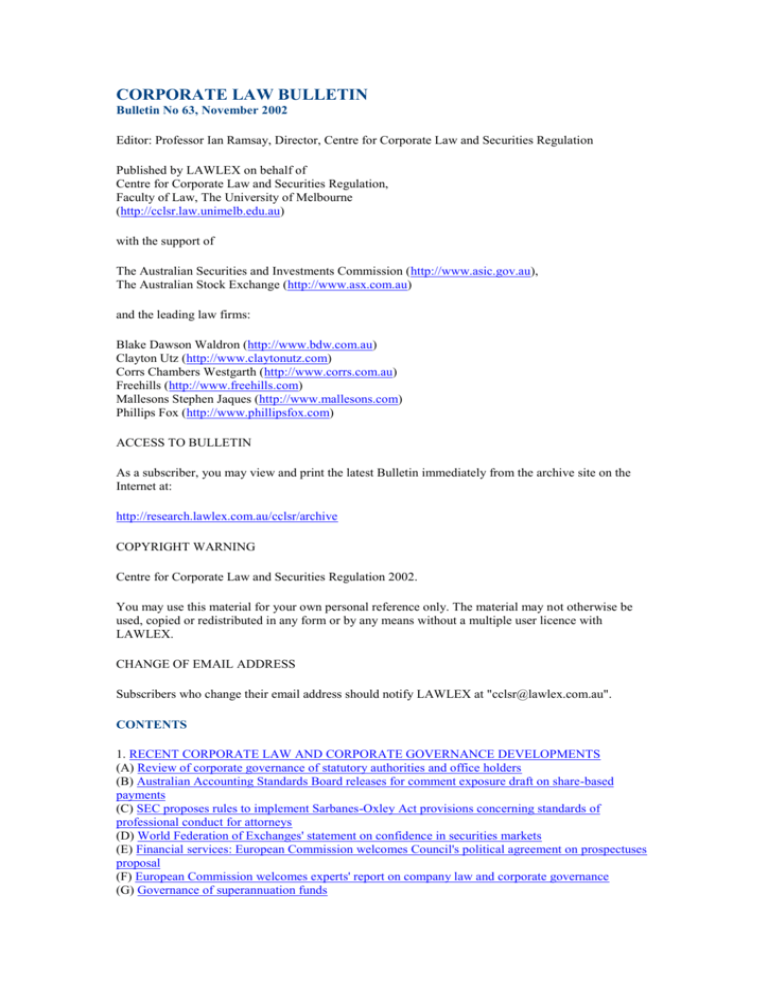

Corporate Law Bulletin 63 - November 2002

advertisement