g. ACCC ◦ Immigration review Delegated Legislation Powers of Parliament ‘given’ to other bodies Parliament does not have time or expertise to make law Regulations, By-laws, Ordinances, or Statutory Rules Delegated Legislation Powers of Parliament may be passed to: ◦ Executive Council – emergency situations ◦ Local Councils – eg rubbish collection ◦ Government Departments – operating rules/procedures ◦ Statutory Authorities – eg Housing SA Lecture 2 Revision of Business Entities Introduction to Agency and Partnership Law 30 Business Entities Sole Trader - Owner/operator - Advantages (low set up costs, control) - Disadvantages (unlimited liability, limited access to funds, tax, single expertise) Business Entities Partnerships “the relation which exists between various persons carrying on a business in common with a view of profit” – Partnerships Act (SA) Key features: - Each partner is principal and agent for other partners; - Equal share in profits and losses; - All participate in decision making; - Each must act in best interests of partnership; ◦ ◦ ◦ ◦ ◦ Creation Liability Agency Rights and duties Distribution of assets Business Entities Number of partners - Generally 2 -20 people but exceptions:Actuaries, medical practitioners, sharebrokers or stockbrokers 50 Architects, chemists, vets 100 Legal practitioners 400 Accountants 1000 Business Entities a) Creation Written Agreement (partnership agreement) - Highly recommended Duties, responsibilities, rights Easier to resolve disputes if agreement Will override provisions of Partnership Act Contains – details of partners, duration, duties, details of keeping of accounts Business Entities b) Verbal agreement - No written document, implications for disputes. c) Conduct (partnership by estoppel) - Others led to believe partnership exists by individuals conduct. Business Entities Liability of Partnerships Joint and unlimited liability for debts and contractual obligations TORT – Joint and several liability - All partners liable for a tort if act or omission occurred when partner:-was acting in the ordinary course of the partnership business; or - had actual or apparent authority from the other partners Business Entities Relationship to Third Parties Provided they acted with authority, “…all partners are as liable for the actions of the partners as if they did those acts themselves”. (Vickery & Pendleton, 5th edition) Business Entities Actual authority - real, clearly stated, all partners agree Apparent authority - Partner who appears to act with authority. - 3rd party compensation on following bases:- Partner carrying out ordinary kind of business of firm; - Partner’s actions carried out in usual way; - 3rd party unaware that partner lacked authority to bind firm Polkinghorne v Holland (1934) 51 CLR 143 Advice given to client by junior solicitor re investing in company Client argued junior solicitor was negligent and sued senior partners High Court held that giving financial was within the usual scope of business of a law firm and client had reasonably believed junior partner had fully authority = ALL PARTNERS LIABLE Business Entities Implied authority - Those dealing with the partnership are entitled to expect that partners have following implied powers: Sell firms product; Employ staff; Purchase goods normally used; Receive payments; Issue cheques ◦ *should any of the above be removed, anyone doing business with the partnership must be informed, otherwise implied authority will apply and partnership be bound. Novation P29 Transfer of legal duties to another party Example – Partner leaving business Joint Venture Assets – owned as tenants in common Rights of creditors – against joint adventurer Not separate legal entity Conduct of one not legally binding on other Companies – Legal Nature Effect of Incorporation - ‘registered’ s119 – incorporated body - ‘artificial person’ – sue, be sued, hold property, own liability - Main difference to partnership, proprietorship - Exception – murder, lifting ‘corporate veil’ - Members personal liability only to company (guarantee, unpaid amount on shares) not to third parties; - Extent of liability to company depends on class Incorporation – Key cases Salomon v Salomon (1897) Separate Legal Entity principle p157 Lee v Lees Air Farming (1961) p158 The effects of incorporation Separate legal entity Veil of incorporation Powers granted upon incorporation s 124(1) Functions of body corporate Can sue and be sued Perpetual succession Power to deal with property : s124(1)(d) (f) Source: Butterworths, Corporations Law Tutorial Series,2001, p30 Powers of an individual Limited liability: s516 Corporate Veil Company separate from participants ‘veil of incorporation; Court can lift corporate veil despite Salomon; - Common law - Statute Existing Legal Duty eg ‘sole’ or ‘dominant’ purpose of doing something which one of participants is prevented from doing personally ◦ Gilford Motor Co Ltd Veil pierced - obligations imposed on individual now imposed on company Perpetual Succession Company continues regardless of changes in membership; Demise of original members etc; Until deregistered Types of Companies Corporations