Market Capitalism

advertisement

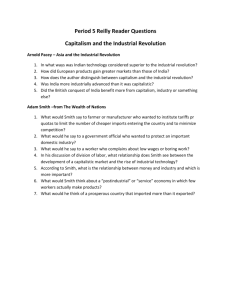

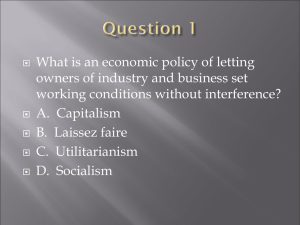

PKU5 ECONOMICS Economics Terms Capitalism(s) To keep in mind as you read: In ideological contexts, one often hears capitalism referred to as if it were a monolithic entity not subject to changes over time. Granted that some major changes are identified in this document, what, if anything, remains a constant core meaning of capitalism that applies in all these instances? Capitalism is, as an economic formation, more complex and long-lived than is commonly thought. One of its indispensable premises, private ownership of property, we can trace as far back as the earliest recorded legal system [link: Hammurabi’s Code]. Commercial Capitalism In the West, the initial stages of commercial capitalism appeared in Italian cities during the late Middle Ages (roughly the 13th to 14th centuries). What made the new Italian ventures distinctive was their base in powerful family-clans. The scale of their operations was vast, and they were able to create their own institutions of banking to finance their far-flung enterprises. Hungry for wealth, the major trading families were willing to pour profits back into financing ever more ambitious projects. High profits were assumed, even though the risk factors were often very high as well. Economic growth was already a Western expectation, based on a desire to acquire more and more goods rather than merely to maintain reliable trade connections. Mercantile Capitalism A second stage of Capitalism emerged in the 17th and 18th centuries with the formation of merchant companies. These were chartered by European monarchs to allow several individuals (or families) to pool their investment resources, thereby spreading the risk in case a ship was lost or a trade caravan was sacked by bandits [link: probability and insurance]. During this period, the kings licensed out trade monopolies to various merchant companies in return for their promise to promote the national economic interest. Mercantile capitalism defined the national interest to be the increase of gold and silver in the national treasury. Such an economic policy turned out to be short-sighted, because no one had foreseen the inflationary effect of a large influx of precious metals entering Europe from its new colonies. Spain, in particular, found its economy seriously undermined by taking in too much gold and silver without an accompanying increase in productivity. More money simply chased the same amount of goods with the effect of causing higher and higher prices. Market Capitalism Adam Smith (1723-1790) articulated the new market capitalism idea in 1776. Here the goal was to leave individual entrepreneurs free from government interference. That way, each one would feel an incentive to maximize profits by seeking out the most efficient means of production. If there was no interference, their products could be sold at the lowest possible prices in a competitive marketplace. Gold and other precious metals Smith understood not as money or value-in-itself but as commodities to be bought and sold whenever market conditions driven by supply and demand allowed profits to be made. The key to economic success was not how much money you had, but how much money you could make. Profits and the drive to maximize them were expected to motivate a constant search for better and cheaper ways to make products, hence to sell more and more compared to competitors. Adam Smith believed that the free market operated by means of a secular “invisible hand,” which would automatically make everyone richer [link: Milton Friedman]. Industrial Capitalism The industrial capitalism stage of development starting in the 19th century is what Karl Marx and others attacked so vigorously. The logic of Adam Smith’s system led to larger and larger factories involving ever more efficient but increasingly expensive machinery to produce key products of all kinds. The larger amounts of capital required to finance such enterprises led to another innovation in finance: the limited-liability corporation. Under this device individual stockholders bought shares in a corporation which took on itself the risk of any eventual failure. If the enterprise went into bankruptcy, the individual shareholders would at most lose their initial investment, whereas under earlier partnership arrangements, their personal fortunes might be at risk. Because their liability was now limited to what they invested, wealthy individuals were more willing to invest in shares or to loan money to this kind of corporation, in hopes that the enterprise would prosper, thereby generating dividends on investments or, at the very least, interest on loans. As the 19th-century corporations became larger and more impersonal; workers were often exploited cruelly on starvation wages. The factories gave rise to the alienated urban industrial proletariat that Marx and Engels saw as open to an imminent Communist Revolution [link: Communist Manifesto]. East German heroic bust of Karl Marx (1818-1883) by Will Lammert (1953) Capitalist countries have evolved a great deal since Karl Marx’s time. Workers are commonly represented by independent trade unions that defend their interests, if necessary, by strikes or other work stoppages. Workers are employed year round with contracts guaranteeing annual vacations and retirement benefits. In the 19 th century only capitalist bosses had comparable privileges. Though there are still startling differences in income between the rich and the poor, the vast majority of workers in the West support the capitalist system as it has now evolved. In recent decades, many workers have even become capitalists, in the sense that they own shares in corporations either directly in their own name or indirectly through shares in mutual funds or their pension funds. In the USA, about half the population now own at least some such shares. Multinational Capitalism Multinational corporations as they have developed since World War Two have extraordinary latitude to maneuver among various different national governments. On the other hand, multinationals are obliged to conform to the laws of every country in which they do business, not a simple undertaking. These developments do not qualitatively change the nature of capitalism. Its goals are still to maximize profits by maintaining growth in the face of competition. The expectation – and the felt necessity – for growth is essential in capitalist ideology. A fixation on growth drives not only economic decisions but now affects Western thinking on all subjects. Study questions: 1. Compare and contrast Adam Smith’s invisible hand with the Daoist wuwei concept as it might apply to economic matters [link: wuwei]. 