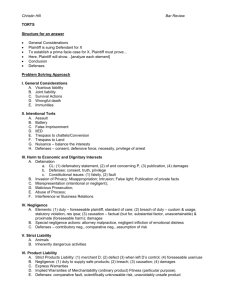

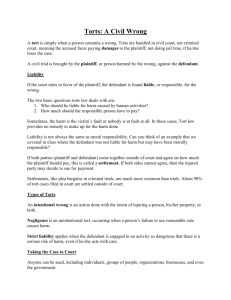

[Prima Facie Case of Negligence] The prima facie [self evident

advertisement

![[Prima Facie Case of Negligence] The prima facie [self evident](http://s3.studylib.net/store/data/009235222_1-88f016891e67f600fa256d19feb5b383-768x994.png)