Fiscal vulnerability and financial repression in France since 1950

Fiscal vulnerability and financial repression in France since 1950

To be presented at Strasbourg Conference, September 13-14, 2012

Macroeconomic and financial vulnerability indicators in advanced economies by

Marcel Aloy, Aix-Marseille Université (AMSE) and GREQAM

Gilles Dufrénot, Aix-Marseille-Université (AMSE), Banque de France & CEPII

Anne Péguin-Feissolle Aix-Marseille Université (AMSE) and GREQAM (CNRS)

Abstract

This paper contributes to the recent empirical literature on financial repression and the vulnerability of public finance through the examination of the French case since the end of

World War II. Using a simple econometric analysis we obtain several interesting results. Over the years of financial repression, governments were able to obtain primary balances consistently above sustainable levels. This suggests that fiscal adjustment needed to lower the debt ratio have been smaller than during the years of full liberalization of credit markets.

Secondly, the negative interest-rates were the consequence of low nominal rates, the latter being correlated with different indicators of financial repression. These indicators also played a major role in accounting for the growth of real GDP. Given these results, we conduct a counterfactual analysis to see whether the vulnerability of public finances would have been different, if, since the late 1980s, governments had continued to carry out the same financial repression policies? We answer affirmatively showing that the cost of debt service would have been reduced, that the contribution of growth to the variation of the debt ratio would have been more important than it actually was, and that the repressive policies would have eased the adjustments of the primary balance.

JEL classification : G28, H63, N20

Keywords : Financial repression, Fiscal vulnerability, France, historical economics

1

Fiscal vulnerability and financial repression in France since 1950

Marcel Aloy, Aix-Marseille Université (AMSE) and GREQAM

Gilles Dufrénot, Aix-Marseille-Université (AMSE), Banque de France & CEPII

Anne Péguin-Feissolle Aix-Marseille Université (AMSE) and GREQAM (CNRS)

1.- Introduction

Could new financial repression policies help the French governments to deal with the fiscal vulnerability induced by the high debt ratio this country has experienced since more than a decade now? This is a hotly debated issue. When the resources needed for growth and public finances become scarce (because governments face stronger constraints in international markets and have to rely on resources stemming from domestic credit markets), what is the best way of allocating efficiently these rare resources in the economy? Can financial markets working alone do the job, or do we need institutional rules to increase the selection capabilities? Are the effects of the contributions of debt service, growth and primary balance to the variation of the debt ratio conditioned by the nature of financial policies implemented by government: liberalization or regulation?

The answers to these questions are not unambiguous, if we refer to the theoretical literature dealing with the effect of financial repression on the determinants of the debt ratio.

It is common wisdom that a higher growth helps reducing fiscal vulnerability. From a theoretical point of view, models of the causal link between repressed finance and growth were proposed during the 1990s within the context of endogenous growth theory. Their conclusions are mixed. While some of them conclude that financial repression policies leads to lower growth rate, others shows that it can be optimal to repress the financial sector in order to foster growth 1 . These models attempted to give a formal basis to an already existing theoretical apparatus on financial repression and growth. The negative impact of financial repression had its foundation in the neoclassical tradition. In their pioneering papers

McKinnon (1973) and Shaw (1973) explain that strict regulation of interest-rate, high reserve

1 See, among others, Greenwood and Jovanovic (1991), Levine (1991), De Gregorio (1991), Greenwald and

Stiglitz (2003), Roubini and Sala-i-Martin (1995).

2

requirements and a compulsory regulation of credit allocation reduces the amount of saving needed for financial intermediation and result in a misallocation of capital in productive sectors. The reason is that, when government deficits pre-empts lending resources of the deposit banks, private saving and investment are stifled. The negative impact also works through financial distortions that reduce the rate of innovation (King and Levine, 1993). Other authors also point to the costs induced by financial repression: rent-seeking behaviors, erosion of the tax base, capital flight, etc (see for instance, Dooley and Mathieson, 1987). Regulated interest-rates prevent the credit markets from achieving their equilibrium, credit controls result in a reduction of financial flows. On the other side, criticisms have been leveled against the neoclassical view by the institutional approach to financial economists. Those who demonstrate the effect of a positive causality of financial repression on growth are based on the fact that the existence of market failures and credit rationing motivates a potential role for governments in the allocation of credit (see for instance, Stiglitz and Weiss, 1981, Stiglitz,

1993).

The budgetary impact of financial repression has also been analyzed. Government revenue from such a policy includes the reduction of interest expenses stemming from the tax inflation or the nominal interest-rate ceiling, the increase in the size of implicit tax base through the high cash reserve requirements, the gains accruing to the government from seigniorage. The main conclusion from the theoretical arguments is that some governments may choose to resort to this type of implicit taxation while other may not, depending on several factors like the efficiency of tax systems, tax evasion, the degree of financial development, asymmetric information (see, among others, Bacchetta and Caminal, 1992, Bhattacharya and Haslag,

2001, Cuikerman et al., 1992, Di Giorgio, 1999, Espinosa and Yip, 1996, Haslag and Young,

1998).

In spite of the ambiguous findings of the theoretical models, the idea that a financial repression policy could be a way to solve the sovereign debt crisis resurfaces today. It is implemented by the central bankers themselves, for instance through the adoption of the recent quantitative easing policies or through the declaration of former governors like

Greenspan confessing that there was a flaw in his prior belief that self-interest would prevent the type of financial crisis we recently faced and arguing that tighter capital and liquidity controls appears uncontroversial (see Taylor, 2011). Moreover, in a number of cases, the negative causality between financial repression and economic growth obtained in the theoretical models is contradicted by the historical observation, especially in the industrialized

3

countries. Indeed, in some countries, a strict control of the financial system promoted impetuous growth. For instance, this was the case of Japan during the Meiji era between 1868 and 1912 (Konno, 2003), of most Asian tigers from the years 1960s onwards and of some

European countries after WWII.

This motivates the re-emergence of empirical studies dealing with the public finance aspects of financial repression. For instance, some recent papers attempt to quantify the amount of debt wiped out since the post World War II in the industrialized countries due to the so-called liquidation effect, i.e. saving to the governments from having a negative interestrate (see Magud et al., 2011, Reinhart and Sbrancia, 2011). Additional studies are needed to examine the impact of financial repression on the other determinant of the debt ratio so that we understand how repression today could contribute to rapid debt reduction.

This paper seeks to contribute to the recent empirical literature on financial repression and the vulnerability of public finance through the examination of the French case since the end of

World War II. Previous papers examined how the real interest-rate, the primary balance and the growth rate contributed to the variations of the debt ratio in this country. The main conclusion is that the three variables accounted for the reduction of the debt ratio up until the mid 1980s. however, since 1990 fiscal rectitude and growth rebounds do not help in stopping the debt ratio that is climbing at rapid rate (see Dufrénot and Triki (2012a, 2012b). Can the specific kind of the domestic financial and monetary policies explain these differences?

Indeed, from the end of World War II till the mid 1980s, the financial architecture was characterized by financial repression with government debt accounting for a significant share of the domestic banks’ asset holdings, high reserve requirements, captive credit markets and ceilings on nominal interest-rates. During these years the inflation rate was high, thereby implying negative interest-rates. In the wake of the liberalization policies undertaken all over the world from the mid 1980s, the restrictions and regulations in the credit and financial markets were progressively lifted and financial liberalization was completed in the 1990s. An interesting question is for instance whether the fiscal adjustments undertaken to reduce the debt levels before the mid 1980s were facilitated by the capacity of the governments to have an implicit taxation of the banking system? Could the healthy growth of the thirty glories be explained by the negative interest-rates and by the fact that public firms and the governments could recur selectively to the domestic credit?

