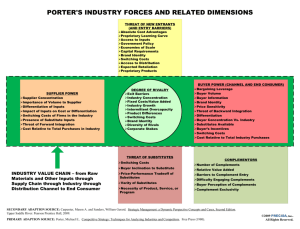

The guts of a GUT: Elements of a Grand Unified Theory of Growth

advertisement

The guts of a GUT: Elements of a Grand Unified Theory of Growth Lant Pritchett LACEA November 12th, 2010 Outline of the presentation • What is growth theory a theory of? The four facts a growth theory should explain • Growth phases and phase transitions versus a single linear equation of motion • “Institutions”: general or specific? • Equations of motion for “institutions” a la Hirschman: “unbalanced growth” through “backward linkages” in institutions Four Facts about Growth • Small group of countries with sustained, nonaccelerating, stable growth of 1.8-2.0 ppa producing very high levels of output. • Small group of countries very near subsistence (hence long-run growth near zero) • Small group of countries with very rapid growth over extended periods • Growth rates lack persistence over time—very low correlation of growth from one period to the next—growth is (mostly) an episodic condition (not a characteristic) First Fact: Long-run stability in growth among now leaders • The growth rate 1870 to 2003 of the 16 leading countries is 1.89 ppa with std dev across countries of only .33 • Predicting US GDP per capita in 2003 using only data from 1870 through 1907 and the simplest possible linear trend in natural logs produces a forecast off by 2 percent ( 29,037 actual versus 28,242 predicted GK 1990 dollars) • Median forecast error for 70 year ahead prediction of all leading countries from pre-depression data is 3.9 percent! • The median acceleration of these 16 countries from 18901915 versus 1980-2003 is only .14 ppa • High levels of per capita output produced by moderate, sustained, stable, non-accelerating growth. Long-run stability: example of US (Cover of Jones’s book on growth) Same figure, Denmark Predict 2003 levels—≈100 years ahead—almost perfectly Data 1890-1901 to estimate a trend Fact II: Small number of countries very near subsistence (hence zero long-run growth) • Can infer growth from level if you are willing to assume a minimum level of output—the “Adam and Eve” level • The maximum growth could have been over any period is the growth that takes you from “Adam and Eve” at the beginning to the current observed level. • Countries still near “Adam and Eve” levels implies slow growth—often very slow growth. • Conversely one can ask when the leaders were at the currently observed levels Poorest countries in Maddison data (GK 1990 $) have cumulatively very slow growth Country GDP per capita in 2003, GK 1990 units (Maddison 2007) Maximum growth rate since 1870 (minimum=450) Zaire (DRC) 212 -0.57% Burundi 477 0.04% Central African Republic 511 0.10% Niger 518 0.11% Sierra Leone 579 0.19% Eritrea and Ethiopia 595 0.21% Guinea 601 0.22% Tanzania 610 0.23% Afghanistan 668 0.30% Zambia 689 0.32% Haiti 740 0.37% Mapping current income into modern economic history (post 1820) Mapping the poorest countries into pre-modern history Peace of Westphalia 1648 Fact III: A small number of countries have grown 27 (or more) years at very rapid rates—2 to 3 times higher than the historical pace of the leaders Fastest 27 year episode in the recent (post 1950) data JPN East Asia 1950 7.54% BWA Africa 1963 7.29% CHI East Asia 1980 7.16% TWN East Asia 1961 7.05% KOR East Asia 1970 6.74% HKG East Asia 1960 6.29% SGP East Asia 1963 6.19% THA East Asia 1970 5.42% MYS East Asia 1958 5.02% BRA Latin America 1953 4.94% IDN East Asia 1965 4.71% COG Africa 1960 4.51% VNM East Asia 1980 4.48% Extended rapid growth episodes are concentrated in two regions (East Asia and Europe) Of the 21 fastest 27 year growth episodes in the PWT6.3 data: 10 are East Asia: Japan, China, Taiwan, Korea, Hong Kong, Singapore, Thailand, Malaysia, Indonesia, Vietnam 8 are European (ish): Romania, Greece, Spain, Portugal, Ireland, Austria, Italy, Israel (European ARS) Only exceptions: Botswana, Brazil, Congo (?! go figure) Fact IV: Economic growth is (mostly) a condition of countries, not a characteristic • Characteristics are relatively stable empirical features—being left-handed, being tall (for people), having coast-line, speaking Spanish (for countries). • Conditions are relatively impermanent empirical features—having a cold, being hungry (for people), having just won the World Cup, having recently had an earthquake (for countries). • Characteristics have high persistence and high intertemporal correlations (the left handed are left handed), conditions have low persistence and low inter-temporal correlations (people with colds are not “the colds”). R-Squared of growth on past growth Per capita growth is condition-like—R-squared of current growth on past growth is .05 at 5 year horizons and less than .13 even at 25 year horizons–in contrast population growth is a characteristic-like 0.800 0.700 0.600 0.500 growth, gdp per capita 0.400 growth, population 0.300 0.200 0.100 0.000 5 10 15 20 Horizon (n) of t+n on t-n 25 World