Companies registered under the Corporations Act Public companies Other corporations (eg incorporated associations, statutory corporations) Proprietary companies Limited by shares Limited by shares Limited by guarantee Unlimited with share capital Unlimited with share capital No liability Source: Hanrahan, Ramsay & Stapledon, Commercial Applications of Company Law, 2007, p64 Classes of Company (nature of liability) S112: Limited by shares Limited by guarantee Unlimited No liability Amount, if any, unpaid on shares Agreed to contribute on winding up No limited on liability No liability to contribute even if shares only partly paid Public v Private Company Public (sec 9) - eg BHP Billiton Shares to public 1 member minimum (no max) 3 directors, 2 to reside in Australia Listed on ASX Publishes financial statements – public accountability Obligations imposed by Corporations Act Public v Private cont. Private (sec 9 and 13) - Propriety (Pty) – family members/friends - Not a ‘no liability’ company - By Constitution or Replaceable Rules: - Option to restrict right to transfer shares; - Min 1 member, max 50 - Cannot offer or invite members of public to subscribe for shares or debentures - Must contain ‘Pty’; - At least 1 director resident of Australia Small & Large Pty Co (Sec 45A) Small Pty Co:- Sec 45A(2) - If 2 out of 3 satisfied Consolidated gross operating revenue for financial year of company and entities it controls is < $10 million*; Value of consolidated gross assets at end of fin year < $5 million*; Company and entities it controls have fewer than 50 employees at end of fin year *calculated as per accounting standards (Sec 45A(6)) Small Pty - Advantages No obligation under Corporations Act to prepare annual accounts (although necessary for tax and loan applications); Need only prepare financial report and directors’ report if: - 5% voting shareholders request within 12 months after end of financial year; - ASIC order Advantages/Disadvantages +s - Separate legal entity; - Business conducted in own name; - Limited liability; -s - High compliance costs; - High establishment; DUTIES OF DIRECTORS Director regarded as fiduciary Duties of loyalty and good faith Duty to act bone fide in the interests of the company Duty to exercise powers for prop purpose Duty to exercise powers in good faith in the best interests of the corporation and for a proper purpose Duty to retain discretions Duties of care, skill and diligence Duty to act bone fide in the interests of the company Duty not to make improper use of information or position for advantage or cause detriment: ss 182 and 183 Source: Butterworths, Corporations Law Tutorial Series,2001, p137 Duty to exercise the degree of care and diligence that a reasonable person would if they were a director or officer s 180(1) Directors not liable under s180 if they make the judgment in good faith for a proper purpose, do not have material interest, reasonably inform themselves and rationally believe it to be in the best interests of the company: s180(2) Shareholders Part owner of company (Proprietary v public company); Different types (classes) of shares, different voting rights; Dividend out of profits only; Can sue in the name of the company Questions What type of companies are the following: - ABC Ltd - ABC Pty Ltd - ABC NL List the differences between a company limited by shares and a company limited by guarantee What kind of company can comprise a single member and be operated by a single director? Do small propriety companies have to lodge their accounts with ASIC? Do public companies have to lodge their accounts with ASIC? Principal and Agency Law Principal and Agent Relationship where one person is appointed to act as the representative of the other. Agency = the relationship which exists between two parties whereby one party, the principal, authorizes another party, the agent, to do on their behalf acts which will bring the principal into legal relations with a third party. Contracts Involved Two contracts involved - one creating the agency, the internal relationship, - second where the agent contracts on behalf of the principal with a third party, the external relationship. AGENCY DISTINGUISHED from other RELATIONSHIPS Employer –employee relationships ◦ Employees usually lack the authority to make contracts on behalf of their employers. ◦ No liability to third party (doctrine of vicarious liability) ◦ the employment contract may specifically grant contractual agency to an employee. Independent contractor ◦ hired by a client to perform specific work. ◦ client has little control as to how the work is carried out; ◦ less likely to be a contractual agent than an employee, although there are exceptions. TYPES OF AGENTS Special agent General agent Universal agent (power of attorney) CAPACITY OF THE AGENT An agent has the contractual capacity of the principal due to the delegation of contractual capacity by the principal to the agent. 