As part of the answer to the above question, Monnet (2011) estimates the impact of credit control and selectivity on the investment and the output growth rate of 49 sectors between

4

1949 and 1974. He documents a positive correlation between the marginal productivity of capital and investment credit, a positive correlation between medium to long-term credit and the most capital intensive sectors, a positive impact of credit investment on the growth of production within each sector. The results of his quantitative evidence are along the line of previous qualitative studies showing the strong relationship between the industrial policy and the financial repression policy in France during the postwar years (Hall, 1986, Hayward,

1986, Zysman, 1983, Loriaux, 1991). These studies are interesting because they show that, contrary to a widespread idea according to which financial repression impedes growth, it served as a tool of growth-enhancing during the period from 1950 to 1975.

Our paper goes a step further in an attempt to answer the preceding questions. We first consider the historical experience of financial repression policies in France from 1950 to the mid-1980s, examining the effects on the determinants of the public debt ratio. By using a simple econometric analysis we obtain several interesting results. Over the years of financial repression, governments were able to obtain primary balances consistently above sustainable levels. This suggests that fiscal adjustment needed to lower the debt ratio have been smaller than during the years of full liberalization of credit markets. Secondly, the negative interestrates were the consequence of low nominal rates, the latter being correlated with different indicators of financial repression. These indicators also played a major role in accounting for the growth of real GDP. Given these results, it is then interesting to conduct a counterfactual analysis: would the vulnerability of public finances have been different, if, since the late

1980s, governments had continued to carry out the same financial repression policies? We answer affirmatively showing that the cost of debt service would have been reduced, that the contribution of growth to the variation of the debt ratio would have been more important than it actually was, and that the repressive policies would have eased the adjustments of the primary balance.

The remainder of the paper is structured as follows. Section 2 presents an overview of the salient features of the institutional framework of financial repression policies in France between 1950 and the end 1980s. The comparative behavior of the real interest-rate in contexts of financial repression and liberalized financial markets is brought in Section 3.

Section 4 looks at the impact of financial repression on fiscal vulnerability through the effects on the main determinants of the debt ratio. Finally Section 5 concludes.

5

2.- The institutional framework of financial repression in France between 1950 and the end 1980s

The concept of financial repression was coined in the seminal papers by Shaw and

McKinnon (1973). It refers to situations where the financial system is regulated such that prices and quantities in credit, money and asset markets do not reflect market equilibrium conditions. Financially repressed policies take several forms: legal ceilings on nominal interest-rates, high reserve requirements, creation of captive credit markets with governments pre-empting the resources of the deposit bank, seigniorage via the monetary financing of public deficits. Whichever are the policies adopted, financial repression is usually accompanied by capital account restrictions and exchange rate controls. Further, interest-rate savings are obtained through an inflation policy. Given nominal interest-rate caps, high inflation rates have the following incidence: real rates are very low (negative) and below the growth rate of the real GDP, thereby facilitating episodes of huge drops of the debt ratio.

Like in other industrialized countries, financial repression policies in France have been used as a method of resolution of public debt surges from the post-war years till the end

1980s. We briefly portray the main features of the financial architecture in this country at that time for a more in-depth analysis, we refer the reader to Quenouelle-Corre (2005) and Monnet

(2011).

Though financial repression was a widespread practice in the industrialized countries after the instauration of the Bretton Woods system and the breakdown of fixed exchange rates, this policy was already implemented in France before the Second World War. The regulatory framework of the 1950s inherited from both the post-WWI and the interwar years. In order to consolidate the huge amount of debt inherited from WWI, governments relied primarily on the banking system. From the 1920s onwards, the selling of public debt to investors was based on a network of commercial banks that the government legally erected as “Agents”.

The banks included the Crédit Lyonnais, the Société Générale, the Crédit Industriel et

Commercial. 23 institutions were involved. At that time, the commercial banks designated to take a very active part in the creation of captive markets for public debt were highly involved because, in turn, they received high commissions from governments. The amount of public debt sales and the interest rates were defined during meetings between the Ministry of

Finance and commercial banks. This was completed during the interwar years by the active role of the “Caisse des Dépôts et Consignations” that bought short-term public debt in the monetary market and exchanged them at the Treasury against long-term securities. The Great

6

Depression of 1930 promoted the role of the central bank in the financing of budget deficits: rediscount of Treasury bills held by banks at the Banque de France, seigniorage through the central bank’s advances to governments, implementation of open market policy. During the

1940s the so-called “Treasury circuit” was set up. It consisted of a set binding mechanisms allowing the government to direct domestic savings to himself: banks’ portfolios were mainly composed of treasury bills, regulations promoted payment by check and bank deposits,

Treasury deposits and postal check accounts developed, the issuance of private bonds and equities beyond a certain limit were subject to authorization, the public treasury was fed by the “correspondants du Trésor”. All these took place within a context of authoritarian setting of the volume and of the timing of issuance of private bonds and equities in the financial.

The end of WWII and the willingness to liquidate part of the accumulated war debt gave birth to financial repression policies inherited from the pre-war years. The rules of credit allocation and credit policy orientations were defined and supervised by the “Conseil National du Crédit” a supervision agency created in 1945. Public financial institutions were directly involved in the distribution of resources to the productive sectors and credits were monitored across sectors according to a policy of credit selection. The priority was the long-term financing of public firms and much effort was devoted to reduce the cost of public borrowing.

In this view, the power of the Treasury, of the Caisse des Dépôts and of the Banque de France was reinforced to control of nominal rates in the bond and monetary markets.

The interest-rate policy relied on the following triptych: the control money market rates by the Bank of France, the control of public bond yields through the interventions of the Caisse des Dépôts in the bond market and a regulation of the deposit rate. This helped maintaining the nominal rates at very low levels and allowed the government to benefit from negative real rates. For purpose of illustration, Table 2.1 traces out the main yields of saving between 1969 and 1980. We see that the regulated deposit rates were sometimes twice as low as the market rates, Treasury bonds and other public bonds had a higher yield than deposits in banks and that there was a strong spread between the interest of medium- to long-run savings and the short-term interest rate. Interest rates appeared to be negative over the whole period because they were stabilized in spite of the acceleration of the inflation rate. Credit loan rate were also maintained at low levels through a system of subsidized credits in order to support mediumterm and long-term investment. An interesting feature is that the fixation of the conditions and of the level of lending rate was the outcome of discussions within the Conseil National du

Crédit between different economic actors. Indeed, the CNC council was composed by

7

representatives of the Banque de France, of high level civil servants of the main ministries and of private and public commercial banks. As illustrated in Table 2.2, there were huge differences between the non-subsidized and subsidized real interest rates, the latter being importantly negative. From the viewpoint of the lenders, repressed finance consisted in creating legally specific types of loans in order to reduce the borrowing costs and boost the investment in some selected sectors. The subsidies stems from a fund called the “Fonds de

Développement Économique et Social”.

Another practice was the management of a queue of borrowers that contributed to create captive credit markets in which public firms had an advantage over the private companies.

The mechanism was the following. A company or institution wishing to issue bonds above a given amount preliminary needs the authorization of the minister of finances. At the beginning 1950s, the threshold was 250000 Francs. Then, governments established legally an order in the queue of borrowers. The first institutions able to sell bonds in the capital market were the Treasury and the financial institutions and enterprises under its control: Postal and

Telecommunication administration (PTT), the national railway enterprise (SNCF), the gas and electricity company (EDF), etc. Then, in second place, big companies were served (in different sectors such as automobile, aeronautic, etc). In last place, private companies could sell their bonds. Given the context of scarce domestic resources and the capital account control, a consequence of this system was credit rationing with an eviction of private companies which were unable to collect the whole amount of debt they needed for their business.

In addition to these measures the former system of Treasury circuit was re-activated and seigniorage was further used as a mean of financing public expenses. The Banque de France plays a central role in rediscounting medium-term loans through a system of ex-ante selection of the sectors needing credits (see Monnet, 2011). Further, restrictions and extensive controls of capital account and exchange rate were maintained up until 1986-1988.

3.- Financial repression and the real interest-rate: some empirical observations

We now attempt to quantify some of the dimension of financial repression in France and its consequences on the cost of service on public debt. Since the core variables reflecting financial repression are the interest-rates and inflation, some key features on these variables are first shown.

