Home Networking Preferences

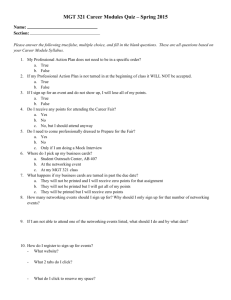

advertisement

CABA Connected Home Council Connected Home Framework 4.26.05 1 Consumer Segments Based on Technology Adoption • As noted by Geoffrey Moore in Crossing the Chasm (1991), the initial customer set for new technology products consists primarily of innovators and early adopters. The innovators or technology enthusiasts are the first to realize the potential in the new product, but the early adopters or visionaries dominate the buying decisions in the market. • This graph shows the distribution of consumer segments based on self-identified technology adoption in late-2000 and late-2003. Despite the influx of new home technology in the interim, the incidence of these consumer segments remains stable. 50% 40% 34% 34% 30% 20% 16% 14% 10% 3% 1% 2% 10% 9% 46% 40% 37% 39% 6% 10% 0% Innovators Early Adopters Early Majority 2003 2000 Late Majority Laggards Pop. Est. 2 Internet Home Alliance Consumer Segmentation Alliance Segmentation Scheme Electrons Neutrons Protons Nuclei - +/- + ++ Very negative towards connected home Very positive towards connected home Electrons - Like the negatively-charged particles of an atom, this segment is hostile to the notion of the connected home. Neutrons - Just as the name suggests, this segment is largely neutral towards the connected home. Protons - This segment is mainly positive about the connected home, though not as enthusiastic as the next and most promising segment. Nuclei - This segment represents the most likely adopters of the connected home. Like the nucleus of an atom, they are the positively-charged core market. The term ‘primary market consumers’ in this report refers to a combination of the two most promising segments: the Nuclei and Protons. This combined segment represents about 42% of single-family, owner-occupied households in the US and is profiled in the Appendix. 3 Internet Home Alliance Consumer Segmentation US Home Ownership, Q4 1998 (US Census) 62.2 million Single-Family, Owner-Occupied Households Electrons 48% (29.9 million households) Nuclei 17% (10.6 million households) Protons Neutrons 25% (15.5 million households) 10% (6.2 million households) 4 Home Networking Computers & Peripherals Owned 87% 89% 86% Desktop PC 38% 43% 34% Laptop • Ownership of a number of items appears to be correlated with income. The higher their annual household income, the greater the likelihood that consumers will own a laptop or notebook computer, a wireless keyboard, a wireless mouse, a laser or multi-function printer, and a home fax machine. 10% 13% 8% 18% 24% 13% Wireless Keyboard Wireless Mouse • Primary market consumers are significantly more likely than mass market consumers to own any of the computing and related devices listed, with the exception of a Web or media tablet. 92% 94% 90% Printer 72% 77% 69% Inkjet Printer 21% 23% 20% 23% 26% 21% 29% 33% 26% 35% 39% 32% 24% 27% 21% Laser Printer Multi-function Printer Computer Game Controller Fax Machine Joystick Total Prim ary Market Mass Market 10% 12% 8% Game Pad 0% 20% 40% 60% (Total n=1,919; Primary Market n=1,008; Mass Market n=911; Q21) 80% 100% 5 Home Networking Familiarity with Home Network Concept Total 12% 23% 42% • About two-in-three consumers are ‘somewhat’ or ‘very familiar’ with the concept of a home network (65%). • Primary market consumers are significantly more likely than mass market consumers to be ‘somewhat’ or ‘very familiar’ with the concept (76% vs. 57%, respectively). 23% • Consumers aged 25-44-years-old are significantly more likely than older consumers to be ‘very familiar’ with the concept. Primary Market 6% Mass Market 18% 16% 0% 45% 26% 20% 31% 40% 40% 60% 17% 80% Not At All Familiar Heard Term Somewhat Familiar Very Familiar (Total n=1,914; Primary Market n=1,008; Mass Market n=907; Q39) • Familiarity with home networking appears to be correlated with income as well. Consumers with annual household incomes of $100,000 or more are significantly more likely than those who make less than $50,000 to be ‘very familiar’ with the concept. 