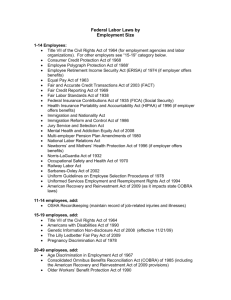

Employment Law Update 2014 - Association of Corporate Counsel

advertisement

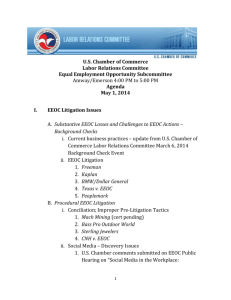

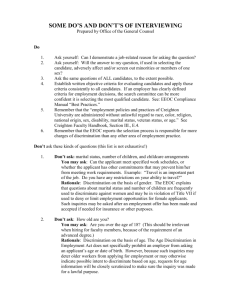

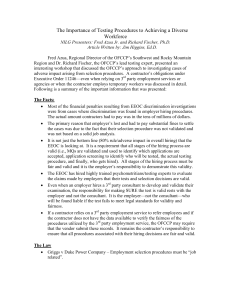

Session #106: Employment Law Update Wednesday, October 29, 2014 (9:00 am – 10:30 am) Presenters: Hon. Harry I. Johnson, III, Member, National Labor Relations Board Vincent A. Cino, Chairman, Jackson Lewis P.C. Danitra T. Spencer, Senior Staff Attorney for Labor & Employment, Consolidated Edison Co. of New York, Inc. Greg Watchman, Managing Associate General Counsel, Freddie Mac Q&A With NLRB Member Harry Johnson 2 Q&A With NLRB Member Harry Johnson • Noel Canning (Invalidation of Recess Appointments)— A “Blockbuster” Decision? – In June, the Supreme Court affirmed the DC Circuit decision invalidating President Obama’s recess appointments to the NLRB. – What impact has this had on the many decisions previously rendered by these recess appointees? – How is the Board addressing these decisions? 3 Q&A With NLRB Member Harry Johnson • In the Board's Fresh & Easy decision on August 11, an employee pursuing an internal individual harassment claim asked some of her colleagues to provide statements in support of her claim. • In previous cases the Board had said similar actions were not concerted activity, because the employee was seeking to benefit only herself. But in Fresh & Easy, the majority reached the opposite conclusion. • You agreed with the result in this case, but not with the majority's rationale generally. • Can you briefly summarize the majority and minority views on this issue? What practical advice would you have for employers based on this decision? 4 Q&A With NLRB Member Harry Johnson • D.R. Horton (Validity of Class Action Waivers Under NLRA) – The NLRB held in DR Horton that class action waivers violate §7 of the NLRA. But the Fifth Circuit subsequently rejected that ruling in DR Horton v. NLRB. The Second, Ninth and Eighth Circuits have reached a similar conclusion. – Nevertheless, the NLRB’s General Counsel continues to authorize complaints against class action waivers, and in July an NLRB ALJ held again that an employer’s arbitration agreement violated the NLRA, relying on the NLRB’s original decision in DR Horton. The ALJ said he was “required to follow Board precedent unless and until it is reversed by the Supreme Court.” – Can you shed light on the NLRB’s lack of deference to the federal courts of appeals and to the Federal Arbitration Act? 5 Q&A With NLRB Member Harry Johnson • Joint Employer Relationship – The NLRB General Counsel has indicated a desire to redefine more broadly when a host employer may be deemed a “joint employer” of a contractor’s employees for collective bargaining purposes. – Can you update us on the status of this issue? 6 Q&A With NLRB Member Harry Johnson • Confidentiality in Investigations – The Board held in Banner Health (2012) that employers adopting a blanket policy requiring confidentiality in internal investigations are in violation of the NLRA. – Some contend that there should be a presumption that requiring confidentiality is lawful—since it serves a host of legitimate business purposes as well as employee interests—unless a charging party can show some evidence that it is being used to circumvent §7 rights. – Can you share your perspective on this issue, or offer any practical tips? 7 Q&A With NLRB Member Harry Johnson • Accelerated Elections Procedures – After its first effort was overturned in the courts, the NLRB is back with the same proposal to reduce the time for a representation election in significant ways. Can you outline the concerns you have raised publicly about this proposal, which you have labeled “vote now, learn later”? – What is the likely timetable for finalizing these procedures? 8 Q&A With NLRB Member Harry Johnson • Use of employer email systems – In the 2007 Register Guard decision, the Board limited union access to employer email systems, finding no statutory NLRA right of access. – Can you update us on the efforts by some at the Board to overturn Register Guard in pending cases? 9 Q&A With NLRB Member Harry Johnson • Social Media Policies – The Board has struck down a number of corporate social media policies, concluding that they violated employees’ §7 rights. In the Kroger case, for example, an ALJ struck down the company’s requirement that employees identifying themselves as Kroger employees in social media must state that they do not represent the opinions of Kroger. – What practical guidance would you give employers on drafting their social media policies? 10 Supreme Court Wrap-Up 11 Sandifer v. U. S. Steel Corp., ___ U.S. ___, 134 S. Ct. 870, 187 L. Ed.2d 729 (2014) • Plaintiff-employees claimed they were unlawfully denied compensation for time spent putting on and taking off protective gear needed to do their jobs and required by their employer. • Section 3(o) of the Fair Labor Standards Act allows a collective bargaining agreement to exclude from pay “clothes”-changing time. Such a provision was in the plaintiff-employees’ collective bargaining agreement. 12 Sandifer v. U. S. Steel Corp., ___ U.S. ___, 134 S. Ct. 870, 187 L. Ed.2d 729 (2014) • Employees need not be paid under the Fair Labor Standards Act for their pre-shift and post-shift donning and doffing of clothing required for work where the employer and the workers’ union have agreed in a collective bargaining agreement that such activity would not be compensated. • Adopts majority view of Circuit Courts. 