Chapter 5

advertisement

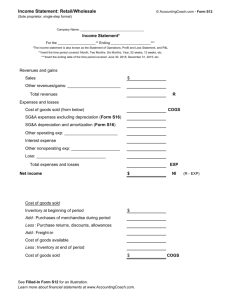

Intermediate Financial Accounting I The Accounting Information System Objectives of the Chapter I. Learning the accounting process in preparing financial statements. II. Introduce the accrual accounting concept and the adjusting entries. III.Introduce the worksheet (including the trial balance, the adjustments and the adjusted trial balance, the I/S and the B/S columns), the preparation of financial statements from the worksheet and the closing entries. Accounting Cycle 2 I. Accounting Process 1.Identification and measurement of business transactions and other events; 2. Journalization (general or special journals); 3. Post (to ledger accounts and subsidiaries); 4. Prepare worksheet (including unadjusted T/B, adjustments; adjusted T/B, I/S, B/S…); 5. Prepare financial statements; Accounting Cycle 3 Accounting Process (contd.) 6. Prepare and post adjusting entries; 7. Prepare and post closing entries; 8. Prepare post-closing trial balance (T/B) (optional); 9. Prepare and post reversing entries. Accounting Cycle 4 The Accounting Cycle (Source: Kieso, et al., 14th E, Illustration 3-6) Accounting Cycle 5 1. Identifying Accounting Events External Events: Purchase of assets, sales of goods, loss from flood, … Internal Events: Consumption of prepaid rent, use of depreciable assets, transfer of raw material to W-I-P, … Accounting Cycle 6 1. Identifying Accounting Events (contd.) Events are recognized as accounting events and would be recorded if: a. have occurred; b. affect the financial position of the business; c. can be measured in monetary terms (measurable); d. relevant, reliable. Accounting Cycle 7 Examples 1. Two months of prepaid insurance expired. 2. Purchase of a machine. 3. Sales of merchandise. 4. Changes in managerial policies. 5. Value of human resources. 6. The development of a new product. 7. Sign a contract to buy a building. 8. Investment from owners. 9. Distribution to owners. Accounting Cycle 8 2. Journalization Introduction of the Double-Entry System and Journal Entries: A. Double-entry system; B. T-account; C. Increases and decrease in the accounts. Accounting Cycle 9 A. Double-Entry System Each transaction affects at least two accounts and the balance of the accounting equation must be maintained. Example: Purchases inventory and charges to accounts payable. Assets = Liabilities + Equity Inventory Accounts Payable + + Accounting Cycle 10 A. Double-Entry System (contd.) 1 2 3 4 5 6 7 8 9 10 Assets = Liabilities + Equity Revenues Expenses + + + + + + + - Accounting Cycle 11 B. Introduction of the T-account Inventory Debit Credit Accounts Payable Debit Credit Accounting Cycle 12 C. Increases and Decreases in the Accounts A L E Debit Credit Credit Debit Debit Credit Debit Debit Revenue Expense Accounting Cycle Credit Credit 13 Examples of the Journal Entries: Page 1 Journal Date Accounts and Ref. Debit Credit Explanation Apr. 2 Cash………………… 50,000 Common stock…. 50,000 Issued common stock to owners Apr. 3 Land………………... 40,000 Cash…………….. 