Chapter 4 More Interest Formulas

advertisement

Chapter 4

More Interest Formulas

EGN 3615

ENGINEERING ECONOMICS

WITH SOCIAL AND GLOBAL

IMPLICATIONS

1

Chapter Contents

Uniform Series Compound Interest Formulas

Uniform Series Compound Amount Factor

Uniform Series Sinking Fund Factor

Uniform Series Capital Recovery Factor

Uniform Series Present Worth Factor

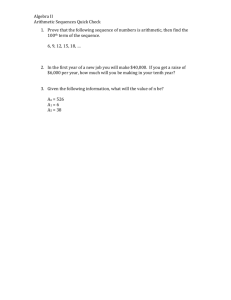

Arithmetic Gradient

Geometric Gradient

Nominal Effective Interest

Continuous Compounding

2

Uniform Series Compound Amount Factor

0

A

A

A

A

1

2

3

4

A

0

1

0

1

1

0

1

2

3

4

F1

2

3

A

0

F1+F2+F3+F4 =F

2

2

4

F1 A (1 i)3

F2

3

4

A

F3

3

4

F2 A (1 i)

2

F3 A (1 i )

A=F4

0

1

2

3

4

F4 A

3

Uniform Series Compound Amount Factor

That is, for 4 periods,

F = F1 + F2 + F 3 + F4

= A(1+i)3 + A(1+i)2 + A(1+i) + A

= A[(1+i)3 + (1+i)2 + (1+i) + 1]

4

Uniform Series Compound Amount Factor

For n periods with interest (per period),

0

A

A

A

A

A

1

2

3

4

n-1

F

A

n

F = F1 + F2 + F3 + … + Fn-1 + Fn

= A(1+i)n-1 + A(1+i)n-2 + A(1+i)n-3 + … + A(1+i) + A

= A[(1+i)n-1 + (1+i)n-1 + (1+i)n-3 + …+ (1+i) + 1]

5

Uniform Series Compound Amount Factor

(1 i) n 1

F A

A ( F / A, i, n)

i

Notation

Uniform Series

Compound Amount Factor

i = interest rate per period

n = total # of periods

6

Uniform Series Formulas (Compare to slide 25)

(1) Uniform series compound amount: Given A, i, & n, find F

F = A{[(1+i)n – 1]/i} = A(F/A, i, n)

(4-4)

(2) Uniform series sinking fund: Given F, i, & n, find A

A = F{i/[(1+i)n – 1]} = F(A/F, i, n)

(4-5)

(3) Given F, A, & i, find n

n = log(1+Fi/A)/log(1+i)

(4) Given F, A, & n, find i

There is no closed form formula to use.

But rate(nper, pmt, pv, fv, type, guess)

7

Uniform Series Compound Amount Factor

Question: If starting at EOY1, five annual deposits of $100 each are

made in the bank account, how much money will be in the account

at EOY5, if interest rate is 5% per year?

F= 552.6

i=0.05

0

1

2

3

4

5

$100 $100 $100 $100 $100

(1 i) n 1

(1 0.05)5 1

F A

100

100(5.526)

i

0.05

8

QUESTION CONTINUES (USING INTEREST TABLE)

F= 552.6

i=0.05

0

1

2

3

4

5

$100 $100 $100 $100 $100

(1 i) n 1

F A

A ( F / A, i%, n) 100 (5.526)

i

9

QUESTION CONTINUES(SPREADSHEET)

A= ($100)

i=

5%

n=

5

$552.6

Go to XL

--Chap 4 extended examples-A1

Use function: FV(rate, nper, pmt, pv, type)

10

Uniform Series Compound Amount Factor

Question: Five annual deposits of $100 each are made into an

account starting today. If interest rate is 5%, how much money

will be in the account at EOY5?