13 Sandifer v. U. S. Steel Corp., ___ U.S. ___, 134 S. Ct. 870, 187 L. Ed.2d 729 (2014) • The Supreme Court ruled “clothes,” for the purposes of the FLSA, means “items that are both designed and used to cover the body and are commonly regarded as articles of dress.” It rejected the plaintiffs’ argument that items designed to protect against workplace hazards (e.g. glasses, earplugs) could not be “clothes.” • Court rejected the employer’s argument that “clothes” were “anything worn on the body” (e.g. respirators kept and put on as needed at job locations). • Court ruled the time workers spent donning and doffing these items was not compensable because the statutory exclusion for “time spent” changing clothes was broad enough to include items that were not “clothes,” so long as the vast majority of the time in question is spent donning or doffing clothes as opposed to nonclothes items. 14 Burwell v. Hobby Lobby Stores, Inc., ___ U.S. ___, 134 S. Ct. 2751, 189 L. Ed.2d 675 (2014) • Regulations promulgated under the Affordable Care Act (“ACA”) require group health plans to provide preventive care for women without cost sharing. The regulations also specified 20 contraceptive methods approved by the FDA that must be provided, including four methods that may have the effect of preventing a fertilized egg from implanting in the uterus. • Hobby Lobby, a Christian-owned arts and crafts store chain, challenged the contraceptive mandate on the grounds that it violated its religious freedom under the Religious Freedom Restoration Act of 1993 (“RFRA”). 15 Burwell v. Hobby Lobby Stores, Inc., ___ U.S. ___, 134 S. Ct. 2751, 189 L. Ed.2d 675 (2014) • Supreme Court ruled 5-4 that closely-held corporations cannot be required to provide contraceptive coverage as mandated by the ACA. • The RFRA prohibits the federal government from “substantially burdening” a person’s exercise of religion, except where the burden is both in “furtherance of a compelling governmental interest” and is the “least restrictive means” of furthering the interest. • The Supreme Court found that closely held corporations are “persons” within the meaning of the RFRA and, therefore, the protections of that statute apply. • Additionally, the Court held that the ACA’s penalties for failure to comply with the contraceptive mandate (estimated at close to $475 million a year for Hobby Lobby) were a “substantial burden” within the meaning of the RFRA. 16 Burwell v. Hobby Lobby Stores, Inc., ___ U.S. ___, 134 S. Ct. 2751, 189 L. Ed.2d 675 (2014) • Four justices dissented from the majority opinion. • The dissenters sharply criticized the majority for essentially concluding that commercial entities could opt out of almost any law considered incompatible with their owners’ religious beliefs. • Found the ACA’s contraceptive coverage requirements did not substantially burden the exercise of religion, because covered employers merely directed money into undifferentiated funds to finance a wide variety of benefits. • ACA’s contraceptive coverage requirements furthered the compelling interests of public health and the well-being of women. 17 Supreme Court: Lawson v. FMR LLC (3/4/14) • • • Does SOX §806 Extend to Contractor Employees Working on Behalf of Public Companies? • Mutual funds: public companies covered by SOX – but no employees • Plaintiffs: former employees of private consulting firms that advised the mutual funds District Court: YES; First Circuit: NO Supreme Court (6-3): YES—SOX §806 Extends to Contractor Employees • Concern that mutual fund wrongdoing could never be safely reported unless §806 is extended–given that funds often have no employees. • Rule subject to “various limiting principles”; precise bounds uncertain • Majority: only extends to contracts lasting “a significant period of time” • Plurality: protected activity must relate to work for public company • Doesn’t address self-employed independent contractors working for public companies 18 Supreme Court: U.S. v. Quality Stores (3/25/14) • IRS Rule: Under the Internal Revenue Code, severance pay tied to the receipt of unemployment benefits is a “supplemental unemployment compensation benefit” (“SUB”) not traditionally considered as taxable wages. • Quality Stores paid taxes on severance pay, then sought refund • Bankruptcy court, district court, and 6th Circuit agreed: no taxes owed • Supreme Court reversed: • • • FICA broadly defines “wages” Here the severance pay was not tied to the receipt of unemployment benefits In addition, the severance pay varied by position and tenure, and was deemed remuneration for employment under the FICA definition • Court did not consider whether IRS position is consistent with the broad definition of wages under FICA. 19 Supreme Court: Fifth Third Bancorp v. Dudenhoffer (6/25/14) • Fifth Third’s 401K plan included an ESOP option • The company’s stock declined by 74% from 2007 and 2009 • Participants brought a “stock drop” class action claiming the plan’s administrators breached their fiduciary duties by maintaining the ESOP option, given their alleged knowledge that stock was overvalued and excessively risky • Holding: No “presumption of prudence” for ESOP fiduciaries • Under ERISA, ESOP