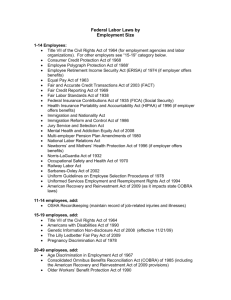

CPP Chapter 4 - Health Accident and Retirement Benefits

advertisement

Darcy Borelli, PHR, CPP Chapter 4 Health, Accident & Retirement 2016 From Knowledge Assessment Calculator (KAS) Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) Requires health plan sponsors to provide employees and their beneficiaries with the opportunity to elect continued group health coverage for a given period should their coverage be lost due to “qualifying event” • Applies to employers with 20 or more employees (FTEs) on typical business day. • Coverage period generally is 18 to 36 months Coverage same as provided to similarly situated beneficiaries who have not suffered the qualifying event. • Employees who purchased health care coverage under a cafeteria plan (including flexible spending) are eligible for COBRA continuation at level of coverage before event • Long Term Care Insurance is not included in COBRA Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) Cont. Qualifying events- an event that results in the loss of group health coverage. To be eligible, your employees and their dependents must be covered by your group health plan the day before one of these qualifying events. Examples of Qualifying events Employer Responsible to Report Voluntary Termination Involuntary Termination Reduction of Hours Medicare Entitlements Employees of Bankruptcy* Employee Responsible to Report Divorce/Legal Separation Dependent child ceasing to be dependent Social Security Disability Benefits Secondary events (* Bankruptcy of the employer-affects Retirees only and their dependents) Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) Cont. FMLA/COBRA Interaction • Date employee is to return to work at end of FMLA Leave (or date employee notifies employer he/she is not returning if before end of FMLA Leave) is qualifying date ◦ Unpaid required premium while on FMLA Leave does not eliminate the employees right to COBRA continuation coverage How long does COBRA coverage last? 18- months These qualifying events provide for 18 months of coverage for all qualified beneficiaries from the date of the qualifying event: -Voluntary Termination -Involuntary Termination (gross misconduct exception) -Reduction of hours (strike, layoff, leave of absence) Exceptions the 18-month time frame can be extended : -to 36 months due to an additional event -to 29 months due to a disability determination within 60 days of the qualifying event. -to 24 months if the employee goes out on Military leave -Lifetime for bankruptcy of retired covered employee and their spouse. However, once the retiree passes away, the spouse is only offered 36 more month of coverage from the date of the employees death date. Rule of thumb: 18 months of coverage for events that happen directly to the employee. How long does COBRA coverage last? (con’t) 36 months These qualifying events provide for 36 months of covered spouse and/or covered dependent child of the employee from the date of the qualifying event: -Death of the employee -Divorce or legal separation -Dependent child ceasing to be a dependent -Medicare entitlement* (*Medicare entitlement is an original qualifying event in a limited number of circumstances. ) Rule of thumb: 36 months of coverage for dependents of the employee Remember: 18 months –events to employee 36 months—events to dependents 24 months—if employee is going out on military leave 29 months – for employee on disability Lifetime for retirees of bankrupt company and their spouse Knowledge check Debbie never enrolled in her employer’s health plan and has been laid off from her 40 hour a week job. Does Debbie qualify for COBRA? No, there has been no COBRA qualifying event. She had a reduction in hours, but no loss of coverage as she never enrolled in health care with her employer. If John tenders his resignation effective two months from today, has he experienced a qualifying event? No, because John is still at work. Employment must be terminated in order for an event to occur. Qualifying events always need to happen, you can not future date them. COBRA coverage ends when: -Employer stops providing group health coverage to employee -The premium for the coverage is not paid within 30 days of due date -Employee or dependent becomes covered under another group health plan -The employee or dependent becomes entitled to Medicare benefits (children added to coverage do to birth or adoption, there coverage ends at the same time as the other family members) Premiums for COBRA- COBRA is NOT cheap You pay the full cost of the coverage, plus a 2% administrative fee. Full premium means any amount you contributed, PLUS what your employer contributed, PLUS the 2% fee. Example: Employer Sponsored while employed vs. COBRA While Employed Family of four, age 30-39 PPO, $250 deductible Monthly premium: $756.00 Employer pays 90%: $680.40 You pay 10%: $75.60 Enrolled In COBRA Family of four, age 30-39 PPO, $250 deductible Monthly premium: $756.00 You pay 102%: $771.12 Premium exception: If a qualified beneficiary is disabled, their premium may increase to 150% of the premium on the 18th month of coverage. So months 1-17 they would pay 102% of the premium Months 18-29 they would pay 150% of the premium Why would some one take COBRA? Things to consider when deciding if the COBRA coverage you have been offered are your best option: -Whether or not you prefer the comprehensive benefits and don’t mind the added cost -Whether you are willing to exchange continual, guaranteed coverage for an added cost. -If you have had recent health problems. -If you have had ongoing health problems. -If you require expensive medications. -Whether or not you have been declined for private insurance recently. -If you are currently pregnant. -If you found a new job and your new employer does not offer a health plan. COBRA Timeline •With in 90 days being covered under the health plan, the COBRA continuation coverage right notice must be sent (COBRA Rights) •Employers have 30 days to notify the COBRA plan administrator of an employee's termination, work-hour reduction, death, entitlement to Medicare or employer’s bankruptcy (retirees only). •Employees have 60 days to notify the COBRA plan administrator of a divorce, legal separation or a loss of dependent child status. •A COBRA plan administrator has 14 days from the date of a notification to send a COBRA election notice to employee and all dependents. (must include contact information on the plan and the COBRA administrator. How to elect coverage, premium payment requirements, what happens if you don’t elect coverage and any extensions for coverage) •An eligible individual has 60 days to decide whether to elect COBRA continuation coverage COBRA timeline (con’t) Once COBRA is elected, qualified beneficiary has 45 days to make their first payment •If they fail to make the first payment their coverage end date will be the date of the qualifying event. If everyone waits to the last day to in every step of the process, first bill could be for up to 5 months of back coverage. 