ssi payment

advertisement

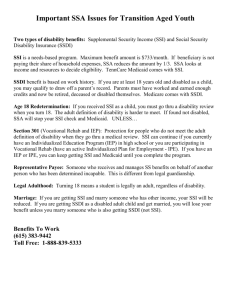

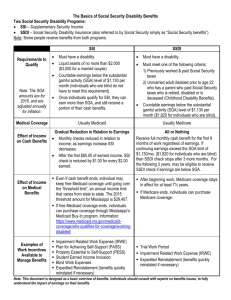

Making Work Part of the Plan Work Incentives for People with Disabilities The Landscape For people with disabilities… the unemployment rate is roughly 10 times higher than the national average What keeps people with disabilities from working? Attitudes… Fears… Misconceptions… • Family, friends, employers and society • People with disabilities can’t work • People with disabilities will lose benefits if they work – especially health care Medical Assistance for Employed Persons with Disabilities MA-EPD A work incentive/health care program MA-EPD Eligibility at a glance • • • • • • Age 16 to 64 Certified disabled Employed Pay taxes Meet $20,000 asset limit Pay premium MA-EPD Eligibility • Individuals must be at least 16 but less than 65 years old • Individuals must be certified disabled by either the Social Security Administration or the State Medical Review Team (SMRT) Continued on next slide • Individuals who can’t be certified by SSA due only to earnings over SGA ($900/month in 2007) may be certified disabled through SMRT. • Individuals on extended Medicare continue to be certified disabled by SSA even though their cash benefits have ended. Refer to SMRT prior to Medicare coverage ending. MA-EPD Eligibility • Individuals must be employed • To be considered employed, a person must have average gross monthly wages or countable self-employment earnings of more than ?? $65 Earned Income • Enrollees must receive earned income each month, unless: • They change jobs and receive no pay check for 1 month because of different pay periods • They are on a temporary medical or job loss leave Continued on next slide Safety Nets • 4-Month Medical Leave: Enrollees may have an interruption of employment due to a physician verified medical condition for up to 4 months. • 4-Month Job Loss Leave: Enrollees who lose their job, through no fault of their own, may remain on MA-EPD for up to 4 months while looking for another job. Continued on next slide • There is no limit on the number of leaves a person can use, as long as they return to work in between. • A job loss leave can be used immediately following a medical leave. • A medical leave cannot be used immediately following a job loss leave. Calculating Earned Income • For retro months, use actual gross wages or countable self-employment income received in that month Determine countable self-employment income by deducting allowable costs of doing business from gross receipts. • For current and future months, use the average anticipated earned income (MAXIS: fiat EBUD) Continued on next slide • If six-month averaged earned income is more than $65, the individual is eligible for MA-EPD though the 6-month budget period as long as all other eligibility factors are met. E.g., Budget period November – April. Projected earnings of $120 in November, February, March and April but $60 in December and January due to reduced hours during holidays. Six-month averaged income is $100/month, therefore, the client is eligible for the entire budget period. • If the 6-month averaged earned income is $65 or less, determine earned income eligibility separately for each month. • E.g., Budget period May – October. • Projected earnings of $90 in May, June and July. • Client reports surgery scheduled in August resulting in $0 earnings for August, September, and October. • Six-month averaged earned income would be $45/month, which would make client ineligible for entire budget period. • Instead of averaging, look at each month individually. (Client would be eligible for 4-month medical leave for August, September and October.) Earned Income Verification • Acceptable earned income verifications include: • pay stubs • employer statement (DHS-2146) • tax forms or business records Continued on next slide • Examples of acceptable self-employment business records include: • Detailed, hand written or computer generate records of gross receipts and expenses • Business quarterly report • Signed statement from the business’s accountant verifying projected business income or expenses Taxes • To be considered employment, Medicare and Social Security taxes must be paid or withheld from earnings • Proof of state or federal income tax being paid is not required. Continued on next slide • Acceptable Medicare and Social Security tax withholding/payment include: • Wages Pay stubs Written Employer Statement (DHS-2146) • Self-employment: Quarterly Schedule ES or Schedule SE Annual federal income tax return Business records Continued on next slide • Generally, quarterly estimated tax payments are required by the IRS only if taxes of $1,000 or more are owed. • If