2 Cases Minor as principal Adult as principal CREATION OF AGENCY Expressly created agency Deed (contract under seal) - POA In writing (simple contract) Verbally Impliedly created agency Agency by necessity By ratification By estoppel By position or status EXTENT of AGENT’S AUTHORITY Actual AUTHORITY Express (verbal or writing) (eg sell land) Implied (eg to negotiate) Apparent Caselaw Polkinghorne v Holland Panorama Developments v Fidelis (5th ed p229) (6th ed p238) (5th ed p199) (6th ed p206) THE DUTIES OF AN AGENT TO THEIR PRINCIPAL Duty to follow the principal’s lawful and reasonable instructions Duty to act personally Duty to act in the principal’s best interests Duty to exercise reasonable care, skill and diligence Duty to keep proper accounts of all money and property received on behalf of the principal Continued… Duty to keep all money and property of the principal separate from that of the agent Duty of confidentiality Duty not to make a secret profit RIGHTS OF AGENTS Right to remuneration – to be paid as agreed Right to indemnity and reimbursement Right to a lien over the principal’s property in the agent’s possession until the agent’s remuneration and expenses are paid Right to redirect the goods in order to possess and retain them AGENT’S LIABILITY TO THE PRINCIPAL The agent will only be responsible to the principal if the agent does not comply with the principal’s instructions, or breaches a duty owed, in which circumstances, they will be responsible for any loss. AGENT’S LIABILITY TO A THIRD PARTY A third party who wishes to take legal action over a contract that was arranged by an agent usually only has rights against the principal. The principal and not the agent will be liable to a third party for any torts committed by the agent whilst acting within the scope of their actual or apparent authority, even if the principal gained no benefit from the agent’s conduct. However, an agent may be responsible to a third party in the following situations: Liability of Agent The principal is disclosed and named but special factors make the agent liable ◦ the named principal does not exist ◦ the agent agreed to be liable ◦ it is standard practice in a trade or industry that an agent becomes liable ◦ the agent executed a deed or bill of exchange in their own name instead of that of the principal ◦ the agent acts outside actual or apparent authority (breach of warranty of authority) Disclosure & Liability of Agent Existence but not name of the principal is disclosed ◦ No liability except when: agent acts outside actual authority agent specifically agrees to be liable Existence of principal not disclosed ◦ third party can choose whether they sue the agent or the principal, usually based on who will be more able to pay any judgment sum. ◦ A third party who obtains a judgment against one party, loses all rights against the other. Breach of warranty of authority ◦ This action may exist where the agent has falsely claimed to have authority they do not in truth possess ◦ Thus, warranty of authority will be breached if the agent; falsely claims to be acting with the principal’s authority – the claim may be made directly or indirectly, fraudulently or innocently; the claim of authority induced the third party to enter into the subject contract with the principal; the third party was not aware of the lack of authority; and the third party suffered loss. Liability – Consumer Protection The agent’s possible liability under consumer protection legislation TPA – e.g. misleading and deceptive conduct TERMINATION OF AGENCY Performance of the agency contract as agreed Mutual agreement Revocation of the agent’s authority Renouncement of authority by the agent Acceptance of secret commission TERMINATION OF AGENCY Continued. By operation of law ◦ lapse of a set time period for the life of the agency ◦ death, bankruptcy or insanity of the agent or principal ◦ frustration of the contract ◦ object of the contract becomes illegal REMEDIES OF A PRINCIPAL If breach by agent:- rescission of the agency agreement; refusal to pay commission; damages; recovery of secret commission; and/ or criminal charges laid for accepting a secret commission TYPES of COMMERCIAL AGENTS ‘Factors’ or mercantile agents ◦ eg: sells on consignment Del Credere agents ◦ Higher commission but guarantees payment upon sale of goods (eg: livestock selling agents) Real estate agents Partners Brokers Lecture 3 Torts and Negligence 81 Torts Civil Wrong Protects against infringement of rights against A person Property Reputation Not necessary that tortfeasor to have intended to cause harm. Torts Trespass Nuisance Negligence Occupiers Liability Defamation Trespass / Nuisance Interference with quiet enjoyment / land rights Noise, waste, other discomfort to others property Negligence Duty of Care is Owed Breach of that Duty of Care Loss / Injury as a result of Breach of Duty of Care Duty of Care Good Neighbour Principle Donoghue v Stevenson Duty of Care Situations where a Duty of Care exists: Certain professional business r/ships - adviser role (principal/agent, accountant/client, solicitor/client, financial planner) Occupier of premises to entrant (occupiers liability) Manufacturer (product liability) Road Users (CTP insurance) Schools Councils Cigarette Companies Breach of Duty of Care Likelihood of injury Gravity of injury Effort required to remove the risk Social utility of defendants conduct Damage as a Result of Breach of Duty Remoteness of damage Assessment of damage Defences Contributory Negligence Voluntary Assumption of Risk Vicarious Liability Vicarious Liability Not a tort Employer responsibility for employee actions Hollis v Vabu Product Liability No direct contract between manufacturer and consumer; Manufacturer responsibility for negligence:◦ Knowledge of defect and releases product; or ◦ Inherently dangerous product with no adequate warning; ◦ DOC – breach DOC - Damages DOC principle applied to: Any person that goods could foreseeably harm; Applies to all classes of goods; Property damage + personal injury; Applies also to repairers, importers, retailers, hirers etc 5 important points:1. 