60 days to notify the COBRA plan administrator + 14 days to send the notification to elect COBRA notice + 60 days to decide whether to elect COBRA continuation coverage First bill would be for 134 days of back coverage= 5 months What is the cost of COBRA non-compliance? COBRA is jointly enforced by the Internal Revenue Service, the U.S. Department of Labor and the Department of Health and Human Services. Penalties for COBRA violations include: •Excise tax penalties of $100 per day ($200 if more than one familymember is affected) •Statutory penalties of up to $110 per day under the Employee Retirement Income Security Act (ERISA) •Civil lawsuits •Attorneys' fees and interest The minimum tax levied by the IRS for noncompliance discovered after a notice of examination is generally $2,500. The maximum tax for "unintentional failures" is the lesser of 10 percent of the amount paid during the preceding tax year by the employer for group health plans, or $500,000. The IRS places the burden of proof of compliance on the company. Family Medical Leave Act (FMLA) Allows employees to take up to 12 weeks of unpaid leave in any 12 month period • Newborn or newly adopted child • Take care of seriously ill child, spouse, or parent • Care for themselves if they are seriously ill • Employee’s spouse, child or parent is a covered military member on active duty, OR has been notified of an impending call to active duty in support of a contingency operation (can take up to 26 wks in a 12 month period to care for covered military service member with a serious injury or illness) • Guarantees continuation of employees’ health benefits while on leave Family Medical Leave Act (FMLA) Cont ‘d • Applies to private sector employers and public sector employees with 50 or more employees with in a 75 mile radius (including part-time and employees on leave or suspension, but not laid-off employees) • For public sector (government) employees and public elementary and secondary schools – no limit on employees or distance between locations • Employee must have been employed by employer for at least 12 months and have worked at least 1,250 hours within the previous 12-month period ◦ the 12 months of employment need not be consecutive ◦ Employment prior to a continuous break in service of 7 years or more does not need to be counted, unless: • For fulfillment of National Guard or Reserve • Period of approved absence or unpaid leave Family Medical Leave Act (FMLA) Cont ‘d • Expatriates are not covered • Employer decides what constitutes a 12 mo period – must be consistent; if employer policy is not clear, what favors employee • CA & NJ require FMLA • Employer can require employee to take leave • “Serious Health Condition” defined in FMLA regulations • Intermittent leave ◦ Can be several days or weeks at a time or by working reduced hours ◦ Reduced hours can be deducted from an exempt employee’s salary without jeopardizing exempt status ◦ If employee would be required to work overtime if not for FMLA leave, hours employee would have been required to work may be counted against FMLA entitlement Family Medical Leave Act (FMLA) Cont ‘d Designation as paid or unpaid leave • Employer an require employee to use paid leave available to the employee • Employer must designate leave as paid or unpaid FMLA leave within 5 days of receiving notice from employee a leave will be taken. ◦ Notice must be in writing. ◦ Must inform employee of number of hours, days, or weeks that will be counted against the employee’s FMLA leave entitlement • Employer must notify employee of eligibility to take FMLA leave within 5 business days after either employee requests leave or employer learns employee’s leave may be for an FMLA qualifying reason. If employee is not eligible for FMLA, notice must indicate at least one reason why employee is not eligible or has no FMLA leave available. Family Medical Leave Act (FMLA) Cont ‘d • Regulations provide for a notice of FMLA rights and responsibilities of the employer separate from the eligibility notice. Notice must include the following information: ◦ FMLA leave designations ◦ How 12 mo period and “single 12-mo period” are determined ◦ Employee certification requirements ◦ Substitution of paid leave for unpaid leave ◦ Premium payment requirements to maintain health benefits ◦ Job restoration rights, including effect of a “key employee” designation ◦ Potential liability for health insurance premiums if employee does not return to work Family Medical Leave Act (FMLA) Cont ‘d • Consequences exist for employer’s failure to follow FMLA notice requirements • There is a notice requirement for employees ◦ If medical treatment is foreseeable, a 30 day notice (or as much as can be given under the circumstances) • Medical or military certification can be required by employer • Health insurance benefits employee enjoyed before the leave must be continued during FMLA leave on the same basis ◦ Employer can require any employee premiums ◦ If employee fails to pay, employee can lose coverage after 30 days, but coverage must be restored when employee returns to work without employee having to meet any additional qualifications for coverage Family Medical Leave Act (FMLA) Cont ‘d • Job guarantee upon return from leave – either previous job or one that is “equivalent” with no loss of pay or benefits ◦ Employer may deny reinstatement to “key employees” if it’s necessary to prevent “substantial and grievous” economic injury to the employer’s operations • Key employee = paid on a salary basis; among the highest paid 10% of all employees within 75 miles of employee’s worksite when FMLA leave was requested • Recordkeeping Requirements ◦ Basic payroll records – hours worked, rate of pay, deductions from wages ◦ Records detailing dates and amount of FMLA leave taken ◦ Copies of notices and documents related to FMLA leave Family Medical Leave Act (FMLA) Cont ‘d • Enforcement administered and enforced by Department of Labor’s Wage & Hour Division • Retaliation for exercise of FMLA rights is prohibited by law • Employers covered by both FMLA and state law must comply with the law that provides the greatest benefits and protection to the employee requesting leave • Interaction of FMLA and cafeteria plans ◦ Employee is responsible for their share of premiums of group health plan during leave ◦ Cafeteria plan may offer one or more of the following 3 payment options • Pre-Pay • Pay-As-You-Go • Catch-up Sick Pay Sick Leave Pay • Paid by employer from regular payroll account Taxable as regular income • Worker’s Compensation is different! Sick Leave Pay under a Separate plan (STD, LTD) • Premiums paid by employee on after tax basis – benefits are not taxable • Premiums paid by employer or on pre-tax basis – benefits are fully taxable • Premiums paid by employer and employee (after-tax) – portion of benefits attributable to employer-funded portion is taxable Sick Pay Cont ‘d Responsibility for income withholding and employment taxes Employer makes payments and the plan is self-insured • Employer withholds taxes based on employee’s most recent W-4 • Employer withholds and pays employer share of Social Security, Medicare, and FUTA taxes for all payments made within 6 calendar months after the end of the last month during which the employee worked. If employee returns to work, new six-month period begins if employee is later on disability Sick Pay Cont ‘d Responsibility for income withholding and employment taxes • Payments made by employer’s agent OR employer is self insured. ◦ Agent may withhold FIT at 25% ◦ Employer retains responsibility for Social Security, Medicare, and FUTA unless agreement with agent to take on this responsibility. • Payments are made by an insurance company (3rd party) who receives premiums for disability coverage. ◦ Third party not required to withhold FIT from payments unless requested by disabled employee (W-4S) ◦ IRS allows employee to decide if they want for fixed amount or percentage (W-4S has no provision for percentage) ◦ Third party withholds and remits Social Security and Medicare taxes or advises employer who pays the taxes and includes