Best Practices for Effective DSO Management and

advertisement

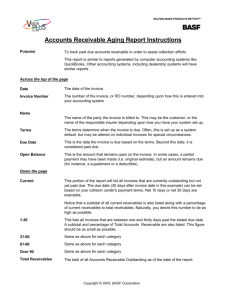

Best Practices for Effective DSO Management and Reductions in Past Due Receivables Paul J. Clausen Corporate Director, Customer Financial Services Emerson Overview • Founded in 1890 – in business for 124 yrs • • Diversified global manufacturing and technology company. Business grouped by segments: • • • • • – • 2 Process Management Climate Technologies Network Power Industrial Automation Commercial & Residential Solutions Emerson has approximately 135,000 employees and 235 manufacturing locations worldwide. Headquartered in St Louis, Missouri, USA St. Louis headquarters • Publicly traded (NYSE : EMR) • Global product and market leadership • Recognized for engineering capabilities, outstanding management process, and record of consistent long-term performance • Sales of US$24.7 billion in fiscal year 2013 FY 2013 Sales By Business Segment Process Management Network Power Industrial Automation Climate Technologies Comm. & Res. Solutions Eliminations Total Sales FY 2013 FY 2012 $8,610 $7,899 6,155 6,399 4,885 5,188 3,876 3,766 1,864 1,877 $25,390 $25,129 (721) (717) $24,669 $24,412 Δ $'s $711 (244) (303) 110 (13) $261 (4) $257 Diversified Portfolio of Companies Continuous Portfolio Management Drives Growth! 3 Δ% 9.0 % (3.8)% (5.8)% 2.9 % (0.7)% 1.0 % 0.6 % 1.1 % FY13 Sales by Geography 6% 6% 44% 24% 20% 37% Emerging Markets 4 US & Canada Europe Asia Latin America Middle East/Africa Operating Cash Flow Drives Shareholder Value 3.6 3.3 3.1 3.2 $ in Billions 3.1 63% 56% FY2009 FY2010 FY2011 FY2012 FY2013 5 OCF Shldr Payout Receivable Landscape 32 Reporting Business Units that operate autonomously – Each have their own President, CFO etc. • Credit function reports to BU CFO 6 Business systems vary across the operating units – Oracle – SAP – JDE – Various other ERP platforms (some home grown) Operate globally in 78 countries – Transactions in local language and currency – Majority of collections are supported in best cost locations BEST COST RESOURCE UTILIZATION XIAN CLUJ MANILA Perfect Execution…. A challenge to everyone in the company to better understand our customers and then work and think in different ways and at new levels on their behalf A cultural transformation that… – Reduces complexity – Breaks down silos – Strengthens collaboration across our organization 7 How Does Perfect(Ex) Apply to Receivables Management? Our Receivables Effort Has Been Broad... Implement Corporate Sponsored Software Tools To Support The Effort … Involve Executives To Call On Key Accounts… 8 Utilize Best Cost Resources & Shared Services… Current Focus Evaluates Processes & Execution… Managing Disputes 1. Cash Cycle Elements 2. Supportive Processes Collections Processing Payments Billing Credit Risk & Exposure Executive Oversight Methodology: Best-Practice Benchmarking − Emerson & Industry − 47 Elements Examined 9 So What Happened in FY2013…. Incorporating the principles of Perfect Execution, we developed a process of evaluating a business unit’s performance based on defined best practices – Best Practices were cross functional and looked at all elements of the cash cycle OBJECTIVES Understand and evaluate a B.U.’s processes, structure and overall approach to DSO management Focus on Past Due reduction Provide a set of recommendations (roadmap) for improvement CONSIDERATIONS 10 Credit policies and execution Cross functional interaction that supports receivables Executive involvement and focus given to DSO management Understanding reasons for past dues and corrective actions employed Dispute management processes and analysis Establish what sales policies are in place that support receivables Is there automation in place and how is it used to support Receivables DSO Prioritization / Performance Model… F O C U S BUSINESS PROCESS Perfect (Ex ) Actions Tracked Early X-Functional Communication Root Cause Analysis & Corrective Action Taken Managing Managing Disputes Disputes Rapid Remittance Posting Frequent Customer Contact EXECUTION Processing Receipts Credit/Sales Proactive Efforts on Terms Approval Billing Process POLICY Policy & Escalation Procedures Sales, Credit, CS Collaboration Managing Collections Effective Credit Risk Policy O N Projects? Account Reviews Frequent Invoicing Consequences For Slow Paying Customers Supportive Sales Policy & Interaction E X E C U T I V E O V E R S I G H T Credit Risk & Exposure Comprehensive Policies, Finance Lead, Supported Cross Functionally, & With Executive Meetings… 11 To Support the Objectives, on Site Visits Were Required With The Business Units… ANALYSIS METHODOLOGY Review various materials requested from the B.U. prior to an on-site visit – Written policies covering risk, collections and dispute management – Standard terms and conditions – Standard payment terms – Most recently completed ICQ • Documents reviewed