F1

F2= 580.2

4

5

i=5%

0

1

2

3

$100 $100 $100 $100 $100

(1 i ) n 1

(1 0.05) 5 1

F1 A

100

100 (5.526) 552.6

i

0.05

F2 F1 (1 i ) n 552.6 (1 0.05)1

11

QUESTION CONTINUES(INTEREST TABLE)

F1

F2= 580.2

4

5

i=5%

0

1

2

3

$100 $100 $100 $100 $100

(1 i) n 1

F1 A

A ( F / A, i%, n)

i

A ( F / A, 5%, 5)

100 (5.526) 552.6

F2 F1 ( F / P, 5%, 1) 552.6 (1.050)

12

QUESTION CONTINUES(SPREADSHEET)

A= ($100)

i=

5%

n=

5

$552.6

$580.2

13

Uniform Series Compound Amount Factor

Question: If starting at EOY1, five annual deposits of $100 each are

made in the bank account, how much money will be in the account

at EOY5, if interest rate is 6.5% per year?

F= ?

i=6.5%

0

1

2

3

4

5

$100 $100 $100 $100 $100

( F / A,6.5%,5) ?

( F / A,6%,5) 5.6371

( F / A,7%,5) 5.7507

14

INTERPOLATION

6.0

0.5

1

6.5

( F / A,6%,5) 5.6371

( F / A,7%,5) 5.7507

5.6371

X

0.1136

7.0

5.7507

0.5

X

1

0.1136

X 0.0568

(F/A, 6.5%, 5) 5.6371 0.0568 5.6939

F 100(F/A, 6.5%, 5) 100 (5.6939) 569.39

Interpolation

15

Uniform Series Sinking Fund Factor

F=Given

i=Given

0

1

2

3

4

5

n=Given

A=?

A= Equal Annual Dollar Payments

F= Future Some of Money

i = Interest Rate Per Period

n= Number of Interest Periods

16

Uniform Series Sinking Fund Factor

i

AF

F (A / F , i%, n)

n

(1 i) 1

Uniform Series

Sinking Fund

Factor

Notation

17

Uniform Series Sinking Fund Factor

Question: A family wishes to have $12,000 in a bank account

by the EOY 5. to accomplish this goal, five annual deposits

starting at the EOF year 1 are to be made into a bank account

paying 6% interest. what annual deposit must be made to

reach the stated goal?

F=$12,000

i=5%

0

1

2

3

4

5

n=5

A =$2172

i

0.05

AF

12,000

12,000 (0.1810)

n

5

(1 i) 1

(1 0.05) 1

18

QUESTION CONTINUES(INTEREST TABLE)

F=$12,000

i=5%

0

1

2

3

4

5

n=5

A = $2172

i

AF

F ( A/F, i%, n)

n

(1 i ) 1

F ( A/F, 5%, 5)

12,000 (0.1810)

19

Uniform Series Sinking Fund Factor

Question: A family wishes to have $12,000 in a bank account by the

EOY 5. to accomplish this goal, six annual deposits starting today

are to be made into a bank account paying 5% interest. What

annual deposit must be made to reach the stated goal?

F=$12,000

i=5%

0

1

2

3

4

5

n=6

A = $1764

i

0.05

AF

12,000

12,000 (0.1470)

n

6

(1 i) 1

(1 0.05) 1

20

$1764

QUESTION CONTINUES(INTEREST TABLE)

F=$12,000

i=5%

0

1

2

3

4

5

n=6

A = $1764

i

AF

F ( A/F, i%, n)

n

(1 i ) 1

F ( A/F, 5%, 6)

12,000 (0.1470)

21

Uniform Series Sinking Fund Factor

Example: the current balance of a bank account is $2,500. starting

EOY 1 six equal annual deposits are to be made into the account.

The goal is to have a balance of $9000 by the EOY 6. if interest rate

is 6%, what annual deposit must be made to reach the stated goal?

F=$9000

i=6%

0

P=$2,500

1

2

3

4

5

6

A = $796.23

FPvalue 2,500 (F/P, 6%, 6) 2,500 (1.419) 3547.50

FTotal 9000 3547.50

A 5452.50 (A/F, 6%, 6)

A 5452.50 (0.1434)

5452.50

22

Uniform Series Capital Recovery Factor

P=Given

i=Given

0

1

2

3

4

5

n

A=?