in 941. Sick Pay Cont ‘d Reporting Responsibilities • Employer makes payments ◦ Report taxable amounts on Form 941 ◦ Report income tax withheld on Form 941 ◦ Report taxable amounts to employee on Form W-2 ◦ Report payments on Form 940 • Employer’s agent makes payments ◦ Usually employer retains reporting responsibilities • Third-party insurer makes payments ◦ Both the employer and the 3rd party have reporting responsibilities; if 3rd party does not properly transfer liability to employer, 3rd party is required to report on Form 941, Form W2, and Form 940 Sick Pay Cont ‘d Permanent Disability benefits • Payments subject to income tax when premiums were paid ◦ by employer or ◦ If employee paid with pre-tax dollars • Payments are not subject to Social Security, Medicare, or FUTA ◦ On or after employment relationship has terminated because of death or disability retirement ◦ Employee receiving disability insurance benefits under the Social Security Act – still subject to FUTA Workers Compensation Insurance Form of insurance employers are required to buy to insulate them from lawsuits brought by employees who are hurt or become ill while working. • Benefit payments – are not included in gross income or subject to any employment taxes • Premium payments – paid by employer based on specific earnings and classifications Each state has its own Workers Compensation Insurance law. There are 4 categories: • National Council States (38 states plus District of Columbia) • Non-National Council States (7 states) • Monopolistic States (5 states) • Competitive State Funds (12 National Council States) Workers Compensation Insurance Cont’d • Employers are assigned Classification Codes based on the type of business ◦ There are classification code exceptions for employees who work exclusively in an office, outside salespeople, and drivers & their helpers ◦ Certain types of compensation can be excluded when determining total payroll figure • The “half” portion of overtime premium • Reimbursed travel expenses • Third-party sick pay • Reimbursed moving expenses • Tips • Personal use of company-provided vehicle • Group Term Life Insurance over $50,000. • Severance Pay • Education Assistance Payments • Employer contributions to pension or insurance plans Cafeteria Plans Cafeteria Plans provide employees a choice from a “menu” of cash compensation and nontaxable benefits authorized by Section 125 of the Internal Revenue Code A qualified Cafeteria Plan must contain at least one taxable (cash) and one nontaxable (qualified) benefit Examples of qualified benefits: • Coverage under accident & health insurance plans • Coverage under dependent care assistance plans • Group Term Life insurance on lives of employees • Qualified adoption assistance • Premiums for COBRA continuation coverage • Accidental death & dismemberment insurance • Long-term and short-term disability coverage • A 401(k) plan • Contributions to HSA Cafeteria Plans Cont’d Exceptions to qualified non-taxable benefits would be: • Scholarships and fellowships • Nontaxable fringe benefits under IRC Section 132 • Educational Assistance • Meals and lodging furnished for the benefit of the employer • Employer contributions to Archer MSAs • Long-term care insurance (unless purchased with funds from a HSA offered as a qualified benefit) • Group-term life insurance on the life of anyone other than an employee • Health Reimbursement Arrangements that allow any unused amount to be carried over to the next coverage period to increase the maximum reimbursement amount • Elective deferrals to a Section 403(b) plan Cafeteria Plans Cont’d Reasons a plan would fail to satisfy Section 125 requirements: • Offering nonqualified benefits • Not offering an election between at least one permitted taxable benefit and at least one qualified benefit • Deferring compensation • Failing to comply with the uniform coverage rule or use-orlose rule • Allowing employees to revoke elections or make new elections during a plan year (except as allowed by law) • Failing to comply with substantiation requirements • Paying or reimbursing expenses incurred for qualified benefits before the effective date of the cafeteria plan or before a period of coverage • Allocating experience gains other than expressly allowed by law • Failing to comply with grace period rules Cafeteria Plans Cont’d • Premium-only plan – known as POP’s or premium conversion plans. Used by employers who require their employees to contribute towards benefits (usually health insurance) • Deferred Compensation is prohibited under the rules governing cafeteria plans EXCEPTIONS ◦ 401(k) ◦ Educational institution contributions for postretirement group-term life insurance ◦ Amounts remaining in a HSA at end of calendar year ◦ Benefits under a long-term disability policy relating to more than one year ◦ Mandatory two-year election for vision or dental ◦ Using salary reduction amounts to pay premiums for the 1st month of the next plan year ◦ Purchase of additional time off carried over to next year Cafeteria Plans Cont’d Cafeteria plans are usually funded by either or both of the following: • “Flex dollars” or “flex credits” • Salary reduction – pre-tax contributions by the employee result in a higher take-home pay for the employee Automatic deferrals (i.e., “negative elections”) are OK After-tax employee contributions also are part of a cafeteria plan A Cafeteria Plan must have a written document laying out the particulars of the plan and it must be intended to be a permanent plan. There are certain items the plan must contain to be considered a Cafeteria Plan according to IRC Section 125. (See page 4-70) Cafeteria Plans Cont’d Benefit Elections Usually irrevocable before the benefit becomes available or the plan year begins. Changes or revocations during the plan year are only allowed under limited circumstances. IRS Regulations clarify employees’ right to revoke or change an election during a plan year based on a change in status • Marital status changes • Changes in the number of dependents • Employment status changes (applies to employee, spouse, or dependent) • Change in dependent status • Residence change • Adoptions An election change can be made only if the status change results in the employee, spouse, or dependent gaining or losing eligibility for coverage under the plan Cafeteria Plans Cont’d Special Exceptions • COBRA • Medical Support orders • Medicare or Medicaid eligibility • Special enrollment rights under HIPPA • Elective deferrals under a CODA • FMLA leave changes Election changes may also be made to reflect significant cost or coverage changes for all types of qualified benefits provided under a Cafeteria Plan during the plan year. Contributions may be made to a HSA through a cafeteria plan, with specific rules surrounding the pre-tax qualification Option election for new employees – 30 days after hire date to elect coverage Cafeteria Plans Cont’d Participation in a Cafeteria Plan must be restricted to employees and the plan must be maintained for their benefit. Nondiscrimination testing • Plan cannot discriminate in terms of eligibility, contributions, or benefits in favor of highly compensated individuals, or participants, or key employees • Three main nondiscrimination tests ◦ Eligibility test ◦ Contributions and benefits test ◦ Concentration test • Special health benefits test • Separate tests allowed for new employees • Testing must be performed at year-end Cafeteria Plans Cont’d Flexible Spending Arrangements (FSA’s) • Employees can elect a pre-tax salary deduction to pay for certain covered health