2. To what extent do the Learned Men in the Han debates on iron and salt [link: text] affirm an Adam Smith vision of a marketplace free from government interference? Market Economy To keep in mind as you read: The idea of a market economy now receives lip service nearly everywhere in the world, yet there remain major differences in its applications. Is there a “right” way? What are some of the hidden costs of this way of organizing life? The concept of the market economy has by now become world-wide in its influence, but its origins merit close and critical attention for that very reason. Capitalism is closely associated with the market idea, but capitalism had already been part of several earlier economic formations [link: capitalisms]. Hence a market economy is not necessarily linked to capitalism. In China during the Han Dynasty leaders were already debating the wisdom of private enterprise as opposed to government monopolies [link: Iron and Salt Debates]. These are issues of market access: who decides when and where and at what price goods are sold. The idea of a market economy in its modern sense involves something more: a systemic conception that aspires to control all economic and social relations in a given time and place. It extends economic ideas to affect all cultural domains. The modern market system originated with the Scottish thinker Adam Smith (17231790) and his book entitled An Inquiry into the Nature and Causes of the Wealth of Nations (1776) [link: Adam Smith]. Adam Smith (1723-1790) Adam Smith presumed that, if there were no interference in the marketplace by governments or other regulatory agencies, the most efficient producers or suppliers of all products would be able to make a profit while selling at lower prices than their competitors. Those competitors would then be obliged either to lower their prices or else, in the long run, go out of business. This privileging of the more efficient producers or suppliers would inevitably, he asserted, increase the total wealth available in the system. Thus Smith’s famous “invisible hand” was supposed to work automatically to the benefit of all. The incentive to greater profits would, he predicted, encourage new technological advances and ever more efficient operations. In fact, remarkable advances in efficiency emerged in the 19th and 20th centuries beyond anything that Adam Smith could have foreseen. These were due to many factors: to technological innovations, to unprecedented degrees of specialization (both in the division of labor and in machines for specific purposes) , to progressively more efficient energy sources (wood, then coal, then oil, then electricity, nuclear energy, solar energy) , and to more efficient organizations making better informed decisions in modern limited-liability corporations. Thus Adam Smith’s free market provided only part of the story of Western industrial expansion, though his advocates, illustrated here by Milton Friedman [link: text], would claim all the benefits follow from the “invisible hand.” Modernization as an Economic Concept To keep in mind as you read: If economic “modernization” is so ethnocentrically Western, what is its appeal in other parts of the world? Social scientists in the West often limit the concept of modernization to a certain time period or to certain technological advances rather than to larger processes. Such concepts are identified here as limited to socio-economic concerns as opposed to larger-scale modernity [link: modernity] that is central to this course. According to C. E. Black and other social-science theorists of the late 20th century, modernization is characterized by: continuous and accelerating expansion of knowledge (science, education) deliberately applied to technology and industry (factory system) involving ever more efficient forms of energy (wood to coal to oil to nuclear) to increase the production of goods and services (materialist “quality of life”) with the goal of maximizing efficiency (and hence profits) for distribution according to market principles (freely, by supply and demand) in an atmosphere of secularization (decline of traditions, esp. religious beliefs) supporting impersonal and utilitarian values (spreading worldly goods) encouraging economically unconstrained policies (to motivate innovation) with individuals free to pursue their rational self-interest (“individualism”) Such an approach has the merit of generality. It can be applied anywhere in the world, but only at the cost of making Western-style economic development the touchstone criterion for distinguishing “advanced” from “developing” nations. [Recommended reading C.E. Black, Dynamics of Modernization: a Study in Comparative History, New York: Harper & Row, 1966.] In broadly applicable terms, one can derive these characteristics from the history of Western economic developments since the beginnings of industrialization in late 18thcentury England. As a model, it applies less than well to many other parts of the world; but its ethnocentrically Western bias dismisses any deviations as due to “underdevelopment,” i.e., a failure to be part of the Western world or to take the Western world as the only legitimate model for economic development. This Western bias may easily provoke controversy [link: Daniel A. Bell on “Asian Values”]. In addition to such ethnocentric flaws in the Western modernization model, its materialist focus on homo economicus (Latin: humans as economic entities) oversimplifies human nature. In all parts of the world people are apt to act in ways that contradict simple-minded models of behavior such as “rational self-interest.” Humans often respond on the basis of more complex motives than those of maximizing their incomes or enhancing their competitive position. Study questions: 1. This approach to “modernization” identifies ten tendencies that characterize it. How many of them could be cited to characterize China in recent years? 2. Does thinking of a country as a “developing” nation commit it to following the West in each of these different domains? Why or why not? 3. Which of the ten might be separable from the others in the case of China? 4. Are there any of these ten that seem to you no longer applicable in the West? Are we perhaps entering a “post-modernization” period? Excerpt from Western Civilization with Chinese Comparisons, 3rd ed. (Shanghai: Fudan University Press, 2010), pp 322-28.