fiduciaries not required to diversify • But still subject to ERISA’s general duty of prudence • May rely on stock’s market value as accurate absent “special circumstances” that suggest the market price is unreliable • ESOP fiduciaries not expected to act on insider information 20 EEOC Developments 21 What’s Happening at the EEOC? Overall charges remain steady • Biggest contenders • Race (33,068 charges in FY 2013 – 35.34% of all charges filed) • Sex (27,687 charges in FY 2013 – 29.5% of all charges filed) • Retaliation (38,539 charges in FY 2013 – 41.1% of all charges filed) • Age (21,396 charges in FY 2013 – 22.8% of all charges filed) • Disability (25,957 charges in FY 2013 – 27.7% of all charges filed) 22 EEOC’s Wild Ride • Of late, the EEOC has been experiencing an unprecedented series of losses, fee awards and harsh criticism from the federal courts • District Court Slams EEOC for Background Check Lawsuit – EEOC sued employer for criminal & credit check process – Testimony of EEOC’s expert was “an egregious example of scientific dishonesty” – EEOC failed to identify a specific practice within the criminal and credit check process that caused a disparity – Court: EEOC itself conducts criminal checks (all hires) and credit checks (90% of new hires) EEOC v. Freeman, No. RWT 09cv2573 (D. Md. 8/9/13) 23 EEOC’s Wild Ride More Trouble on Background Checks . . . • Kaplan Higher Learning (6th Circuit 4/9/14) (dismissing EEOC’s disparate impact claim based on employer’s credit checks; unreliable data used to demonstrate disparate impact; noting that EEOC was challenging the same practice it uses itself) – Rejects EEOC’s “homemade methodology” of “eyeballing” drivers license photos to identify employees’ race; approach was “crafted by a witness with no particular expertise to craft it, administered by persons with no particular expertise to administer it; tested by no one, and accepted only by the witness himself.” • Peoplemark (6th Cir. 2013) (upholding fee award of $750,000 against EEOC; agency continued to litigate case after learning that company did not have a blanket “no felons” hiring policy) 24 EEOC’s Wild Ride Even more trouble on background checks . . . • The State of Texas has filed suit to invalidate the EEOC’s enforcement guidance on background checks, issued in April 2012. Texas v. EEOC (N.D. Texas 11/4/13) (dismissed for lack of case or controversy, 8/20/14) • Nine state attorneys general (WV, AL, KS, MT, CO, GA, NB, SC, UT) wrote to the EEOC calling the background check suits “misguided and a quintessential example of gross federal overreach.” (7/24/13) 25 EEOC’s Wild Ride More trouble on other fronts: • EEOC v. CRST Van Expedited (N.D. Iowa 8/1/13) (awarding employer $4.7 million in fees against EEOC in long-running sexual harassment lawsuit; “the EEOC’s actions in pursuing this lawsuit were unreasonable”) • Case New Holland v. EEOC: Company suing EEOC for sending over 1,000 emails to its employees & managers without prior notice to company and without finding of reasonable cause. • Romero v. Allstate (E.D. Pa. 3/13/14) (dismissing EEOC claim that employer’s mere offer of release in exchange for additional severance or a right to rehire was retaliatory) 26 EEOC’s Wild Ride Even more trouble on other fronts: • EEOC v. HomeNurse (N.D. Ga. 2013) (refusing to enforce EEOC subpoena due to EEOC’s “highly inappropriate” misuse of authority) • EEOC v. Womble Carlyle Sandridge & Rice, LLP, 13-CV-46 (M.D.N.C. 1/6/14) (EEOC failed to ensure that relevant job search records were preserved by individual on whose behalf the agency brought suit; finding “negligence, if not gross negligence” on EEOC’s part; awarding fees and costs to employer but delaying resolution of adverse inference issue) • EEOC v. Sterling Jewelers (W.D.N.Y. 3/10/14) (EEOC’s largest systemic pattern & practice lawsuit dismissed because EEOC failed to conduct a pre-litigation investigation of the pay & promotion discrimination claims it asserted; mere gathering of information from others was insufficient without independent analysis; labeled by commenters as a “stunning defeat” for EEOC) 27 “Bronies”: A New Protected Class? • Since 2010, Hasbro’s “My Little Pony” cartoon TV show about candycolored ponies, targeted at 6-year-old girls, has attracted a large following of adult heterosexual males, who call themselves “Bronies”. • Recently, a Brony was terminated from his job because of his Brony status. He displayed “Applejack the Pony” as his screen saver, and talked with his colleagues about his love for the show. • His boss told him it was weird that he had a TV show for little girls as a background, and that his Brony status made others uncomfortable. • His posting about the termination spawned debate over whether firing a Brony should be unlawful. • Was the termination a case of unlawful gender stereotyping? 28 “Bronies”: Three Million Men Can’t Be Wrong • Bronies are part of “the New Sincerity”, which is heralded as a response to the age of cynicism, because Bronies watch My Little Pony “un-ironically.” • Bronies are associated with the motto, “Be More Awesome.” 