care, dependent care, and adoption expenses. • There are specific requirements that FSA’s must meet ◦ Elections cover a full plan year ◦ Limit of $2,550 ◦ No deferred compensation – “use it or lose it” ◦ Plan can allow a “grace period” up to 2 ½ months ◦ Unused balances can be distributed to reservists – ◦ “qualified reservist distributions” allowable if employer decides to include it in the cafeteria plan ◦ Uniform coverage throughout coverage period ◦ 12 month period of coverage ◦ Prohibited reimbursements; claim substantiation; claims incurred ◦ Limiting health FSA enrollment to health plan participants Cafeteria Plans Cont’d Flexible Spending Arrangements (FSA’s) (cont’d) • Specific Requirements (continued): ◦ Reimbursements must be for medical expenses – health care reform legislation has changed the definition of medical expenses – only cost of medicines prescribed by a doctor and insulin (for over-the-counter drugs, doctor must provide a prescription to qualify for FSA) • Coordination with HIPAA requirements • FSA benefits followed transferred employees after asset sale • Can be set up to use debit and credit cards for payments and reimbursements with specific requirements ◦ After 1/15/11, FSA debit cards may not be used to purchase over-the-counter medicines or drugs unless specific IRS rules are followed • Special dependent care assistance rules Cafeteria Plans Cont’d Tax Treatment of Cafeteria Plans • Employer contributions are excluded from employee’s income – not subject to federal withholding or employment taxes • Pre-Tax contributions (salary reductions) made by employee are excluded from employee’s income – not subject to federal withholding, Social Security, Medicare and FUTA taxes • NOTE 401(k) plan pre-tax contributions are subject to Social Security, Medicare, and FUTA taxes • Group-term life insurance – first $50,000 is not taxable • After-tax contributions – totally taxable (subject to federal income tax, Social Security, Medicare and FUTA) Cafeteria Plans Cont’d W-2 Reporting • 401(k) – does not reduce Social Security or Medicare and FUTA taxable wages; • report amount of 401(k) deferral in Box 12, Code “D” • Dependent care assistance – report amount in Box 10 Retirement and Deferred Compensation Plans • • • • Qualified Pension and Profit Sharing Plans IRC 401(a) Cash or Deferred Arrangements IRC 401(k) Tax-Sheltered Annuities IRC 403(b) Deferred Comp Plans for Public Sector and Tax-Exempt Groups IRC 457 • Employee-Funded Plans IRC 501(c)(18)(D) • Individual Retirement Accounts (IRA) • Simplified Employee Pensions IRC 408(k) • Savings Incentive Match Plans for Employees of Small Employers (SIMPLE Plans) • Employee Stock Ownership Plans • Nonqualified Deferred Compensation Plans Retirement and Deferred Compensation Plans Cont’d Qualified Pension and Profit Sharing Plans –IRC 401(a) • Defined Benefit Plans ◦ Benefit to employee based on age, compensation level and length of service ◦ Employer required to make contributions to plan sufficient to provide level of benefits earned by employee • Defined Contribution Plans ◦ Account for each employee, with set amount being contributed. Employee’s retirement benefit depends on the amount of money in the account at retirement. ◦ Payroll maintains records of hours worked, compensation earned, dates of birth and hire date Retirement and Deferred Compensation Plans Cont’d Qualified Pension and Profit Sharing Plans 401 (a) • Types of Defined Contribution Plans ◦ Money Purchase Pension Plan - Employer makes contributions each year based on employee’s compensation. ◦ Profit Sharing Plan – Employer contributions are substantial and recurring, although they may be discretionary to some degree Qualified Pension and Profit Sharing Plans 401 (a) • Annual Compensation and Contribution Limits ◦ Set by Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) ◦ For 2015 annual compensation limit is $265,000 (indexed annually to the next lowest multiple of $5,000). ◦ Annual contributions and other “additions” to defined contribution plans is limited under IRC 415 to the lesser of $53,000 in 2015 (indexed annually) or 100% of employee’s annual compensation. ◦ Pre-tax elective deferrals to 401(k), 403(b), 457, 125, 132(f)(4) are included in employee’s contribution to determine the limit. •Tax Treatment of Pension and Profit Sharing Plans ◦ Qualified Plan – meets certain requirements under IRC 401(a) regarding participation, vesting, contribution limits, benefit limits, and nondiscrimination in favor of highly compensated employees. • Employer contributions are excluded from wages and are not subject to federal income tax withholding, or Employment taxes. • Employee after-tax contributions are included in income and taxable whether voluntary or required. 401a Chart Type of Limit • • • • Annual Benefits limit for defined benefit plans Annual Compensation limit Annual additions to defined contribution plan limit Elective Deferral limit for 401(k), 403(b), 457(b), 408(k) SEP page 107 Limit for 2015 • $210,000 • $2650, 000 • $53,000 • $18,000 401a Chart con’t page 107 Type of Limit • Elective deferral limit for 408(p) SIMPLE plans • Annual IRA contribution limit • Highly compensated employee definition • Annual compensation minimum for 408(k) SEP plan eligiblity Limit for 2015 • $12,500 • $5,500 • $120,00 • $600 Cash or Deferred Arrangements (CODA) • Voluntary Salary Reduction Plan – 401(k) Allows part of your salary contributed pre tax--reduces employees taxable income. (becomes subject to income tax when withdrawn) Pension Protection Act of 2006 put ability to automatically enroll employees in 401(k) plan into the law for plan years starting after 12/31/07 • Must provide specific schedule of automatic contribution. It must be at least 3% at hire and may stay at that level until the beginning of the second year after hire. • Increases must be at least 1% each year up to 6% for fourth. The arrangement can specify larger percents up to 10% of compensation. • If employer matches contributions, the plan must provide 100% match for first 1%; plus 50% for contributions between 2% and 6% or non-elective contribution of at least 3% of compensation – cannot contribute at high percent for highly compensated employees and cannot match contributions over 6%. ◦ When hired employees must have 90 days to withdraw from automatic elections and recover contributions from the plan. Employees can change or stop future contributions at any time. ◦ Cash or Deferred Arrangements (CODA) Contribution Limits for 401(k) • 2015 contribution limit is $18,0000 ◦ Adjusted for inflation in $500 increments • Tax Treatment of 401(k) contributions ◦ Not taxable for Federal Income Tax (and most states) ◦ Taxable for Employment Taxes • Reporting for 401(k) contributions on W-2 ◦ Not in box 1, but in boxes 3 & 5 ◦ In box 12 with a “D” ◦ Retirement box is checked if any deductions in the tax year. Catch-up” contribution began in 2002 • Under EGTRRA –plans 401(k), 403(b), SEP, Simple, and 457 plans ◦ Employee must be at least 50 years old in the current year • Limits of “catch-up” for all but SIMPLE ◦ 2015 catch-up limit is $6000 ◦ Adjusted for inflation in $500 increments • SIMPLE “catch-up” (small business 401k) ◦ limit is $3,000 in 2015 ◦ Adjusted for inflation in $500 increments Cash or Deferred Arrangements (CODA) Non Discrimination Testing • Must not discriminate in favor of highly compensated employees ◦ 5% owner of stock or capital ◦ Annual compensation over $120,000 in 2015 or top paid 20% of employees • Other Contributions can be included • “Catch-up” Contributions are not