distribution of N year growth rates across countries Proportion Of periods in Growth range Low growth Country What a “growth as Characteristic” world would look like Medium growth Country High growth Country World Distribution 0 2 4 Growth Rate Growth as a condition—countries change growth rates and span the possible range of growth experiences Medium growth country which Spends more time in rapid growth and in slow growth than the world Distribution of episodes World Distribution Ghana—has more episodes of superrapid growth and of negative growth than the world distribution More time in negative growth More time in rapid growth How leaders grow—centered in the middle (e.g. Great Britain) No negative No rapid What stars look like…Singapore with lots of very rapid and no negative (pretty characteristic-like growth) What a consistently slow grower looks like (Niger) But countries with the exactly same growth rate have very different distributions—Colombia, overall 1.9 ppa—concentrated Chile—growth of 2.1 ppa—but with more bust and more boom— roughly the world’s experience Brazil—overall 2.6 ppa—more boom, not so much bust, more stagnation Congo—grew “faster” (2.4 ppa) than Colombia or Chile—but most time was either boom or bust What “the same” growth looks like Encompassing theory to explain all four facts • Set of leading countries with steady growth around 2 ppa as an “absorbing” state • Set of lagging countries with growth near zero (for a very long time)—(some consistently, others booms followed by busts) • Set of countries with rapid growth (at least twice historical pace of leaders) for extended periods • Lots of countries doing all of the above (negative and zero and moderate and rapid growth) back and forth in episodic fashion (e.g. discrete looking starts and stops)—averaged out to near non-converging growth on the leaders Big problem with a “unified” theory of growth • “Institutions” are an important, causal, driver of levels of income (AJRobinson, Hall and Jones)—which we can identify because institutions have long persistence • “Institutions Rule” in that they are claimed to drive out “policy” (e.g. Rodrik, Subramanian, and Trebbi, Easterly and Levine, AJRobinsonT) • “Growth has low persistence” (Easterly et al.) • “Growth is episodic” with discrete starts and stops (Ben David and Papell, Pritchett) • Accelerations and decelerations of growth are common (Hausmann, et. al.) are common, even among poor countries (Jones and Olken) Measured rankings of aggregated components of quality of “institutions” tend to be very stable Bureaucratic Quality Corruption Law and Order 0.80 0.71 0.77 198596 0.82 0.70 0.64 199709 0.78 0.70 0.81 198509 0.62 0.58 0.58 0.60 R-2 of current on past Indicator from ICRG Five year periods 0.50 0.40 0.30 0.20 0.10 0.00 Democratic Accountability 0.72 0.65 0.70 0.51 Horizon (years) Socioeconomic Risk 0.67 0.47 0.73 0.63 "Institutions" Grow th 5 12 Damn. Its both. What a single growth model (esp. single linear equation of motion) cannot do • Most “determinants” of growth are characteristics (e.g. having a coast, good “institutions”) have very high persistence, but growth has low persistence • Related, most growth equations cannot predict the onset of episodes of either growth accelerations or growth decelerations (Hausmann, Pritchett, Rodrik) • The magnitudes of growth dynamics are all out of whack with typical “micro” estimates—much larger total level “impacts” than would be predicted. • Parameter instability is a specification test—and regressions fail • Standard growth models are getting worse as more and more is “TFP”—the residual • Cannot distinguish between covariates that have impact “within state” versus variables associated with higher/lower growth state transitions—e.g. do “institutions” play a role within states or with transitions across states? The problem We now have a growth empirics (and some accompanying theories) that explains everything except precisely what we wanted a theory and empirics for—to tell us how to accelerate growth rates In waterfalls, water…well, it falls …except when it doesn’t: water has had a phase transition to ice Simple “states and transitions” simulations with chosen transition probabilities and constant within state growth dynamics can mimic all growth facts Collapse Stagnation Moderate Rapid gc(..) gS(..) gM(..) gR(..) πCC(..) πCS(..) πCM(..) πCR(..) πSC(..) πSS(..) πSM(..) πSR(..) πMC(..) πMS(..) πMM(..) πMR(..) πRC(..) πRS(..) πRM(..) πRR(..) Notation: πRC(..)—probability of transition from Rapid to Collapse, gi(..)