8

Table 2.1. Nominal and real interest-rates on saving

Saving banks Medium-term deposits and certificates of deposits

Treasury bill

(5 years)

Home saving plans

Public bonds Equities

Regulated rates Non-regulated rates

Nominal Real Nominal Real Nominal Real Nominal Real Nominal Real Nominal Real Nominal Real

1969 4.00 1.40 4.50 1.90 8.85 6.25 7.50 4.90 8.0 5.4 8.63 6.03 3.95 1.35

1970 4.25

1971 4.25

-1.55

-1.25

4.50

4.50

-1.30

-1.00

8.15

7.15

2.35

1.65

8.25

7.87

2.45

2.37

8.0

8.0

2.2

2.5

8.26

8.28

2.46

2.78

4.47

5.28

-1.33

-0.22

1972 4.25

1973 4.25

1974 6.50

1975 7.50

-1.95

-3.15

-7.20

-4.20

4.50

4.50

6.75

7.00

-1.70

-2.90

-6.95

-4.70

7.65

10.95

12.95

9.35

1.45

3.55

-0.75

-2.35

7.50

7.50

9.02

9.25

1.30

0.10

-4.68

-2.45

7.0

7.0

8.0

9.0

0.8

-0.4

-5.7

-2.7

8.78

9.65

11.21

10.18

2.08

2.25

-2.49

-1.52

4.55

5.40

7.82

6.17

-1.65

-2.00

-5.88

-5.53

1976 6.50

1977 6.50

1978 6.50

1979 6.50

1980 7.50

-3.10 6.50

-2.90 5.50

-2.60 5.50

-4.20 5.50

-5.80 6.50

-3.10 10.15

-3.90 8.80

-3.60 8.30

-5.20 11.0

-6.80 10.75

0.55 10.50

-0.60 9.75

-0.80 9.50

0.30 9.50

-2.55 10.50

0.90

0.35

9.0

8.0

0.40 8.0

-1.20 8.0

-2.80 8.0

-0.6

-1.4

-1.1

-2.7

-5.3

11.04

11.07

9.94

12.59

14.31

1.44

1.67

0.84

1.89

1.10

6.96

7.68

5.84

5.79

6.69

-2.64

-1.72

-3.26

-4.91

-6.61

Source: Bulletin Trimestriel de la Banque de France and INSEE

9

Table 2.2. Real cost of credit, subsidized and non-subsidized loans

1969 1972 1977 1979

Non-subsidized loans

Commercial discount

Overdraft advances

Personal loans

Base rate

Medium-term credits

Housing credits (buyer)

4.65

5.85

7.05

2.0

4.55

6.30

3.8

5.0

6.55

0.8

3.2

4.8

3.4

4.1

8.48

-0.1

2.25

5.6

4.4

5.0

6.85

0.8

3.25

5.2

Subsidized loans

Loans to young artisans

Loans to artisans

-0.95

0.55

Export credits -

Subsidized loans to agriculture sector -1.70

Participation to the rebuild of firms -3.20

-0.95

0.55

0.70

-1.70

-3.20

-3.4

-1.4

-1.4

-4.9

-6.4

Loans to public housing building -1.20

Loans associated to home saving plans -0.70

-2.5

-1.2

-2.9

-3.9

-

-5.2

Special loans of the real estate bank -0.70 0.8 -1.4 -

Source : Conseil National du Crédit et Bulletin Trimestriel de la Banque de France

4.7 to -3.2

-1.2

-2.7

-4.7

-7.7

The real cost of debt in relation to other interest-rates

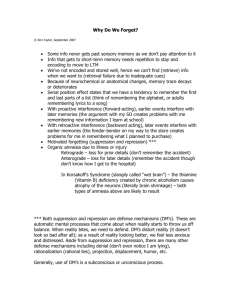

Figure 1 shows the evolution of the effective nominal interest-rate on public debt

(measured by the cost of debt service as a ratio of the stock of debt in the previous year) along with the inflation rate (headline and core inflation 2 ). The interest-rate appears to be characterized by a stepwise evolution. It first remains below or near 1% from 1950 to 1982, than increases gradually to a ceiling of 1.8% until 1990 and jumps at higher levels with a peak corresponding to the year 1998. The curve of core inflation is suggestive of a humped-shaped dynamics with an increase up until 1979 followed by a gradual decrease until 1990 before a plateau is observed from 1991 onwards. As a consequence, the real interest-rate on public debt is negative before 1990 with the gap between the nominal rate and inflation being particularly huge between 1965 and 1986 (see Figure 2).

2 The latter is measured by applying a HP filter to the series of headline inflation

10

Figure 1. Nominal interest-rate and inflation

24

20

16

12

8

4

0

-4

50 55 60 65 70 75 80 85 90 95

Nominal explicit interest rate on debt

Headline inflation

Core inflation

00 05

1.0

0.5

10

0.0

3.5

3.0

2.5

2.0

1.5

Figure 3. Interest-rate on public debt and lending rate

2

1

0

4

3

16

12

8

4

0

50 55 60 65 70 75 80 85 90 95

Nominal interest rate on public debt

Lending rate

00 05 10

Figure 2. Real interest-rate

4

-8

-12

0

-4

-16

60 65 70 75 80 85 90 95 00

Nominal interest rate minus headline inflation

Nominal interest rate minus core inflation

05 10

Figure 4. Lending rate (nominal and real

16

12

8

4

0

-4

-8

-12

-16

50 55 60 65 70 75 80 85 90

Lending rate (nominal)

Lending rate minus inflation

95 00 05 10

11

Are these evolutions related to the policies undertaken by governments during the era of financial repression? As shown in Figure 3, the nominal interest-rate seems to evolve in parallel with the lending rate until 1983 with a gap between the two rates shrinking between

1972 and 1983. And then, from 1984 onwards a divergent evolution is observed. The lending rate is quite stable until 1968 as the result of explicit caps on interest-rates. Then, it increases between 1970 and 1980, thereby reflecting the governments’ effort to channel to themselves the credits by discouraging the demand for credits by the private sector and increasing their weights in the credit market in a context of control of capital flows and a low financial depth.

As is seen in Figure 3, the increase in the lending rate (or other nominal rates) allows the governments to benefit from a cost of debt service on public debt between 1970 and 1980 lower than the average cost before 1970.

Further, Figure 4 shows that the nominal and real lending rate evolve jointly only after

1985. These observations reflect the fact that the nominal interest-rates were inhibited from reacting to inflation before 1985

3

. This comes from the interest-rate policies, described in the preceding section, during the years of financial repression: administrative control and regulations on credit markets allow the governments to keep the real interest-rates below the level they would have achieved in a context of deregulated markets (notably between 1970 and 1983).

Implicit tax on financial intermediation

A financial repression policy results in an implicit tax on financial intermediation. This is achieved in several ways. First, interest-rates on T-bills are considerably lower than the rates on deposits, thereby implying that required holding of government bonds is equivalent to a tax on the banking sector. Figure 5 illustrates this situation during the years of high financial repression from 1960 to the mid 1990s. The nominal spread, defined as the difference between the nominal lending rate and the nominal deposit rate was also high between 1978 and 1995, reflecting a high cost of financial intermediation. The lending rates reach fairly high levels because the banking sector was forced to hold a high proportion of deposits in statutory reserves and could not substitute foreign assets for public domestic assets. The legislation in France during the 1960s, 1970s and 1980s was typical of an asymmetric control

3 We obtained similar conclusions by considering other interest-rates such as the deposit rate or the central bank discount rate.

12

of capital flows. Indeed, public enterprises were encouraged to borrow abroad, but credit to the private sector and foreign sector was rationed or prohibited. Figure 6 shows a positive correlation between the cost of intermediation and the negativity of the interest-rate (the higher the interest-rate spread, the more negative the real effective interest-rate on public debt).