counted. • At least 70% of non-highly compensated employees must be eligible or the % of non-highly compensated eligible employees is at least 70% of the percentage of eligible highly compensated employees. Cash or Deferred Arrangements (CODA) Other ways to meet non-discrimination testing • Employer matches 100% of elective deferrals for not highly compensative employees up to 3% and 50% up to 5% • Employer is required to contribute at least 3% of salary for non highly compensated employees regardless of the employee’s participation in 401(k) Failure of ADP (Actual Deferral Percentage) Test • Must distribute some elective deferrals and earnings to highly compensated employees within certain period and report on 1099-R Holding period for 401k contributions • In 1996 the Labor Dept. shortened the maximum holding period for 401(k) contributions from 90 days to the 15th business day of the month following the month during which the amount would have been paid to the employee. • Employers who cannot meet the deadline can have an extra 10 business days, but must provide reasons for the delay. Cash or Deferred Arrangements (CODA) • • Early Distribution Penalty ◦ If employee receives a distribution before retirement (with exceptions) there is a 10% excise tax on the taxable portion of the distribution. Veterans can make deferrals for years spent in military service ◦ Extra deferrals can be made for up to three times the period of military service (not to exceed 5 years) ◦ Separate reporting requirements ◦ Not included in non-discrimination tests Roth 401(k) • • • Starting in 2006 employers may permit employees to designate some or all of the contributions as Roth 401(k) ◦ The contributions are made with after-tax dollars. ◦ The earnings from the eventual distribution will be tax exempt. ◦ 2015 contribution limit is $243,000 for both deferral and catch up ◦ All 401(k) contributions (both pre-tax and Roth) are taken into account for limits and anti-discrimination testing. Small Business Jobs Act of 2010 – allows participants in 401(k), 403 (b) and 457 plans with a qualified designated Roth contribution program to roll over amounts distributed from these plans to designated Roth accounts – effective September 27, 2010 Reporting of Roth 401(k) on W-2 ◦ The amount contributed in boxes 1, 3 & 5. ◦ The amount contributed in box 12 with “AA” Tax Shelter Annuities - 403 (b) • • Who can offer ◦ Public Schools, Tax Exempt Charitable, Religious, and Educational Organizations ◦ Employer can offer a 401(k) program IF it existed before the Tax Reform Act of 1986 Automatic salary reductions ◦ Can qualify as elective deferrals ◦ Newly hired employee, who does not make an election can have automatic 4% deductions toward purchase of annuity. • At hire employee must receive notice of auto election and right to elect to change the amount or opt out altogether. • Every year employee notified of reduction percentage and their right to change it, including procedure and timing for doing so. Tax Shelter Annuities - 403 (b) • Requirements ◦ Annuity contract may not be purchased through a qualified plan under 401(a), 403(a) or 457(b) plan ◦ Employee’s rights must be non-forfeitable unless employee fails to pay premiums ◦ The Plan (other than church plan) must meet nondiscrimination requirements. ◦ Plan must offer all employees the chance to defer at least $200 annually if one employee is given the opportunity. ◦ The elective deferral limits must be met if plan provides for salary reduction agreement. ◦ 2015 plan elective deferral is $18,000 Tax Shelter Annuities - 403 (b) • • • • Requirements and Taxability ◦ Has many of the same requirements as 401(k) ◦ Employer contributions (e.g. match) are not included in wages or subject to withholding ◦ Employee contributions are not Taxable for Federal Income Tax and most state income taxes. ◦ Employee contributions are Taxable for employment taxes Reporting on W-2 ◦ Contributions not in box 1 but in boxes 3 & 5. Contributions also show in box 12 with an “E” ◦ Box 13 Retirement plan is checked if there are any contributions for the tax year Excess deferrals included in box 12 but NOT included in box 1. ◦ Reported on 1099-R. Deferrals can go to a Roth beginning in 2006 Tax Shelter Annuities - 403 (b) • Catch-up special rule ◦ For employees with as least 15 years of service with employer. • Amount of catch-up limited to the lesser of ◦ $3,000 additional contribution in any year (same as catchup for those at least 50 years old) ◦ $15,000 reduced by any amounts contributed under this special provision in previous years. ◦ $5,000 x years of service less total elective deferrals from previous years. ◦ If eligible for both special and over 50 catch-up cannot go over $5,500 – first dollars considered under special rule. Deferred Compensation Plan for Public Sector and Tax Exempt Groups -457 (b) • • • • Who can Offer ◦ State and local government employers and tax-exempt organizations (other than churches) Eligibility ◦ Only individuals performing services for the employer are eligible (including independent contractors) Nondiscrimination Testing ◦ 457 plans can be discriminatory. Deferral Limits ◦ Same as 401(k) (2015 contribution limit is $18,000) Deferred Compensation Plan for Public Sector and Tax Exempt Groups -457 (b) Con’t • Catch-up Contributions – new in 2002 ◦ Same as 401(k) (2015 catch up is $6,000) • Special rule near retirement ◦ For last 3 years before normal retirement, maximum deferral is lesser of twice the normal deferral or the current year limit plus the limits from previous years, reduced by participant’s deferrals for those years. Cannot use both Catch-up and Special Rule • Deferred Compensation Plan for Public Sector and Tax Exempt Groups -457 (b) Con’t Rules • Funds and earnings in tax-exempt trust for exclusive benefit of employees and beneficiaries ◦ Funds must be transferred within 15 business days after the month when would have been paid to employees. • Deferrals and earnings remain assets of the employer subject to employer’s general creditors Tax Treatment • Not subject to federal income tax withholding • Subject to Social Security, Medicare, and FUTA as soon as there is no substantial risk of forfeiture of right to the benefit Reporting • Not in Box 1 of W-2, • in Box 3 and 5 & in Boxes 4 and 6 • Box 12 preceded by Code “G.” • Employer should not mark check box in Box 13 “Retirement plan” based on 457 deferrals IRC 457(b) con’t Distributions • Economic Growth and Tax Relief Reconciliation Act (EGTRRA) of 2001 ◦ No distributions before employee reaches age 70-1/2 ◦ separation from employment (retirement) or the employee faces an unforeseeable emergency. ◦ Plan may allow early distribution if total amount payable is no more than $5,000 and ◦ no amount has been deferred within 2 years of the distribution. • Distributions are considered pension ◦ Entity distributing has responsibility for withholding and remitting income taxes ◦ Reported on 1099-R – Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc ◦ Distributions under a non-governmental plan – reported on W2, box 1 and box 11 ◦ Under the Small Business Jobs Act of 2010, deferrals can go to a Roth IRA beginning in 2011; subject to federal, Social Security, Medicare and FUTA taxation Employee-Funded Plans – 501(c)(18)(D) • Pension plans created before June 25, 1959 and funded solely by employee contributions ◦ Does not discriminate in favor of highly-compensated employees ◦ Deferrals are excluded from Income ◦ Contributions are limited to $7,000 a year • Taxation requirements ◦ Not subject to federal tax