—within state growth dynamics Two needs for a GUT of Growth • A “states and transitions” model that can explain phase transitions across growth states (e.g. from stagnation to boom, from boom to crisis)—and why some countries but not others stay in growth booms. • An equation of motion of “institutions”— how do “institutions” evolve to explain the four big facts of growth? “Institutions”: General or Specific? • While there are demonstrable general differences between countries in the overall quality of institutions, there are also huge variances of institutions within countries • The “quality” of the institutional environment as it affects specific industries (and/or firms) varies— the “institutions” for tea versus textiles versus pharmaceuticals • Moreover, with weak institutions there is huge variances across firms—the “policy action” that is the results from the application of the policy depends on how it is chosen Do the rules matter more or less than deals? More variance across firms than across countries “Favored” versus “Disfavored” firms have massively different experience—even with the same rules • Comparing Doing Business indicators of three different indicators from the Enterprise Surveys (e.g. days to get a construction permit, days to get an operating license, days to clear customs) • Massive differences between the DB estimates and ES estimates in general • Massive differences across firms—up to a year between 10th and 90th percentile in time to get construction permits Same country: Peru 90th percentile a year DB 210 days 10th percentile 9 days Three levers to explain the world • A “product space” with products arrayed conceptually according to the extent to which their “capability” or “functionality” inputs are similar • The “receptivity” with which sector/firm performance translates into increased public action to augment capability • The specificity of the “acceptable ask” in receptivity—person/firm specific to economywide (an element of politics which is “institutionally” constrained (or not)). An empirical product space (goods arrayed by how likely they are to be co-exported) A simplified, conceptual product space arrayed by the similarity of “public action” inputs (laws, regulations, infrastructure, skills, etc.) Cluster of activities with similar Public action inputs An industry produces when its “intrinsic” profitability (determined by technology, endowments, world prices) plus contribution of public inputs exceeds a threshold—once in production it climbs up towards the potential Cluster of activities with similar Public action inputs So far, this is “Monkeys and Trees”—The second lever is the receptivity is how the public inputs respond to production--first in height Firms/industries who are producing use some of their revenue/profits to ask for additional public actions---better regulation, protection, specific inputs, tax breaks Cluster of activities with similar Public action inputs The third element is the “acceptable ask”—what is it that a firm/industry can lobby for? Possibilities? The third element is the “acceptable ask”—what is it that a firm/industry can lobby for? Only level playing field—government is responsive, in principle, but only for “all actors” actions Moderate spillovers (to neighbors in this product space) Firm/industry specific ask—which could include harming (lowering profitability of) close competitors So, here is the dynamics: industry becomes “capable”, begins to expand output, attempts to pull up a tent after them, the shape of the tent is constrained Positive dynamic feedback loop with (a) receptivity and (b) spillovers So, here is the dynamics: industry becomes “capable”, begins to expand output, attempts to pull up a tent after them, the shape of the tent is constrained Positive dynamic feedback loop with (a) receptivity and (b) spillovers This is Hirschman(esque) • Hirschman’s “backward linkages”—but instead of in a purely input/output space of market mediated demands leading to “integration” the “backward linkages” are in the public action space, mediated by politics (and hence the institutions of politics which construct both receptivity and acceptable ask • “Uneven” development as it is the receptivity as output expands that finds/identifies the needs for public inputs—the “balanced growth” perspective cannot anticipate what is needed. Five Scenarios • Centered on remote section of product space— so no feedback loop (a model of boom and bust due to politically/institutionally mediated resource curse). • Acceptable ask is too narrow (oligarchic chimneys) • No feedback because no activities to generate pressure (poverty trap) • Less dense part, booms that peter out. • Dense part of product space, responsive, limitations on “specificity” of lobbying Scenario I: Success in a part of the product space that is “remote” (institutionally determined spillover to distance in product space) Implications: Growth spurt as economy moves up the industry Stagnation afterwards Economy hinged to ups and downs in potential (e.g. terms of trade) Average “public input” quality never improves “Institutional quality” has high variance—great Institutions for tea/coffee/oil/gold Scenario II: Acceptable ask unconstrained— oligarchic chimneys—the “private sector” owns the state—and naturally hates competitive capitalism (e.g. “Seize the state, seize the day”) •Bursts of rapid