The role of financial repression variables in accounting for highly negative interest-rates

Looking at Figure 2, the real interest-rate on public debt can be regarded as evolving in two “regimes”. These regimes correspond respectively to times of exceptionally negative low real rates (between 1970 and 1985) and times of “normal” levels of the real rate (moderately negative - before 1970 and between 1985 and 1990 - or positive rate after 1990). To see whether the times of exceptionally low real interest-rate could be attributable to the financial repression policies, we propose a simple empirical model with financial repression variables that distinguish between the two regimes.

We estimate a time-varying transition probability (TVTP) Markov-switching model proposed initially by Filardo (1994). Technical details on the model are given in Appendix A.

Such a model allows a relationship between the two regimes and some indicators of financial repression. Different variables can potentially serve as indicators for financial repression.

Such variables capture elements of inflation “surprise”, the degree of banking intermediation, captive borrowing markets and stock market depth. The variables we propose to capture these features are the following.

Inflation “surprise” is measured as the difference between headline inflation and a ten-year moving average of this variable. The reason is that governments may search to reduce their debt level through unexpected inflation. Dufrénot and Triki (2012) show that, historically, the contribution of inflation in explaining times of decreasing debt ratio was important when inflation was unanticipated. The degree of banking intermediation is measured by the level the M2-to-GDP ratio. We expect this variable to be negatively correlated with the real interest-rate in times of financial repression since this ratio tends to be higher in market economies. A variable measuring captive borrowing markets is here the ratio of commercial’s banks and/or central bank’s claims on government relative to total public debt. A high ratio is illustrative of a situation of financial repression. Finally, captive credit market are successful in terms of channeling the available saving to the public sector if financial entities no or low

13

access to other assets such as equities. Therefore, the stock market capitalization as share of

GDP is an indicator of financial constraint put on the investors. The initial data are collected from the International Financial Statistics of the IMF for the different indicators. The endogenous variable is the ex-post real effective interest-rate on public debt. The series is taken from Dufrénot and Triki (2012a).

Tables 3.2 till 3.4 report the results of the estimated TVTP model. The model is able to differentiate between very low or normal real interest-rate regimes. The regime of low interest-rate is identified by a negative -and very often statistically significant – intercept, while the intercept is either statistically positive or near zero in the second regime. For instance, when the central bank’s claims on government is the indicator of financial repression, the estimated mean of the real interest-rate is -2.13% in times of low interest-rate

(regime 1), while it is 0.19% in the second regime corresponding to times of moderately negative or positive real interest-rates (see Table 3.2). An interesting feature of the regressions is that the dynamics of the real interest-rate appears to be more volatile in the regime of low interest-rate (for instance, in the case of the central bank’s claims on governments, the volatility equals 4.82 against 0.74 in the other regime). Since we saw that the nominal rate was quite stable during the years of negative real rates, this result would suggest that the source of volatility is headline inflation. When the cost of debt service is diluted through price changes this may come from transitory shocks in inflation. This does not mean that investors were reacting to noise rather than to new signals in the prices (in repressed markets, investors are confronted to fixed nominal rates and there are no Fisher effects). The result simply suggests that there is an overlap between the regime of low real interest-rates and years of high variability in inflation. Up until the mid 1980’s the surge in the inflation rate was due to several shocks: the Algerian war, the end 1960’s social crisis, the oil price shocks and the socalled “stop and go” policies.

The model also captures the transition from one regime to another. Indeed, at least one of the coefficients of the transition function is statistically significant, thereby indicating that the variables of financial repression considered are successful in predicting changes in the regimes of real interest-rates.

14

Table 3.1. TVTP model

Financial repression variable : surprised inflation

________________________________________________

Param std-errors t-stat alpha1 -0.8584 0.6378 -1.3460 alpha2 0.7244 0.1392 5.2042 beta1 0.9074 0.0916 9.9022 beta2 0.0751 0.0318 2.3622 sigma1 2.3696 0.2705 8.7600 sigma2 0.5876 0.0937 6.2711 a1 1.8279 0.3715 4.9204 a2 -1.3972 0.4172 -3.3490 b1 0.6661 0.2135 3.1193 b2 -0.6700 0.2517 -2.6619

________________________________________________

Table 3.3. TVTP model

Financial repression variable : Claims on gvt. (total)

________________________________________________

Param std-errors t-stat alpha1 -3.9076 1.5061 -2.5946 alpha2 0.3172 0.1413 2.2444 beta1 0.5909 0.1428 4.1376 beta2 0.7109 0.0361 19.7089 sigma1 4.0481 0.7023 5.7643 sigma2 0.6313 0.1048 6.0239 a1 1.2002 1.0222 1.1741 a2 -3.8714 1.3696 -2.8266 b1 -0.0071 0.0163 -0.4356 b2 0.0559 0.0253 2.2098

_______________________________________________

15

Table 3.2. TVTP model

Financial repression variable : Claims on gvt. (Cl. Bank)

________________________________________________

Param std-errors t-stat alpha1 0.4566 0.2380 1.9188 alpha2 -5.2121 1.3392 -3.8919 beta1 0.7381 0.0612 12.0562 beta2 0.7243 0.3138 2.3085 sigma1 0.7952 0.2966 2.6810 sigma2 4.8273 1.1908 4.0538 a1 1.5866 0.5016 3.1630 a2 -0.5849 0.3627 -1.6127 b1 -0.1347 0.0390 -3.4517 b2 0.0379 0.0322 1.1785

________________________________________________

Table 3.4. TVTP model

Financial repression variable : M2/GDP

________________________________________________

Param std-errors t-stat alpha1 0.6180 0.1538 4.0172 alpha2 -0.6578 0.5190 -1.2674 beta1 0.0614 0.0294 2.0894 beta2 0.9024 0.0774 11.6540 sigma1 0.5139 0.1034 4.9717 sigma2 2.1411 0.2411 8.8822 a1 -6.0016 5.3577 -1.1202 a2 2.5584 2.2196 1.1526 b1 0.1677 0.1450 1.1565 b2 -0.0931 0.0539 -1.7283

________________________________________________

Figure 5. Nominal interest-rate spread

16

14

12

10

8

6

4

2

0

1965 1970 1975 1980 1985 1990 1995 2000 2005

(Nominal spread :lending rate minus deposit rate, )

2010

Figure 7. Posterior probability of low real interest-rate (inflation)

Figure 6. Real rate on public debt (y-axis) and nominal spread (x-axis)

-3

-4

-5

-6

-7

-8

-9

-10

-11

0 1 2 3 4 5 6 7

Figure 8. Claims on government

80

70

60

50

40

30

20

10

0

50 55 60 65 70 75 80 85 90 95

Commercial banks' claims on governement

Central bank's claims on government

00 05 10

16

An increase in unexpected inflation (inflation surprise) raises the probability that the real interest-rate will continue to be strongly negative if this is already the case, but reduces the probability that the real interest-rate continue to be positive, moderately negative or near zero if this evolution is currently observed. Indeed, in Table 3.1 we see that the coefficient b1 is positive and statistically significant while b2 is statistically negative. Therefore surprised inflation is successful in signaling the occurrence of very low interest-rate whichever their current level. Figure 7 shows the estimated posterior probability of the low interest-rate regime. We see that this regime is identified as corresponding to the years from 1960 to the end 1980s which as we know were characterized by financial repression. b1 and b2 estimated for the central bank’s claim ratio also carry the expected signs (see

Table 3.2). However, this variable is informative only about the transition from a situation of

“normal” to low real interest-rates (as b1 is significant while b2 is not). This means that if we consider the real interest-rate dynamics over the period from 1950 to 2010, the central bank’s claim on government was a leading indicator in signaling the occurrence of moving from moderate to low interest-rates. In other words, we can say that a higher weight of the government in the credit market was a factor of decreasing real interest-rate. However, there was no correlation between the end of captive credit markets and the times of interest-rate increases. The graph of the posterior probability of the regime of low interest-rate corresponds to the years from 1950 to the end 1980s, but is not reported here to save place.