the client does not file quarterly, accept the annual federal tax return from the previous year • If the client hasn’t been in business long enough to file taxes or has not filed taxes in the past, accept business records until the review due following the next filing deadline Assets • Individuals must have assets of less than $20,000 • Exclude standard MA assets plus retirement accounts, medical expense accounts set up through an employer and all spousal assets. • People on MA-EPD who lose employment for any reason retain the MA-EPD asset limit and rules for up to 12 months. Premiums • Individuals must pay a premium of $35 or more, based on their income and household size • People with unearned income must pay ½ % of their unearned income. • Both are calculated on MAXIS/EBUD Continued on next slide • Counties bill and collect initial premiums • Eligibility cannot be approved until premium is paid • Applicants can choose which month(s) they want eligibility and pay only those months • Counties must work the “overdue premiums” report each month Continued on next slide • Clients with overdue premiums will show on the report until they’ve paid all past due premiums • Over due MA-EPD premiums do not affect eligibility for other programs • Notify DHS Special Recovery of new, changing or discontinued premiums via MAXIS email “MADE” • Ongoing premiums can be paid by mail, in person, by auto-withdrawal, or online at http://payments.dhs.state.mn.us/selectthepaymenttype.asp • MA-EPD premium estimator online at: www.dhs.state.mn.us/maepd (scroll down to “MA-EPD monthly premium esitmator”) Still more… • Do not switch people eligible for 1619(b) to MA-EPD • Counties must reimburse Medicare Part B premiums for MA-EPD enrollees with income below 200% FPG who are not eligible for QMB/SLMB • DHS mailing to MA/DX enrollees Still need more? Disability Linkage Line 1-866-333-2466 Beth Grube DHS Health Care Eligibility/Pathways to Employment 651-431-2412 Beth.grube@state.mn.us MAXIS email “QS” Work Incentives Connection Work Incentives Planning and Assistance (WIPA) Yikes--The Connection Again? The Connection Goal: assist people with disabilities to return to work; to increase work effort; or to work off benefits. Method: answer, “What will happen to my benefits if I work?” Partnership: DEED, DHS & SSA, funded mostly by SSA. Now equal $$$$. News: Became a nonprofit agency in October 2006. Connection Services • Focused on providing information. • Provided through phone hotline. Primary services include: • Specialized information and referral • Problem-solving and advocacy • Benefits Analysis • Outreach on changes in benefit programs. What are Work Incentives?? Work Incentives are special rules that Social Security uses to encourage an individual to work. • On Supplemental Security Income (SSI), work incentives increase the amount of the SSI payment. • On Social Security Disability Insurance (SSDI), work incentives let individual keep their SSDI cash payment when earning more than $900 in 2007. Work Incentives To Look For: • Impairment Related Work Expenses (IRWE) • 1619(b) to continue Medical Assistance • Plans for Achieving Self-Support (PASS) “THE FORMULA” Gross Earnings: Minus General Exclusion: Minus Earned Income Exclusion: Divided by 2: Countable Earnings $615 - 20 $595 - 65 $530 ÷ 2 $265 2007 Federal Benefit Rate (FBR): $623 Minus countable earnings: - 265 SSI PAYMENT: $358 Impairment Related Work Expenses (IRWE) • An IRWE allows certain expenses, necessary to go to work, to be disregarded from individual’s earned income. • An IRWE expense must be: • paid for by the individual; • related to serious medical condition; & necessary in order to work • Approved by SSA Examples of IRWEs • Medication copays • Adaptive Equipment • Transportation different from what nondisabled worker use for work • Special assistance – note takers, readers, interpreters. Impairment Related Work Expense (IRWE) Gross Earnings: Minus GE and the EIE: Impairment Related Work Expense: Divided by 2: Countable Earnings $615 - 85 $530 - 80 $450 ÷ 2 $225 2007 Federal Benefit Rate (FBR): $623 Minus countable earnings: - 225 SSI PAYMENT: $398 SSI with & without IRWEs Mike is on SSI, earning $615/month. He has $80 in IRWEs each month that have been approved by the SSA. • Without IRWEs, SSI payment is $358. • With $80 in IRWEs, SSI check is $398. The IRWE results in a $40.00 increase in SSI payment! SSI and High Wages Step 1. Step 2. Step 3. Step 4. $1,350.00 Earned Income - 20.00 General Income Exclusion $1, 330.00 - 65.00 Earned Income Exclusion $1,265.00 ÷ by 2 = $632.50 Countable Income $623.00 2007 Federal Benefit Rate - 632.50 Countable Income $ 0 SSI Payment What happens to Medical Assistance eligibility? Work Incentives 1619(b)! Allows Medical Assistance (MA) coverage to continue after the individual’s earned income becomes too high to allow an SSI cash payment. 