40,000 Paid Cash for Land Accounting Cycle 14 Special Journals (Cash Disbursements and Receipts) Cash Disbursements Journal Check Date No. 9 9 4 7 9 16 9 22 9 28 246 247 248 249 250 Payee G. Winkle Stephens Wholesale Harris Insurance City of Norwich Burkett Supply Cash Cr. A/P Dr. 80.00 Selling & Other Accounts Administrative Exp. Dr. Acct Title Ref. Debit Credit 80.00 163.00 163.00 Prepaid Insurance 96.00 62.00 96.00 62.00 105.00 506.00 225.00 105.00 185.00 Accounting Cycle 96.00 15 Special Journals (Cash Disbursements and Receipts) Cash Receipts Journal Date 9 Explanation 1 Collection from R. Wood on Account 5 Sale of Merchandise to Customers 9 12 Collection from J. Smith on Account 9 19 Receipt of Dividend from Ford Motor Co. Cash Dr. 150.00 A/R Cr. Sales Cr. Other Accounts Acct Title Ref. Debit Credit 150.00 9 9 25 Sale of Merchandise to Customers 250.00 75.00 250.00 75.00 Dividend Rev. 120.00 400.00 400.00 995.00 225.00 650.00 Accounting Cycle 120.00 120.00 16 3. Posting (to ledger accounts and subsidiaries) Account: Cash Account No. 101 Balance Date Item Jrnl. Ref. Debit Credit Debit Credit Apr. 2 J.1 50,000 50,000 3 J.1 40,000 10,000 The Ledger: all individual accounts (assets, liability, and stockholder’s equity accounts) combined make up the ledger. Accounting Cycle 17 Another Example of Posting (Kieso, et al., 14th edition, Illustration 3-8) Accounting Cycle 18 General Ledger (T-Account Format) Accounts Receivable 20x1 Mar 31 Balance 672.00 Apr 30 CR8 Apr 30 S6 2,662.00 Accounting Cycle No. 3 1,136.00 19 Examples of Posting using T-accounts (Kieso, et al., 14th edition, Illustrations 3-9 and 3-10) Accounting Cycle 20 Subsidiary Ledger Accounts Receivable SUBSIDIARY LEDGER Ellen Odom 202 520 910 Nita Doty 204 20x1 Mar 31 Balance Apr 2 S6 20x1 Mar 31 Balance Apr 6 S6 20x1 Mar 31 Balance Apr 4 S6 20x1 Apr 1 S6 30 Apr 18 CR8 750 Joe Leo 750 122 Apr 16 CR8 816 Rex Road 200 186 Apr 7 186 Accounting Cycle CR8 206 208 21 Examples of Controlling Accounts General Ledger Controlling Acct. Accounts Receivable Accounts Payable Capital Stock Notes Receivable Type of Subsidiary Record Individual customers’ ledger accounts, or a file of uncollected sales invoices. Individual ledger accounts, or a file of unpaid purchase invoices. A record of the stock certificates and number of shares held by each shareholder. A file of uncollected N/R, or a “register” or book in which the notes are listed. Accounting Cycle 22 Examples of Controlling Accounts (contd.) General Ledger Controlling Acct. Raw Material on Hand Equipment Land Type of Subsidiary Record Separate record card for each item of material used in manufacturing. Separate record card for each item of equipment. This is often known as a plant ledger. Separate record card for each parcel of land owned. Accounting Cycle 23 The Flows of Accounting Data Transaction Occurs Source Documen ts Prepared Amounts Posted to Ledger Transaction Analysis Takes Place Transaction Entered in Journal Accounting Cycle 24 XYZ Corp. Trail Balance 4/30/20x1 Cash Accounts receivable Office supplies Land Accounts payable Common Stock Dividends Service revenue Rent Expense Salary Expense Utilities Expense Total 33,300 2,000 500 18,000 100 50,000 2,100 8,500 1,100 1,200 400 58,600 58,600 . . Accounting Cycle 25 II. Accrual Accounting The time-period concept, the revenue recognition and matching principles. Accrual versus cash basis accounting. Adjusting entries. Accounting Cycle 26 The Time-Period Concept, the Revenue Recognition & Matching Principles The time-period concept: Income and financial position of a business are reported periodically, not until the end of life of a business. Accounting Cycle 27 Revenue Recognition Principle (SFAS No. 5) (-An Accrual