29 EEOC DEVELOPMENTS 30 EEOC v. CVS Pharmacy, Inc., 14-cv-00863 (N.D. Ill.) • On February 7, 2014, the Chicago office of the EEOC filed an action in the U.S. District Court for the Northern District of Illinois challenging a release agreement as improperly limiting an employee's ability to file EEOC charges and to participate in an EEOC investigation. • Filed as a Section 707(a) action alleging that certain language in the release deterred the filing of charges and interfered with employees' ability to communicate with the EEOC and state human rights agencies. • Significantly, the agreement in question contained specific language advising the employee that nothing in the agreement restricted him/her from filing a charge. • It is the EEOC's position that this language does not insulate the company's release from challenge. 31 Potential Release Provisions Impacted • Language regarding the employee's right to participate in proceedings by federal, state or local government agencies enforcing discrimination laws. • Non-disparagement provisions. • Non-disclosure provisions, particularly those that cover information on personnel, skills, abilities, duties of employees, wages and benefits and affirmative action plans and planning. • General release language that includes a release of "charges." • Affirmation of no pending claims. • Language providing for attorneys' fees to the employer in the event of a breach of the agreement by the employee. • Language requiring notification to the employer in the event of a subpoena • Covenants not to sue. 32 EEOC v. CVS Pharmacy, Inc., 14-cv-00863 (N.D. Ill.) • The District Court granted CVS’ motion to dismiss on September 18, 2014. • The Court based the dismissal on its finding that the EEOC had not attempted to secure a conciliation agreement acceptable to the Commission prior to filing the District Court complaint. • The Court did not reach the key legal issues under Title VII in the case. • Since the matter was dismissed on a procedural issue, it will likely not affect the EEOC’s scrutiny of employer separation agreements. 33 Employee Release Agreements • • • A number of EEOC offices – including Manhattan – are reviewing private agreements as a condition of granting withdrawal requests from Charging Parties. Some common release provisions that may present issues to the EEOC include: – non-disparagement – cooperation – covenants not to sue – Ledbetter affirmations (if applicable) – no reemployment – confidentiality clauses which prohibit discussion of the underlying facts leading up to the agreement. At least one EEOC office, Manhattan, is refusing to grant a withdrawal request if the submitted agreement includes a general release that was negotiated directly with a Charging Party who was not represented by legal counsel. 34 EEOC Guidelines on Religious Garb and Grooming in the Workplace • Set forth EEOC’s position that employers are required to accommodate an employee’s reasonable request for modification of uniform and dress policies unless granting the request would impose an undue hardship. • Employee request must be grounded in sincerely-held religious belief • Employers are permitted to request information from the employee in order to evaluate the sincerity or religious nature of a particular belief or practice. • Requires accommodation for religious practices that may deviate from commonly-followed tenets of the religion. • Recognizes that an individual's religious beliefs or degree of adherence may change over time. 35 EEOC Enforcement Guidance on Pregnancy Discrimination and Related Issues • First comprehensive update on the subject since 1983 and supersedes earlier guidance. • Guidance is in four parts: – Part One - Discusses the prohibitions under Title VII of the Civil Rights Act, as clarified by the Pregnancy Discrimination Act of 1978 (PDA). – Part Two - Discusses the application of the ADAAA’s accommodation and non-discrimination requirements and the definition of disability to pregnancy-related impairments. – Part Three discusses other legal requirements affecting pregnant workers, including the FMLA. – Part Four describes “Best Practices” for employers. 36 EEOC Enforcement Guidance on Pregnancy Discrimination and Related Issues The Guidance’s more controversial requirements include the following: – An employer policy of providing light duty only to employees with onthe-job injuries violates the PDA (Commissioner Lipnic noted that this position has not been adopted by any federal circuit court); – An employer must provide accommodations to an employee with a normal and otherwise healthy pregnancy; – Certain employer inquiries, comments or discussions regarding an employee’s pregnancy or potential pregnancy are indicative of discrimination; and – An employer health insurance plan must cover prescription contraceptives on the same basis as prescription medications that prevent medical conditions other than pregnancy. 37 EEOC v. Mach Mining – Federal Split Over Judicial Review of EEOC Conciliation • Conciliation is important in Equal Employment Opportunity Commission matters, occurring in cases in which the EEOC finds reasonable cause to believe an employer has violated a statute it enforces. • The EEOC may file a lawsuit only if the Commission has been unable to secure a conciliation agreement acceptable to the Commission. • Most circuit courts (Second, Fourth, Fifth, Sixth, Tenth and Eleventh Circuits) have decided that courts may engage in a searching review of the EEOC’s conciliatory efforts. • Provides employers the opportunity to cite flaws in the agency’s conciliation process as a defense to the lawsuit and seek dismissal of the lawsuit based on the failure of the conciliation process. 