P= Present Sum of Money

A= Equal Annual Dollar Payments

i = Interest Rate

n= Number of Interest Periods

23

Uniform Series Capital Recovery Factor

i

i

n

AF

P(1 i )

n

n

(1 i ) 1

(1 i ) 1

i (1 i ) n

AP

P (A / P, i %, n)

n

(1 i ) 1

Uniform Series

Capital

Recovery Factor

Notation

24

Uniform Series Formulas (Compare to slide 7)

(1) Uniform series present worth: Given A, i, & n, find P

P = A{[(1+i)n – 1]/[i(1+i)n]} = A(P/A, i, n)

(4-7)

(2) Uniform series capital recovery: Given P, i, & n, find A

A = P{[i(1+i)n]/[(1+i)n – 1]} = P(A/P, i, n)

(4-6)

(3) Given P, A, & i, find n

n = log[A/(A-Pi)]/log(1+i)

(4) Given P, A, & n, find i (interest/period)

There is no closed form formula to use.

But rate(nper, pmt, pv, fv, type, guess)

25

Uniform Series Capital Recovery Factor

Example: A person borrows $100,000 from a commercial bank. The

loan is to be repaid with five equal annual payments. If interest rate

is 10%, what should the annual payments be?

P= $100,000

i=10%

0

1

2

3

4

5

A =26,380

i(1 i ) n

0.1(1 0.1)5

AP

100,000

n

5

(1 i) 1

(1 0.1) 1

100,000 (0.2638)

26

Example CONTINUES(INTEREST TABLE)

P= $100,000

i=10%

0

1

2

3

4

5

A =26,380

A P ( A/P, i%, n)

100,000 ( A/P, 10%, 5)

100,000 (0.2638)

27

Uniform Series Capital Recovery (MS EXCEL)

Use function: PMT(rate, nper, pv, fv, type)

rate = interest rate/period

nper = # of periods

pv = present worth

fv = balance at end of period n (blank means 0).

type = 1 (payment at beginning of each period) or

0 (payment at end of a period)(blank means 0)

See spreadsheet

28

Uniform Series Capital Recovery Factor

Example: At age 30, a person begins putting $2,500 a

year into account paying 10% interest. The last deposit

is made on the man’s 54th birthday (25 deposits).

Starting at age 55, 15 equal annual withdrawals are

made. How much should each withdrawal be?

Solution

Step 1: First A will be converted into F.

Step2: F will be considered as P.

Step3: P will be converted into Second A

29

EXAMPLE CONTINUES

F = 245,868

i=10%

0

1

2

3

21

22

23

24

A=$2500

F 2500 ( F/A, 10%, 25) 2500 (98.347)

i=10%

0

1

2

3

12

13

14

15

A =$32,332

P= $245,868

A 245,868 ( A/P, 10%, 15) 245,868 (0.1315)

30

Uniform Series Present Worth Factor

A=Given

0

1

2

3

4

5

n=Given

i=Given

P=?

A= Equal Annual Dollar Payments

P= Present Sum of Money (at Time 0)

i = Interest Rate/Period

n= Number of Interest Periods

31

Uniform Series Present Worth Factor

(1 i) n 1

PA

A ( P / A, i, n)

n

i(1 i)

Uniform Series

Present Worth

Factor

Notation

32

Uniform Series Present Worth Factor

Example: A special bank account is to be set up. Each year, starting

at EOY 1, a $26,380 withdrawal is to be made. After five withdrawals

the account is to be depleted. if interest rate is 10%, how much

money should be deposited today?

A=26,380

0

1

2

3

4

5

i=10%

P= 100,001

(1 i) n 1

(1 0.1)5 1

PA

26,380

26,380(3.791)

n

5

i(1 i)

0.1(1 0.1)

33

EXAMPLE CONTINUES (USING INTEREST TABLE)

A=26,380

0

1

2

3

4

5

i=10%

P= 100,001

P A ( P/A, i%, n)

26,380 ( P/A, 10%, 5)

26,380 (3.791)

34

Uniform Series Present Worth (Using MS EXCEL)

Use function: PV(rate, nper, pmt, fv, type)

rate = interest rate/period

nper = total # of periods (payments)

pmt = constant payment/period

fv = balance at end of period n (blank means 0)

type = 1 or 0

PV(0.1, 5, -26380) = $100,000.95

See spreadsheet

35

Uniform Series Present Worth Factor

Example: Eight annual deposits of $500 each are made into a

bank account beginning today. Up to EOY 4, the interest rate

is 5%. After that, the interest rate is 8%. What is the present

worth of these deposits?