Basis) Revenue is recognized when it is earned and realized or realizable (SFAC 5, par. 83). Earned : the entity has substantially accomplished what it must do to be entitled to compensation. Realized: goods are exchanged for cash or claims. Realizable: assets received as compensation are readily convertible into cash or claims to cash. In general, these conditions are met at time of sale (delivery) or when services are rendered regardless whether cash is collected or not (SFAC Income 5, par. 84). And Profit Analysis Measurement 28 Revenue Recognition Principle Other conditions for revenue recognition (Staff Accounting Bulletin No. 101(1999)): Persuasive evidence of a sale. Price is fixed or determinable. Collectibility is reasonably assured. Delivery has occurred or services have been rendered. Income Measurement And Profit Analysis 29 The Expense Recognition (Matching) Principle If revenues are recognized in a period, all related expenses should be recognized in the same period regardless whether expenses are paid or not. The related expenses include traceable costs (e.g. product costs), period costs, (e.g. interest and rent expenses) and estimated expenses (e.g. depreciation expense and bad debt expense). Accrual Accounting and the Financial Statements 30 Accrual vs. Cash Basis Accounting Accrual-basis accounting: Revenues are recognized based on revenue recognition principle (i.e., recognized when realized and earned regardless whether cash is collected or not). Expenses are recognized based on matching principle (i.e., recognized when incur regardless whether they are paid or not). Note: revenue and expense recognize before cash settlementAccrual . Accounting and the Financial Statements 31 Accrual vs. Cash Basis Accounting (contd.) Cash-basis accounting: The accountant does not record a transaction until cash is received or paid. Cash-basis accounting is NOT acceptable for financial reporting. Accrual Accounting and the Financial Statements 32 Adjusting Entries Due to the periodicity concept, financial reports are prepared periodically. Based on revenue recognition principle, adjusting entries are prepared at the end of a period to recognize revenues earned during the period but not yet recorded (i.e., accrued revenues). Accrual Accounting and the Financial Statements 33 Adjusting Entries (contd.) Based on the matching principle, the accrued expenses (i.e., expenses incurred but not yet paid/recorded) and estimated expenses (i.e., depreciation expense and bad debt expense) are recorded at the end of a period. Accrual Accounting and the Financial Statements 34 Types of Adjusting Entries (Kieso, et al. textbook, 14th edition, illustration 3-20) Accounting Cycle 35 Adjusting Entries and Reversing Entries Types of Adjusting Entries Can or Cannot Have Reversing Entries Can B/S approach: Cannot I/S approach: Can 3. Estimated Expenses Cannot (except for I/T Exp.) 1. Accruals 2. Deferrals Accounting Cycle 36 Adjusting Entries for Accruals (Kieso, et al. 14th edition, illustration 3-27) Accounting Cycle 37 1. Accruals: Unrecorded Revenue or Expenses a. Accrued expense: A one-year note payable was issued on 11/1/x1 to purchase an equipment. The face amount of the note is $2,400. The annual interest rate is 10% and interests are paid on 4/30/x2 and 11/1/x2. 