FAS 123(R): Long-Term Incentive Plan Implications

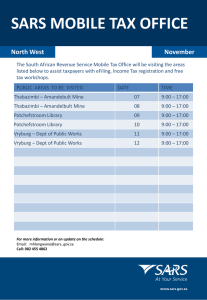

advertisement

FAS 123(R): Long-Term Incentive Plan Implications Presented by: Susan Marcille Ernst & Young Performance & Reward Practice Leader Implications • As a result of option expensing, companies are reviewing their overall compensation strategy, especially as it relates to long-term incentives. To do so they are focusing on the following: – Fresh look at linkage to current business strategy – Delivering same “value” with less dilution and cost – Diversification in LTIP’s – Holding periods and ownership guidelines – Performance orientation to vesting – Assessing design features in terms of international effectiveness 2 Implications (cont’d) • Cost analysis for alternative LTIP approaches is often important in decision making process • One important objective in LTIP design is program efficiency defined as the relationship between cost and employee perceptions of value delivered • Cost analysis often includes assessment of financial statement expense, cash flow and tax implications 3 Implications (cont’d) • Pay elements are shifting – Base salaries will likely remain fairly flat – There will be a higher correlation between performance and incentive payout • Long-term incentives will likely experience the most significant change and be delivered via blended arrangements (stock options, restricted stock, cash-based performance incentives) 4 Implications (cont’d) • Companies are evaluating alternative LTIP devices such as: – – – – – Stock options Restricted stock Restricted stock units Performance shares/units Stock appreciation rights • Share versus stock settled – Others 5 Impact of IRS Sec. 409A • The term “stock rights” under the regulations includes stock appreciation rights (SARs) and nonstatutory stock options • As under the Notice, both stock options and SARs must be in “service recipient” stock in order to be exempt from Section 409A – Must be granted at no less than FMV – Cannot have any additional deferral feature 6 Stock Options • Companies are continuing to use stock options to drive attraction, motivation, and retention of key talent. However, they are reducing the weight of stock option grants in the total compensation package and/or granting options to fewer employees. – Trend began even before FAS 123R became effective • Example: the average options burn rate fell 24% for both the Russell 3000 and S&P 500 companies between fiscal years 2001 and 2003 (3.12% and 2.26% in 2003, respectively) 7 Stock Options • Companies that decide to utilize stock options as part of their LTIP strategy are evaluating alternative design features including: – Vesting terms • time vs. performance vesting – Performance features are considered “share holder friendly” – Option term • considering shorter terms – Expected to be one of the most common design changes – Potentially helps with expense, overhang and volatility related issues (i.e., under-water options) 8 Stock Options – Holding period for stock acquired • Implementing “targeted ownership” programs • The existence of stock ownership guidelines is increasingly being viewed by investors as evidence of good corporate governance • Multiple of compensation, typically base salary only, was the most common type of executive stock ownership guideline – The median CEO multiple of salary is 5x 9 Stock Options – Switching from ISOs (qualified) to Non-Qualified Stock Options on a select basis • ISO permanent book/tax difference • Belief that participants do not hold stock long enough to take advantage of preferential long-term capital gain rates 10 Restricted Stock • Restricted stock may be used much more often with these characteristics: – – – – 11 Longer vesting terms Performance-based vesting more likely Stronger retention incentive Beware IRS Sec. 162(m) implications • Restricted Stock (unlike Stock Options) is not generally exempt from the $1 mill 162(m) limitations Cash Based Incentives • Cash-based incentives may be introduced to: – Tie incentives to internal value measures over a fixed period of time – Control the income statement impact of the longterm incentive • Caps • Predictable – Reduce dilution 12 Stock Appreciation Rights • Stock Appreciation Rights – Share settled maintains relatively favorable tax and accounting treatment – Uses fewer plan shares • Benefit not realized until SARs are exercised – 409A Implications • Parity for private company and public company SARs • Parity for stock settled and cash settled SARs 13 Contact information Susan H. Marcille susan.marcille@ey.com, 703.747.0511 14 Ernst & Young LLP