on-site: – Organization structure of Finance • 12 Sales and AR tabs only Including the Credit function – Key management organization structure – Paretos for past due and or dispute reasons – KPI’s produced to measure: • Collections productivity • Past Due issues • Dispute Issues • Progress on corrective actions presented at most recent Pres. Council, Perfect (Ex) or Profit Reviews Includes Actions to Resolve The analysis is completed using Benchmarking tool while on site What is The Benchmarking Tool? Compares a B.U.’s performance to industry & Emerson best practices for the elements of the cash cycle – Credit risk, billing, processing receipts, collections, managing disputes…. – Identifies gaps and opportunities Also considers sales policy and support, customer account reviews, executive oversight and influence on receivables management Identifies “Must Have” capabilities to build a foundation for performance in DSO management – “DSO Performance Pyramid” Considers the degree of automation employed to support processes – Is data being collected, analyzed and actioned? 13 BEST PRACTICE DSO MANAGEMENT IS NOT JUST A FUNCTION OF FINANCE… IT IS AN ORGANIZATIONAL ISSUE Benchmarking Template DSO - BEST PRACTICES ASSESSMENT Business Unit: Emerson Network Power - Asia Date: July 22 - 24, 2013 Oversight Deviations Collection Region: = Essential Pre-Collection /"Foundation" Instructions: Please enter the number (1, 2, or 3) that best describes the current degree of adoption for each of the best practices listed below. CURRENT ASSESSMENT - DEGREE OF ADOPTION PROCESS BEST PRACTICES BEST PRACTICE EXPLANATION 3 SCORE 1 2 No Policy Policy inadequate No reviews Reviews take place; no scorecard Reviews take place minimum of There is a continuous process for monitoring customer accounts to enable ongoing adjustments of credit quarterly, and scorecards utilized assessment. Credit risk scorecards use multiple factors to categorize risk and to establish credit limits. w/ multiple scoring factors Credit limit exceptions process in There are tight controls of credit limits that are maintained in the ERP system. Exceptions are approved place and documented in policy based on the credit policy LOA. and evidence it is functioning PRE-COLLECTION MANAGING CREDIT RISK & EXPOSURE Credit Mgr/Dept Head Policy in place with evidence to Policy that defines establishing credit for new and existing customers, limits of authority (LOA), credit hold support process, escalation and terms management. 1 A defined credit risk management policy is utilized. 2 Regular and periodic account reviews are performed, and credit risks scorecards are utilized. 3 Credit limit controls are in place. No credit limits in place Credit limits in place in ERP system 4 Effective customer data management is in place. Ownership and governance not defined Credit approves bill to customer set-up before entered in ERP Credit Dept. owns customer master, customers not set-up without a P.O. Policy and governance in place 5 Account updates and credit risk changes are shared and coordinated with other business units. No sharing Some sharing, no formalized process Documented process with evidence it is functioning Ownership and governance of customer master data is defined and includes Credit department as part of the process. Within the business group, as well as across business groups or corporate where there is a common customer. BILLING PROCESS Credit Mgr/Dept Head 6 There is no ambiguity between payment terms and conditions on customer contract or PO and the payment terms in the ERP system. No Process exists to ensure consistency Process but with exceptions Process functioning without exceptions 7 Frequent invoicing. No defined process Process but with exceptions Daily invoicing, no exceptions Invoices are issued at time of shipment, when services are performed, or acceptance as defined in contract . 8 Standard invoice format. Invoices manually generated via Excel ERP generated but with exceptions ERP generated, no exceptions There are clear and concise invoices with formats that are designed to minimize errors made by customers A/P, lockbox banks, and cash application personnel. 