1619 (b) continued • To qualify for 1619(b) the individual must: have been eligible for an SSI cash payment for at least one month; still be disabled; meet non-disability requirements; & need and use MA. • 1619(b) can continue until person reaches MN’s 1619(b) threshold of $44,009 per year. Plan for Achieving Self-Support (PASS) PASS allows an individual to set aside income or resources for a set amount of time to achieve a specific vocational goal. • Examples of possible PASS goals include: Education Equipment Transportation • The funds that are set aside are not used to calculate the individual’s SSI payment. PASS EXAMPLE: Gross Earnings: Minus GE and the EIE: Countable Earnings Divided by 2: $615 - 85 $530 ÷ 2 $265 PASS deposit: -$265 0 2007 Federal Benefit Rate (FBR): $623 Minus countable earnings: -0 SSI PAYMENT: $623 Myths about working and benefits • Working will cause you to lose your benefits and this is a bad thing! • You will be worse off financially by working! • You will lose your health care if you work! MYTH BUSTING Using Benefits Analysis and Work Incentives Benefits Analysis (BA) Comprehensive look at how all benefits are affected by work. Includes: • Benefits verification/information finding • Identification of work incentives • Development of examples of different levels of earnings----individual’s goals • Exploration of health care options • Comparison of finances before & after working • Benefit management help & follow-up Anne, Not Working SSDI SSI MSA MA Medicare Food Support Subsidized Housing Available Income $575.00 $ 68.00 $ 81.00 Yes Yes $ 10.00 -$207.00 $527.00 Earning $650 per Anne month vs. not working Wages: Minus 15% taxes SSDI: SSI: MSA: MA: Medicare: Food Support: Subsidized Housing: Available Income: Not Working Earning $650/mo. $650.00 $0.00 -$ 97.50 $0.00 $575.00 $575.00 $ 0.00 $68.00 $ 0.00 $81.00 Yes Yes Yes Yes $10.00 $10.00 -$373.00 -$207.00 $764.50 $527.00 $237.50 - A 45% increase in available income Anne earning even more! Wages: Minus 15% taxes: SSDI: SSI: MSA: MA: Medicare: Food Support: Subsidized Hsng.: Available Inc.: Not Working $0.00 $0.00 $575.00 $68.00 $81.00 Yes Yes $10.00 - $207.00 $527.00 $650/mo $650.00 - $97.50 $575.00 $0.00 $0.00 Yes Yes $10.00 - $373.00 $764.50 $875/mo $875.00 - $131.00 $575.00 $0.00 $0.00 Yes Yes $10.00 - $446.00 $883.00 $356.00 - A 67.5% increase in available income! Significant Earnings for Anne Wages: Minus 15% taxes: SSDI: SSI: MSA: MA: Medicare: Food Support: Subsidized Housing: Available Income: Not Working $0 $0 $575.00 $68.00 $81.00 Yes Yes $10.00 $207.00 $527.00 Earning $1,400/mo $1,400.00 $ 210.00 $0 $0 $0 Yes, 1619(b) Yes $0 $409.00 $781.00 $254 - A 48% increase in available income! Healthcare with SSDI and working Social Security Disability Insurance (SSDI) • Medicare – after 24 months on SSDI. • Extended Medicare---off SSDI, but may continue to receive Medicare for at least 93 months after the end of the Trial Work Period. Still disabled. • Medical Assistance for Employed Persons with Disabilities (MA-EPD) • State Medical Review Team process if no longer eligible for SSDI benefits. Still disabled. Healthcare with SSI Medical Assistance – Automatic eligibility with SSI, but must apply at the county. • 1619(b) – When work off SSI • Medical Assistance for Employed Persons with Disabilities (MA-EPD) – If working and 1619(b) eligibility ends. ONE MORE THING……. Disabled Adult Child What are DAC benefits? • DAC stands for Disabled Adult Child. • The child: • receives SSA benefits based on a parent’s work record not their own • disabled prior to age 22---meets SSA’s definition of disability • is at least age 18 • has a parent who is eligible for disability or retirement benefits, or is deceased DAC Disregard for MA • DAC payment may make individual ineligible for SSI (thus losing MA without a spenddown). • The Disabled Adult Child (DAC) Disregard allows the DAC payment to be excluded when calculating the spenddown for MA. Only applies to people who lose SSI eligibility due to receipt of the DAC payment. DAC Disregard for MA cont . . . Qualifiers: • • • • Must be 18 years old or older, and Were blind or disabled before age 22, and Were eligible for SSI due to disability, and lost SSI after 7-1-87 due to receipt of DAC benefits under a parent’s record. DAC Disregard for MA cont . . . Spenddown Calculation: • The DAC Disregard allows the spenddown to be calculated without using the DAC payment in the calculations. It has the effect of reducing or eliminating the MA spenddown, due to the receipt of DAC benefits.