38 EEOC v. Mach Mining – Federal Split Over Judicial Review of EEOC Conciliation • U.S. Court of Appeals for the Seventh Circuit in EEOC v. Mach Mining, LLC, 738 F.3d 171 (7th Cir. 2013), took the opposite view. • Employer argued circuits have long found that the EEOC’s efforts to conciliate are subject to “good faith” review as to whether the EEOC: – provided sufficient information to the employer, – gave it a meaningful opportunity to respond, – exhibited a reasonable attitude in light of the employer’s response. • U.S. Supreme Court granted certiorari on June 30, 2014 39 EEOC Suits Regarding Transgender Discrimination • Another focus of the EEOC SEP is the area of coverage of lesbian, gay, bisexual and transgender individuals under Title VII’s sex discrimination provisions, “as they may apply.” • In September 2014, the EEOC filed two separate actions involving discrimination claims by transgendered individuals: • EEOC v. Lakeland Eye Clinic, 14-cv-2421-T35, in the U.S. District Court for the Middle District of Florida. • EEOC v. R.G. & G.R. Harris Funeral Homes, Inc., Civ. No. 14-cv-13710 in the U.S. District Court for the Eastern District of Michigan. • The lawsuits allege the employers fired the transgendered employees because they were transitioning from male to female, and/or because they did not conform to the employer's “gender-based expectations, preferences, or stereotypes.” • These are the first two lawsuits ever filed by the EEOC alleging sex discrimination against transgender individuals. 40 Class Actions and Waivers 41 Impact of Wal-Mart Stores Inc. v. Dukes • In 2010 (the year prior to the Wal-Mart decision), the top 10 employment discrimination settlements totaled $346.4 million. • In 2012 (the first year after Wal-Mart), the top ten employment discrimination settlements totaled $48.65 million. • In 2012, filings of employment discrimination claims remained relatively constant, a trend that continued into 2013. 42 American Express Co. v. Italian Colors Restaurant,___ U.S. ___, 133 S. Ct. 2304, 186 L. Ed.2d 417 (2013) • Arose out of antitrust claim brought by merchants against American Express. • Held: A class-action waiver in an arbitration agreement is enforceable, even if the plaintiffs are able to demonstrate that the cost of proving their claims individually would deter litigation. • Justice Scalia’s opinion noted the following factors supporting this holding: – Arbitration is a matter of contract which courts must “rigorously enforce” according to their terms unless the Federal Arbitration Act (FAA) mandate has been expressly overridden by Congress; – The “effective vindication” exception does not guarantee class arbitration simply because the expense of individual vindication of a statutory right would be expensive. 43 American Express Co. v. Italian Colors Restaurant,___ U.S. ___, 133 S. Ct. 2304, 186 L. Ed.2d 417 (2013) The American Express decision built on other recent decisions by the Court which upheld arbitrability of claims: • CompuCredit Corp. v. Greenwood, ___ U.S. ___, 132 S. Ct. 665, 181 L. Ed.2d 586 (2012) – Court held that FAA presumption in favor of arbitration is so strong that another federal statute could only bar arbitration if expressly stated by the other statute. • AT&T Mobility, LLC v. Concepcion, ___ U.S. ___, 131 S. Ct. 1740, 179 L. Ed.2d 742 (2011) – Court held California state law invalidating class action waivers in consumer arbitration agreements was preempted by FAA. 44 Regulatory Changes to Strengthen Diversity & Inclusion Expanding Support for Individuals with Disabilities and Veterans • Office of Federal Contract Compliance Programs (OFCCP) enforces the contractual promise of affirmative action and equal employment opportunity • OFCCP monitors thousands of federal contractors each year to ensure that they are meeting their legal obligation to provide equal employment opportunities for women, minorities, individuals with disabilities, and protected veterans • The OFCCP is responsible for: – Enforcing laws and order - Executive Order 11246, Section 503 of the Rehabilitation Act of 1973, and Vietnam Era Veterans Readjustment Assistance Act of 1974 – Conducting audits of AAPs to ensure contractors are providing effective equal employment opportunities 46 New Regulations Promulgated by the OFCCP • These new regulations enhance Federal Contractor’s affirmative action obligations for protected veterans and individuals with disabilities • The regulations require: – changes to how Company’s collect and report data – An assessment of the Company’s outreach, recruiting, and retention of individuals with disabilities and protected veterans – new language to be used when incorporating the equal opportunity clause into a subcontract by reference 47 EEO LAWS & Affirmative Action Programs (AAPs) • Employers who have 50+ employees and $50,000+ in government contracts must have AAPs • AAPs require contractors to maintain data that tracks/analyzes participation of protected groups; and identify potential issues with the contractors’ recruitment and treatment of these groups • Issues identified by AAPs may require contractors to enhance efforts in outreach, recruitment, and training to help members of the protected groups compete for jobs and other opportunities on equal footing 48 Individuals with Disabilities Section 