11/1/x1 Equipment 2,400 Notes Payable 2,400 Adj. Entry 12/31/x1 Accounting Cycle 38 Accruals: (contd.) b. Accrued revenue: A one year note was received from a credit sale with a face amount of $3,000 and an annual interest rate of 12% on 9/1/x1. Interests are received on 3/1/x2 and 9/1/x2. 9/1/x1 N/R 3,000 Sales 3,000 Adj. Entry 12/31/x1 Accounting Cycle 39 Adjusting Entries for Deferrals (Kieso, et al. textbook, 14th edition, illustration 3-21) Accounting Cycle 40 2. Deferrals: Postponing the Recognition of Revenues or Expenses a. Unearned revenues Receiving $2,400 for one-year advanced rent payment from tenant on 12/1/x1 (B/S Approach) (I/S Approach) 12/1/x1 Cash 2400 Unearned Rent 2400 12/31/x1 Unearned Rent 200 Rent Revenue 200 12/1/x1 Cash 2400 Rent Revenue 2400 12/31/x1 Rent Revenue 2200 Unearned Rent 2200 Accounting Cycle 41 Deferrals (contd.) b. Prepaid expenses Prepaid 12 month insurance of $1,200 on 11/1/x1 (B/S Approach) (I/S Approach) 11/1/x1 Prepaid Ins. 1200 Cash 1200 12/31/x1 Ins. Exp. 200 Prepaid Ins. 200 11/1/x1 Ins. Exp. 1200 Cash 1200 12/31/x1 Prepaid Ins. 1000 Ins. Exp. 1000 Accounting Cycle 42 3. Estimated Expenses (no reversing entry except for I/T) Examples - Depreciation Exp.: 12/31 Depreciation Exp. Accumulated Depr. XXX Bad Debt Exp.: 12/31 B/D Exp. Allowance for B/D XXX Income Tax 12/31 Income Tax Exp. Income Tax Payable XXX Accounting Cycle XXX XXX XXX 43 III. Worksheet Example A. The adjusting entries information for the worksheet example. B. Preparing financial statements from a worksheet. C. Closing and reversing entries. Accounting Cycle 44 A. Adjusting Entries Information The following items are the adjusting entries information for the worksheet example (source: Kieso, et al. textbook): (a) Furniture and equipment is depreciated at the rate of 10% per year based on original cost of $67,000. Depreciation Expense --Furniture and Equipment Accumulated Depreciation --Furniture and Equipment Accounting Cycle 6,700 6,700 45 A. Adjusting Entries Information (contd.) (b) Estimated bad debts, one-quarter of 1% of sales ($400,000). Bad Debts Expense 1,000 Allowance for Doubtful Accounts 1,000 (c) Insurance expired during the year, $360. Insurance Expense Prepaid Insurance Accounting Cycle 360 360 46 A. Adjusting Entries Information (contd.) (d) Interest accrued on notes receivable as of December 31, $800. Interest Receivable Interest Revenue 800 800 (e) The Rent Expense account contains $500 rent paid in advance, which is applicable to next year. Prepaid Rent Expense Rent Expense Accounting Cycle 500 500 47 A. Adjusting Entries Information (contd.) (f) Property taxes accrued December 31, $2,000. Property Tax Expense 2,000 Property Tax Payable 2,000 (g) Income taxes accrued December 31, $3,440 Income tax expense Income tax payable Accounting Cycle 3,440 3,440 48 Uptown Cabinet Corp.(source: Kieso, et al. Illu. 3C-1) TEN-COLUMN WORK SHEET (with Periodic Inventory System) For the Year Ended December 31, 2010 Accounts Cash N/R A/R Allow. for double Accounts Inventory, 1/1/12 Prepaid insurance Furniture & equip. Accu. Depr. -furniture & equip. Trial Balance Dr. Cr. 1200 16000 41000 Adjusted Adjustments Dr. Cr. 1200 Trial Balance Dr. Cr. 16000 41000 2000 36000 900 67000 (b) 1000 12000 (a)6700 (c) 360 3000 36000 540 67000 Accounting Cycle 18700 49 TEN-COLUMN WORK SHEET (contd.) Accounts N/P A/P B/P Common stock R/E, 1/1/12 Sales Purchases Sales Salaries exp. Advertising exp. Traveling exp. Office Sal. exp. T&T exp. Trial Balance