However, the choice of this variable may raise some concerns since it does only partially capture the weight of governments in the credit market due to captive policies. Let us consider not only the central bank’s claims, but also the commercial bank’s claims on governments as share of GDP. A high ratio can also reflect the oligopolistic structure of the banking sector.

From the years 1970’s onwards the share of public debt hold by the commercial banks become higher than that of the Banque de France (with a stronger role for the Caisse des

Dépôts et Consignations). Figure 8 shows that, between 1970 and 1982 (a period of resurgence of strong financial repression after timid liberalization reforms undertaken during the 1960s), the share of public debt hold by the former increases while the share of the latter decreases. During these years, the Treasury set the amount of bonds, the schedule of emissions in consultation with banks and the setting of loan rates (on the T-Bills, bonds with long maturities and other rates) was the result of negotiations with the ministry of finance, the

Banque de France and the financial institutions which were the main holders of public debt.

In Figure 3, we observe that during these years the nominal lending and effective rate on

17

public debt increase. As a consequence, an increase in the total claims on central governments does not necessarily help predicting low real interest-rate (which is reflected by the small and non-significant coefficient b1 in Table 3.3). Conversely, a positive correlation may exist as shown by the positive sign carried by b2.

Table 3.4 presents the results when the variation of M2-to-GDP ratio is used as the indicator of financial repression. The graph of the posterior probability of a low real interestrate (Figure 9) suggests that this regime was observed up until the mid 1980s and also during the end 1990s and the 2000s. From 1950 to 1986, credit transactions were intermediated mainly by the banking sector and this important level of banking intermediation is known to have taken place within a financial repression policy. This distorted the interest-rates paid by the governments due to the required bank holdings of government bonds at controlled and low interest-rates. Therefore, a-priori, we could expect b1 to carry a negative sign and b2 to be a positive sign, in the sense that a high intermediation ratio drives down the interest-rates and vice-versa. Meanwhile, as seen from Table 3.4, b2 is significantly negative. A plausible explanation might be the following. Financial repression tends to induce disintermediation since this creates an incentive for the banks to reduce savings. This result could be shown using a microeconomic model where banks have a reservation real interest-rate. The saving decision is likely to vary inversely with the spread between this reservation rate and the loan interest-rate imposed by governments. In times of financial repression the spread tends to widen, thereby reducing loan decisions. Therefore, a decline in financial intermediation may actually signal a stronger financial repression policy, while a higher level of the M2-to-GDP ratio may reflect the end of the financial regulation. Figure 10 shows the evolution of this ratio. We see that from 1973 to 1992 it declines hugely before rising up from 1993 onwards.

In summary, the point that leaps out from this section is that there are signs of financial repression in France, at least until the end 1980s. How this happened is the important question. Firstly, can we consider that the negative real interest-rates were the outcome of a strategy of deliberate debt liquidation through inflation? We saw above that the component of inflation that seems to play a role in explaining the real interest-rate is the noisy component

(variability of the inflation rate and unexpected inflation). Therefore, though the inflationary context in which the financial repression took place should not be ignored, the choice of inflation as the main instrument to reduce the cost of debt service is not uncontroversial.

18

The evidence collected from the empirical observations above suggests that it is the maintenance of the nominal rate at low levels which explains the negativity of the real rate peculiarly up until the end 1980s. For instance, to allow low negative interest-rate required increased costs of banking intermediation and direct government bond purchases by the central bank. Our empirical features also point some features on which there are not an agreed upon about whether they should be interpreted as signs of financial repression. For instance, the usual story according to which financial regulation are positively correlated with high banking intermediation does not apply in our case. The logic might be reversed, as a stringer repression can provoke a disintermediation (this is shown by the inverted signs of the coefficients b1 and b2 when total claims and the M2-to-GDP ratio are retained in the transition function).

4.- The effect of financial repression on the determinants of the debt ratio and impact on fiscal vulnerability

4.1.- How much revenues lost from the end of repressed interest-rates?

Papers in the literature have attempted to calculate the so-called “liquidation effect”.

Reinhart and Sbrancia (2011) define it as the amount of government debt reduction wrought by financial repression. This is an equivalent of an increase in government revenues due to a financial repression tax. This tax can be defined in several ways. First, the revenues accruing to government as the result of artificially low level of interest-rates can be measured by the difference between a market-based real rate and domestic interest-rates times the stock of domestic public debt (with the market rates reflecting the shadow price of funds). These market rates can be the interest-rates in the world markets (like in Giovannini and de Melo,

1993, Easterly et al., 1995). A second approach is to consider that financial repression is the result of nominal rate ceilings well below the prevailing inflation rate. This approach is retained for instance by Reinhart and Sbrancia (2011) who consider savings in interest cost as stemming from negative real interest-rate.

Unlike previous studies, this paper proposes, not only to calculate the amount of savings on the cost of servicing debt during the years of financial repression, but also the amount that governments would have obtained after the end of such policy, had they decided to pursue such a policy up until now. Indeed, lowering the real interest-rate payment is not only a historical issue, but also timely, in regard to the current debt crisis. The issue of captive

19

markets is back (see Magud et al. (2011). To perform our calculation, we propose a methodology more cumbersome than simply considering the years of negative interest-rates.

But it provides us a more accurate estimate of the savings gained from the repressed interestrates and the revenues lost from the end of financial repression.

Choosing the years of real negative interest-rate as those of the “liquidation years” for public debt raises several worries. The zero cutoff as the threshold for liquidation value is arbitrary (see Taylor (2011) for an extended discussion). Secondly, our preference is to relate the cutoff for the real interest-rate, not only to inflation, but also to the determinants of the nominal interest-rates in times of repressed interest-rates and market-based interest-rates.

We proceed as follows. First, as the determinants of the real interest-rates over the years from 1950 to 2010, we consider the following potential explanatory variables: the central bank’s claims on government, surprised inflation, commercial banks’ reserve as share of total debt, changes in the M2-to-GDP ratio, the German interest-rate (discount rate), the volatility of the nominal exchange rate against the US dollar. All the data are taken from the IFS data base.

The explanatory variables

As argued before, claims on governments by the central bank capture the captive domestic credit markets.

The commercial banks’ reserves are determined by two elements. First, the statutory reserves can be viewed as a way of taxing financial intermediation (this has been analyzed in theoretical models among which Brock (1989) and Romer (1985)). Secondly, the extrareserves may be high in a repressed economy because the financial intermediaries cannot diversify their loan portfolio. This facilitates the imposition of high reserve requirements.

We also consider the influence of the external side of the economy. The discount rate in

Germany is retained as a leading indicator of the other nominal interest-rates in this country.

In a context of binding controls on foreign and domestic securities and a situation where governments searched to bar the foreign borrowers in the domestic market, the French bond market was insulated for the European market. During the years of financial repression, we thus expect the French real interest-rate not to be connected to the German. Conversely, the end of repressed domestic rates marked a convergence in the European bond markets.

20

We introduce an indicator of the management of the exchange rate (through the volatility of the nominal exchange rate), as the era of financial repression in France between 1950 and

1980 was also a period during which devaluation policies were one of the backbones of the strategies to boost the economy. After the second World War II There were five devaluations.

The French Franc was devaluated by 29% in 1958, 11% in 1969 and three small cascades of devaluations occurred between 1981 and 1983 between 2.5% and 5%. These have been associated with a higher variance of the nominal exchange rate in comparison with what was observed from the beginning 1990s onwards (see Figure 11). This higher volatility has been channeled to the real interest-rate of public debt through both the inflation rate and the nominal rate in an unexpected way (unexpected with regard to what we would a priori expect, as devaluations are usually thought of as resulting in higher internal prices and thus reduced real interest-rates). Figure 11 shows three peaks in the exchange rate volatility corresponding to the years of the devaluations we have just mentioned. Astonishingly, it is seen that they coincide with times when inflation slowdowns or drop. Therefore, it is likely that we would find a positive relationship between the real interest-rate and the volatility of the exchange rate. The explanations are the following. All the devaluations between 1950 and 1985 were triggered in a context where governments attempted at the same time to reduce the inflation rate. In 1958, Pinay launched a policy of “grand emprunt” (big borrowing) increasing the interest-rate on public bonds to 3.5% and adopting measures to keep inflation under control by squeezing the domestic demand and adoption regulation policies on retailed prices. In

1969, Valéry Giscard d’Estaing adopted a plan which aimed at reducing domestic demand and substituting foreign demand for it, while also increasing the nominal rates on public debt.

