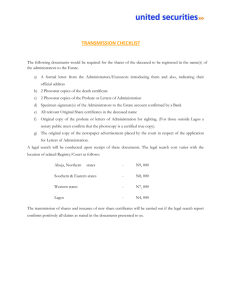

Administration and Probate Act 1958

advertisement