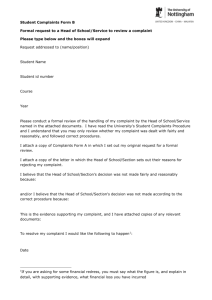

Tennessee State Board of Accountancy

advertisement

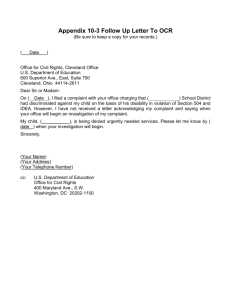

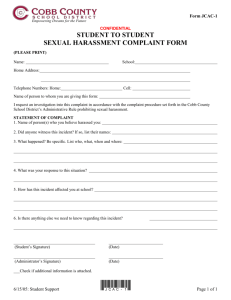

Ethics for the Tennessee CPA A Presentation for the National Association of State Auditors, Comptrollers & Treasurers Don Mills, CPA, CFE, CFF TNSBA Investigator 1 20 Questions Where did these 20 questions come from? ◦ Attendees at our previous seminars ◦ Calls from our licensees ◦ Problem areas in compliance 2 What is “the Board”? Eleven Members – Appointed by Governor Serve Terms of 3 Years Nine are CPAs One is Attorney One is Public Member Meets Quarterly- usually in January, May, July and October 3 Current Members of the Board • William Blaufuss, CPA, Chairman.– Nashville • Don Royston, CPA,Vice-Chair – Kingsport • Henry Hoss, CPA, Secretary – Chattanooga • Vic Alexander, CPA – Nashville • Gay Moon, CPA – Nashville • Jennifer Brundige, JD – Nashville, Public Member • Stephen Eldridge, CPA – Jackson • John Roberts, Attorney-at-Law – Nashville, Attorney Member • Charlene Spiceland, CPA – Memphis • Casey Stuart, CPA– Chattanooga • Trey Watkins, CPA– Memphis 4 How many CPAs are there in Tennessee? 5 CPAs in Tennessee Status April 2015 Active 10,407 Inactive 4,127 Closed 2,962 Probation/Suspended 4 Revoked 56 Retired 1,063 Delinquent 194 Expired 2,314 Deceased 2,695 Other 414 Total Licenses 24,236 6 What Are the Requirements to Maintain a License in Good Standing? Status Pay License Renewal Fee Complete CPE Professional Privilege Tax Active Inactive Retired (55 yrs+) Retired Over 65 Closed No – But Must Return Wall Certificate 7 License Status – Bad (Not In Good Standing) Expired-Grace Expired Probation Suspended Revoked 8 How do I know when to renew? • The expiration date is listed on the license itself. • Odd-numbered licenses renew in odd years. • Even-numbered licenses renew in even years. • The Board sends a courtesy reminder postcard each October. 9 Can you explain the CPE requirements one more time? • All Licensees Holding Active License • 80 Approved Hours every two years – add 8 penalty hours if you don’t • 40 Technical Hours (A&A, Taxes, Ethics & Management Advisory) ◦ 2 Hours State Specific Ethics • Minimum of 20 Hours Each Year – add 8 penalty hours if you don’t • Special Areas: • Attest Services – 20 Hours A&A • Expert Witness Services – 20 Hours in Area • If you are short on Technical or Ethics hours but have your 80 hours, make them up without penalty. 10 Is Carry Over CPE worth the headache? Limited to 24 Hours Carries over as “Other” hours Cannot be used to meet 20-hour minimum Must have actually completed more than 80 hours in the preceding reporting period Carryover hours will never increase your total to more than 80 hours. 11 Example of Carryover CPE Reporting Period 1 Reporting Period 2 Reporting Period 3 Year 1: earned 30 hours Year 2: earned 60 hours Year 1: earned 20 hours Year 2: earned 52 hours Total of 90 hours in the reporting period Total of 72 hours in reporting period No carryover available because no extra hours earned in Period 2 10 extra hours earned Carry forward 8 hours from Period 1 to make up deficiency 12 It’s December 31st and I don’t have enough CPE. What can I do? • • • First – Renew your license. Answer “no” to the CPE question. Do not make things worse by practicing on a expired-grace license and accruing late fees. Then get busy and finish your hours along with the “penalty hours”. Or: • Change License to Inactive or Retired • Close License and return wall certificate • Request an Extension of time (max 6 months) and have a really good reason. Extension must be requested before license expires. 13 What about CPE for reinstatement and reactivation? Reactivate: 1. 2. 3. You must have a viable license (Inactive, Retired or Closed) Complete 80 hours of technical CPE within 24 months of reactivation. This CPE counts toward your renewal hours. Pay a $110 fee. 14 What about CPE for reinstatement and reactivation? Reinstate: 1. 2. 3. 4. You do not have a viable license (Expired) Request a Reactivation application from Board staff. Complete 80 hours of technical CPE within 6 months of your request for reinstatement. These are penalty hours and do not count towards renewal Pay a $250 penalty. 15 Any other rule changes I need to know about? 1. 2. 3. 