100% 6 Home Networking Home Network Ownership • About two-in-five single-family, owner-occupied households with Internet access in the U.S. have two or more PCs, allowing for the possibility of home networking. • About 12% of consumers claimed to have a home network, defined for the purposes of this research as “ …a connection between two or more computers or Internet appliances in order to exchange data across one or more rooms of your home and/or to share a connection to the Internet or other digital services. Please note that the following connections do NOT qualify as home networks: connections between a single computer and a printer, even if the devices are in separate rooms; and connections between one or more computers and portable devices like PDAs, and digital cameras.” • This estimated adoption figure comes close to the 10% estimate issued by In-Stat/MDR in February 2003. According to this firm, home networking gained in popularity among all demographic groups in 2002, jumping 2% from 8% of US households in 2001. • The difference between our estimate and that of In-Stat/MDR is explained, in part, by the fact that our sample consisted only of single-family, owner-occupied households, while In-Stat/MDR included renters. We would expect a larger share of home owners than renters to have a home network. 7 Home Networking Current Ownership Total • Home network ownership, while still most popular among innovators/early adopters, is starting to gain ground among members of the early majority. 12% Primary Market • As might be expected, consumers with broadband at home are more likely than their dial-up counterparts to have a home network (25% vs. 3%, respectively). • Demographically, home network owners are more likely to be 25-54-years-old (with the highest concentration of owners in the 25-34 age bracket) than 55-years-old or older. 19% Mass Market • Two-parent households and couples with children are more likely than other household types to own a home network. Part of this correlation is explained by household income. These households generally have more discretionary income than singles or single parents. 7% • Accordingly, households with annual incomes of $50,000 or more are significantly more likely than those with lower incomes to own a home network. 0% 20% 40% 60% 80% 100% * Respondents were provided the following definition of a home network: “By the term ‘home network,’ we mean a connection between two or more computers or Internet appliances in order to exchange data across one or more rooms of your home and/or to share a connection to the Internet or other digital services. Please note that the following connections do NOT qualify as home networks: connections between a single computer and a printer, even if the devices are in separate rooms; and connections between one or more computers and portable devices like PDAs and digital cameras.” (Total n=440; Primary Market n=310; Mass Market n=157 Q40) 8 Home Networking Device Part of Home Network 100% 100% 100% 83% 84% 82% 78% 81% 72% Computer Printer Router 50% 50% 51% Hub Security System Stereo Television Home Automation System Other 20% • Males are significantly more likely than females to have entertainment or household management functions integrated into their home network. For example, about 16% of males reported an integrated security system compared to only about 4% of females. • No other notable significant differences emerged based on demographics. 11% 10% 12% 8% 8% 7% 5% 5% 6% 3% 5% 0% 1% 2% 0% 0% • As might be expected given the immaturity of the market, most home networks consist primarily or solely of basic components—PCs, routers, hubs and printers. • Self-described innovators/early adopters are significantly more likely than members of other technology adoption segments to have a television connected to their home network, and/or substantial home automation functions. 40% 60% 80% 100% Total Primary Market Mass Market (Total n=238; Primary Market n=195; Mass Market n=67; Q42) 9 Home Networking Main Reasons for Ownership • Home networking is still driven primarily by practical concerns rather than an interest in entertainment or home automation options. 71% Share Internet Access Across PCs 76% • The desire to share Internet access remains the most popular reason for establishing a home network. 61% 17% Share Files Across PCs 11% 27% 7% Share Printer Access Across PCs 7% 7% 5% Other 6% 4% 0% 20% 40% 60% 80% 100% Total Primary Market Mass Market (Total n=238; Primary Market n=195; Mass Market n=67; Q41) 10 Home Networking Main Reasons Against Ownership • There is a perceived lack of need among the majority of those who don’t currently have a home network. This finding indicates a dearth of compelling bandwidth-hungry applications and/or the need for further consumer education about the benefits of home networking. 