2. 3. 4. 5. Intention to reach consumer in same form; Intermediate Examination; Standard of Care; Facts speak for themselves; Avoidance of liability and contributory negligence Occupiers Liability Duty to all entrants to the premises Negligent Misstatement No contractual relationship; Professional advice; DOC owed to individual seeking advice Breach of DOC; Eco loss suffered Caselaw Hedley Byrne v Heller (1964) ◦ Owed duty of care when giving advice based on reasonable foreseeability of reliance; ◦ Disclaimer on advice = not liable MLC v Evatt (1968) ◦ DOC owed when advice given in ‘serious circumstances’ ◦ Discount social occasion? Shaddock v Parramatta Council (1981) Established modern tests for negligent misstatement in Aust. Flow chart p108 Liability of auditors to third parties ◦ V & P p111 ◦ Caparo Industries Plc v Dickman [1990] ◦ No DOC owed to potential shareholders Defamation complex area of law; “…publication of a statement that tends to lower a person in the estimation of right thinking members of society generally; or that tends to make them shun or avoid that person” (Winfield and Jolowicz on Tort) Protection of reputation from comments affecting that reputation Defamatory statements Written, spoken, drawing, film, sign; ‘publication’ – communicated to others; Libel & Slander; Libel – defamation in permanent form eg film, writings etc Slander – transient form – gesture or speech; DEFAMATION ACT 2005 S7—Distinction between slander and libel abolished (1) The distinction at general law between slander and libel is abolished. (2) Accordingly, the publication of defamatory matter of any kind is actionable without proof of special damage. Elements: 1. Must be defamatory (eg injurious to reputation, third party reactions); 2. Refer to plaintiff (reasonable person would say statement about plaintiff); 3. Published; 4. Unable to rely on valid defence Defences Consent of plaintiff to publication (complete defence) Justified (substantial truth) Fair comment on matter of public interest (success only if based on true facts) Absolute privilege – made in course of parliamentary, court, solicitor/client Qualified privilege – maker of statement has, “interest or a duty, legal, social or moral to make it to the person to whom it is made, and the person to whom it is so made has a corresponding interest or duty to receive it” Lectures 4 to 7 Contracts Formation Elements Discharge Remedies for Breach 104 Formation of a contract LOGICAL Legal capacity Offer and Acceptance Genuine Consent Intention Consideration And Legality Classification Simple v Formal Simple Oral or written Must have consideration No witnesses required Formal Specific requirements to be a valid contract Contract of record Contract under Seal Do not require consideration Written Validity P71 workbook ◦ ◦ ◦ ◦ ◦ Valid Void Voidable Unenforceable Illegal 1. Intention Domestic ◦ Assumption - no legal effect ◦ Assumption can be overridden by evidence Intention Business ◦ Assumption - legal effect ◦ Assumption can be overridden by evidence Offer and Acceptance Offer ◦ ◦ ◦ Must be communicated Whom made – person, class, world. Not an invitation to treat Offer and Acceptance Offer ◦ ◦ ◦ ◦ Not a request for information May be conditional Revocation must be before acceptance May lapse Offer and Acceptance Acceptance ◦ ◦ ◦ Response and reliance on offer Unconditional and unqualified Only offeree (s) can accept Offer and Acceptance Acceptance ◦ Acceptance not able to be revoked unless have consent of offeror ◦ Must be communicated ◦ Must be communicated in manner specified in offer ◦ Made in time frame or reasonable time ◦ POSTAL RULE exceptions (V&P p290) CONSIDERATION Consideration is essential to the validity of every simple contract Consideration is the exchange of a benefit and burden by parties to a contract. Consideration is therefore the bargained for price. Consideration is something of value promised, given or foregone. CONSIDERATION Consideration may be: A promise for a promise. An act for a promise Forbearance – ie CONSIDERATION As long as consideration exists, the court is not concerned with its adequacy CONSIDERATION Consideration must not be unlawful. Consideration must be possible to perform. Consideration must not be too vague or indefinite. Legal Capacity There are certain classes of people who are considered at law to lack full capacity to contract. This may have serious