Adjustments Adj. T-B Dr. Cr. Dr. Cr. Dr. Cr. 20000 20000 13500 13500 30000 30000 50000 50000 14200 14200 400000 400000 320000 320000 20000 20000 2200 2200 8000 8000 19000 19000 600 600 Accounting Cycle 50 TEN-COLUMN WORK SHEET (contd.) Accounts Rent exp. Property tax exp. Interest exp. Totals Dep. Exp-fur. & equ. Bad debts exp. Insurance exp. Int. receivable Int. revenue Prepaid rent exp. Property tax pay. Totals Trial Balance Adjustments Adj. T-B Dr. Cr. Dr. Cr. Dr. Cr. 4800 (e) 500 4300 3300 (f) 2000 5300 1700 1700 541700541700 (a) 6700 6700 (b) 1000 1000 (c) 360 360 (d) 800 800 (d) 800 800 (e) 500 500 (f) 2000 2000 2000 11360Accounting 11360 552200 552200 Cycle 51 TEN-COLUMN WORK SHEET (contd.) Accounts Inv., 12/31/12 Totals Income bef. I/T Totals Income bef. I/T Income tax exp. Income tax payable Net income Totals Trial Balance Adjustments Dr. Cr. Dr. Cr. Adj. T-B Dr. Cr. (g) 3440 (g) 3440 Accounting Cycle 52 Uptown Cabinet Corp. TEN-COLUMN WORK SHEET (contd.) Accounts Cash N/R A/R Allow. for double Accounts Inventory, 1/1/12 Prepaid insurance Furniture & equip. Accu. Depr. -furniture & equip. Adjusted Trial Balance Dr. Cr. 1200 16000 41000 3000 36000 540 67000 Income Statement Balance Sheet Dr. Cr. Dr. Cr. 1200 16000 41000 3000 36000 540 67000 18700 18700 Accounting Cycle 53 TEN-COLUMN WORK SHEET (contd.) Accounts N/P A/P B/P Common stock R/E, 1/1/12 Sales Purchases Sales Salaries exp. Advertising exp. Traveling exp. Office Sal. exp. T&T exp. Adj. T-B I/S Dr. Cr. Dr. Cr. 20000 13500 30000 50000 14200 400000 400000 320000 320000 20000 20000 2200 2200 8000 8000 19000 19000 600 600 Accounting Cycle Dr. 20000 13500 30000 50000 14200 B/S Cr 54 TEN-COLUMN WORK SHEET (contd.) Accounts Rent exp. Property tax exp. Interest exp. Totals Dep. Exp-fur. & equ. Bad debts exp. Insurance exp. Int. receivable Int. revenue Prepaid rent exp. Property tax pay. Totals Adj. T-B I/S Dr. Cr. Dr. Cr. 4300 4300 5300 5300 1700 1700 6700 1000 360 800 800 500 B/S Dr. Cr. 6700 1000 360 800 800 500 2000 552200552200 Accounting Cycle 2000 55 TEN-COLUMN WORK SHEET (contd.) Accounts Inv., 12/31/12 Totals Income bef. I/T Totals Income bef. I/T Income tax exp. Income tax payable Net income Totals Adj. T-B Dr. Cr. I/S Dr. Cr. 40000 40000 425160 440800 15640 440800 440800 15640 3440 Dr. B/S Cr 3440 12200 12200 15640 15640 167040 167040 Accounting Cycle 56 B. Preparing Financial Statements from a Worksheet (Source: Illustration 3-39 of Kieso, et al. 14th edition) Uptown Cabinet Corp. INCOME STATEMENT For the Year Ended December 31, 2012 Net sales Cost of goods sold Inventory, 1/1/x2 Purchases Cost of goods avail. for sale Subtract inv., 12/31/x2 Cost of goods sold Gross profit on sales Accounting Cycle $400,000 $ 36,000 320,000 356,000 40,000 316,000 84,000 57 INCOME STATEMENT (contd.) Selling expenses Sales salaries exp. 20,000 Adv. exp. 2,200 Traveling exp. 8,000 Total selling exp. 30,200 Administrative exp. Office Salaries exp. $19,000 T&T exp. 600 Rent exp. 4,300 Property tax exp. 5,300 Depr. exp.-fur. & equip. 