pptx - Tony Yates

advertisement

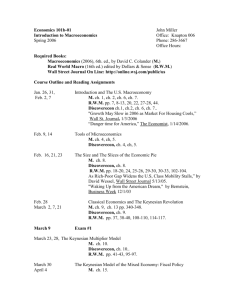

MSc Open Economy Macroeconomics: Overview and intrododuction Lecture 0 (!) to Birmingham MSc International Macro Autumn 2015 Tony Yates Course admin details • • • • • • • • 10, 2 hour lectures delivered by me Assignments for each lecture. [Almost] Solutions posted after tutorials Tutorials taken by 3 class assistants. Office hours: Mon 1-2pm, Tue 10.30-12.30 But watch teaching homepage for alterations. Material posted on my teaching homepage: https://tonyyateshomepage.wordpress.com/teac hing/ Exams • 80%: 3 hour end of year exam spanning this course, and the growth/business cycles course run by Kaushik Mitra. • 20%: 2 hour multiple choice question test, spanning the same two courses, held at the start of next term. • My course material is new, albeit under the same course rubric. Approach • Lecture and assignment material is hard and mathematical. • Try to get you to the point where you have seen ‘under the hood’ how the models work. • The exam material will almost always not be as hard as the assignments! • Motivation and intuition will be covered too. Hope is this emerges out of the maths, and you reinforce that yourselves. Me • Email: t.yates@bham.ac.uk • Skype: anthony_yates; facetime anthony_yates@yahoo.com • If an office hour doesn’t happen or you can’t make it, try these other routes. • When making contact, remind me that you are part of this course so I don’t think it is spam. More on me • Research and study interests: – Computation methods for macro – Applied time series methods; VARs – Monetary policy rule design – Diagnosing the sources of business cycle fluctuations – The zero lower bound – Alternatives to rational expectations – See my publications on my homepage. Me/ctd • 2 years at Department of Employment. 21 years at Bank of England. 2 years lecturing at Bristol. • Blog: www.longandvariable.wordpress.com • Twitter: @t0nyyates • Debates on central bank design, fiscal policy, causes of the crisis, current interest rate policy, and much more. International macro • Study of how economies interact with one another. • Determination of exchange rates, relative price levels, disparities in GDP/head and growth, patterns of trade and cross border borrowing and asset positions. • • • • • Global financial crisis Secular stagnation and low world real rates The Eurozone sovereign debt crisis of 2012. Greece, now. All these topical issues are questions of international macroeconomics, and the debates hinge on positions people take on the classic models and philosophies in international macro. Like: do markets work, or are there significant frictions? • Dornbusch-Mundell-Fleming and exchange rate overshooting. • Structural vector autoregressions and tests of the DMF model. • Debt-deleveraging and low global real rates • Small open economy, intertemporal model of the current account. • VAR-based tests of the SOE model. • Uncovered and covered interest parity in a 2 period SOE model of asset pricing. • Deviations from PPP and LOOP explored and explained. • [Policy topics, with less formal material, yet to be prepared, depending on how we go]. • Revision Along the way • Preponderance of quantitative formal modelling, but put in context with topical issues. • Emphasis on micro-founded models based on aggregating up whole economy behaviour from individuals, but with a comparison to older methods [eg DMF]. • Connections with time series macroeconometrics used to test these models. Sources • See the reading list on my teaching home page. • Obstfeld-Rogoff ‘Foundations of International Macroeconomics’ • Lecture notes and textbook mimeos by Schmitt-Grohe, Uribe and Woodford. • Miscellaneous papers, some on the reading list, some you have to find yourself.