5) China and India - Joergen Oerstroem Moeller.

advertisement

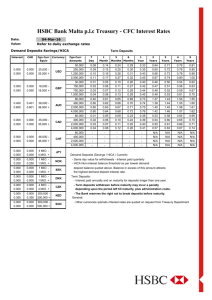

Conquering the China Market Topic: Recent developments & Future Trends. By: Adjunct Professor - CBS, Visiting Senior Research Fellow ISEAS, Jørgen Ørstrøm Møller. www.oerstroemmoeller.com Singapore September 10, 2005. Prelude Potential versus reality. - The potential is an unprecedented shift in power structure. - The reality is whether it will be allowed to happen and if so the circumstances. The bad news. All the ingredients known from the world wide depression in 1929 are smiling at us – like the Cheshire cat in Alice in wonderland. Too much liquidity chasing assets instead of productive investment. The bubble(s) will burst. Japanese stockmarket. Then Japanese property market. Third Nasdaq/IT bubble. Fourth property bubble (US, UK). Prelude Three rules of thumps announcing a melt down. - Liquidity chases fast profits trading assets. - Anyone can make money in the market. - Exponential rise in asset prices. All three are here – right now. The good news: Anyone got a hearing aide! - May be China and India. If the US allows them to step in. - US policy vis-à-vis China. Preventive and pre-emptive economic strike? 1. Current Trends Business cycle. Global growth peaked in summer 2004. Falling since. Electronic cycle does not look promising. Economic policies in major countries (primarily US) is not any longer expansive. Oil price impoverish the global economy. Key word: Business cycle not promising. Main culprit US economy with strong and persistent imbalances. Deficit on balance of payment about 5% and rising in the phase of the businesscycle when it should be falling. What does it tell us about competitiveness and growth disparity. 1. Current Trends Deficit on public finances about 4% and rising. For the fun: Website US National Debt Clock. Debt calculated continously. Fx August 29, 2005 at 09.31.58 AM GMT: $ 7,944,100,670,429.30. Not so fun: It rises with 1,8 billion USdollar….every day. 8.78% % of US GNP per year; 239% of DKs GNP! http://brillig.com/debt_clock/ Imbalances in Japan. Almost the opposite of US. Japanese recovery? Europe? Nothing much happens there. China and India revert later 2) The global economy is a roller coaster having derailed in a curve continuing out in the free airspace! Key words for the global economy: US consume. China (and India) produces. Low costs in Asia keep global inflation down. FED is splashing out liquidity. The whole dump show is financed by Japan and China /Greater China accumulating USdollars as a substitute for consumption but how long can you live eating greenbacks? Come and buy a chunk of the wild west! Key of the key: Under-consumption in Asia, over-consumption in US. Over-production in Asia, under-production in Asia. 2) The global economy is a roller coaster having derailed in a curve continuing out in the free airspace! Adjustment must and will take place. Transfer of purchasing power/economic strength from US to Asia. It can be done in one of the following ways: - Economic policies primarily in US. Fiscal policy. Monetary policy. - Currency rate changes. - Protectionism - Let the market do it not knowing what will happen. Where are we right now? Tighten your safety belts. Which factors will stop it: - Either Asian unwillingness to produce without being paid – a change of preferences production/consumption in China. - Or the US real interest rate gets to a level corresponding to the trend growth of US (approx 3-3,5 %). Can the world function with savings surplus in developing (poor) nations and dis-savings in developed (rich) nations? 3) The shift from US to China and India a) Measured in official exchange rates Chinas share of global GNP is about 3%, India about 1,4%. BUT PPP gives about 13% respectively about 7%. China is the factory of the world, pricesetter for industrial goods and offer technology. PPP second largest economy, largest recipient of Foreign Direct Investment (FDI). India is the servicecenter for the world, price setter for service goods and offers solutions. Fourth largest economy (PPP). 3) The shift from US to China and India b) Total communication. Nomads. China 402 mio subscribers on mobile phones end 2005. Fixed line 360 mio. About 103 mio on internet. Broadband user 2005: US 39 mio, China 34 mio. Prognosis for 2007. China 57 mio – US 54 mio. SMS China 6 billion in ONE DAY! New language emerges. India 60 million subscribers on mobile phones. 2 million more every month. Prognoses 2010. China globally number one PCs 178 mio. India 80 mio. Cernet2, IPv6. 3G technology. 