4. License Renewal Fee—Lowered from $120.00 to $110.00 The Board has no jurisdiction over fee disputes between a licensee and a client. Activities of Inactive Licensees Department of Revenue and unpaid Privilege Tax. 16 I have a client who is leaving… ...and wants me to provide an electronic copy of his Quickbooks file to his new accountant. Can I send a paper copy instead? 17 If the client has made satisfactory arrangements for payment for services rendered, you must provide a copy of the licensee’s working papers “to the extent that such working papers include records which would ordinarily constitute part of the client’s books and records and are not otherwise available to the client”. Rule 0020-03-.11(1)(c). The rule does not address the form in which these working papers must be provided. 18 I work in private industry but volunteer my time … ...at a nonprofit agency where I perform basic bookkeeping services. I do not prepare financial statements. Do I need a firm permit? 19 No – as long as the licensee does not make management decisions for the agency. 20 What name can I use for a new firm? If you apply for a firm permit using a fictitious name, the Board may decide the name is misleading if: a. b. c. d. e. f. g. It implies the existence of a legal entity when it is not. It is similar to or the same as existing fictitious names. The name tends to mislead regarding the nature of the business. It includes the name of an individual whose license has been suspended or revoked. The name contains more than 1 fictitious name. It includes the name of a person who is neither a present or past member of the firm. It includes the name of a person who is not a CPA if the term CPAs is used. 21 When is Peer Review Required? • Tennessee requires peer review for any firm that performs the attest function. • Tennessee defines the attest function to include compilations. • Only engagements conducted under SSARS #21 may be excluded from the requirement. (Be careful, this is a high risk area) • Notice to the Board of change in a firm’s requirement for peer review is required 22 Can you define “Attest” as it relates to peer review? • Any audit or other engagement performed in accordance with the Statements on Auditing Standards (SAS) • Any review performed in accordance with the Statements on Standards for Accounting and Review Services (SSARS) • Any examination performed in accordance with the Statements on Standards for Attestation Engagements (SSAE) • The issuance of any report, including compilation reports, prescribed by the SASs, the SSARSs, or the SSAEs on any services 23 How many complaints does the Board receive in a year? 24 Complaint History 25 Who files a complaint? ◦ Licensees ◦ Your (former) clients ◦ The Board ◦ State and Federal Agencies 26 What is each step in the complaint process? 27 The Complaint Process – Initiation After receipt of a complaint, the Executive Director must determine: ◦ Does the TNSBA have jurisdiction? ◦ Is there a violation of the Law and Rules? If a violation appears to have taken place, the director must reference the appropriate Statute and/or Rule in the notice of the complaint that is sent to the Respondent. The notice of the complaint, which includes a copy of the complaint, is sent via certified mail and regular mail 28 The Complaint Process - Response The individual receives a copy of Complaint along with a letter referencing the section of the Law and Rules allegedly violated The individual must respond to TNSBA regarding the complaint ◦ The response must be received within 14 days of receipt of the complaint ◦ The response must be in writing. ◦ The response may include any supporting documents deemed pertinent The response is a matter of public record and it is Board practice to send the response to the Complainant, if known 29 The Complaint Process – Legal The Complaint File is sent to the Board Attorney who may: ◦ ◦ ◦ ◦ Request an Investigation Recommend disciplinary action to the Board Dismiss the complaint Issue a Cease and Desist Order If an Investigation is requested: ◦ The Investigator may obtain a written affidavit from the Complainant and the Respondent ◦ The Investigator prepares a report, along with all working papers, that is transmitted to the Board Attorney 30 The Complaint Process – Investigation If an Investigation is requested: ◦ The Investigator may perform the following: Obtain a written affidavit from the Complainant and the Respondent, as well as other parties as needed Perform a working paper review of all relevant data Research sources for precedent and standards; eg.,Yellow Book, SAS, SSARS, GAGAS A roster and file search for information regarding the