withholding ◦ IS subject to Social Security and Medicare withholding and is reportable for FUTA taxation • W-2 Reporting requirements ◦ Deferrals included in box 1 and box 12, code “H” ◦ Check box 13 for “Retirement Plan” Individual Retirement Account (IRA) Employer sponsored IRA must be in writing and created for exclusive benefit of employees and beneficiaries. • Contribution Limits ◦ 2015 --$5,500 ◦ Adjusted for inflation to next multiple of $500 • Catch-up Provision ◦ Participant must be at least 50 by the end of the year. ◦ Additional $1,000 in years 2012 and beyond. Individual Retirement Account (IRA) Tax Treatment • Contributions are deductible ◦ Reduced if employee or spouse is an active participant in a qualified retirement plan ◦ Amount of reduction is based on adjusted gross income. For 2015 the reduction: • married employees filing a joint return at $98,000 • single $61,000 • married filing separately $00. ◦ Employee not active participant (but spouse is) reduction starts at $183,000 for 2015 (married filing joint return) ◦ Employer contributions included in income, but not subject to federal withholding up to the amount the employer reasonably believes the employee will deduct on their personal 1040 form; totally taxable for Social Security, Medicare and FUTA Roth Individual Retirement Account (Roth IRA) Contributions • Established by Taxpayer Relief Act of 1997 • Contributions are Taxable ◦ No phase-outs because of active plan participant status, but amount allowed is reduced by contributions by the individual to other IRAs for that year • For 2015, deductions begin to be phased out once individual’s adjusted gross income exceeds ◦ $183,000 for joint filers ◦ $116,000 for single filers • For 2015, contributions are completely phased out at ◦ $193,000 for joint filers ◦ $131,000 for single filers. Roth Individual Retirement Account (Roth IRA) • Employers can allow direct deposit of contributions ◦ No contribution allowed by employer ◦ Participation Voluntary ◦ No endorsement by employer allowed ◦ IRA sponsors publicize direct to employees ◦ Contributions are remitted to IRA sponsor ◦ Employer does not receive any kind or consideration. • Distributions ◦ Distributions are not included in gross income • If made no sooner than 5 years after first contribution and • Made on or after age 59-1/2, death, disability, or used for a first time home purchase. Simplified Employee Pensions – 408(k) SEP Commonly known as an SEP • An IRA that meets requirements governing: ◦ Employee participation ◦ Non-discrimination in favor of highly compensated employees ◦ Written formula to determine employer contributions • Employer must make contributions ◦ On behalf of all employees age 21 and over ◦ Employees that worked for employer at least 3 of the last 5 years ◦ Employees that earned at least $600 in 2015 • Contribution must be made based on the same compensationrelated formula for all employees up to $265,000 in compensation in 2015 • W-2 Reporting ◦ Not in box 1; In box 12, code “F”; check box 13 for “Retirement Plan” Savings Incentive Match Plans for Employees of Small Employers (SIMPLE Plans) Contribution Limits and Requirements • Employee can elect to defer $18,000 in 2015 • Deferral amount must be expressed as a percentage of compensation • “Catch up” contributions allowed for employees age 50 or older by end of plan year • Employer must match employee’s elective deferral dollar-for-dollar up to 3% ◦ Employer may make a nonelective contribution of 2% of each eligible employees’ compensation – employee must have at least $5,000. in compensation for that year and employee doesn’t have to defer any salary • All employee elective deferrals and employer matching and nonelective contributions must be fully vested and nonforfeitable when made • Employees have between Nov 2 and Dec 31 to participate in SIMPLE plan for next year or modify their elective deferral amounts Savings Incentive Match Plans for Employees of Small Employers (SIMPLE Plans) • SIMPLE IRA plan can include an automatic contribution arrangement if employee does not make an affirmative election • Tax treatment ◦ Not subject to federal withholding ◦ Subject to Social Security, Medicare, and FUTA taxes ◦ Employer matching and nonelective contributions are not subject to taxation • W-2 Reporting Requirements ◦ Deferrals not included in box 1 ◦ Deferrals reported in box 12, Code “S” ◦ Check box 13 for “Retirement Plan” Employee Stock Ownership (ESOP) • Defined Contribution Plan • Stock bonus plan or combined stock bonus and money plan designed to invest primarily in the employer’s stock. • Same general requirements as IRC 401(a) Tax Treatment • Employer contributions are not wages and not subject to federal income tax withholding, Social Security, Medicare, or FUTA. ◦ 2015 Limit: lesser of $53,000 or 100% of compensation Non Qualified Deferred Comp Plan American Jobs Creation Act of 2004 created IRC Section 409A which places significant restrictions on nonqualified deferred compensation plans • Tightened rules governing inclusion of deferrals in gross income for federal income tax purposes • Expanded the types of compensation plans and arrangements • Employee has a legally binding right during a taxable year to compensation that has not been actually or constructively received and included in gross income and is payable to him or her in a later year Emergency Economic Stabilization Act of 2008 created IRC Section 457A which provides that any compensation deferred under a nonqualified deferred compensation plan of a nonqualified entity is includible in the employee’s gross income where there is no substantial risk of forfeiture of the right to such compensation Non Qualified Deferred Comp Plan • Employer plan to defer compensation to a later date which may or may not coincide with retirement. • Plans can be either funded or unfunded ◦ If unfunded, employee has only employer’s promise of money ◦ If funded, contributions & earnings based on them are wages subject to federal income tax withholding when the employee’s interest is vested • The majority of these plans are unfunded ◦ Funds are not protected from employer’s creditors or successors If a nonqualified deferred compensation plan does not conform to the restrictions of IRC Section 409A, all amounts deferred and other vested amounts, plus earnings on those amounts, are subject to federal income tax and an additional tax of 20% of the amount included in income. In addition, interest will be charged on underpaid taxes, calculated at the IRS underpayment rate plus 1% Non Qualified Deferred Comp Plan Tax Treatment • Any deferrals or earnings included in income because of the new rules in Section 409A are subject to federal income tax withholding and should be treated as supplemental wages • All amounts deferred under one or more nonqualified deferred compensation plan in a calendar year of more than $600 must be reported by the employer on Form W-2, whether or not the amounts are included in income for that year; report in Box 12, Code “Y” – Notice 2008-115 nullifies this requirement until further guidance is issued • Amounts required to be included in income must be reported on Form W-2 in Box 1 and in Box 12, Code “Z”. Amount in Box 12 should include all amounts deferred under the plan for the taxable hear AND all preceding taxable years (plus earnings) that are currently includible in gross income under Section 409A Non Qualified Deferred Comp Plan Reporting Requirements • Amounts deferred into plan are reported in Box 12, code “Y” • Such deferrals are reported in Box 11, if