503 of the Rehabilitation Act • Section 503 – Requires federal contractors to take affirmative action to employ and promote qualified individuals with disabilities – ADAAA (Americans with Disabilities Act Amendments Act): A disability is a “physical or mental impairment that substantially limits one or more major life activities; or (2) a “record of” such an impairment; or (3) being “regarded as” having such an impairment – 2012 unemployment rate for individuals with disabilities was 15.0% (general unemployment rate 7.9%) – The regulations provide employees with the opportunity to voluntarily self-identify as an individual with a disability in a confidential manner 49 Voluntary Self-Identification of Disability 50 51 Vietnam Era Veterans’ Readjustment Assistance Act (VEVRAA) • VEVRAA – Prohibits federal contractors and subcontractors from discriminating in employment against protected veterans, and requires these employers to take affirmative action to recruit, hire, promote and retain these veterans • OFCCP Findings – Increasing number of veterans returned from Iraq and Afghanistan – 2012 veteran unemployment rate was 9.5% (general unemployment rate 7.9%) – VEVRAA regulations revised to address the higher unemployment rate for veterans 52 Unemployment Rate 53 New Requirements Requirement Section 503 – IWD VEVRAA Hiring Percentage (Outreach, Recruitment and Workforce) Establish disability goals by job group and monitor progress toward goal attainment – 7% utilization goal Establish hiring benchmark for veterans – 8% Self Identification (Required Invitation) 3 Phases: Applicants (Pre-offer), Hirees (Post-offer) and Workforce (1st year, every 5 years thereafter) Data Collection Implement new ways to track whether hiring and utilization goals are being met Quantitative Comparison: • Applicants: Number of protected applicants, total number of job openings, the number of jobs filled and total number of applicants for all jobs • Employees: Total number of protected applicants hired and total number of applicants hired 54 New Requirements Requirement Section 503 – IWD VEVRAA Annual Assessment Determine effectiveness of outreach and recruitment activities and document yearly evaluation. Affirmative obligations to make changes, if necessary Record Retention 3 years – must retain information to identify trends in recruitment and hiring and assess success of outreach and recruitment EEO Clause Revise contracts, subcontracts and purchase orders (not retroactive); mandated Language Job Listings Required notice to applicants and employees of our efforts to recruit veterans and individuals with disabilities 55 Implementation Dates for Requirements Effective March 24, 2014 Effective for New AAP Cycle Update EEO policy New voluntary self-identification requests Update language in contracts and purchase orders Utilization goals and hiring benchmarks Update language to be included in job advertisements, postings Enhanced data collection Record retention Annual written assessment of outreach and requirements efforts Notification to labor organizations of company EEO policies and commitment to taking affirmative action 56 Sample Data Collection 2014 2015 2016 Number of applicants who self-identify as individuals with disabilities before an offer of employment is made Total number of job openings Total number of jobs filled Total number of applicants for all jobs Number of applicants with disabilities hired Total number of applicants hired 57 OFCCP Directive 2014-02 & Executive Order 13672 Gender Identity & Sex Discrimination • On June 30, 2014, the Secretary of Labor (“SOL”), announced that the DOL would ensure that individuals with claims of gender identity and transgender status discrimination receive the full protection of federal nondiscrimination laws. • On August 19, 2014, the OFCCP issued directive to 2014-02, Gender Identity and Sex Discrimination. – The directive clarifies that under Executive Order 11246, as amended, sex discrimination includes discrimination on the basis of gender identity and transgender status. – The new directive is consistent with the EEOC’s April 20, 2012 decision in Macy v. Holder. • Executive Order 13672: along with Directive 2014-02, Executive Order 13672 prohibits discrimination on the basis of gender identity. Executive Order 13672 specifically prohibits discrimination on the basis of gender identity and sexual orientation, as separate protected categories. 58 Challenges OFCCP guidance and procedures continue to evolve Encouraging voluntary self identification Challenges Review of physical and mental qualifications standards of jobs Labor market competing for same applicants 59 Executive Order 13665 - Non-Retaliation For Disclosure of Compensation Information • • • • On April 8, 2014, which is National Equal Pay Day, President Obama signed Executive Order 13665, the Non-Retaliation Executive Order. EO 13665 amends Section 202 of Executive Order 11246 of September 24, 1965. EO 13665 prohibits discrimination by federal contractors against employees making inquiries about compensation or who disclose compensation information. On September 15, 2014, the OFCCP issued a notice of proposed rule making for EO 13665, and announced a public comment period which runs until December 16, 2014. EO 13665 expressly states: “The contractor will not discharge or in any other manner discriminate against any employee or applicant for employment because such employee or applicant has inquired about, discussed, or disclosed the compensation of the employee or applicant or another employee or applicant. This provision shall not apply to instances in which an employee who has access to the compensation information of other employees or applicants as a part of such employee’s essential job functions discloses the compensation of such other employees or applicants to individuals who do not otherwise have access to such information, unless such disclosure is in response to a formal complaint or charge, in furtherance of an investigation, proceeding, hearing, or action, including an investigation conducted by the employer, or is consistent with the contractor’s legal duty to furnish information.” 