6,700 Bad debts exp. 1,000 Insurance exp. 360 Total administrative exp. 37,260 Accounting Cycle 58 INCOME STATEMENT (contd.) Total selling & admin. exp. Income from operations Other revenues and gains Interest revenue Other exp. And losses Interest exp. Income bef. income taxes Income taxes Net income Earnings per share 67,460 16,540 800 17,340 1,700 15,640 3,440 $12,200 $1.22 Accounting Cycle 59 B. Preparing Financial Statements from a Worksheet (contd.) (Source: Illustration 3-40 of KWW textbook, 14th edition) Uptown Cabinet Corp. STATEMENT OF RETAINED EARNINGS For the Year Ended December 31, 2012 Retained earnings, Jan. 1, 2012 $14,200 Add net income for 20x12 12,200 Retained earnings, Dec. 31, 2012 $26,400 Accounting Cycle 60 B. Preparing Financial Statements from a Worksheet (contd.) (Source: Illustration 3-41 of KWW textbook, 14th edition) Uptown Cabinet Corp. BALANCE SHEET As of December 31, 2012 Assets Current assets Cash $ 1,200 Notes receivable $16,000 Accounts receivable 41,000 Interest receivable 800 $57,800 Less allow. for doub. acct. 3,000 54,800 Merchandise inv. on hand 40,000 Accounting Cycle 61 BALANCE SHEET (contd.) Prepaid insurance Prepaid rent Total current assets Property, plant & equip. Furniture & equipment Less accu. Depr. Total property, plant & equip. Total assets 540 500 97,040 67,000 18,700 48,300 $145,340 Liabilities and Stockholders’ Equity Current liabilities Notes payable $ 20,000 Accounts payable 13,500 Property tax payable 2,000 Income taxes payable 3,440 Accounting Cycle 62 BALANCE SHEET (contd.) Total current liabilities 38,940 Long-term liabilities B/P, due June 30, 20x7 30,000 Total liabilities 68,940 Stockholders’ equity Common stock, $5.00 par value, issued & outstanding, 10,000 shares $50,000 Retained earnings 26,400 Total stockholders’ equity 76,400 Total liabilities & stockholders’ equity $145,340 Accounting Cycle 63 C. Closing and Reversing Entries Closing Entries (Source: p. 98 of Kieso, et al., textbook, 13th edition) General Journal December 31, 2012 Inventory (12/31) 40,000 Cost of Goods Sold 316,000 Inventory (1/1) 36,000 Purchases 320,000 (To record ending inv. bal. & to determine CGS) Interest Revenue 800 Sales 400,000 CGS 316,000 Sales Sal. Exp. 20,000 Adv. Exp. 2,200 Accounting Cycle 64 Closing Entries (contd.) Traveling Exp. 8,000 Office Salaries Exp. 19,000 T&T Exp. 600 Rent Exp. 4,300 Property Tax Exp. 5,300 Depr. Exp. - Fur. & Equip. 6,700 Bad Debts Exp. 1,000 Insurance Exp. 360 Interest Exp. 1,700 Income Tax Exp. 3,440 Income Summary 12,200 (To close revenues and expenses to Income Summary) Income Summary 12,200 Retained Earnings 12,200 (To close Income Summary to Retained Earnings) Accounting Cycle 65 C. Closing and Reversing Entries Reversing Entries (Optional) January 1, 2012 (D) Interest Revenue Interest Receivable 800 800 (E) Rent Expense Prepaid Rent Expense 500 500 (F) Property Tax Payable Property Tax Expense 2,000 2,000 (G) Income Tax Payable Income Tax Expense 3,440 Accounting Cycle 3,44066 Closing Entries for Periodic Inventory System( with Purchase Returns and Allow): An Example Inventory & Related Accounts Inventory B.B 12,600 Freight-In 4,350 Purchases 44,650 Pur. R&A 3,700 Income Summary CGS Assuming Ending Inv. = 17,200 CGS= Beg. Inv + Net Purchases - Endings Inv. Net Purchases = Pur. -Pur. R&A - Pur. Dis + Freight-In Accounting Cycle 67 IFRS Insights (Source: Kieso, etc. 14th e, p153155) Companies around the world use the same accounting process as shown in this chapter. Despite some differences in standards between IFRS and GAAP, the double entry accounting system is the basis of accounting systems worldwide. IFRS is growing in acceptance around the world. Approximately 40% of Global Fortune 500 companies use IFRS. Accounting Cycle 68