The Accounting Cycle:

Accruals and Deferrals

Chapter 4

McGraw-Hill/Irwin

Copyright © 2010 by The McGraw-Hill Companies, Inc. All rights reserved.

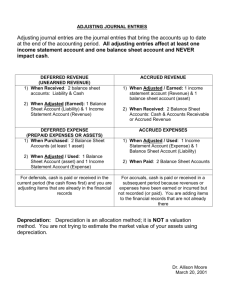

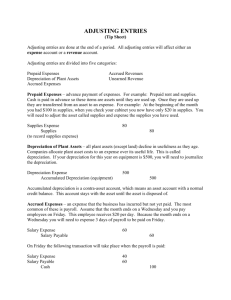

Adjusting Entries

Adjusting

entries are

needed whenever

revenue or expenses

affect more than one

accounting

period.

Every

adjusting

entry involves a

change in either a

revenue or expense

and an asset

or liability.

4-2

Types of Adjusting Entries

Converting

assets to

expenses

Accruing

unpaid

expenses

Converting

liabilities to

revenue

Accruing

uncollected

revenue

4-3

Converting Assets to Expenses

End of Current Period

Prior Periods

Transaction

Paid cash in

advance of

incurring

expense

(creates an

asset).

Current Period

Future Periods

Adjusting Entry

Recognizes portion

of asset consumed

as expense, and

Reduces balance of

asset account.

4-4

Converting Assets to Expenses

$2,400 Insurance Policy

Coverage for 12 Months

$200 Monthly Insurance Expense

1 Jan.

31 Dec.

On 1 January, Webb Co. purchased a

one-year insurance policy for $2,400.

4-5

Converting Assets to Expenses

Initially, costs that benefit more than one

accounting period are recorded as assets.

GENERAL JOURNAL

Date

1

Account Titles and Explanation

Jan Unexpired Insurance

Cash

Debit

Credit

2,400

2,400

Purchase a one-year insurance policy.

4-6

Converting Assets to Expenses

The costs are expensed as they are

used to generate revenue.

GENERAL JOURNAL

Date

Account Titles and Explanation

Debit

Credit

Monthly Adjusting Entry for Insurance

31 Jan Insurance Expense

Unexpired Insurance

200

200

Insurance expense for January.

4-7

Converting Assets to Expenses

Balance Sheet

Cost of assets

that benefit

future periods.

Income Statement

Cost of assets

used this period to

generate revenue.

Unexpired Insurance

1/1 2,400 31/1

200

Bal. 2,200

Insurance Expense

31/1

200

4-8

The Concept of Depreciation

Depreciation is the systematic allocation of

the cost of a depreciable asset to expense.

Fixed

Asset

(debit)

On date

when initial

payment is

made . . .

Cash

(credit)

The asset’s

usefulness is

partially

consumed

during the

period.

Depreciation

Expense

(debit)

At end of

period . . .

Accumulated

Depreciation

(credit)

4-9

Depreciation Is Only an Estimate

On 2 May 2009, JJ’s Lawn Care Service

purchased a lawn mower with a useful

life of 50 months for $2,500 cash.

Using the straight-line method, calculate

the monthly depreciation expense.

Depreciation

Cost of the asset

expense (per =

Estimated useful life

period)

$50 = $2,500

50

4-10

Depreciation Is Only an Estimate

JJ’s Lawn Care Service would make the

following adjusting entry.

GENERAL JOURNAL

Date

31

Account Titles and Explanation

May Depreciation Expense: Equipment

Debit

Credit

50

Accumulated Depreciation: Equipment

50

To record one month's depreciation.

Contra-asset

4-11

Depreciation Is Only an Estimate

JJ’s $15,000 truck is depreciated over 60

months. Calculate monthly depreciation and

make the journal entry.

GENERAL JOURNAL

Date

Account Titles and Explanation

31 May Depreciation Expense: Truck

Debit

Credit

250

Accumulated Depreciation: Truck

250

To record one month's depreciation.

$15,00060 months = $250 per month

4-12

Depreciation

Is Only

an Estimate

JJ's Lawn

Care Service

Partial Balance Sheet

Accumulated

depreciation

would

May

31, 2001

appear on theAssets

balance sheet as L

Cash

$ 3,925 N

follows:

Accounts receivable

75 A

Equipment

$ 2,500

Less: Accum. depr.

50

2,450

Truck

$ 15,000

Ow

Less: Accum. depr.

250 14,750 J

To

Cost - Accumulated Depreciation = Book Value

4-13

Converting Liabilities to Revenue

End of Current Period

Prior Periods

Transaction

Collect cash in

advance of

earning revenue

(creates a

liability).

Current Period

Future Periods

Adjusting Entry

Recognizes portion

earned as revenue,

and

Reduces balance of

liability account.

4-14

Converting Liabilities to Revenue

$6,000 Rental Contract

Coverage for 12 Months

$500 Monthly Rental Revenue

1 Jan.

31 Dec.

On January 1, Webb Co. received $6,000 in

advance for a one-year rental contract.

4-15

Converting Liabilities to Revenue

Initially, revenues that benefit more than one

accounting period are recorded as liabilities.

GENERAL JOURNAL

Date

Account Titles and Explanation

1 Jan Cash

Unearned Rent Revenue

Debit

Credit

6,000

6,000

Collected $6,000 in advance for rent.

4-16

Converting Liabilities to Revenue

Over time, the revenue is recognized

as it is earned.

GENERAL JOURNAL

Date

Account Titles and Explanation

Debit

Credit

Monthly Adjusting Entry for Rent Revenue

31 Jan Unearned Rent Revenue

Rental Revenue

500

500

Rental revenue for January.