60 A Balancing of Free Speech Rights and Protected Activity with Employer’s Rights • The NLRB has long held that employees who discuss the terms and conditions of their employment – including compensation information – are engaging in protected concerted activity. • Recognizes employers may still protect their confidential business information by requiring employees not to disclose the compensation of co-workers. • On August 8, 2014, the DOL issued its Notice of Proposed Rule Making for “Government Contractors, Requirement to Report Summary Data on Employee Compensation.” Public comments must be received by November 6, 2014. 61 Presidential Memorandum Regarding Employee Compensation • On April 8, 2014, President Obama also signed a Presidential Memorandum to the U.S. Secretary of Labor titled “Advancing Pay Equity Through Compensation.” • Secretary of Labor must issue a rule that “would require federal contractor and subcontractors to submit to DOL summary data on the compensation paid to their employees, including data by sex and race.” (120 Days) • Cited U.S. Census Bureau figures showing that annual earnings for women were only 77 percent of what men earned. (2012) • When measured by hourly earnings, the difference narrows to 86 percent, according to the Federal Bureau of Labor Statistics. 62 Equal Pay Report – Requirement for Federal Contractors to Report Summary Pay Data • On August 6, 2014, the DOL announced a proposed rule requiring federal contractors and subcontractors to submit an annual Equal Pay Report on employee compensation to the OFCCP. • This requirement applies to Company’s that have more than 100 employees, and hold federal contracts or subcontracts worth $50,000 or more. • The proposed Equal Pay Report will help the OFCCP direct its enforcement resources towards contractors whose summary compensation data suggests potential pay violations. • The proposed rule has a public comment period which runs until November 6, 2014. 63 Wage & Hour Developments 64 March 13, 2014 Presidential Memorandum • On March 13, 2014, President Obama directed the Secretary of the Department of Labor to proposed revisions to modernize and streamline overtime regulations to: • • • Update existing protections consistent with the FLSA; Address the changing nature of the workplace; and Simplify the regulations for employers and employees to understand. • President Obama specifically stated that the minimum salary threshold for white collar exemptions needs to be updated. The current weekly threshold of $455 ($23,660 annually) was established in 2004. 65 Executive Order 13658 • On February 12, 2014, President Obama signed Executive Order 13658 - Establishing a Minimum Wage for Contractors. • Raises the hourly minimum wage paid by federal contractors to workers on covered contracts to $10.10 per hour beginning January 1, 2015. The minimum wage on federal contracts will be increased on January 1 each subsequent year by an amount determined by the Secretary of Labor. • The Department of Labor issued a Notice of Proposed Rulemaking in connection with the Executive Order on June 3, 2014. The DOL must issue final regulations by October 1, 2014. 66 Minimum Wage Developments • July 24, 2009 – Federal minimum wage increased from $6.55 to $7.25 per hour. • Twenty-one states have minimum wages higher than the federal rate. • In his 2014 State of the Union Address, President Obama called for raising the minimum wage. Raising the minimum wage is a key component of the administration’s “year of action” on the economy. The President’s plan calls for tying the minimum wage increase to the rate of inflation and increasing the minimum wage for tipped workers. 67 Minimum Wage Developments • In March 2014, Sen. Tom Harkin (D-Iowa) and Rep. George Miller (D-Calif.) introduced legislation to increase the minimum wage to $10.10 and tie increases to an inflation index. • A DOL report released in July 2014 found that the 13 states that raised their minimum wages January 1, 2014 actually saw faster job growth than those that did not. • The Congressional Budget Office predicted raising the federal minimum wage to $10.10 would result in the loss of 500,000 jobs. 68 State Law Developments 69 Paid Sick Leave • 2006 - San Francisco became the first municipality to provide for guaranteed paid sick days to employees. • 2009 - Washington D. C. enacted legislation that required paid sick days including the use of paid time off for victims of domestic violence, sexual assault and stalking. • 2011 – Connecticut becomes the first state to pass legislation requiring paid sick days for employees. • 2014 – CA enacted Healthy Workplaces, Healthy Families Act of 2014 in September. • Legislation or campaigns to enact legislation exist in at least 21 states including NY and NJ and a number of major cities including Chicago, San Diego and Philadelphia. 