61% No Need 47% 70% 17% 24% 11% Cost 10% 10% 10% Complexity of Network Setup • By the same token, consumers with dial-up are significantly more likely than those with broadband to report a lack of need as the main reason they don’t have a home network (66% vs. 52%, respectively) 5% 7% 4% Uncertainty About Info. Source 3% 3% 3% Complexity of Tech Choices Other • Mass market consumers are significantly more likely than primary market consumers to cite lack of need as the primary reason they don’t have a home network (69% vs. 44%, respectively). • Other concerns, such as associated cost and the apparent complexity of set-up are relatively marginal issues. 3% 5% 1% 0% 20% 40% 60% 80% 100% Total Primary Market Mass Market (Total n=481; Primary Market n=255; Mass Market n=227; Q46) 11 Home Networking Home Networking: Future Opportunities • At this point, most home network owners appear content to pursue established home networking activities. • The area of home networking that may see the greatest growth is home automation. Only 5% of home network owners currently access home automation functions via their network, yet 29% have an interest in doing so in the next 12 months. • Interest in home automation was followed by interest in an Internet-linked home security system. Only 7% of home network owners have such a system today and 21% expressed an interest in using one in the next 12 months. • Other areas of interest include: recording broadcast TV programs on a PC to watch on a TV or PC at a later time (18%), viewing PC video on a TV (15%), accessing Internet streaming audio via a stereo system (14%), and accessing PC applications via an in-home portable device like a tablet PC (12%). 12 Home Networking Current Uses Current Uses 90% 92% 87% Share Internet Access Across PCs 81% 81% 82% Share Access to Peripherals 79% 79% 78% Share Electronic Files Across PCs 23% 25% 19% Listen to PC Music Files on Stereo Play Multi-player Games/Multiple Devices w/in House Access Internet Streaming Audio via Stereo 10% 10% 9% 0% 20% 7% 8% 4% Record TV Programs on PC 6% 9% 1% Access PC Applications via Inhome Portable Device 13% View PC Video on a TV Internet-linked Home Security Other 40% 5% 7% 3% Home Automation 22% 27% 10% 11% 7% 9% 12% 4% Play Online Games via a Game Console 60% Total Primary Market Mass Market (Total n=238; Primary Market n=195; Mass Market n=67; Q44) 80% 100% 4% 6% 1% 2% 2% 2% 0% 20% 40% 60% 80% 100% Total Primary Market Mass Market 13 Home Networking Future Uses Future Uses 29% Home Automation 43% 3% Internet-linked Home Security Record Broadcast TV on PC 21% 32% 1% 18% 27% 1% View PC Video on TV Access Internet Streaming Audio via Stereo Listen to PC Music Files on a Stereo 15% 20% 9% 10% 7% Play Multi-player Games/Multiple Devices w/in House 8% 11% 3% Play Online Games via Game Console 7% 10% 1% 4% 5% 3% Share Electronic Files Across PCs 4% 14% 20% Share Internet Access Across PCs 2% 2% 3% 13% 18% Other 1% 2% 0% 12% 18% Interest in None 3% 4% Access PC Apps via an In-Home Portable Device 0% 0% Share Access to Peripherals 55% 42% 81% 20% 40% 60% Total Primary Market Mass Market (Total n=238; Primary Market n=195; Mass Market n=67; Q44) 80% 100% 0% 20% 40% 60% 80% 100% Total Primary Market Mass Market 14 Home Networking Main Reason for Adoption 45% Improving Work Productivity at Home • Practical, work-related needs continue to be the primary driver of home network ownership, although more and more consumers are citing entertainment and household management needs as rationales. This trend bodes well for expanding the concept of home network to include functionality traditionally associated with consumer electronics and, in the case of household management, merely mechanical devices. • Primary market consumers are significantly more likely than mass market consumers to cite ‘streamlining routine household tasks’ as the main reason they’re interested in setting up a home network (26% vs. 16%, respectively). • Consumers with children at home appear to be more likely than those without children at home to report that ‘streamlining routine household tasks’ is the most compelling rationale for setting up a home network. 