for prior years services • Amounts distributed are reported in Box 1 only • The amounts should be reported in Box 11, if there were no deferrals in the year of distribution • Any deferrals/earnings included in income because of the new rules in 409A are subject to federal income tax withholding and taxed as supplemental wages Calculating the amount includible in income upon a failure to meet the requirements of Section 409A 1. Determine total amount deferred 2. Calculate portion of total amount deferred that is either subject to a substantial risk of forfeiture or has been included in income in a previous year 3. Subtract amount determined in step 2 from step 1 – excess is includible in income and subject to additional income taxes Non Qualified Deferred Comp Plan Tax Treatments of Employer Contributions • Doesn’t matter if plan is funded or unfunded • Employer contributions & earnings are subject to Social Security, Medicare and FUTA taxes on the later of: ◦ Date services are performed that form the basis for the contributions; OR ◦ When there is no substantial risk of forfeiture of the employee’s interest in the funds Reporting Requirements • Employer contributions to an unfunded nonqualified deferred compensation plan are not included in income • Amounts deferred to a funded, secured plan are income if employee has no risk of losing the benefits; must be reported in Box 1 and Box 11 *** Health & Accident Insurance Contribution- Tax Non-Taxable Contributions Treatment − − − Contributions made by an employer Contributions made under a Section 125 Cafeteria Plan • If employer reduces salary and then reimburses premium to employee, then the premium is taxable to the employee Premiums must be for Employee, Spouse, Dependents (on 1040) • For purposes of this provision dependent status will continue to apply to a person who is receiving more than ½ his/her support from the taxpayer even if their earnings more than the annual exemption. • Coverage for “adult children” (under age 26by end of taxable year) – married or unmarried. Plan cannot define “dependent” for purposes of eligibility other than relationship between child & participant. No coverage for grandchildren allowed *** Health & Accident Insurance Contribution- Tax Treatment Cont. − Change in definition of “Medical Expenses” • Applies for purposes of direct reimbursement of employee expenses or indirect reimbursements through FSAs, HRAs, and Archer MSAs. ° Only costs of medicines prescribed by a doctor and insulin are eligible. Change only affects over-thecounter medicines unless doctor prescribes with a written prescription – for tax years beginning 2011 Health Insurance – Nondiscrimination Requirements Patient Protection and Affordable Care Act – effective for plan years beginning on or after September 23, 2010 − If insurance is provided through third party insurance company there is no nondiscrimination requirement. − If employer is self-insured (reimbursing employees’ medical expenses from its own funds), employer may not discriminate in favor of highly compensated employees in either benefits or eligibility. − IRS Code Section 105(h) Non Discriminatory Plan Self-insured plan must benefit: • At least 70% of all employees • At least 80% of employees eligible to participate in the plan (IF at least 70% of all employees are eligible to participate) • A classification of employees that the Secretary of the Treasury finds not to be discriminatory • If all benefits provided to highly compensated employees are provided for all other participating employees Discriminatory Plan Amounts paid to highly compensated employees must be included in taxable income Highly Compensated employees: • 5 highest-paid officers • Owner of more than 10% of employer’s stock • Top-paid 25% of employees Although discriminatory reimbursements are taxable to the highly compensated employees receiving them, they are not subject to federal income tax withholding or employment taxes. W-2 Reporting of employer-sponsored health coverage Patient Protection and Affordable Care Act • Requires employers to report the total cost of employersponsored health coverage on employees Forms W-2. Applies to Forms W-2 for 2012 for first time. • For informational purposes only ◦ To inform employees of the cost of their health care coverage ◦ Does NOT cause excludable employer-sponsored health care coverage to become taxable ◦ Aggregate reportable employer cost reported on W-2 in box 12, code DD ◦ No reporting on Form W-3 • Reporting exceptions for 2012 W-2’s: ◦ If employer filed less than 250 W-2’s for preceding calendar year ◦ If employee terms and requests a W-2 before end of calendar year W-2 Reporting of employer-sponsored health coverage Definitions to know • Aggregate Cost – total cost of coverage under all applicable employer-sponsored coverage provided to employee • Applicable employer-sponsored coverage – coverage under any group health plan made available to employee by employer that is excludable from employee’s gross income – see exceptions (p. 4-12 & 4-13) • Group health plans – A plan of, or contributed to by, an employer or employee organization to provide health care to employees, former employees, the employer, others associated or formerly associated with the employer in a business relationship, or their families • Aggregate reportable cost – Includes both the portion of the cost paid by the employer and the portion of the cost paid by the employee, regardless of pre-tax or after-tax contributions W-2 Reporting of employer-sponsored health coverage Definitions to know (continued) • Not included in the aggregate reportable cost – ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ Archer medical savings account Health savings account Multiemployer plan (IE: amounts contributed to a union plan) Health reimbursement arrangement Health flexible spending arrangement Dental or vision plan (if plan is offered under a separate policy, certificate, or contract of insurance) Cost of coverage under hospital indemnity or other fixed indemnity insurance (UNLESS employee purchases policy on a pre-tax basis under a Section 125 plan OR employer makes any contribution to the cost of coverage that is excludable Self-insured plan not subject to COBRA Plan primarily for the military Excess reimbursements Coverage provided under an EAP, wellness program, or on-site medical clinic W-2 Reporting of employer-sponsored health coverage Definitions to know (continued) • Methods of calculating the cost of coverage – ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ COBRA applicable premium method Premium charged method Modified COBRA premium method Composite rate Employer provides some benefits that are employer-sponsored coverage and others that are not Cost changes during the year Employee begins, changes, or terminates coverage during the year Adjustments for events after end of calendar year Coverage period that includes December 31st and continues into the subsequent calendar year Transition relief Long Term Care Insurance Treated as accident and health insurance under “Health Insurance Portability and Accountability Act of 1996” • Employer provided coverage is excluded from income • Benefits are excluded from income ◦ If per diem – excludible limit is $310/day in 2012 (indexed for inflation) ◦ Excess will be excluded to the extent of actual cost of care Restrictions • Not subject to COBRA • Cannot be part of Cafeteria Plan • If part of flexible spending arrangement it is included in employee’s taxable income American Recovery and Reinvestment Act of 2009 (AARA) Discounted