70 Ban The Box Legislation • Legislation designed to remove unfair barriers to employment. • Requires public and/or private employers (depending on the jurisdiction and legislation) to remove questions on job applications concerning an applicant’s criminal convictions and to defer background checks until later in the hiring process. • In 2013 and 2014, eight states (CA, DE, IL, MD, MN, NE, NJ and RI) passed “ban the box” legislation bringing the total to 12 states that have passed “ban the box” legislation (CO, CT, HI, MA, NM). Washington, D.C. also enacted a “ban the box” law on August 21, 2014. • Over 60 cities and counties, including New York City, Philadelphia, Seattle, San Francisco, Baltimore and Rochester, NY, have passed some “ban the box” legislation. 71 Social Media Passwords • Beginning in 2012, states began to introduce legislation designed to prevent employers from requesting passwords to employees’ and applicants’ personal email accounts and other social media accounts. • In 2014, legislation has been introduced or is pending in 28 states. LA, ME, OK, TN and WI enacted legislation in 2014. 72 Pregnancy Accommodation Laws • 15 states and two cities (NYC and Philadelphia) have enacted laws requiring employers to provide reasonable accommodations to pregnant workers. • In February 2014, New Jersey amended the Law Against Discrimination to include pregnancy as a protected category and require employers to provide reasonable, pregnancy –related accommodations to pregnant employees. • In April 2014, the Florida Supreme Court ruled held that the Florida Civil Rights Act’s ban on discrimination based on gender can cover claims for pregnancy discrimination, resolving a conflict among appellate courts in the state. Delva v. The Continental Group, Inc., 137 So. 3d 371 (Fla. 2014). • In May 2014, Minnesota enacted the Women’s Economic Security Act which, inter alia, requires employers with at least 22 employees to provide reasonable minor accommodations (water, food, and a stool) or a reasonable, temporary position transfer for pregnant women. 73 Pregnancy Accommodation Laws • In June 2014, the City of Houston enacted the Houston Equal Rights Ordinance expanding protected characteristics to include a number of categories including pregnancy. • In July 2014, New York amended the New York State Human Rights Law to protect unpaid interns against workplace discrimination and retaliation. The prohibitions include compelling a pregnant intern to take a leave of absence unless the pregnancy prevents her from performing the activities associated with her position in a reasonable manner. • California enacted similar protections for unpaid interns, volunteers and apprentices effective January 1, 2015. 74 Marijuana • 23 states and the District of Columbia have laws legalizing marijuana in some form (i.e., legalizing medicinal use, decriminalizing possession of small amounts). • Colorado and Washington are the only states to have legalized the recreational use of marijuana. 75 Marijuana • Some states (AK, CA, CO, HI, MA, MI, MO, NH, NJ, OR, RI, WA) have pro-employer laws regarding the use of marijuana. For example: • Colorado’s Amendment 64 includes language that states the legalization of marijuana is not intended to require an employer to permit or accommodate use or affect the ability of the employers to have policies restricting the use of marijuana. • Coats v. DISH Network, L.L.C., 303 P.2d 147 (Colo. Ct. App. 2013): Colorado Court of Appeals reinforced an employer’s ability to discharge employees who test positive for marijuana finding that for an activity to be lawful it must be permitted by and not contrary to both state and federal law. 76 Marijuana • Some states (AZ, Ct, DE, IL, ME, MN) provide for employee protections. For example: • On May 29, 2014, Minnesota enacted the Medical Cannabis Act provided that an employer may not discriminate against a person in the terms or conditions of employment based upon the employee’s status as a qualified patient or a qualified patient’s positive drug test for medical marijuana. • Other states (D.C., MD, NV, NM, NY) are silent as to employment issues. 77 California Abusive Conduct Training • On September 9, 2014, the CA governor signed Assembly Bill 2053 modifying California state law AB1825 which requires mandatory sexual harassment training for any employee who performs supervisory functions within a company of 50 employees or more. • AB2053 requires the mandatory training to include training on “abusive conduct.” • Abusive conduct means: • Conduct of an employer or employee in the workplace, with malice, that a reasonable person would find hostile, offensive, and unrelated to an employer’s legitimate business interests. • May include repeated infliction of verbal abuse, such as the use of derogatory remarks, insults, and epithets, verbal or physical conduct that a reasonable person would find threatening, intimidating, or humiliating, or the gratuitous sabotage or undermining of a person’s work performance. • A single act shall not constitute abusive conduct, unless especially severe and egregious. 78