42% 50% 33% Expanding Entertainment Options 31% 34% 22% Streamlining Routine Household Tasks 26% 16% 0% 20% 40% 60% 80% 100% Total Primary Market Mass Market (Total n=353; Primary Market n=264; Mass Market n=116; Q52) 15 Home Networking Interests & Options As part of this study, we asked consumers to indicate which one of three types of home networks they preferred, if any. The three types we evaluated consisted of: Integrated Network Point-to-point networks--networks consisting largely of single room, discrete PC-to-device applications; Distributed networks—networks comprised of multi-room, ecosystemoriented applications; and Integrated networks—networks made up of multi-room, cross-ecosystem applications. Distributed Network Point-to-Point Network Each type of network represents an increasing level of sophistication. Our working hypothesis was that primary market consumers would gravitate toward distributed and integrated networks, while mass market consumers would lean toward point-to-point networks as a relatively low-risk means of enjoying some of the benefits of home networking. Primary market consumers did, indeed, tend to prefer distributed and integrated networks; however, mass market consumers expressed little interest in any type of network and those who did were divided in their preferences. 16 Home Networking Preferences Overall Appeal by Segments Mean Score 4.3 19% Total 4.4 22% 5.9 36% 3.3 8% 0% • Among key demographic groups, consumers aged 25-34years-old are significantly more likely than consumers 35years-old and older to rate any type of network highly. 6.4 45% Mass Market • High-income consumers—those with annual household incomes of $125,000 or more—are significantly more likely than consumers generally to find any of the network types strongly appealing. 5.8 33% Primary Market • As might be expected, mass market consumers expressed comparatively little interest in any type of home network. 4.2 18% 5% 3.0 6% 3.0 20% 40% 60% 80% • A plurality of primary market consumers (45%) have a strong preference for an integrated network over the alternatives. • Overall, consumers with children living at home appear to be more likely than those without children to favor an integrated home network. 100% Point-to-Point Network Distributed Network Integrated Network (Total n=1914; Primary Market n=1008; Mass Market n=907; Q59/Q60/Q61) 17 Home Networking Preferences Overall Appeal by Network Ownership Mean Score 37% 6.0 Owner 6.1 16% 4.1 15% 4.0 4.2 19% 0% 20% • Broadband users are significantly more likely than dial-up users to find any of the three types of home networks appealing. 5.9 39% 46% Non-Owner • A plurality of current home network owners find the concept of an integrated home network ‘very appealing.’ 40% 60% 80% 100% Point-to-Point Network Distributed Network Integrated Network (Owner n=238; Non-Owner n=1676; Q59/Q60/Q61) 18 Home Networking Preferences Likely Adoption by Segments • Among those interested in one or more types of home networks, a plurality would most likely adopt a distributed or integrated home network if cost were not an issue. 2% Total • The total addressable market (TAM) for each of the three types of home networks is small, consistent with the relative immaturity of the market overall. The TAM represents the maximum percentage of single-family, owner-occupied households in the U.S. that would take a strong interest in one of the three types of home networks. It assumes perfect awareness and distribution. 3% 5% 2% Primary Market 6% Estimated TAM 11% Segment Mass Market Point-to-Point Network Distributed Network Integrated Network 1% Total Market 2% 3% 5% 1% Primary Market 2% 6% 11 % 1% Mass Market 1% 1% 1% 0% 20% 40% 60% 80% 100% Point-to-Point Network Distributed Network Integrated Network (Total n=1914; Primary Market n=1008; Mass Market n=907; Q62/Q63/Q64) 19 Home Networking Preferences Likely Adoption by Network Ownership • Current home network owners tend to prefer the integrated home network option over the alternatives. • Consumers without home networks that found one or more of the home network concepts appealing are more divided than current home network owners in their preferences. 