Finally, while devaluating the currency in the 1980, the government retained a series of measures that allowed them to cope with inflationary pressures (freeze of price and wage increase, no indexation of salaries on inflation, decreases of expenditure in the public sectors, quantitative credit control, etc.).

Endogenous variable and stepwise regressions

To the extent that we choose a zero cutoff for the real interest-rate in order to identify times of liquidation, there exists a potential risk that the latter will be overestimated. We accordingly choose to separate the observations of the real interest-rate according to the mean of the series over the period under examination. The mean is -3.27%. Below this value, the

21

real interest-rates values can be defined as being “very low” and above this value they are stated as “moderately low” or “positive”.

With the mean as a cutoff, the following years are identified as of years of low real interest-rate and those of non-low rates:

years of moderate or positive real rates: 1953-1955, 1959-1961, 1964-1968, 1985-2011

years of low real rates: 1949-1952, 1956-1958, 1962-1963, 1969-1984.

The second group includes those years during which financial repression has been the most intensive, from the beginning 1970s to the mid 1980s.

Then, for each group of observations we run a stepwise regression. This is a step-by-step iterative regression that involves an automatic selection of the explanatory variables according to the statistical significance of the estimated coefficients. We include all potential independent variables in the model (contemporaneous and lagged) and eliminate those that are not significant.

In addition to the independent variables mentioned before, we consider a constant term and the lagged value of the real interest-rate. This allows us to see whether the financial repression has been enduring. Indeed, as argued by Alesina et al. (1998), there are several reasons why governments may search to delay or abort financial reforms in order to deregulate or liberalize the financial and banking sectors. These motivations can be studies in political economy models (governments are reluctant to painful fiscal adjustment because market-based financial reforms are usually accompanied by changes in taxation and public spending, vested interest may prevent any changes, etc.). Even with the end of financial repression, a persistence of the real interest-rate can be observed linked with the behavior of investors in the markets.

Table 4.1 and 4.2 contain our results. In both cases, surprised inflation exert a negative effect on the real interest-rate (the cumulated sum of the contemporaneous and lagged coefficients are negative). Also, in both cases we find evidence of a persistent dynamics of the real interest-rates. Now, what does distinguish the two regressions?

For the observations below the mean, the model selects the following variables as key determinants of the real interest-rates: the central bank’s claims on governments, the reserves as share of total debt, changes in the M2-to-GDP ratio. It is noteworthy that the latter two variables are not selected for the observations of the real interest-rate above the mean. Instead,

22

for this regression, we find that the German nominal discount rate is a significant explanatory factor, thereby indicating a higher integration of the French market with foreign markets when interest-rates are market-based. The signs of some coefficients are consistent with our observations in Section 3. In time of repressed interest-rates, the behavior of the banking sector can lead to a situation whereby the high degree of banking intermediation is compatible with higher interest-rates (so the cumulated sum of the coefficients of changes in the M2-to-

GDP ratio is positive in Table 4.2). A higher volatility of the nominal exchange rate does not produce lower real interest-rates (the coefficient carries a positive sign).

From these regressions, we are able to see how the real interest-rate would compare with the actual interest-rate, had the governments continue to repress the interest-rate and to use inflation to wipe out their debt. In this respect, we compute the predicted values of the real interest-rates, from 1950 to 2010, using the estimated model in Table 4.2. Figure 12 shows the savings in interest-rate service on the debt as percentage of GDP. It is computed as the difference between the historical interest-rate and the predicted real rate multiplied by the debt ratio. This can be viewed as the revenues stemming from financial repression governments would have afford, had they maintained regulated nominal rates. From 1985 onwards, such a policy would have generated financing and the lost savings is even stronger when we consider the years following 1999. The repression tax (saving in interest-rate as percentage of GDP) would have been about 0.57% per year between 1985 and 1998 and by 1.14% on average per year between 1999 and 2010. Similarly, France would have been better off, if we compare the differential between the real GDP growth rate and the interest-rate. Using the historical data, we find a difference of respectively 2.46% and 0.64% on average per-year for the periods

1985-1998 and 1999-2010. Using the predicted values of the model in Table 4.2, these numbers turn to respectively 4.36% and 2.8%. The key point here is that these numbers accumulated over the last ten years would mean a debt service reduction of around 30% over a decade.

4.2- Positive growth in spite of a repressive financial policy

To investigate the causal relationship between the financial repression policies and the growth rate of GDP in France, we adopt a macroeconomic perspective. We propose a simple econometric investigation in which the growth rate of the real GDP is used as dependent variable and regressed on three types of explanatory variables.

23

We first consider a set of indicators of financial repression: claims on central government

(central bank and depository bank) as share of total debt, reserve requirements as share of total debt, the growth rate of the ratio M2/GDP and a dummy variable capturing the influence of negative real interest-rate. The latter is computed by considering the difference between the deposit rate and the inflation rate. If the difference is positive, then our variable takes the value 0. If the difference is negative and lower than -5%, the variable takes the value 0.5.

Finally the variable takes the value 1 if the real interest-rate is higher than -5%. We do so because we want to distinguish between moderately and strongly negative real interest-rates

Table 4.1 Regressions of the real interest-rate (real rate above the mean)

Intercept

Claims on government (-1) (central bank)

Surprised inflation

Surprised inflation (-1)

German interest-rate

Real interest-rate (-1)

Adjusted R²

Coeff. t-ratio

-0.30 -1.28

-0.12 -2.92

-1.03 -14.09

0.73

0.14

0.72

14.37

3.47

18.50

Table 4.2 Regressions of the real interest-rate (real rate under the mean)

Intercept

Claims on government (central bank)

Reserve requirements (-1)

FX volatility

Surprised inflation

Surprised inflation (-1)

Variation of M2/PIB

Variation of M2/PIB (-1)

Real interest-rate (-1)

Adjusted R²

Coeff. t-ratio

-3.09 -3.91

0.16

-0.14

3.10

-4.72

4.78 7.72

-0.89 -15.64

0.62

0.31

-0.26

0.85

0.97

6.50

4.65

-4.08

18.88

0.98

24

Figure 9. Posterior probability of low real interest-rate (M2/PIB)

Figure 11.- FX volatility and inflation

28

24

20

16

12

8

4

0

50 55 60 65 70 75

FX Volatily

80 85 90

INFLATION

95 00

4

0

12

8

24

20

16

05 10

-4

3

2

1

0

-1

-2

-3

-4

Figure 10. M2-to-GDP ratio

72

68

64

60

56

52

48

44

40

36

32

1965 1970 1975 1980 1985 1990 1995 2000 2005 2010

Figure 12. Loss in tax repression

Savings in interest rate service on the debt as % GDP

60 65 70 75 80 85 90 95 00 05 10

25

The second set of independent variables captures the role of the degree of financial and trade openness. Likewise in Section 4.1, we consider the volatility of the nominal exchange rate vis-à-vis the US dollar and the German nominal interest-rate.

The third set of explanatory variables consists of the following determinants: the growth rate of production of industry, the growth rate of wages rates taken as a proxy of the growth rate of labor productivity and the growth rate of population as a proxy for the demographic factors. These variables are taken from the OECD and IFS databases over the period from

1950 to 2011.