4-17

Converting Liabilities to Revenue

Balance Sheet

Liability for

future periods.

Unearned Rental Revenue

31/1

500

1/1 6,000

Bal. 5,500

Income Statement

Revenue earned

this period.

Rental Revenue

31/1

500

4-18

Accruing Unpaid Expenses

End of Current Period

Prior Periods

Current Period

Adjusting Entry

Recognizes expense

incurred, and

Records liability for

future payment.

Future Periods

Transaction

Pay cash in

settlement of

liability.

4-19

Accruing Unpaid Expenses

$3,000 Wages

Expense

Monday,

29 May

Wednesday,

31 May

Friday,

2 June

On 31 May, Webb Co. owes wages of

$3,000. Payday is Friday, 2 June.

4-20

Accruing Unpaid Expenses

Initially, an expense and a liability are

recorded.

GENERAL JOURNAL

Date

Account Titles and Explanation

31 May Wages Expense

Wages Payable

Debit

Credit

3,000

3,000

To accrue wages owed to employees.

4-21

Accruing Unpaid Expenses

Balance Sheet

Liability to be

paid in a future

period.

Wages Payable

31/5 3,000

Income Statement

Cost incurred this

period to generate

revenue.

Wages Expense

31/5 3,000

4-22

Accruing Unpaid Expenses

$5,000 Weekly Wages

$3,000 Wages

Expense

Monday,

29 May

$2,000 Wages

Expense

Wednesday,

31 May

Friday,

2 June

Let’s look at the entry for 2 June.

4-23

Accruing Unpaid Expenses

The liability is extinguished when the

debt is paid.

GENERAL JOURNAL

Date

Account Titles and Explanation

2 June Wages Expense (for June)

Wages Payable (accrued in May)

Cash

Debit

Credit

2,000

3,000

5,000

Weekly payroll for 29 May - 2 June

4-24

Accruing Uncollected Revenue

End of Current Period

Prior Periods

Current Period

Adjusting Entry

Recognizes revenue

earned but not yet

recorded, and

Records receivable.

Future Periods

Transaction

Collect cash in

settlement of

receivable.

4-25

Accruing Uncollected Revenue

$170 Interest

Revenue

Saturday,

15 Jan.

Monday,

31 Jan.

Tuesday,

15 Feb.

On 31 Jan., the bank owes Webb Co.

interest of $170. Interest is paid on the

15th day of each month.

4-26

Accruing Uncollected Revenue

Initially, the revenue is recognized and

a receivable is created.

GENERAL JOURNAL

Date

Account Titles and Explanation

31 Jan Interest Receivable

Interest Revenue

Debit

Credit

170

170

To recognize interest revenue

4-27

Accruing Uncollected Revenue

Balance Sheet

Receivable to

be collected in a

future period.

Interest Receivable

31/1

170

Income Statement

Revenue earned

this period.

Interest Revenue

31/1

170

4-28

Accruing Uncollected Revenue

$320 Monthly Interest

$170 Interest

Revenue

Saturday,

15 Jan.

$150 Interest

Revenue

Monday,

31 Jan.

Tuesday,

15 Feb.

Let’s look at the entry for 15 February.

4-29

Accruing Uncollected Revenue

The receivable is collected in a future

period.

GENERAL JOURNAL

Date

Account Titles and Explanation

15 Feb Cash

Debit

Credit

320

Interest Revenue (for February)

150

Interest Receivable (accrued 31 Jan)

170

To record interest received.

4-30

Accruing Income Taxes Expense:

The Final Adjusting Entry

As a corporation earns taxable income, it

incurs income taxes expense, and also a

liability to governmental tax authorities.

GENERAL JOURNAL

Date

Account Titles and Explanation

31 Dec Income Taxes Expense

Income Taxes Payable

Debit

Credit

780

780

Estimated income taxes applicable to

taxable income earned in December.

4-31

Adjusting Entries and Accounting

Principles

Costs are matched with revenue

in two ways:

Direct association of costs

with specific revenue

transactions.

Systematic allocation of costs

over the “useful life” of the

expenditure.

4-32

The Concept of Materiality

An item is “material” if knowledge of the

item might reasonably influence the

decisions of users of financial statements.

Many companies

immediately charge

the cost of

immaterial items to

expense.

Light bulbs

Supplies

4-33

Effects of the Adjusting Entries

Income Statement

Adjustment

Type I

Converting Assets to Expenses

Type II

Converting Liabilities to Revenue

Type III

Accruing Unpaid Expenses

Type IV

Accruing Uncollected Revenue

Revenue Expenses

Profit

Balance Sheet

Assets

Liabilities

Equity

No effect Increase Decrease Decrease No effect Decrease

Increase No effect Increase No effect Decrease Increase

No effect Increase Decrease No effect Increase

Decrease

Increase No effect Increase Increase No effect Increase

4-34

Adjusted Trial Balance

JJ's Lawn Care Service

Adjusted Trial Balance

31 May 2009

Cash

$

3,925

Accounts receivable

75

Tools & equipment

2,650

Accum. depreciation: tools & eq.

$

50

Truck

15,000

Accum. depreciation: truck

250

Notes payable

13,000

Accounts payable

150

Share capital

8,000

Dividends

200

Sales revenue

750

Gasoline expense

50

Depreciation exp.: tools & eq.

50

Depreciation exp.: truck

250

Total

$

22,200 $ 22,200

All balances

are taken from

the ledger

accounts on

31 May after

preparing the

two

depreciation

adjusting

entries.

4-35

End of Chapter 4

4-36