PTotal ?

i=8%

i=5%

0

P3

1

2

P2

3

A=500

4

5

6

7

P1

36

EXAMPLE CONTINUES

PTotal

i=8%

i=5%

0

1

2

3

4

5

6

7

A=500

P1

P2

P2 500(P/A, 5%, 4)

P1 500 (P/A, 8%, 3)

500(3.546) 1773

(P/F, 5%, 4)

500(2.577)(0.8227)

P1 P2 P3 3333.05

1060.05

P3

P3 500

PTotal

37

EXAMPLE CONTINUES (Using MS EXCEL)

P1 = PV(0.08, 3, -500)(1+0.05)–4

= (1288.55)(0.8227)

= $1,060.09

P2 = PV(0.05, 4, -500)

= $1,772.98

PTotal P1 P2 P3 $3,333.07

38

Arithmetic Gradient

Arithmetic Gradient series (G): each annual amount differs

from the previous one by a fixed amount G.

A+3G

A+G

A+4G

A+2G

A

0

1

2

3

4

P A ( P / A, i, n)

G ( P / G , i, n)

5

=

0

A

A

A

A

A

1

2

3

4

5

3G

4G

4

5

+

G

2G

0

0

1

2

3

39

Arithmetic Gradient Present Worth Factor

Given G, i, & n, find P

(4-19)

(1 i) n in 1

PG 2

G ( P / G, i%, n)

n

i (1 i)

Notation

Arithmetic Gradient

Present Worth Factor

40

Arithmetic Gradient Present Worth Factor

Question: You has purchased a new car. the following maintenance

costs starting at EOY 2 will occur to pay the maintenance of your car

for the 5 years. EOY2 $30, EOY3 $60, EOY4 $90, EOY5 $120. If

interest rate is 5%, how much money you should deposit into a

bank account today?

$120

$30

$60 $90

0

0

1

2

3

4

5

i=5%

G=$30

P= $247.11

(1 i) n in 1

(1 0.05)5 0.05(5) 1

PG 2

30

30(8.237)

n

2

5

i (1 i)

0.05 (1 0.05)

41

QUESTION CONTINUES (INTEREST TABLE)

$30

$120

$90

$60

0

0

1

2

3

4

5

i=5%

G=$30

P= $247.11

P G (P/G, i%, n)

30 (P/G, 5%, 5)

30(8.237)

42

Arithmetic Gradient Present Worth Factor

Question: If interest rate is 8%, what is the present worth of

the following sums?

550

600

500

450

400

400

1

2

400

400

400

4

5

150

200

4

5

400

0

1

2

3

4

5

=

0

3

+

50

100

0

0

1

2

3

43

QUESTION CONTINUES

0

400

400

1

2

400

3

400

400

4

5

150

200

4

5

ATotal A1 A2

A1 400

50

100

0

0

1

2

3

400 92

492

P 492 ( P / A, 8%, 5)

492 (3.9927)

1,964.41

A2 50 ( A / G, 8%, 5) 50 (1.8465)

92.33 92

44

Arithmetic Gradient Uniform Series Factor

Convert an arithmetic gradient series into a uniform series

Given G, i, & n, find A

(4-20)

(1 i) in 1

AG

G ( A / G, i%, n)

n

i(1 i) i

n

Notation

Arithmetic Gradient

Uniform Series Factor

45

Arithmetic Gradient Uniform Series Factor

Question: Demand for a new product will decrease as competitors

enter the market. What is the equivalent annual amount of the

revenue cash flows shown below? (interest 12%)

3000

3000 3000 3000 3000 3000

2500

2000

1500

1000

0

1

2

3

4

5

=

0

AEQIV 3000 500 ( A / G , 12%, 5) 0

3000 500(1.775)

2112.50

1

2

3

4

5

4

5

+

1

0

2

500

3

1000

1500

2000

46

Geometric Series Present Worth Factor

Geometric series: Each annual amount is a fixed percentage

different from the last. In this case, the change is 10%.