We consider the following equations: 𝑔 𝑡

= 𝛼

1

+ ∑ 1 𝑖=0 𝛽

1𝑖 𝑔𝑖𝑛𝑑

∑ 1 𝑙=0 𝛽

4𝑙 𝑡−𝑖

+ ∑

𝑂𝑃𝐸𝑁

1 𝑗=0 𝑡−𝑙 𝛽

+

2𝑗 𝑔𝑤𝑎𝑔𝑒𝑠

∑ 1 𝑚=0 𝛽

5𝑚 𝑡−𝑗 𝑛

+ ∑ 1 𝑘=0 𝛽

3𝑘

𝑅𝐸𝑃𝑅 𝑡−𝑘 𝑡−𝑚

+ 𝜀 1 𝑡

+ 𝑔𝑖𝑛𝑑 𝑡

= 𝛼

2

+ ∑ 1 𝑖=0 𝛽

6𝑖 𝑝𝑟𝑖𝑚 𝑡−𝑖

(1)

+ ∑ 1 𝑗=0 𝛽

7𝑗

𝑅𝐸𝑃𝑅 𝑡−𝑗

+ ∑ 1 𝑘=0 𝛽

8𝑘 𝑖𝑛𝑓𝑙 𝑡−𝑘

+ 𝜀 2 𝑡

(2) g is the growth rate of the real GDP, gind is the growth rate of industrial production of, gwages is the growth rate of wage rates, REPR is a vector of financial repression variables,

OPEN is the vector of trade openness and the volatility of the nominal exchange rate, prim is the primary fiscal balance as share of GDP, infl is the inflation rate and n is the population growth rate.

The second equation is helpful in taking into account the fact that the financial repression policy up until the end 1980s took place within the context of a planned economy in which selective and directed credit, as well as heavy interest-rates, served as a tool for industrial policy. Selective credit operations aimed at fostering the industrial basis of the economy.

Therefore, during the thirty glories a great part of the investment was directed toward industrial sectors and the growth rate of total industry was strongly correlated with that of the investment rate. We therefore consider that the growth rate of the industrial sector is endogenous, at least with respect to the financial repression variables. We also consider that, irrespective of the nature of financial policy, governments have played a major role in fostering global investment through public expenditure. The role of public consumption and investment is reflected in the primary balance. Equation (2) is estimated first, by GLS using a

Newey-West correction for the variance-covariance matrix of coefficients, and then the predicted values of the dependent variable are substituted for gind in equation (1). We do stepwise regressions an eventually select those variables whose coefficients are statistically significant in the regressions.

26

Since our aim is to see whether financial repression makes a difference in fostering growth, we consider estimations of the above equations over two sub-periods: 1950-1985 and 1986-

2010.

As a starting point, the results of the regression corresponding to Equation (2) show that while the indicators of financial repression affect the growth rate of total industry during the years of financial repression, their coefficient are no longer significant during the second subperiod after 1986. During the years 1950-1986, lower negative real interest-rates appear to significantly foster industrial growth while higher statutory reserves and financial intermediation are positively related to the growth rate of output in the industrial sector. Then, from the regressions in Table 4.4 we see that the variables of financial repression do not appear to be significant, once they are already used as instruments in Equations (2) and the fitted values reported in Equation (1). This is in accordance with the fact that financial repression has been used to achieve long-run industrial output growth and this was in turn reflected in the global growth rate. During the years of financial liberalization (after 1986), the real growth rate is influenced by both the financial and trade openness (the coefficients of these variables are statistically significant in the second regression, ie over the years 1986-

2011). The outcome of the regressions in Table 4.4 is that repressive policies between 1950 and 1985 in France had a positive effect on growth due to their fostering effect on the industrial production.

It is interesting to wonder about the implications of these results for public finances. What would the contribution of growth to the variation of the debt ratio have been, had the governments maintained the repressive policies? By proceeding in a similar way as in Section

4.1, we first compute the fitted values of regression (1) obtained for the years 1950-1985 using the historical data of the exogenous variables for the period from 1986 to 2010. In order to consider realistic hypothesis, we assume that if such policies had continued to be activated after 1985, the inflation rate would have been higher than its actual level. We assume an arbitrary level of 4%. Further, in order to take into account the structural transformation of the economy (the greater part of services in accounting for the economic growth), we consider only half of the impact of the industrial growth rate on the global growth rate. We consider a coefficient of 0.18 instead of 0.37 as reported in Table 4.4. The computation of the contribution of growth is done as usual by using the government’s budget constraint in which the ratio of debt is expressed in terms of the primary balance ratio, the real growth rate and the real interest-rate. For the latter, we consider the simulated series used in Section 4.1 to

27

compute the saving in interest-rate that governments would have obtained under the assumption of financial repression.

Growth rate of industrial production (-1)

Primary balance ratio

Primary balance ratio (-1)

Inflation

Real interest-rate (-1) (dummy variable)

Claims on governments

Reserve requirements

M2/PIB

Intercept

Adjusted R²

Table 4.3 Regressions of the growth rate of industrial production

1950-1985 1986-2010

Coeff. t-ratio Coeff. t-ratio

-0.2 -1.79 -

3.87

-2.95

7.11

-6.46

2.89 7.29

-1.87 -2.48

-0.53

-6.56

-0.03

0.30

0.33

-

0.76

-5.79

-5.20

-2.03

2.89

6.45

-

-0.41

-

-

-

-

-1.54

7.34 5.39

0.71

Table 4.4. Regression of the growth equation

Population growth

Growth rate of wages

Growth rate of wages (-1)

Growth rate of industrial production (fitted)

FX volatility

German rate (-1)

Trade openness

Intercept

Adjusted R²

1950-1985

0.77

0.12

-0.17

0.37

-2.80

2.32

2.71

-3.10

7.22

-1.93

-

-

3.21

0.73

4.26

1986-2010

Coeff. t-ratio Coeff. t-ratio

-

-

0.39

0.39

10.57

-

0.75

-

-

2.71

10.20

-0.62 -4.10

-0.14 -2.74

3.38

Figures 13 and 14 suggest that the consequences on the reduction of debt ratio might be important under repressive policies. Figure 13 is consistent with the hypothesis that if financial repression had continued after 1985, the consequences on growth would have not

28

been harmful. The regressions indeed show a positive gap between the historical growth rate and the growth rate simulated after 1986. A direct consequence is that the contribution of growth to the reduction of public debt might have been more important (Figure 14).

4.3- Implications for debt sustainability and fiscal adjustment

Over the period of financial repression, from 1950 to the end 1980s, the French primary balance has evolved above its levels considered as sustainable. In figure 15, the sustainable level is deduced from the government budget constraint using the usual definition of the primary balance ratio for which the debt ratio remains constant over time. Comparing the primary balance and the sustainable balance based on historical data, the graph suggests that budgetary imbalances have been limited and fiscal adjustment easier in comparison to what happened from the beginning 1990s onwards. There is an indication on the graph that the positive gap was facilitated by the context of financial repression. Indeed, we draw a second curve of sustainable primary balance using the results of the regressions in Sections 4.1 and

4.2. We see that, at least up until the mid nineties this curve is very near the historical curve corresponding to the historical sustainable level. The years after 1990 are characterized by episodes of over-borrowing (1991-1996 and 2000-2004). Using the simulated series for the interest-rates and the growth rate under a regime of financial repression to construct another series of sustainable primary balance under financial repression, we see that the fiscal adjustment that governments actually needed to make debt burden bearable is sharper than the adjustment that would have been needed, had the policy of financial repression been pursued.

From 1997 onwards, the spread between the actual primary deficit ratio and the sustainable level is systematically positive under repressed finance, thereby suggesting the elimination of overhang and over-borrowing problems. The explanation of the huge gap observed in the graph is explained by the fact that, under financial repression, debt would have been more comfortably serviced (in section 4.1 we found a repression tax between 0.57% and 1.14% per year on average) and the contribution of the growth rate of the debt ratio more important. It is noteworthy that this outcome could have happened in spite of the swings of the primary balance from surpluses to deficits. When the tax revenue is not stable, it seems interesting to resort to implicit taxation through financial repression.

