Behavioural Traps

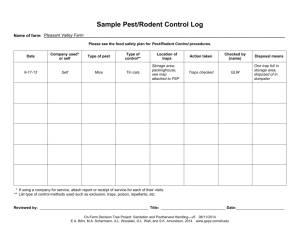

advertisement