3% Owner 5% 13% 2% Non-Owner 2% 4% 0% 20% 40% 60% 80% 100% Point-to-Point Network Distributed Network Integrated Network (Owner n=238; Non-Owner n=1676; Q62/Q63/Q64) 20 Home Networking Preferences Integrated Networks Main Reason for Adoption by Segments 38% 37% Convenience/ Ease of Use Increased Security 3% 3% 0% Useful/Sounds Good 2% 3% 0% Share Technology 1% 2% 0% Increase Productivity 1% 2% 0% 56% 16% 16% 11% Cutting Edge Improve Working from Home Main Reason for Adoption by Segments 8% 8% 0% 7% 7% 11% Remote Access Appealing Streamline Current System 3% 4% 0% Multiple/Concurrent Net Connection Entertainment 3% 4% 0% Good Replacement Central Admin/ Device Control 3% 4% 0% Other 0% 20% 40% 60% Total Primary Market Mass Market (Total n=165; Primary Market n=192; Mass Market n=9; Q64A) 80% 100% 1% 1% 11% 0% 1% 0% 0% 11% 11% 11% 20% 40% 60% 80% 100% Total Primary Market Mass Market 21 Home Networking Preferences Integrated Networks Main Reason for Adoption by Network Ownership 38% Convenience/ Ease of Use 2% 27% Useful/Sounds Good 10% Improve Working from Home 7% Remote Access Appealing 7% Share Technology 8% Increase Productivity 7% Streamline Current 0% System Multiple/Concurrent Net Connection 5% 3% Entertainment 4% Increased Security 39% Cutting Edge Good Replacement 4% Central Admin/ Device Control Main Reason for Adoption by Network Ownership 6% 4% 1% 1% 1% 0% 2% 0% 2% 0% 1% Other 2% 0% 3% 15% 20% 40% 60% Owner Non-Owner (Total n=165; Primary Market n=192; Mass Market n=9; Q64A) 80% 100% 0% 20% 40% 60% 80% 100% Owner Non-Owner 22 Home Networking Preferences Integrated Networks Main Reason Against Adoption by Segments 49% 51% 44% Don’t Need/ No Interest 21% 25% 15% Too Expensive/Cost 8% 4% Sounds Too Complicated 15% 5% Not Enough 1% Time/Too Busy Other Home Issues • Among consumers initially interested in an integrated home network, about half cited a lack of need or interest as their main reason for saying they wouldn’t ultimately adopt one, even if price weren’t an issue. As in the case of the distributed network, this finding points up the limitations of consumers’ current perspectives on home networking. With the possible exception of the entertainment ecosystem, the three ecosystems of interest aren’t sufficiently mature enough for consumers to understand the benefit of connecting them. Our working hypothesis is that only after the ecosystems, particularly, the family ecosystem, are firmly established, will most consumers begin to consider the possibilities inherent in bridging them. 11% 3% 4% 0% Current System 2% Sufficient 1% 4% Other 0% 12% 12% 11% 20% 40% 60% 80% 100% Total Primary Market Mass Market (Total n=87; Primary Market n=68; Mass Market n=27; Q64C) 23 Home Networking Preferences Integrated Networks Appeal of Hub Devices by Segments Mean Score 73% Total 6.3 39% 5.3 26% 79% Primary Market 5.6 31% 7.6 50% 5.0 23% 4.0 6% 0% 8.5 6.5 43% Mass Market 8.4 • By far, consumers would prefer to see a home computer or server as the central ‘brains’ behind an integrated network over an interactive entertainment system (essentially, a sophisticated videogame platform) or an advanced set-top box. 20% 40% 60% 80% 100% Home Computer Interactive Entertainment System Set-top Box (Total n=307; Primary Market n=310; Mass Market n=48; Q75) 24 Home Networking Preferences Integrated Networks Maximum Acceptable Costs $0 - $100 $101 - $200 $201 - $300 $301 - $400 $401 - $500 $501 - $750 $751 - $1,000 $1,001 - $1,250 $1,251 - $1,500 $1,501 - $2,000 $2,001 - $3,000 $3,000+ MEAN (Q77, * Denotes statistically significant differences.) Total Segment Primary Market Mass Market (n=307) (n=310) (n=48) 16% 7% 10% 4% 14% 7% 15% 2% 6% 7% 5% 7% $1,226 14% 8% 9% 4% 13% 8% * 15% 2% 5% 8% * 6% 7% $1,346 25% 4% 15% 2% 21% 2% 17% 2% 6% 2% 0% 4% $720 • In the final analysis, primary market consumers are willing to pay, on average (mean), about 53% more than mass market consumers for an integrated network. • Network sophistication appears to be correlated with dollar value. Consumers are willing to pay, on average (mean), about 43% more for a distributed network than for a point-to-point network and about 22% more for an integrated network than a distributed network. • This pattern indicates that a fullyfeatured connected home would generate, on average (mean), maximum acceptable costs of less than $1,495. 25 Internet Home Alliance Ecosystem Framework Home Career VoIP Phone Distributed Audio Notebook Multifunction Printer Personal Internet PVR/STB Television Gaming Media Center PC Home Theater Notebook Hotspots Home Video Cell Phone Audio Players Automotive Mobile Gaming Entertainment Broadband Access Web Camera HVAC Mobile Web-based Services Cellular Network Bridge Security System White Goods Small Appliances Family 26 Family Ecosystem: Consumer Interests Chores Chore Interests Total Market Rank / Top-3 Box Primary Market Rank / Top-3 Box Paying HH bills 1 (32%) 1 (53%) Vacuuming 2 (22%) 2 (36%) Drying Clothes 3 (21%) 3 (36%) Washing Dishes 4 (20%) 6 (33%) Washing Clothes 5 (20%) 4 (36%) Grocery Shopping 6 (19%) 5 (35%) Learning about Community Events 7 (18%) 9 (30%) Mowing Lawn 8 (17%) 10 (29%) Communicating w/HH Members 9 (17%) 8 (31%) Making Grocery Lists 10 (17%) 7 (33%) • Overall interest in streamlining routine household tasks: 19% (total); 36% (primary market); and 7% (mass market). 