COBRA Premiums & Subsidies • American Recovery and Reinvestment Act of 2009 (AARA) – provides employees who have involuntarily lost their job chance to pay for continued health insurance at a deep discount. “Assistance eligible individuals” pay 35% of COBRA continuation coverage premium ◦ Assistance Eligible Individual defined as an employee who has involuntarily lost his/her job ◦ The qualifying event must have occurred between Sept 1, 2008 and May 31, 2010 ◦ Termination has to be involuntary and no caused by employee’s gross misconduct ◦ Individual can be “assistance eligible” more than once! ◦ Discounted premium is calculated on the amount employee would normally be required to pay for COBRA coverage Health Savings Accounts (HSA) Medicare Prescription Drug Improvement and Modernization Act of 2003 • Effective for Taxable years beginning after 12/31/03 • Tax-exempt trust or custodial account created exclusively to pay for qualified medical expenses of the account holder (employee) and his or her spouse and dependents. • Subject to rules similar to those for IRAs Health Savings Accounts (HSA ) Cont’d Qualifications for exclusion Individuals must be only in high deductible health plan (HDHP) • Annual deductible for 2015 ◦ at least $1,300 for individual coverage • out of pocket expense limits no more than $6,450 ◦ $2,600 for family coverage • out of pocket no more than $12,900 for family coverage. • no amounts payable for medical expenses until family has incurred annual covered medical expenses in excess of minimum annual deductible • An HDHP can have a smaller deductible or none at all for preventive care. Health Savings Accounts (HSA ) Cont’d Qualifications for exclusion (cont’d) The insurance can be a PPO or POS – in which case the annual out-of-pocket limit is determined by services within the network Contributions • Contributions can be made by the employer and employee • All contributions are aggregated for purposes of maximum contribution limit. • Contributions to Archer MSAs reduce the limit available for HSA for tax exclusion • Any amount over the limit is includable in gross income ◦ There is a 6% excise tax for excess individual and employer contributions in addition to all federal taxes Health Savings Accounts (HSA ) Cont’d Contributions (cont’d) Maximum annual contribution is the lesser of • 100% of annual deductible or • Maximum deductible permitted same as Archer MSA For 2015 maximum is • $3,350 for an individual • $6,650 for a family Catch up is allowed for individuals at least 55 years old on the last day of the tax year. • For 2009 and beyond $1,000 Health Savings Accounts (HSA ) Cont’d Contributions (cont’d) • No contributions can be made once the individual is eligible for Medicare (65 years old). • Amounts can be rolled over from an Archer MSA and IRA another HAS ◦ Employer contributions must be the same for everyone with comparable coverage either at the same amount or percent of deductible • Comparability is applied separately to part-time workers (normally less than 30 hours per week). • Employers can make a one-time transfer of balance in employee’s HRA or FSA to an HSA. Maximum amount is lesser of HSA or FSA balance on date of transfer OR September 21, 2006. Transfer must be completed by January 1, 2012. Health Savings Accounts (HSA ) Cont’d Contributions (cont’d) • Transfer from an IRA is permitted as a one-time contribution to an HSA – up to maximum deductible contribution limit at the time of the contribution • Transfers from an HRA, FSA, or IRA are treated as rollover contributions and are non taxable ◦ EXCEPTION: If employee is not an eligible individual with coverage under an HDHP at any time during the prior 12 months beginning with the month of the HSA distribution; if employee cannot meet the requirements, distribution is included in gross income and employee is subject to additional tax equal to 10% of distribution unless reason for ineligibility is employee’s death or disability) • Transfer provision not applicable to SEP’s or SIMPLE retirement accounts Health Savings Accounts (HSA ) Cont’d • HSA and HDHP can be included in a Cafeteria Plan • HSAs are not subject to COBRA continuation coverage • Employer can make larger contributions to non-highly compensated employees’ HSA’s beginning in 2007 Calculating Comparable Contributions • Sect 4980G mandates use of calendar year for comparability testing purposes • Several ways to comply with testing requirements: ◦ Pay-as-you-go basis ◦ Look-back basis ◦ Pre-funded basis • Impermissible Contribution Methods do exist! Health Savings Accounts (HSA ) Cont’d Penalty for not making comparable contributions to all employees’ HSA’s is an excise tax equal to 35% of all amounts employer contributed during the calendar year Distributions • Excluded from gross income if for qualified medical expenses of employee, spouse or dependents not covered by other insurance • If not used for qualified medical expenses included in gross income • subject to additional 10% tax unless ◦ after death, ◦ disability, ◦ or the employee reaches 65 years old. Health Savings Accounts (HSA ) Cont’d Distributions Qualified medical expenses Generally health insurance premiums are not qualified except: • Qualified long term care insurance • COBRA health care continuation coverage • Health insurance premiums while the individual is receiving unemployment compensation benefits • Individual over 65 for Medicare premiums and employer share of premium for employer provided health insurance Cannot use HSA funds to pay premiums for Medigap policies. Health Savings Accounts (HSA ) Cont’d • Employers are not required to determine whether HSA distributions are used for qualified medical expenses. • Employee makes determinations and must maintain records to substantiate. • Employers can provide eligible individuals with debit, credit or stored-value cards – same guidance as under HRAs Health Savings Accounts (HSA ) Cont’d In 2004, IRS issued guidance clarifying how FSAs and HRAs interact with HSAs • Employee covered under DHDP and a health FSA or HRA that pays or reimburses medical expenses, not eligible to make contributions to an HSA ◦ CAN make contributions to an HSA for period of time employee is covered under certain specified types of employer-provided plans that reimburse employee medical expenses • Limited purpose health FSA or HRA • Suspended HRA • Post-deductible health FSA or HRA • Retirement HRA Health Savings Accounts (HSA ) Cont’d Effect of FSA grace period on HSA eligibility In 2005, IRS issued guidelines clarifying an employee participating in an FSA and covered by a grace period (for incurring medical expenses after the end of the plan year) is not eligible to contribute to an HSA until after the FIRST DAY of the FIRST MONTH following the end of the grace period. Employer could adopt one of two options which will affect employees’ HSA eligibility during the cafeteria plan period • General purpose health FSA during grace period • Mandatory conversion from health FSA to HSA compatible health FSA for all participants Health Savings Accounts (HSA ) Cont’d W2 Reporting Requirements Employer contributions and salary reductions contributions (pre-tax deductions) Box 12 with Code “W” on W-2 Employer contributions over limits Box 1,3, and 5 on W-2 with taxes in boxes 2, 4, and 6 Employee contributions not made by salary reduction Box 1, 3, and 5 on W-2 Employee can deduct up to the annual limit on personal tax return Take one thing at a time.. There is a lot in this section!!! Focus on how how benefits effect your paycheck. You Can Do IT !!!!