4) What makes the Asian economy tick The Asian economy has changed completely. Not an annex to the US economy or the global economy. Self sustained and integrated. Two flywheels. Production – outsourcing- supply chain. Consumption – middle class – urbanization - brandingyoung YOUNG consumer. Outsourcing – computercontrolled container transport – Free Trade areas (FTAs) – 90% of all intra-Asia trade less than 5% tariffs – air freight 1% of volume but 35% of value VOUW! 4) What makes the Asian economy tick China is the spider in the center of the net. Intra-Regional Trade - The Pivotal Role of China Exports to Exports to 2003 China as % China as % of total exports of export growth Hong Kong 30.2 50.4 Taiwan 15.4 80.6 Japan 12.2 67.6 Korea 18.1 36.2 Singapore 16.5 18.0 Thailand 12.4 22.1 Malaysia 8.2 11.2 China Share of the US Market (%) 1996 2003 1.8 0.6 10.6 6.4 28.7 11.4 8.8 7.2 12.1 4.1 3.3 2.3 9.5 8.8 8.5 22.4 4) What makes the Asian economy tick But the coin has two sides: Decreasing growth in China’s import (from a monthly average growth of 35% in 2004 to 15% in 2005.) puts a squeeze on the economic growth in the rest of South East Asia – from 5,5% in 2004 to 4,4% in 2005 5) China and India – a comparison a) Demography. Share of population. 0 – 14 years. China 23,1%. 15 – 64 years. China 69,5%. 65 - years. China 7,4%. India 32,2%. India 63%. India 4,8% 5) China and India – a comparison b) Differences between China and India China India 60 50 40 % % 60 50 40 30 20 10 0 1993 Agriculture 2002 Industry Services 30 20 10 0 1993 Agriculture 2002 Industry Services 5) China and India …. b) Differences between China and India China: 30% of GNP goes to export. India: 15%. China: Savings rate measured as share of GNP 40%. India: 25%. China: FDI 54 billion Usdollar. India: 6 billion Usdollar. What does it tell us about efficiency of the use of capital? China: Non-performing loans as per cent of all loans 40%. India: Negligible. What does it tell us about the financial system? The role of the financial system: Investment or trade surplus. 5) China and India ….. b) Differences between China and India China: State Owned enterprises the incubator. India: The market. China: Strong government. Autocratic India: Weak government. Democracy. China: Good infrastructure. India: Lousy infrastructure, but…….. China: Corporate governance????. India: Not bad. China: Legal system not bad. India: In the long run we are all dead! Water. Key factor. China urbanized. India less so. A whole string of political, economic, social and infrastructure investment repercussion. 5) China and India … The snake in the paradise if any! China: Energy, Environment, Water. Non-performing loans. India: Fiscal deficit. Infrastructure. Prudent financial system. Politics. 6) The strength of the Asian economies Two scenarios. A) Positive Scenarium. - China and India keeps growing. Economic center moves across the Pacific. - The international system adjusts to this new situation. The world sees a peaceful and orderly transformation from an American dominated economy to a global economy with China and India in the drivers seat. - New technology paves the way for a new investment cycle. - The demographic and environmental problems is under control. Terrorism, international crime, infectious diseases are not allowed to derail the global economy.social and infrastructure investment repercussion. 6) The strength of … B) Negative scenarium. -The ice cream gateau slides too fast. China and India cannot make up for the vacuum created by the weakening US economy. - The global economy comes under pressure. US is not strong enough any longer to exercise control and no one else in sight. Rising egoism and rising threat of protectionism heralds the day. - NOIC appears just over the horizon. Gradually we move away from a global model towards a more national model. A more destructive world emerges breaking with may of the hitherto unchallenged ideas. The decisive factor will be private consumption – topic later today. 7) Political and social problems threatening to thraw a spanner into the works -The main political and social problem is that the Asian political systems are economy driven and has never experienced a global economic downturn. -Their social systems do not offer facilities to help social losers. That is sustainable in an era when high growth was the one dish offered on the menu … …..but what happens if the world glides into some kind of recession? 7) Political and social problems ….. Demography. The Asian countries are not converging (Japan, China, India, South East Asia) and immigration is rejected completely by Japan. Foreign- and security policy. Basic assumption. China does not want to derail its economic rise. India quite confident in its newborn role. Japan uneasy and uncomfortable. Not a viable triangle. 7) Political and social problems threat … Taiwan. North Korea. Two main problems. - Pakistan. Politically unstable, nuclear weapons. - Japan. More nationalistic even militaristic. J. Ørstrøm Møller www.oerstroemmoeller.com