consequences for the party with whom they have entered into an apparent contract. Minors Governed by both common law and statute law; Age of Majority (Reduction) Act (SA) – 18 yrs It is the responsibility of the adult party to ensure the capacity of the party with whom they are dealing. Minors – Common Law Position Valid contracts:◦ cash contracts (cash sales); ◦ contracts for necessaries; ◦ Beneficial contract of service See V & P p317 ‘necessary’ – (a) minor must not already have an adequate supply of the goods; (b) food, clothing, transportation, medical and hospital Nash v Inman and Bojczuk v Gregorcewicz Beneficial Contracts of Service Contract of service or apprenticeship ◦ Provide minor with means of livelihood; ◦ Or to acquire skills; and Benefit the minor ◦ Court assesses all terms of contract; ◦ De Francesco v Barnum (1890) 45 Ch D 430 Voidable Contracts Permanent/continuous contracts:◦ eg: lease of land; ◦ Purchase of shares; ◦ Partnership; Regarded initially as valid and binding; Can be repudiated (rejected) any time prior to 18 or ‘reasonable time’ after 18 Void Contracts Contracts for:◦ purchase of non necessary items; ◦ ‘trading’ contracts (eg hire purchase) Minor simply not bound unless ratification (adopts) within ‘reasonable time’ Insanity and Intoxication Contract voidable when person can show that she or he did not understand what they were doing as a consequence of their condition; and the other party was aware of that condition; and they withdraw from the contract within a reasonable time of their regaining their sanity or sobriety. Bankruptcy A declaration of bankruptcy does not deprive a person of their capacity to enter into contracts. Bankruptcy Act 1966 (Cmth) provides that a bankrupt: ◦ must disclose their bankruptcy if – ◦ business is carried on in other than the bankrupt’s name or ◦ credit in excess of $3360 is sought. Corporations Corporations are separate legal persons. It can sue, be sued and own property but cannot enter a contract for personal service. Hostile Aliens An alien is any person who is not an Australian citizen ‘Friendly’ aliens – no restrictions on contractual capacity Hostile aliens – eg: war time – cannot enter into contract or exercise rights/remedies Reality of Consent Genuine consent - all parties to the contract honestly and genuinely agree to the terms of the contract. ‘Meeting of minds’. Absence of genuine consent due to: ◦ ◦ ◦ ◦ ◦ ◦ Mistake of fact; Non est factum; Fraudulent/innocent misrepresentation; Undue influence; Duress; Unconscionable conduct Genuine Consent Mistake of fact a) Common Mistake - both parties make same mistake b) Mutual Mistake - both parties make different mistake c) Unilateral Mistake - one party makes mistake of fact, other party knows/ought ‘reasonably’ to have known - does not inform other party Non est factum ‘Not my deed’ – eg: mistake regarding nature of document (guarantee v mortgage) Arguable if: document fundamentally different unable to read owing to blindness or illiteracy must not have been careless or negligent in signing the document. Misrepresentation - Statement of fact (not opinion) fraudulent (deliberate) misrepresentation innocent misrepresentation, and negligent misrepresentation. Statement of fact prior to contract categorised as: Term (ends up in contract) Innocent Fraudulent Negligent Misrepresentation (statement of fact which is untrue) Not known to be false Intention other party relies No intent to deceive Contract entered Damage suffered Known to be false Intention other party relies Intent to deceive Contract entered Damage suffered False statement of fact/advice/opinion person claiming skill/expertise Contract entered Damage suffered Distinguish from statement of law Opinion Puff Remedy: 1) rescission; 2) Damages (Misrep Act) Remedy: 1)rescission; 2)Damages (tort of deceit) Remedy: 1) rescission; 2) Damages (tortious action) Duress Physical duress Duress to goods Economic duress Undue Influence Legally recognised relationship exists ◦ ◦ ◦ ◦ ◦ ◦ parent and child, trustee and beneficiary, doctor and patient, solicitor and client, guardian and ward and priest and followers Position of dominance Presumption of undue influence Rebuttable by evidence proving plaintiff understood and entered voluntarily If no, then voidable at option of innocent party Unconscionable Conduct party in a superior bargaining position has gained an unfair advantage Commercial Bank of Australia v Amadio LEGALITY OF OBJECT The object of the contract must be legal to support a valid and enforceable contract. Illegal under CL: - To commit tort, crime or fraud on third party eg agreement to have someone assaulted; - Contracts to defraud revenue; - Restraint of trade – eg employment, sale of business or contract to regulate trade; - Restraints of trade are prima facie void as being contrary to public policy; however - Restraints perceived as being reasonable may be enforced - (‘reasonable’ – facts of case but no more than is necessary to promote legitimate interests) Illegal under statute In restraint of trade barred by TPA; To pay secret commissions; Various contracts which require licences if have not been