growth •Self-limiting •Variance increases (deals, not rules) •Average institutions do not improve Scenario III: Threshold (far) exceeds existing contribution of public action inputs at intrinsic profitability—a “Zombie” (Ghost country) Scenario IV: Production starts in moderately dense part—but doesn’t spread •Larger/longer growth boom—might only peter out at medium income levels •Might have high average level of public inputs (just not in dense part) •“Institutions” might be middling (on averag Scenario V: “Sweet spot”—profitability in dense part of product space, government receptive, acceptable ask is constrained—everything is possible Positive dynamic feedback loop with (a) receptivity and (b) spillovers Staying in the sweet spot for growth • Dense parts of the (institutionally ordered) product space • Responsiveness of government to needs of emerging industries (“high bandwidth” responsiveness) • Right level of spillovers of industry demand--tents steep enough to generate reform, flat enough to not build oligarchic chimneys Outcomes • (Potentially) rapid growth with S-curve dynamics into newly profitable industries (within state dynamics faster or slower) • Small exogenous shocks (to profitability or capabilities) sets off rapid growth with no change in overall “institutional quality” • Public inputs gradually expand so that measured “quality” across all industries eventually re-converges Output/growth dynamics as move through product space: size and duration of boom determined by potential (and within state dynamics) Level of output Potential NR plus little cluster plus bug cluster Potential NR plus little cluster Just NR Steady growth of leaders Perpetually poor countries Once at maximum capability growth constrained by expansion of potential (both new industries and moderate growth of existing) Interaction of low “endowment” and poor public inputs—can be a long time Rapid catch up Sweet spot of feedback (dense, receptive, limited ask) Episodic growth with booms and busts •Sparse part of product space •Oligarchic chimneys (weak institutions) •Level playing field too low (selfdiscovery) Long and Short of Growth Theory Unification • In long-run (or cross section) prosperous countries have “high quality” institutions and poor countries have bad institutions • In long-run prosperous countries produce in nearly all parts of the product space (since they have all capabilities) (not specialization) • Small exogenous changes can make segments of the product space profitable—even with “weak” overall institutions (but policy reform might not) • Some booms die and some survive—depending on the location in product space, receptivity, and acceptable ask—leading the observed variability with growth booms and busts (over and above pure resource boom/bust Four ways of staying in the sweet spot (experiences of rapid growers) • Pre-commitment to integration with higher institutional quality regions (so that foreign players pressure institutions) • Industrial policy through large industry groups • Ordered deals as industrial policy • Keeping up with the zones’s Rapid Growers through precommitment? Periphery of Europe (Greece, Italy, Portugal, Ireland, Spain) • Commitment to join “Europe” forced limitations on the ability of domestic firms to lobby for “specific” benefits, even during periods of “weak” institutions • Put pressure for better “level playing field” directly into policy decision making • Other examples? (Caribbean states that remained pre-committed (e.g. Puerto Rico), more recently EU accession for early entrants (e.g. Poland), Hong Kong) Rapid Growers with “managed capitalism” (e.g. Japan, Korea) • Industrial organization of large groups with interests in multiple sectors and organized inter-penetration of business and government at highest levels • Inter-penetration allowed for “high bandwidth” responsiveness • Multiple groups with opposing interests represented prevented oligarchic capture • Performance driven by government Rapid growers with authoritarian corruption: “Ordered Deals” corruption as industrial policy • Industrial policy is the differential favoring of public inputs (of various kinds, including policy and/or its enforcement) across industries • Corruption is the use of public authority for private gain • Indonesia is a case where the combination of the two provided for rapid growth for 30 years as “ordered deals” were available for a modest number of selected industrial groups (e.g. military, family, some conglomerates) Replication of “good institutions” in a limited place: Keeping up with the Zones’s • Create a favorable investment climate only inside a greenhouse--firms inside a designated “space” (which may be conceptual, not geographic) get favored institutional environment • Makes new activities possible • Is there a dynamic of replication and responsiveness? • Other examples? (Mauritius (the 22nd fastest grower), zone boomlets in other economies (e.g. Dominican Republic?)