Respondent’s license status, prior disciplinary actions, licenses held in other states Web search for advertising by Respondent, possible newspaper articles ◦ The Investigator may expand the scope of the investigation based on subsequent discovery ◦ The Investigator prepares a report, along with all working papers, that is transmitted to the Board Attorney 31 The Complaint Process – Presentation The Board Attorney presents all completed cases, along with a recommendation for disposition of each case, to the Enforcement Committee Each case presented to the Board has no licensee identifying information (just a number, not a name) Board will rule on disposition of complaint and notify both complainant and respondent 32 What is the #1 question asked by CPAs during a complaint investigation? 33 Are you going to make me take the exam again? 34 What are the most common complaints received by the Board? 35 2008-2014 Violations AICPA Code of Professional Conduct Breach of Fiduciary Responsibilities Client Records Communication Competence Conduct Unbecoming a Professional Confidential Client Information CPE Discreditable Acts Dishonesty Due Professional Care Failure to Complete Engagement Failure to File Taxes Felony Conviction Fraud Gross Misconduct Gross Negligence Independence Integrity License Issues Other State Revocation Peer Review Professional Privilege Tax Revocation Unlicensed Activity Violation of Consent Order 5 8 14 6 1 8 4 57 30 1 16 1 11 2 12 2 2 1 3 3 77 14 68 23 232 4 0.86% 1.37% 2.40% 1.03% 0.17% 1.37% 0.69% 9.78% 5.15% 0.17% 2.74% 0.17% 1.89% 0.34% 2.06% 0.34% 0.34% 0.17% 0.51% 0.51% 13.21% 2.40% 11.66% 0.17% 39.79% 0.69% 36 What actions can the Board take concerning a complaint? 37 Possible Board Actions Dismissal Letters Consent Orders • Civil Penalties • Additional CPE or Peer Review • Probation • Suspension • Revocation • Informal Conference • Formal Conference (Hearing) • • • 38 Board Action 2008-2014 39 What about Mobility from Tennessee to another state? The newest tool in mobility can be found at: • CPAmobility.org Lets see how easy it is. 40 41 Can we have more case studies? 42 Yes – and today you get to be the Board. 43 THE COMPLAINT The complaint stated that the Respondent, a nonlicensee, was using the name “Memphis CPA Group”. The name was registered with the Secretary of State and used on a LinkedIn accountant. 44 THE STORY When the non licensed owner was confronted regarding the use of the CPA credential, he stated that: 1. There used to be owners who were CPAs, and; 2. He was trying to pass the CPA exam. 45 Unlicensed Activity Disposition: You are the Board – What action should be taken? 1. Dismiss. 2. Letter of warning. 3. Consent Order requiring removal of the CPA designation. 4. Civil penalty of $5000. 5. Other? 46 THE COMPLAINT The Licensee was offering consulting services on a social network without an active license. 47 THE STORY The Licensee had elected to take the status of “Retired”, having reached the age of 70 (old law). This status allowed him to pay no renewal fees and waive the CPE requirement. One of the conditions of the “retired” status is that one cannot perform any accounting services. Consulting services is considered to be an accounting service. 48 Prohibited Activity Disposition: You are the Board – What action should be taken? 1. Dismiss. 2. Letter of warning. 3. Reactivate the Respondent’s license and then revoke it. 4. Civil penalty of $500. 5. Other? 49 THE COMPLAINT The Respondent was the CFO of an investment company that ran a Ponzi scheme until it collapsed, resulting in $18 Million dollars in losses to “investors”. The Respondent pleaded guilty to securities fraud, money laundering, and conspiracy to commit securities fraud, wire fraud and mail fraud. 50 THE STORY When the Investigator visited the Respondent’s last known address, he was informed that the Respondent had already reported to prison. 51 Conviction of a Felony Disposition: You are the Board – What action should be taken? 1. Take no action until the Respondent is paroled. 2. Convene a Formal Hearing for revocation of the CPA’s license in absentia. 3. Consent Order requiring the voluntary revocation of the CPA’s license. 4. Civil penalty of $18 Million. 5. Other? 52 Hope you enjoyed our 20 questions – we need 20 more Contact Information ◦ Phone: 888-453-6150 or 615-741-2550 ◦ Fax: 615-532-8800 ◦ Web: tn.gov/regboards/tnsba ◦ E-Mail: TNSBA web page has direct contact information for all Board Members and Staff Members 53