obtained Contracts in restraint of trade Employment Sale of business CONTENTS OF CONTRACT A condition is a term of fundamental and vital importance Breach = damages & right to rescind (treat as never existed) A warranty is a term of less importance Breach = damages but no right of rescission Luna Park (NSW) Ltd V Tramways Advertising Pty Ltd Parol Evidence Rule Usually, statements not included in contract will be representations; Parol Evidence = verbal statements will not be taken into account where effect is to vary, add or contradict written agreement; However, exceptions:◦ Custom and usage; ◦ Where evidence that written agreement only contains part of the agreement; ◦ Statement amounted to separate contract made prior to written one; ◦ Statement clarifies or correct ambiguous language within written contract; ◦ Where true intentions of parties not expressed in written contract Implied terms Implied by the court Implied by statute ◦ eg: TPA – fitness for purpose Implied by custom or trade usage ◦ established practice Exclusion clauses Usually written clauses stating a party will bear no responsibility for something which happens; ◦ Eg gym not responsible for injury to members; ◦ Car park not responsible for loss or damage to cars Validity – need to be included in contract - Eg clause; or - Signs posted with exclusion before contract is made Car park ticket – exclusion for liability before taking ticket (as when contract formed) NB Trader cannot contract out of statutory obligations Typical Exclusion Clauses The Trade Practices Act 1974 All other conditions and warranties, statutory or otherwise and whether express or implied, are hereby excluded, and no guarantee, other than that expressly herein contained, applies to the product to which the guarantee relates, or any accessory or part thereof. Conditions and warranties implied and the rights and remedies created by the Trade Practices Act 1974 (Cth), [s.68A] cannot be excluded. Any attempt to do so is made void by the terms of the Act, and makes the company liable to prosecution under the Act. The company accepts no responsibility for loss or damage through any cause whatsoever. Under Section 74, contracts for the supply of services to consumers contain an implied warranty that the services will be rendered with due care and skill. This warranty cannot be excluded, so the clause is void. We exchange goods or give credit but do not refund money. If a company supplies goods directly to consumers, those consumers have a nonexcludable right under the Section 75A to return the goods and obtain a refund where there has been a breach of a condition implied by the Act. Service will not be available under this warranty unless the form below is completed and returned to the registered office of the company within fourteen days from the date of purchase. Under Section 68, failure to return the registration card does not extinguish a consumer's statutory rights. New products are covered by this warranty for a period of 12 months. Consumer's rights under Section 71 extend beyond the stated warranty period and may be exercised if there are, for example, inherent defects which appear after the expiration of that period. CONCLUSION or DISCHARGE of a CONTRACT by performance by agreement by frustration by operation of law by breach Remedies for breach Breach of Condition: 1. Damages – monetary compensation if breach and loss/damage occurred; - Put party back into position if not for breach; - Mitigation issues; - Liquidated, unliquidated, nominal; AND 2. Rescission – injured party elect to affirm or rescind (no longer bound by contract) Breach of Warranty: Damages only, not right of rescission. Remedies cont….. Injunction ◦ Prohibitory or mandatory - Equitable – only granted if damages inadequate Specific Performance - Equitable – only if damages inadequate - Not granted if causes hardship Lecture 8 Property Law Case Study Assignment Real Property Mortgages Leases Franchises Insurance 149 Property Physical things you can own, such as land or furniture and the rights you can exercise over physical and non-physical things Real Property Real property refers to land and anything which is fixed or attached to the land Those items which have become fixed to the land are referred to as fixtures Personal Property Personal property may also be referred to as chattels leases over land (chattels real) tangible objects such as cars, books and furniture (choses in possession) intangible things, such as shares in a company or intellectual property rights (choses in action) Fixtures or Non-Fixtures For what purpose has the item been attached? In what manner is the item attached? What damage if any will be caused by the removal of the item? Ownership and Possession Ownership = title over that property ◦ transfer ownership or possession Possession = physical control ◦ intention to assert exclusive control over the property Interests in Land Doctrine of Tenure No person can be the absolute owner of the land because all land is owned by the Crown Instead, land owners have an estate in the land Estates in land An estate in land describes the type of interest a person has