9 Automated invoice delivery processes are in place. No automation in place Some automation (EDI) Fully automated process with Utilization of automated processes to deliver invoice to customer in the most efficient and timely manner established program to drive possible. Processes should minimize reliance on postal service delivery as primary method of delivery for customers to electronic delivery invoices and related trade documents. vs. paper based delivery Some interaction takes place Interaction does take place and evidence supports that credit is Credit Managers participate in sales meetings and other opportunities to communicate importance of cash part of annual sales meetings, flow and expectations to ensure customers pay Emerson according to agreed upon terms. * training and collaboration efforts Invoices are consistent with PO's and contracts. SUPPORTIVE SALES POLICY & INTERACTION 10 Credit Manager meets with Sales to review importance of DSO and Emerson focus on cash flow. – Cross functional – Follows the DSO Performance Model Assessment is based on 3 point scale Assesses the degree to which the BU has adopted a particular best practice. • 14 No evidence to support credit is engaged 46 Identified best practices – Credit Mgr/Dept Head Not intended to be critical of current processes or procedures Recommendations are based on degree of adoption – Short term focus on the “must haves” – Long term focus on strategic initiatives Sales Mgr/Head* CFO** GM*** From The Visit, Develop Priority Based Actions For BU’s, Roadmap for Improvement… Long Term Actions To Receivables Excellence Short Term Actions RECOMMENDATIONS PRE-COLLECTION MANAGING CREDIT RISK & EXPOSURE 1 A defined credit risk management policy is utilized. 2 Regular and periodic account reviews are performed, and credit risks scorecards are utilized. There is no structured policy that defines how credit risk is managed by the shared services team. Customers are set-up before an order is received with a default credit limit of $1,000 USD. The only review that takes place is when an order is entered >$1,000. The analysts get a notification on their credit review screen. The only reviews that take place are when an order exceeds the credit limit, an eRAM packet is pulled and the score is updated based on the seeded EMR Scorecard in eRAM. RECOMMENDATION: Establish a comprehensive Risk Management policy that defines process flows and expectations on managing Risk, Order Hold Management, Account Reviews, Escalation Procedures and limits of authority for approving limits and overriding credit decisions. Current process only requires a customer review when a customer exceeds their credit limit. RECOMMENDATION: Establish a process as part of the Risk Policy whereby regular and periodic reviews are taking place. Utilizing the account refresh tools available in eRAM is a best practice for updating customer risk information. Utilizing the scorecards in eRAM, and using the Filters function in eRAM, will allow for segmenting the customer base based on Risk Bands. Changes in Risk can then be highlighted to adjust collections policy and strategy based on this changes in Risk. For higher volume customers, financial statement reviews should be conducted on an annual basis at a minimum. For those customers that are publicly traded, there is a Corporate resource available in Manila for doing these analysis for the B.U. Adjustments to the review frequency are determined based on this analysis. (i.e. Quarterly, semi-annual or annual). 3 Credit limit controls are in place. The current ERP system does have functionality to place an order on hold if the customer credit limit is exceeded. However, Customer set-up is controlled by another functional area. Current procedure is that if the customer set-up is for a "Bill to" or "Sold to" entity, the entry personnel are instructed to default the limit to $1,000. There is no control in place to ensure that the credit limit value being entered is correct. RECOMMENDATION: The Credit function should have control of customer records being entered into the ERP system if the usage is for a "Bill to" or "Sold to" entity. ,This allows the Credit function to ensure that the proper credit limit is established at the time of set-up, that we are not creating redundant records in the ERP system and that the proper relationships are defined for those customers that have multiple locations. 4 Effective customer data management is in place. Refer to #3 above. In reviewing the customer set-up process with both Credit and Customer Service, ownership for the customer set-up process is not clear. Customer Service was of the understanding that Credit controlled this process; the Credit function indicated it was done in Costa Rica, but were not aware of ownership for the process. RECOMMENDATION: Establish a procedure and policy for approving and entering customer data into the ERP system. The policy should define the Credit function as having ownership for Bill to and Sold to customer set-ups to control the credit limit and terms set-up. The policy also should define governance and standards to keep the database clean and minimize redundancy. The customer data model should also be defined as part of this policy/process. As you migrate to Oracle, managing customers in the TCA model can be complex, but offers tremendous flexibility in how you manage customer data in the Oracle environment. Best Practice is to define the model, define ownership, restrict access to add and change records, establish a standards policy, and governance. 