Towards a New Consensus

advertisement

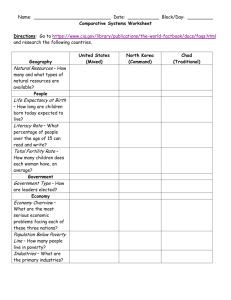

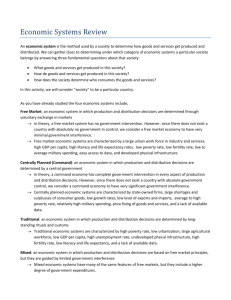

Towards a New Consensus Analyzing Bolivian Poverty Reduction Strategies “It is fair to say that nobody really believes in the Washington Consensus anymore.” From: “Goodbye Washington Consensus, Hello Washington Confusion?” Dani Rodrik Harvard University January 2006 Long wave: depressive phase • • • • Lower growth Increased unemployment Regressive redistribution Decaying “techno-economic paradigm,” or “mode of regulation” (“Fordism”) • Laissez-faire, Washington Consensus policies • “Real business cycles” types of economic theory Long wave: expansive phase • • • • • • Higher growth Increased employment Progressive redistribution Consolidated techno-economic paradigm Policy optimism, New Consensus (Post-)Keynesian, (post-)structuralist theory Changed focus From policy deconstructionism: • Deregulation • Decontrol • Denationalization Changed focus To policy constructivism: • Policy sovereignty • Structural change • Social justice (economic ethics, distributive justice) New focus New instruments Indebtedness policy Policy sovereignty Investment policy Structural change Income distribution policy Social justice Indebtedness policy: regulation of financial flows From : Cycles of massive inflows and euphoria followed by capital flight and debt crises To: Desendeudamiento and regulation of international capital flows Foreign saving = trade deficit = a knowable variable t Investment policy: output structure matters Structure matters • Natural resource exports = low growth • Primary specialization = high inequality • Employment intensity = poverty reduction elasticity of growth Investment policy xt 1 d t xt 1 Income distribution policy: tax and expenditure reform • Increasing inequality in most countries during the low growth phase • Latin America: Most unequal income distribution, low tax/GDP ratio, regressive tax reforms Income distribution policy yt Vt xt New Consensus model Gross outputs Income Income distribution distribution policy Vt X t Public income s Saving propensity Investment efficiency Sectoral investment Private incomes Public Investment investment policy z g allocation Saving propensities Indebtedness policy t Public saving Foreign debt t Private investment allocation Private saving Base scenario: Estrategia Boliviana de Reducción de la Pobreza (Poverty reduction 200-2015: 5.7 points, from 50.3 percent to 44.6) 25,000 Millions of bolivianos 20,000 15,000 10,000 5,000 0 1997 1998 1999 2000 2001 1. Food staples agriculture 5. Small and medium industry 9. Transport 2002 2003 2004 2005 2006 2. Exports crops agriculture 6. Petroleum processing 10. Infrastructure and services 2007 2008 2009 2010 3. Petroleum, gas and mining 7. Construction 11. Public administration 2011 2012 2013 4. Big industry 8. Commerce 12. Finances 2014 2015 Poverty minimizing structural change (Poverty reduction 2000-2015: 10 points, from 50.3 to 40.3 percent) 40,000 35,000 30,000 Millions of bolivianos 25,000 20,000 15,000 10,000 5,000 0 1997 1998 1999 2000 2001 1. Food staples agriculture 5. Small and medium industry 9. Transport 2002 2003 2004 2005 2006 2. Exports crops agriculture 6. Petroleum processing 10. Infrastructure and services 2007 2008 2009 2010 3. Petroleum, gas and mining 7. Construction 11. Public administration 2011 2012 2013 4. Big industry 8. Commerce 12. Finances 2014 2015 Redistribution policies • Millennium tax [and expenditure] reform: Tax rate 8.1 percent (4.6 percent of GDP) Rawlsian tax reform: Tax rate 16.7 percent (9.5 percent of GDP) Undercollection: 3.6 percent of GDP • • 60 50 Percentage 40 30 20 10 0 2000 1. EBRP 2001 2002 2003 2004 2. Millennium investment policy 2005 2006 2007 2008 3. Millennium tax reform 2009 2010 2011 2012 4. Millenium employment strategy 2013 2014 2015 5. Rawlsian tax reform Millennium employment strategy Employment maximizing investment strategy • Strong similarity with poverty minimization Similar GDP and poverty reduction Similar changes in output structure Stronger focus on Food staples agriculture (weaker on Small industry) • Confirmed cross-country by World Bank study (Perry et al. 2006)