KFC_presentation - CI

advertisement

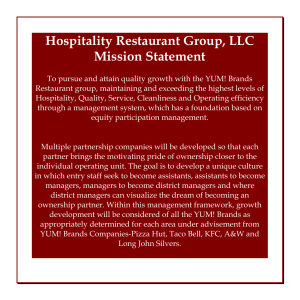

Presentation Overview Ricardo: Company Profile Mission Statement Ownership & Organization Vania: Alliances Products & Technology Market Trends & Growth Key Players Presentation Overview Andrew: SWOT Analysis Talib: Financial Overview Past and Present Financial Ratio Analysis Probable Outcomes and Predictable Crises Critical Success Factors Background & Overview Company Profile Founded in 1952 Operates in more than 108 countries globally Parent company YUM Brands Serves approximately 12 million customers in more than 5,200 restaurants globally Background & Overview Mission Statement YUM BRANDS: Build their brands in China Aggressive international expansion Improve U.S. brand position Drive long term Shareholder and franchisee value Background & Overview Ownership & Organization David Novak, CEO of YUM Brands Roger Eaton CEO of KFC KFC Franchise breakdown: Restaurant General Manager Assistant Managers Average of 20-35 employees per store Background & Overview Ownership and Organization Beginning of Year New Builds Company Franchisee Total 956 4,210 5,166 6 74 80 Acquisitions None Refranchises 60 60 None Closures 47 107 154 Other None (12) (12) End of Year Total % of Total 855 4,225 5,080 17 83 100 Background & Overview Alliances Pizza Hut & Taco Bell Yum Brands: World’s largest proprietor of multi-branded fast-food locations KFC holds 69% of Yum Brands market share Background & Overview Charitable Alliances Animal Welfare World Hunger Background & Overview Products & Technology KFC’S Point of Difference: Secret Recipe for Fried Chicken Fast-Food Competitive Technology: Automation Heating Food Production Shelf-Life Ingredients Market Overview Market Trends & Growth Global Recession = Increase in consumption of cheaper foods 73% of Americans eat fast food out of convenience 33% of Americans and 30% of the Asia Pacific Market eat fast-food at least once a week Market Overview Market Trends & Growth KFC’s usually clustered in urban centres Soaring food prices notably wheat, health and diet concerns have slowed growth of fast food chains since 2006 in U.S. Emerging Markets: Prefer international brands Market Overview Key Players International: McDonald's Domestic: Wendy’s Burger King Sonic Jack in the Box Strategic Analysis Strengths: Market Share KFC has roughly 42% of the global chicken on the bone market share Nearly 3 times as much as their nearest competitor China 2009, 16% increase in market share Aided KFC in declining U.S. Market growth Strategic Analysis Strengths Differentiation: Trademarked items and Recipes International Presence: Global Diversification and ability to expand rapidly (i.e. China) Strategic Analysis Strengths USA 5,166 Mainland China 2,497 Japan 1,150 Great Britain 689 Canada 780 Australia 572 Indonesia 336 Malaysia 431 Strategic Analysis Weaknesses Systemic: Integrity of Supplier & Distributors Decentralization of OwnershipFranchisee model (i.e. quality,service,cleaniness, etc.) Branding: Mom and Family values: Health and weight issues Strategic Analysis Opportunities Stability In Commodity Pricing: Analysts indicate that chicken prices should stay stable in short term Beneficial in further maintaining costs to provide better margins Strategic Analysis U.S Chicken Price per lbs. (cents) Month Value Feb 2009 86.70 Mar 2009 85.73 Apr 2009 85.38 May 2009 86.96 Jun 2009 88.17 Jul 2009 88.56 Aug 2009 86.77 Sep 2009 84.88 Oct 2009 82.85 Nov 2009 82.13 Dec 2009 82.15 Jan 2010 83.00 Strategic Analysis Opportunities Emerging Markets: Estimated 5% growth rate in emerging economies Perceive brands as superior to local Asia Pacific region rates high globally in fast food frequency visits Low Labour Costs Strategic Analysis Opportunities Diversification in Mature Markets: Develop Incremental sales layers (i.e. Breakfast, new beverages, expanded protein options, etc.) Expansion of Multibranding: Single store location pairings with Pizza Hut and Taco Bell Strategic Analysis Threats Mature Market Diet and Health concerns (75% of Americans eat less fried chicken due to health concerns) Foreign Currency Fluctuations Animal Welfare Activists (i.e. PETA) Emerging Competition in Mature Markets (i.e. Chicken Fil A) Avian Flue Financial Overview Past/Present Past: Steady share price increase over past ten years KFC U.S. Sales per unit have grown by 2% over last 4 years Present: Yum Brands achieved 6.9% growth in 2009 compared to 2008 Annual Sales per restaurant in U.S. are around 1.3 million, on par with industry Financial Overview Past/Present KFC U.S. Sales per Unit: Year End thousands 2008 2007 2006 2005 2004 % growth KFC US $967 $994 $977 $954 $896 2% Financial Overview Past/Present KFC Division Sales Growth: In Billions 2008 2007 2006 2005 2004 5-year growth KFC U.S. Company Sales: $1.2 Franchisee Sales: $4.0 Company Sales: $1.4 Franchisee Sales: $7.6 Company Sales: $2.5 Franchisee Sales: $1.1 $1.2 $4.0 $1.4 $3.9 $1.4 $3.8 $1.4 $3.6 (4%) 2% $1.3 $6.7 $1.1 $5.7 $1.1 $5.2 $1.0 $4.7 9% 13% $1.7 $1.1 $1.3 $0.8 $1.0 $0.7 $0.9 $0.6 28% 18% KFC International KFC China Financial Overview Financial Ratio Analysis Debt/Equity: Yum Brands: 3.28 McDonalds: 0.75 Industry: 2.00 Gross Profit Margin: Yum Brands: 20.6% McDonalds: 44.0% Industry: 35.2% Return on Assets: Yum Brands: 15% McDonalds: 15.1% Industry: 12.5% Financial Overview Financial Ratio Analysis Earnings Per Share: Yum Brands: 2.22 McDonalds: 4.11 Current Ratio: Yum Brands: 0.7 McDonalds: 1.1 Industry: 1.0 Inventory Turnover: Yum Brands: 56.4 McDonalds: 117 Industry: 97.8 Financial Overview Financial Ratio Analysis Quick Ratio: Yum Brands: 0.4 McDonalds: 1.0 Industry: 1.0 Asset Turnover: Yum Brands: 1.14 McDonalds: 0.8 Industry: 1.1 Probable Outcomes & Predictable Crises 1. Continue rapid expansion in emerging markets 2. Diversification of Menus in North America 3. Improve control processes on ethical operations 4. Improve operational and supply chain efficiency Critical Success Factors 1) Develop brand equity in new markets and sustain a differentiated brand in existing markets 2) Develop and sustain healthy relationships with franchisees and other stake holders Critical Success Factors 3) Provide an infrastructure that is flexible enough to adapt to local markets under the umbrella brand 4) Ensure the integrity of supply and distribution networks in the face of international variances, environmental crises and intensifying ethical concerns.

![YUM! Brand Stakeholder Communications about KFC in China[3]](http://s3.studylib.net/store/data/008189762_1-44d16d70c11705886641e8dcda42a9df-300x300.png)