We will look at this problem in a few slides.

g=10%

$100 $110 $121

0

1

2

3

$133

4

?

5

?

6

?

7

?

8

?

9

?

10

i=5%

P=?

47

Geometric Gradient

Unlike the Arithmetic Gradient where the amount of period-by-

period change is a constant, for the Geometric Gradient, the periodby-period change is a uniform growth rate (g) or percentage rate.

First year maintenance cost

Cash Flow

1

2

Uniform growth rate (g)

100

100 10%(100)

100(1 0.1)1

100 A1

110 A 2

3

.

110 10%(110)

.

100(1 0.1) 2

.

121 A 3

.

.

.

.

.

.

.

.

.

n

A n -1 10%( A n -1 )

100(1 g ) n 1

An

Year

48

Geometric Series Present Worth Factor

Given A1, g, i, & n, find P

(4-29) & (4-30)

1 (1 g ) n (1 i) n

P A1

where i g

ig

Geometric Series

Present Worth Factor

When Interest rate equals the growth rate,

P A1n(1 i)

1

where i g

49

Geometric Series Present Worth Factor

Question: What is the present value (P) of a geometric

series with $100 at EOY1 (A1), 5% interest rate (i), 10%

growth rate (g), and 10 interest periods (n)?

g=10%

$100 $110 $121

0

1

2

3

$133

4

?

5

?

6

?

7

?

8

?

9

?

10

i=5%

P=?

50

Geometric Series Present Worth Factor

$100

0

1

$133

$121

$110

2

3

4

g=10%

$195

$177

$146 $161

5

6

7

8

$214

9

$236

10

i=5%

P= $1184.67

1 (1 g ) n (1 i) n

1 (1 0.1)10 (1 0.05) 10

P A1

100

ig

0.05 0.1

51

100(11.8467)

Time for a Joke!

What is Recession?

Recession is when your neighbor loses his or her job.

What is Depression?

Depression is when you lose yours.

By Ronald Reagan

52

Problem 4-7

Purchase a car:

$3,000 down payment

$480 payment for 60 months

If interest rate is 12% compounded monthly, at what

purchase price P of a car can one buy?

Solution

i = 12.0%/12 = 1.o% per month, n = 60, and A = $480

P = 3000 + 480(P/A, 0.01, 60)

= 3000 + 480(44.955)

= $24,578

Important: P = $3000 + $480(60) = $31,800, if i = 0.

53

Problem 4-9

$25 million is needed in three years.

Traffic is estimated at 20 million vehicles per year.

At 10% interest, what should be the toll per vehicle?

(a)

Toll receipts at end of each year in a lump sum.

(b)

Traffic distributed evenly over 12 months, and

toll receipts at end of each month in a lump sum.

54

Problem 4-9

Solution

(a)

Let x = the toll/vehicle. Then

F = $25,000,000

i = 10%/year, n = 3 years

Find A (=20,000,000x).

A = F(A/F, 0.1, 3)

20,000,000x = 25,000,000(0.3021)

x = $0.3776 = $0.38 per vehicle

55

Problem 4-9

Solution

(b) Let x = the toll/vehicle. Then

F = $25M

i = (1/12)10%/month, n = 36 months

Find A (=20,000,000x/12).

A = F{i/[(1+i)n–1]}

20,000,000x/12 = 25,000,000{(0.1/12)/(1+0.1/12)36–1}

x = $0.359 = $0.36 per vehicle

56

Problem 4-32

If i = 12%, for what value of B is the PW = 0?

Solution

Consider now = time 1. Then

PW = B+800(P/A, 0.12, 3) – B(P/A, 0.12, 2) – B(P/F, 0.12, 3)

= 1921.6 – 1.758B

Letting PW = 0 yields B = $1,093.06

For any cash flow diagram,

if PW = 0, then its worth at anytime = 0!