5 Account updates and credit risk changes are shared and coordinated with other business units. With the establishment of the Shared Services Credit function for ENP North America, the legacy Services, ERS/HVM and Product credit and collections are managed by the Shared Services organization. There is significant overlap in the customer base between service and product. However, prior to the consolidation under shared services, there was no evidence of sharing customer data across business units within the ENPS group or Emerson. RECOMMENDATION: As part of your policy development, expectations about establishing a discipline to share data about problem customers across the business group, and Emerson is a best practice. BILLING PROCESS There is no ambiguity between payment terms and 6 conditions on customer contract or PO and the payment terms in the ERP system. Contract review process is driven by legal, and all T&C's are managed and approved with the exception of payment terms. Credit is only brought into the process when contract specify's non-standard terms. At that point, there is no opportunity for Credit to engage in other T&C issues that may impact the collection process. RECOMMENDATION: Best practice engages the credit function up front during the negotiation process. The collections process in many cases uncovers contract language that impedes our ability to collect payments when due. Involving the Credit function in the contract negotiation process provides the opportunity to identify restrictive language that impedes collections as well as resolving payment terms issues before the contract is signed. Develop a template or checklist that includes all functional areas of responsibility to sign off before the contract is signed will ensure we are aligned internally on the customer expectation and our ability to meet those expectations. We should have organizational alignment on payment terms issues before the contract is stamped and returned to the customer. 7 Frequent invoicing. Current ERP system generates an invoice file daily that produces a print invoice daily for all customers for Services and Product. Printed invoices are sorted in Columbus and those customers that are on web invoices or require manual invoices due to AIA summary billing or other customer requirements are pulled so that a manual invoice or web portal invoice can be entered to the customers web site. RECOMMENDATION: Short term, recommend having web portal invoice documents printed in Costa Rica. The current practice is they are printed in Columbus, sorted, and then scanned and e-mailed to the team in Costa Rica to input into the web portals. There is no tracking of this process and therefore no assurance that the invoices are being loaded to the web portals in a timely manner. Long term: Consider implementing the BillTrust solution. They have web services interfaces that will automate the process of web presentment. Implementing BillTrust will also standardize the invoice presentment process as Services utilizes Eaton Forms and Product is using traditional mail services to send invoices. Implementing BillTrust now will allow for easier implementation when the business migrates to Oracle as part of the next age project. At that time, all the set-up work, design templates and web portal services will already be established, and the Oracle work will only involve the pointing of the print queue to the BillTrust portal. For other manual documents, other than AIA invoice requirements, this is the result of shipping from multiple ship points at different times when customer requirement is for a single shipment and single invoice as stated on the P.O. This is a business process issue and should be managed cross functionally in the organization to identify a suitable business process that aligns with customer expectation and eliminates the manual processes currently in place to generate these invoice documents. 8 Standard invoice format. No recommendations at this time. Invoice formats are different between the businesses (Services, Product, ERS/HVM). Suggest looking at this if you adopt recommendation in #7 above and utilize the BillTrust services for invoice formats. This allows you to develop common look and feel across the businesses in your invoice documents. 