in real property Freehold estates - Fee simple – continues as long as heir; - may be transferred during owner’s lifetime; or - devised after death as per will - Life estate - interest in land created only for life of particular person Leasehold Estates A lease gives the lessee exclusive possession of real property for a fixed period in exchange for rent. Fixed term – eg 1 year lease (in SA has to be in writing); Periodic – eg weekly, monthly (can be after fixed term); Tenancy at will – Tenant remains in possession by agreement but no rent paid. Either party to terminate at any time; Tenancy at Sufferance – After expiration of tenancy, tenant remains in possession without landlord permission and without paying rent Title to Land Old System Title - Proved by ‘paper trail’ of documents; - Possibility of fraud, or document missing or failure to register mortgage; - System flawed – difficult to prove ownership Torrens Title 1858 – SA – Robert Torrens; Certificate of Title – original CT – LTO, duplicate with owner/ mortgagee; Registration of every dealing; State Govt - guarantee of owner shown on title – ‘indefeasibility of title’ – therefore, not necessary to show paper chain. Priority – registered over unregistered even at later date Legal and equitable interests in land Legal mortgage = eg registered mortgage; ◦ Subsequent registered mortgages ‘queue’ behind on default; ◦ If default - priority on registration Equitable mortgage = unregistered mortgage; ◦ Protection via caveat; ◦ If default – priority on creation ◦ Caveat protection may be lost if reasonable notice of earlier mortgage Joint Ownership of Property Joint tenants right of survivorship four unities (possession, interest, title and time) Tenants in common Mortgages Over Real Property “a contract whereby one person (the mortgagor) borrows money from another and gives rights over real property to the lender (mortgagee) as security for the repayment of the loan” Torrens System Mortgage The mortgagor retains the registered title to the property. The mortgagee receives a statutory charge or right to payment over the property. Mortgagee’s Remedies The power to sue for breach of contract The power to appoint a receiver The power of sale The power to seek an order for disclosure Torrens System Mortgage Mortgagor’s rights ◦ to sell or lease property Equitable mortgages ◦ unregistered mortgage; ◦ Protection needed against subsequent registered mortgage; ◦ Unregistered Mortgagee needs to lodge caveat. Priorities – Unregistered Mortgages Date of execution Priority 14 July 2006 1st 14 December 2006 2nd Priorities – Registered Mortgages Date executed 21 May 2006 Date Priority Registered 21 June 2006 2 1 June 2006 1 June 2006 1 Specialty Contracts LEASES A contract in which an owner of property (the lessor) grants another person (the lessee) the right to exclusive possession of the property for a specific period of time in return for consideration Lease v Licence Lease – one party (landlord) grants exclusive possession to other party (tenant) for amount of time; Interest created and therefore registrable; Licence - gives a person permission to use the land but does not grant exclusive possession (eg to drive across) No interest in land created, therefore not registrable on title Types of Leases Fixed Term Tenancy - amount of time; Periodic Tenancy – eg week to week Tenancy at Will – no fixed duration, not paying rent, consent of landlord Tenancy at Sufferance – not paying rent, no LL consent Lease Covenants Tenant’s covenants under common law ◦ ◦ ◦ ◦ ◦ ◦ To pay the agreed rent. To keep and deliver up the premises to the landlord at the end of the term in their ‘state of repair’ at the commencement of the lease. To permit the landlord to enter and inspect the premises, (usually reasonable notice is required). To refrain from conducting any illegal activity on the premises. To refrain from subletting or assigning the lease without the prior consent of the landlord. To pay rates and taxes if the lease is commercial. Lease Covenants Landlord’s covenants ◦ ◦ ◦ ◦ To allow the tenant quiet possession of the premises. To refrain from conduct which would render the premises unfit for their purpose. To repair the premises. To pay rates and taxes if the lease is residential. Termination of a Lease under Common Law By expiry of time By breach of a covenant By surrender – LL agrees to release tenant By frustration - cont. impossible due to unforeseen event By a notice to quit ◦ the length of the notice must be commensurate to the length of the tenancy (ie 1 yr = 6 months) By forfeiture – tenant loss of right due to breach of condition Residential Tenancies Residential Tenancies Act 1978 which varies the common law rights and obligations of landlords and tenants. Refer to Notes (p130) Commercial Tenancies premises predominantly used for carrying on business; (if not retail tenancy), tenancy regulated by common law, lease agreement and possible statutes (implying conditions); Differences between commercial and residential: ◦ Commercial - all or proportion of rates and taxes paid by tenant; ◦ Regular rent increases permitted – CPI; Retail Tenancy If lease