Measuring GDP and Economic Growth

advertisement

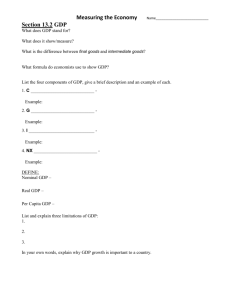

Measuring GDP and Economic Growth Two Ways of Measuring GDP • GDP is a measure of both output and income. Thus, there are two ways it can be measured. • GDP can be derived by totaling the expenditures on final-user goods and services produced during the year. This is called the expenditure approach. • Alternatively, GDP can be calculated by summing the income payments to the resource suppliers and the indirect cost of producing the goods and services. This is called the income approach. Expenditure Approach • Expenditure Approach: • GDP is the sum of expenditures on final-user goods and services purchased by households, investors, governments, and foreigners. • When calculated by this method, there are four components of GDP: • personal consumption purchases “C” • gross private investment “I” (including inventories) • government purchases “G” (consumption and investment) • net exports (exports minus imports) “Nx” Income Approach • GDP is the sum of costs incurred and income (including profits) generated by the production of goods and services during the period. • The direct cost income components of GDP: • employee compensation • self-employment income • rents • interest • corporate profits The SUM of these measurements is called: National Income Making Expenditures and Income Equal We add back to National Income: • Indirect business taxes: Taxes that increase the firm’s production costs and therefore final prices. • Depreciation: The cost of wear and tear on the machines and other capital assets used to produce goods and services. • Net Income of Foreigners: The income that foreigners earn producing goods within the borders of the U.S. minus the income Americans earn abroad. Real and Nominal GDP • The term "real" means adjusted for inflation. • Price indexes are use to adjust income and output data for the effects of inflation. • A price index measures the cost of purchasing a market basket (or “bundle”) of goods at a point in time relative to the cost of purchasing the same market basket during an earlier reference (or base) period. Key Price Indexes • 1. Consumer Price Index An established “market basket” of typical goods and services is periodically measured to track changes in prices. This measurement becomes known as the “Price Level.” (PL) (more on this one later) • 2. GDP Deflator Measures changes in the average price of the market basket of goods included in all of GDP. The GDP deflator is a broader price index than the CPI. Using an Index Inflation Rate = this year’s index – last year’s index X 100 last year’s index Real GDP Per Capita • aka “Per Capita Output” • Formula: – Real GDP ÷ Population – Per Capita GDP is an important measure of Standard of Living (SoL) – Note that this formula acts as a ratio: nations can increase SoL by increasing Real GDP or by reducing the rate of population growth relative to Real GDP Rule of 70 • The Rule of 70 is a “doubling rule.” It allows us to determine, given a constant rate of growth, how long it will take any variable to double. • It is statistically useful but not mathematically precise. • To use, divide the percentage rate of growth into 70. The result is the amount of time it will take to double the variable. • e.g., If a population grows at a rate of 2 percent per year, how long will it take that population to double in size? The Business Cycle Business Cycle Recovery How Do Know Where We Are in the Business Cycle? • Economic Indicators – Leading: Tend to predict economic trends. These indicators change before the business cycle changes. e.g., stock market decline, new orders for consumer /capital goods, initial claims for unemployment, building permits for houses – Coincident: Occur alongside the trend. e.g., retail sales, current GDP and Personal Income – Lagging: Follows changes that have already occurred in the economy. e.g., unemployment, official declaration of recession (two consecutive negative quarters of GDP) Which Areas Are Most Affected by Recession? • Investment: During a recession, business are reluctant to purchase equipment, expand factories and build new homes. Net investment can even be negative, as firms “make do” with old capital. • Capital /Durable Goods: Firms and households put off large purchases. • Service/nondurable goods: Necessities tend to survive recessions with less downturn. Unemployment • I. Measuring Unemployment – Unemployment Rate = unemployed civilian labor force X 100 Who is not counted in the unemployment numbers: people who have given up (discouraged worker) people not in labor force by choice In addition, we count someone who is employed part-time as being employed, thus the official unemployment percentage probably understates unemployment. January 2010 Official Unemployment: 10 percent “Real Unemployment” Likely closer to 17 percent II. Unemployment by Educational Attainment December 2010 Bureau of Labor Statistics • • • • High School dropout: 15.3 percent High School diploma only: 9.8 percent Some college /associate’s degree: 8.1 percent Bachelor’s or higher 4.8 percent • Teenage (16-19) 25 percent III. Types of Unemployment • Cyclical: Moves with the Business Cycle; most recessionary unemployment is cyclical and mostly returns with expansion. • Frictional: Movement from one job to another; unemployment by choice • Structural: Permanent job loss; as skills become outdated, outsourced or replaced by technology.