29

Figure 13.- Growth rate under repressive policies

10

8

6

4

2

0

-2

-4

50 55 60 65 70 75 80 85 90 95

GROW TH (actual)

GROW TH (financial repression)

00 05 10

Figure 15.- Comparing primary balance to its sustainable level

3

2

1

0

-1

-2

-3

-4

-5

1960 1965 1970 1975 1980 1985 1990 1995 2000 2005

Primary balance ratio

Sustainable primary balance (historical data) sustainable primary balance (financial repression)

30

Figure 14. Contribution of growth to the debt ratio

0

-1

-2

-3

2

1

-4

50 55 60 65 70 75 80 85 90 95

Growth contribution (actual)

Growth contribution (financial repression)

00 05 10

An alternative approach to examining the issue of fiscal adjustment under financial repression is to consider fiscal policy reaction functions. Usually, it is argued that fiscal reaction functions ensure fiscal sustainability if the primary balance reacts to the debt level.

Specifically, it is expected that surpluses increase when debt rises. A standard approach to study such a relationship is to make a regression of the primary balance as share of GDP on the debt ratio and the output-gap. Then, one concludes in favor of sustainability if the coefficient of debt has a positive and statistically significant sign. We expand the standard fiscal rule by adding indicators of financial repression to the debt ratio and the output-gap as explanatory variables. With the inclusion of these variables the finding of a significant coefficient of the debt ratio is no longer a no-longer a necessary condition for sustainability.

The reason is simply that financial repression becomes an alternative mean of financing excess expenditure to the financing through a higher indebtedness (inflation tax coming from money creation, tax on financial intermediation through reserve requirements, reduction of the cost of borrowing by driving nominal interest-rate below market rate and by rationing the availability of credit to the private sector, etc.

Table 4.5 displays the estimations of several augmented fiscal reaction functions. For the period from 1950 to 1986, we show the regressions for which the added financial repression variables are statistically significant 4 . For the period of financial repression, we estimate four equations. Regression 1 is the estimation of the standard equation, while Regressions 2 till 4 contains a variable of financial repression. For purpose of comparison, we also estimate a fiscal reaction function for the years of post financial repression (1986-2010). The striking feature of the estimation is that the fiscal reaction to accumulating debts disappears when an indicator of financial regression enter the list of explanatory variables significantly. Indeed, while the debt ratio coefficient carries a significant and positive sign in Regression 1, it becomes non-significant in Regressions 2 till 4. This should be contrasted with the sharper reaction found for the years 1986-2010. For this period, none of the financial repression variables appeared to be significant. Instead, we find that changes in the fiscal balance are influenced by the German interest-rate and the inflation rate. This suggests that, as repressed policies were progressively abandoned, reliable primary surpluses that could repay the debt eventually were conditioned by the financial conditions imposed on the international markets and by the anti-inflationary monetary policy. Conversely, in times of financial repression, the

4 The output-gap is computed by applying an Hp filter to the real GDP and the estimations are done by GLs in order to obtain spherical residuals.

31

willingness to create primary deficits (for instance through increases in expenses) was facilitated by lower real interest-rate and seigniorage. Indeed, in Regressions 2 and 4 the coefficients of the real interest-rate and of the ratio M2/PIB carry respectively a positive and negative sign.

Table 4.5. Estimation of augmented fiscal reaction functions

Primary balance ratio

(-1)

Debt ratio (-1)

Output-gap

Output-gap (-1)

Claims governments on

Real interest-rate (-1)

(dummy variable)

M2/PIB (-1)

German interest-rate

Inflation rate

Adjusted R²

Regression

1

Regression

2

Coeff.

(t-ratio)

0.44

(3.95)

0.02

(2.36)

0.04

(4.75)

-0.04

(-3.66)

-

-

- -

1950-1985

Coeff

(tratio)

0.42

(3.63)

0.04

(1.57)

0.05

(5.34)

-0.03

(-3.34)

0.01

(1.75)

-

Regression

3

Regression

4

Coeff.

(t-ratio)

0.51

(1.02)

0.04

(0.78)

0.04

(4.64)

-0.03

(-1.32)

-

0.41

(1.78)

-

Coeff.

(t-ratio)

-0.06

(-0.32)

-0.07

(-1.43)

0.06

(8.41)

-0.03

(-1.97)

-

-

1986-2010

Regression

5

Coeff.

(t-ratio)

0.68

(6.51)

0.06

(2.81)

0.02

(3.27)

-0.05

(-6.67)

-

-

- - -

-0.13

(-3.49)

-

-

0.60

-

0.62

-

0.56

-

0.55

0.32

(2.19)

0.67

(3.18)

0.78

5.- Conclusion

This paper offers an illustration of the fact that issues on the use of financial repression as a mean of dealing with the French debt overhang may re-emerge. The simple exercise done here is not normative in the sense that we do not conclude from our regressions that one should come back to financial repression measures as adopted by French governments from

1950 to the end 1980s. We simply illustrates a situation in which, if current governments had

32

decided to embark on policies with consequences similar to those of past financial repression policies, then this could have help to reduce budgetary pressures by lowering the cost of debt service, boosting the growth rate, a combination that would have allowed to reduce fiscal vulnerability. Because, government seem confronted today to a limited room for maneuver in adjusting fiscal taxes and spending in order to stop the surge in public debt, the adjustment of nominal interest-rates on the domestic component of public debt may be the locus of future financing policies of fiscal deficits.

Our simple econometric exercises suggest that France has not necessarily been in a much better shape during the post financial repression years, than between 1950 and the end 1980, if we judge by the influence of the determinants of the debt ratio on fiscal vulnerability. From our regressions on fiscal reaction functions, it can be argued that governments need not reacting to rising debt burdens because the crucial factor that made borrowing sustainable was the financial repression policy.

This paper can be extended in the following way. Our counterfactual analysis could be criticized in regard to the fact that, in order to deal with the current debt overhang, governments are likely not to adopt the type of financial repression policies which were in vogue at the creation of the Bretton woods system. So, the equations used to simulate the effects of such policies for the period from 186 to 2011 might have been unstable across time.

Though, this argument is correct, the conclusions above can be viewed as providing qualitative trends, in the sense that we rely on equations that mimic a financial repression environment. To give further likelihood to the exercise, one solution would be to consider new indicators of financial repression more in line with the current policies. In their paper,

Reinhart and Sbrancia (2011) provide examples of such policies, be they prudential regulation policies, processes to create captive credit markets or central bank interventions on debt markets to reduce the interest-rate.

REFERENCES

Alesina, A., Perotti, R., Tavares, J., 1998, “The political economy of fiscal adjustments”,

Brookings Papers on Economic Activity , 28, 197-248.

Bacchetta, P., Caminal, R., 1992, “Optimal seigniorage and financial liberalization”, Journal of International Money and Finance , 11, 518–538.

33

Bhattacharya, J., Haslag, J., 2001, “On the use of inflation tax when non-distortionary taxes are available”, Review of Economic Dynamics , 4, 823-841.

Brock, P., 1989, “Reserve requirements and the inflation tax”, Journal of Money Credit and

Banking , 21, 106-121.

Cuikerman, A., Sebastian, E., Tabellini, G., 1992, “Seigniorage and political instability.”

American Economic Review, 82, 537-555.

Di Giorgio, G., 1999, “Financial development and reserve requirements.” Journal of Banking and Finance , 23, 1031-1041.

Dooley, M. P., Mathieson, D., 1987, “Financial liberalization in developing countries”,

Finance and Development , IMF and World Bank, September.

Dufrénot, G., Triki, K., 2012a, “Public debt ratio and its determinants in France since 1890.

Does econometrics supports the historical evidence?”, Banque de France Working Paper, n°385.

Dufrénot, G., Triki, K., 2012b, “Why have governments succeeded in reducing Franch public debt historically and can these successes inspire us for the future?”, Banque de France

Working Paper, n°386.

Easterly, W., Mauro, P., Schmidt-Hebbel, K., 1995, “Money Demand and Seigniorage

Maximizing Inflation”, Journal of Money, Credit and Banking , 27.

Espinosa, M., Yip, C., 1996, “An endogenous growth model of money, banking, and financial repression”, Working Paper No. 96-4, Federal Reserve Bank of Atlanta.