9 Automated invoice delivery processes are in place. See recommendation in #7 above. Automating the process will allow you to track when the customer is getting the invoice document, eliminate delays, minimize impacts of USPS delays, and provides for a direct link to invoice documents from the GetPaid collections automation software. Communicate Findings And Recommendations To Key BU Personnel (President, CFO, Financial Services/Credit Personnel) 15 What Have We Learned Thus Far? Benchmarking Reviews In FY2013 we Conducted 8 Reviews – North America – Columbia – Brazil – Mexico – Costa Rica – Manila – Australia – Singapore In Q1 FY2014 we have conducted 8 & 2 Follow-up Reviews Extensive Reviews on site, usually 2 – 3 Days Meet with: 17 – General Manager or President – CFO – VP Sales – Operations – Billing – Customer Service – Credit Manager and staff 360° Format one on one interviews – Europe HQ – United Kingdom – Spain – Italy – Turkey – France (2) – Hong Kong A Comprehensive Credit Policy Is The “Foundation” For Good DSO’s… Key Elements Of The Policy: • Do The BU’s Have Documented − Clarifies Options Available If Credit Policies Covering These Elements? • Are They Using Automation Tools? Limit Cannot Be Granted (For Past Dues & Limit Overages) − Covers New & Existing Customers. − Clearly Defines Escalation Processes − Who Does What, When… − When To Stop Shipments… − Final Authority Levels − Defines Collections Process − Who to Contact − When to make the contact − Contact method − Follow-up and Escalation procedures − Covers Dispute Management Process − Specifies Non-Standard T&C’s Approval Process With Limits Of Authority − Clarifies Process Flow, Documentation, & Data Required For Approval 18 Cross-Functionally Defined Processes Are Necessary To Support The Effort… Elements Of a Collections Policy: Best Practice Example − Cross-Functional Processes Should Cover: • Contact Frequency • Escalations • Dispute Resolution − Identified & Agreed To Cross Functionally − Expectations Understood − Cover Multiple Customer Segmentations • Are Roadmaps Utilized? • Do Sales, Operations, & Executive Personnel Know Their Roles & When To Get Involved? 19 Minimizing Disputes Improves Timely Collections, Improves Customer Satisfaction… Knowing Reasons for Past Dues is Key: Example Of The Challenge − Quick Resolution Policies Are Needed − Track By Type & Reason Code − A Higher-Level Roll-Up Tracking Document For Executives − Root-Cause Analysis For Major Issues Required • Are Disputes Being Tracked? • Are There Business Process Improvement Projects To Correct? 20 Executive Oversight Is Imperative… Institutionalize the Process Through Regular Scheduled Meetings with Key Executives − Not Just The CFO’s Job − Key Executives Should Be Assigned To Relationship / Strategic Accounts − Regularly Scheduled Business Process Meetings Should Be Conducted • e.g. S&OP • Aging Reviews • Disputed Items Review − Reporting Must Be Targeted and Specific • Why is it past due • Action needed to resolve • Who owns the action • Expected resolution date 21 Account Name Terms Last Pmt Method Total AR 1-7 8-30 31-60 61-90 91+ Total Past Due Comments 1. Needs Certification document 2. Docs 356,985 being prepared by Engineering. 3. Mr. Smith 4. July 25th UOP LLC NET30 Electronic 516,905 0 356,985 0 0 0 BARIVEN SA NET30 Electronic 242,303 0 6,228 7,464 150,026 78,585 242,303 1. Chronic Past Due 2. Executive visit 3. Mr. Garcie 4. Meeting planned in August SAUDI POLYMERS CO NET30 Electronic 353,219 0 112,675 0 0 0 112,675 1. Goods received late 2. Docs e-mailed to customer 3. Collector 4. July 20th VALTRONICS SALES INC NET30 Electronic 348,187 45,829 53,957 (2,735) 0 0 BARIVEN SA ADVANCE Electronic 80,305 0 80,305 0 0 0 79,067 0 0 0 0 79,067 79,067 1. Warranty Dispute 2. Need engineer to review on site 3. Mr. Jones 4. Aug. 5th 78,119 1. Month end cutoff 2. Payment promised 3. Collector 4. July 10th GOVERNMENT SCIENTIFIC NET30 SOURCE INC Electronic CHEROKEE MEASUREMENT AND CONTROL INC NET30 Check 363,718 78,119 0 0 0 0 GENERAL ELECTRIC CO NET30 Electronic 815,649 106,360 (22,573) 5,000 (26,827) 0 BERRY PETROLEUM CO NET30 61,671 0 61,671 0 0 0 LAURENTIDE CONTROLS NET30 LTD TECNOSTEAM ENERGY SA NET30 PANAMA Total Top 20 Past Due Accounts Grand Total Grand Total % Electronic 104,886 58,042 38,000 38,000 3,003,910 3,003,910 326,351 326,351 10.9% 0 0 649,248 649,248 21.6% 0 0 9,729 9,729 0.3% • What Executive Lead Meetings Are Held? When? 0 0 0 0 123,199 157,652 123,199 157,652 4.1% 5.2% 1. Liquidated Damages, product late 2. 97,051 Negotiate settlement. 3. Mr. Rep 4. not commited 80,305 See #2 above 1. Web billing 2. Invoices submitted late 3. Collector 4. Payment promised 1. Documents required 2. Need NOA 61,671 certifcicate 3. Customer Service 4. Not committed 1. Month end cutoff 2. Payment 58,042 promised 3. Collector 4. July 10th 1. Month end cutoff 2. Payment 38,000 promised 3. Collector 4. July 10th 1,266,178 1,266,178 42.2% 61,960 Summary…. The DSO Performance model defines those best practices in each element of the cash cycle that enable best in class performance – Assessing business units adoption of these best practices provides the roadmap for driving improvements Applying the principles of Perfect Execution to the receivables effort has enabled: – Cross functional focus on receivables management – Adoption of best practices to reduce complexity and drive process efficiency – Collaboration across the elements of the cash cycle to improve customer service and better understand our customers 22 Thank You! Questions?