27 Family Ecosystem: Consumer Interests Home Systems Total Market Rank / Top-3 Box Primary Market Rank / Top-3 Box HVAC 1 (20%) 1 (40%) Outdoor Lighting 2 (19%) 2 (36%) Indoor Lighting 3 (16%) 3 (34%) Pool/Components 3 (15%) 4 (20%) In-ground Sprinkler System 5 (12%) 5 (21%) Indoor Video/ Webcam 6 (9%) 6 (18%) Outdoor Video/Webcam 7 (9%) 7 (18%) Home Systems Interests • Overall interest in home automation: 15% (total); 34% (primary market); and 2% (mass market). • Mean scores (on scale from ‘0’ to ’10’) for first three home automation options positive (6.4 to 6.0) among primary market consumers. All others neutral to negative (5.0 or below). 28 Family Ecosystem: Consumer Interests Family Calendar Example Yahoo! Calendar Adoption • Yahoo! Calendar is a full-featured, Web-based personal calendar available free of charge to registered Yahoo! users. With Yahoo! Calendar, you have convenient access to a userfriendly contact and meeting management service anywhere from any device with a connection to the Internet, including PCs, PDAs, and mobile phones. SEGMENTS Total (n=640) 10% Primary Market (n=329) Mass Market (n=311) 15% • Among all of the family ecosystem products/ services tested, this one garnered the highest estimated take-rate—10%. 6% NETWORK OWNERSHIP Owner (n=102) Non-Owner (n=536) • Interestingly, 21% of those who indicated they will probably or definitely use the service reported that they already do so. 13% 9% • Consumers with children at home appear to be more likely to adopt this service than those without children at home. For instance, about 19% of single-parents with children are likely to use this service compared to only 8% of singles without children. NETWORK SOPHISTICATION Basic (n=23) Advanced (n=43) Expert (n=36) 0% 10% 15% • The most popular rationale for using the service is the fact that it’s free (37%). 12% 20% 40% 60% 80% 100% • About one-in-two unlikely users cited they had no interest or need for the service (50%). Another 35% said they already use an electronic calendar of some kind. Relatively few mentioned security as a concern (8%). (Q87) 29 Career Ecosystem: Consumer Interests Total Market Rank / Top-3 Box Primary Market Rank / Top-3 Box Communication: Family/Friends 1 (30%) 1 (44%) Remote Access: Business Email 2 (28%) 2 (40%) Remote Access: Co. Files 3 (26%) 3 (36%) Career Training 4 (22%) 6 (29%) Scheduling: Family/Friends 5 (21%) 4 (31%) Com: Colleagues/ Clients 6 (20%) 5 (31%) Dynamic Commuting 7 (20%) 9 (23%) Group Collaboration 8 (17%) 7 (27%) Scheduling: Colleagues/Clients 9 (16%) 8 (24%) Public Transit ETA 10 (9%) 10 (13%) Career Interests • Overall interest in improving work productivity at home: 15% (total); 25% (primary market); and 8% (mass market). • Overall interest in improving work productivity on the road: 11% (total); 18% (primary market); and 5% (mass market). 30 Entertainment Ecosystem: Consumer Interests Media Interests Total Market Rank / Top-3 Box Primary Market Rank / Top-3 Box Broadcast TV 1 (40%) 1 (51%) Theatrical Movies 2 (31%) 2 (42%) Recorded Music 3 (30%) 3 (35%) Personal Home Photos 4 (23%) 6 (28%) Radio Broadcast Music 5 (22%) 4 (26%) Personal/Home Video 6 (16%) 5 (20%) Radio Broadcast Talk 7 (15%) 9 (15%) Books on Tape 8 (12%) 7 (14%) Console Games 9 (9%) 8 (14%) Online Games 10 (6%) 10 (8%) Media Interests • Overall interest in home media entertainment: 30% (total); 46% (primary market); and 19% (mass market). 31 Consumer Opportunities Career Automobile Server Application Sharing WiFi Phones 2007 2005 Appliance Monitoring Wireless LAN Live Distance Learning Internet Enhanced Education Smart Appliance Inventory Mngmnt 2003 Classroom Blackberry Training Security System Lighting Control HVAC Program. Thermostat Energy Management Mobile Players Metabolism Monitoring Personalized Medication Movie Downloads Music Subscriptions Media Music Downloads Bridges Online PC Gaming Communicating Thermostat VOD PVRs Gaming Consoles Health Advice Digital TVs DVD P2P PC Office Visits HDTV Home Theater Big Screen TV Appliances Security Monitoring Video Conferencing VoIP Web Telematics Conferencing Instant CBT Messaging Training Online Grocers RFID Tagging Mealtime Voice Office Dynamic Routing Online Gaming Home Media Server Network PVR Home Jukebox Network Music Library Telemedicine 32