57

Problem 4-46

Solution

FW = FW

[1000(F/A, i, 10)](F/P, i, 4) = 28000

By try and error:

At i = 12%, LHS = [1000(17.549)](1.574) = $27,622 too low

At i = 15%, LHS = [1000(20.304)](1.749) = $35,512 too high

Using linear interpolation:

i = 12% + 3%[(28000 – 27622)/(35512 – 27622)]

= 12.14%

58

Use of MS EXCEL

pmt(i, n, P, F, type) returns A, given i, n, P, and F

sinking fund (P=0)

A = F{i/[(1+i)n – 1]}

capital recovery (F=0) A = P{[i(1+i)n]/[(1+i)n – 1]}

or combined (P ≠ 0, and F ≠ 0)

(4-5)

(4-6)

rate(n, A, P, F, type, guess) returns i, given n, A, P, and F

59

Use of MS EXCEL

pv(i, n, A, F, type) returns P, given i, n, A, and F

present worth (A=0)

P = F/(1+i)n

(3-5)

series present worth (F=0) P = A{[(1+i)n – 1]/[i(1+i)n]} (4-7)

or combined (A ≠ 0, and F ≠ 0)

fv(i, n, A, P, type) returns F, given i, n, A, and P

compound amount (A=0)

series compound amount (P=0)

or combined (A ≠ 0, and P ≠ 0)

F = P(1+i)n

F = A{[(1+i)n – 1]/i}

(3-3)

(4-4)

60

Use of MS EXCEL

nper(i, A, P, F, type) returns n, given i, A, P, and F.

If A = 0,

If P = 0,

If F = 0,

n = log(F/P)/log(1+i)

n = log(1+Fi/A)/log(1+i)

n = log[A/(A-Pi)]/log(1+i)

single payment

uniform series

uniform series

effect(r, m) returns ia, given r and m.

effective annual interest rate ia = (1+r/m)m – 1

(3-7)

nominal(ia, m) returns r, given ia and m.

nominal annual interest rate r = m[(ia – 1)1/m + 1]

61

A Real Life Case

Mr. Goodman set up a trust fund of $1.5M for his 2

children in 1991. It is worth more than $300M today

(January 2012).

What is the effective annual interest rate?

Solution

P = $1.5M, F = $300M, n = 20 years

ia = (F/P)1/n – 1 = (300/1.5)1/20 – 1 = 30.332%

ia = rate(20, 0, 1.5, –300) = 30.332%

ia = rate(20, 0, -1.5, 300) = 30.332%

62

End of Chapter 4

Uniform Series Compound Interest Formulas

Uniform Series Compound Amount Factor: F/A

Uniform Series Sinking Fund Factor:

A/F

Uniform Series Capital Recovery Factor:

A/P

Uniform Series Present Worth Factor:

P/A

Arithmetic Gradient

Geometric Gradient

Spreadsheet Solutions

63

Interpolation-1

Given: F(X1); F(X2)

What is F(X3) where X1 < X3 < X2?

Assuming linearity so that a linear equation will do:

Basic equation: y = mx + b so

1. F(X1) = mX1 + b

2. F(X2) = mX2 + b

Subtract 2 from 1:

F(X1)-F(X2) = m (X1-X2) m = (F(X1)-F(X2))/(X1-X2)

From 1 we get b = (F(X1) - mX1)

64

Interpolation-2

F(X1)-F(X2) = m (X1-X2) m = (F(X1)-F(X2))/(X1-X2)

From 1 we get b = (F(X1) - mX1)

Now

F(X3) = m X3 + b

= m X3 + F(X1) - mX1 = m (X3 - X1) + F(X1)

= (X3 - X1) (F(X1)-F(X2))/(X1-X2) + F(X1)

= F(X1) + (F(X1)-F(X2)) (X3 - X1) /(X1-X2)

65

Interpolation-3

F(X3) = F(X1) + (F(X1)-F(X2)) (X3 - X1) /(X1-X2)

Suppose that the Xs are interest rates, i, and the Fs are

the functions (F/A,i,n), then

F(i3) = F(i1) + (F(i1)-F(i2)) (i3 - i1) /(i1-i2)

Return

66