for premises from which retail business operates then Retail Shop Leases Act (SA) 1995; Retail premises = ‘wholly or predominantly for the carrying on of a business involving the hire or sale of goods or services’ (Barron p 311); ◦ Tenants to be given copy of lease otherwise can terminate; ◦ If landlord fails to rectify a plant/equipment failure, then landlord has to compensate tenant; ◦ Landlord must give tenant 3 months notice before the term of the lease is due to expire if lease is not to be extended by way of an option for the tenant to renew the lease; Hire Purchase Agreements The key element is that ownership in the goods does not pass to the hirer until the final payment on the agreement has been made. Franchise Agreements A contract made between the franchisor and the franchisee. The franchisor is the supplier of a product or service, or an owner of a copyright or trademark and the franchisee is the reseller of that property, wishing to do business under the franchisor’s name. Types of Franchise Product – eg: Wendys (Ice creams) System franchise – Jim’s Mowing Process or manufacturing franchise Regulation of Franchises Agreement to contain terms re: the key intellectual property involved, rights and obligations of each party; franchisor’s degree of control over marketing, equipment and fixtures; duration of the agreement and its geographical location; rights of a franchisor to inspect the accounts of the franchisee; the conditions of termination. Franchising Regulation cont. Trade Practices (Industry Codes – Franchising) Regulations 1998, forming part of the Trade Practices Act. Refer to notes (p133) Franchising Policy Council INSURANCE The insurer agrees to compensate or indemnify the insured for any loss or damage suffered on the happening of a certain event. Cover notes Common law doctrines of insurance insurable interest utmost good faith indemnity subrogation proximate cause Insurable Interest A person will have such an interest if they will benefit from the property being preserved and suffer detriment if the property is damaged or destroyed. Utmost Good Faith Owed by insured to insurer & vice versa; Insured required to:- disclose all material facts; and - make truthful representation about material facts; Common Law remedies If breach of good faith fraudulent – insurer avoid contract and refuse claim payment; If innocent – payout reduced When does duty arise? During negotiations; Prior to renewal, extension, variation or restatement of contract; During policy lifetime Duty of disclosure Applies to insured and insurer; Material fact = relevant fact ; - Number and value of previous claims; - Rejected claims; - Previous refusals to cover; - Criminal records Breach of duty If insured fails to disclose a fact that they know, or reasonably should know, is material (relevant); What facts do not have to be disclosed? S21(2) – Insurance Contracts Act 1984 - Less the risk eg fire extinguishers; - Commonly known eg Darwin subject to cyclones; - Insurer knows or ought to know – eg assessor inspected premises prior to accepting policy; Breach by agent of insured Non disclosure of material facts by agent = same as if insured breached eg: Lindsay v CIC Insurance Ltd Insurer’s Obligations To be prompt in admitting liability and paying claims. To inform the insured in writing and in plain English about the general nature and effect of the duty of disclosure before the contract is made. To provide consumers with notices about their rights at pre-sale, point of sale and post sale. To allow consumers a 14 day cooling off period before formally entering a contract of insurance. To avoid unconscionable conduct. The TPA provides remedies in this regard Indemnity The purpose of an indemnity policy is to restore the insured to the position they occupied prior to the actual loss specified in the policy Subrogation Subrogation is the substitution of one person or thing for another The same rights and duties attached to the original person or thing attach to the substituted person or thing. One person ‘stands in another’s shoes’ ◦ eg: insurer pays claims in full; ◦ Right to take over legal rights of insured in regard to loss; ◦ Right to sue in insured’s name to recover loss from third party Proximate cause The proximate cause is the initial cause of loss which may lead to a chain of events. In order to claim on an insurance policy, the claimant must be insured for the initial cause. eg: riot – fire – house – not proximate cause Insurance Agents / Brokers Insurance Agents - Act for insurer (principal) ◦ Paid by commission deducted from premiums ◦ Duties of Agents ◦ Liabilities of Agents Insurance Brokers ◦ ◦ Act for those seeking insurance Receive % of client’s premium from insurer Duties of a Broker Liabilities of a Broker Property insurance Fire and extraneous risks Loss of profits Burglary Theft Fidelity guarantee Cash in transit Engineering Multi-risks Liability insurance Public Liability Product Liability Professional Indemnity Motor vehicle insurance Compulsory Third Party Property Damage(Comprehensive) Third Party Property Other Insurance Types Life insurance Accident and sickness insurance