Real Property

advertisement

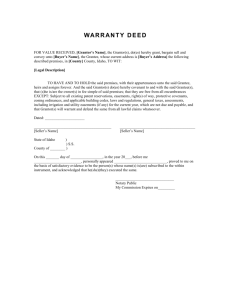

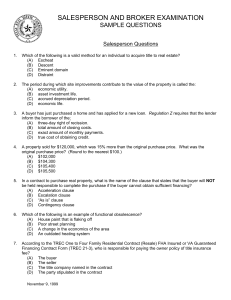

Real Property Chapter 51 Conveyance of Real Property • Two Step Process – First, the contract for sale – At closing, conveyance of the Deed Contract for Sale • Contract is governed by contact rules • 1. Statute of Frauds – Any contract of sale of an interest in property must be ________ _________ and __________ by the one who is sued. • Only some kind of signed writing is required – A ________ of the property – The ________ of the parties – The ____________ • One exception – Doctrine of part performance – O orally contracted to sell the farm to A. After this oral contract of sale, A took possession and immediately started building a barn. Then, before closing, O died. O’s estate refused to go to closing, citing the Statute of Frauds. Who wins, when A sues for specific performance of the oral contract? _____________ Death of Party Before Closing • Doctrine of Equitable Conversion preserves rights as set in the contract, and death of party before closing does not affect them. • If seller dies before closing, buyer closes with _________ __________; seller’s interest is _________________________________. – A contracted to sell Blackacre to B. A then died before closing. In her will A provided that all of there real property would go to X and all of her personal property would go to Y. If B goes to closing with A’s estate, who would ultimately get the money, X or Y? ___ because _________________________. • If Buyer dies before closing, seller closes with ___________; buyer’s interest is _______ _____. – A contracted to sell Blackacre to B. B then died before closing. In his will B provided that all of his real property would go to J and all of his personal property would go to K. When B’s estate closes with A, who will ultimately get title to Blackacre, J or K? ____ because ___________________ Risk of Loss of Property • If property is damaged or destroyed before closing, ___________ loses: Once contract is signed, title is in the buyer for all practical purposes and if the property is destroyed, risk of loss is on the buyer, even if the seller remains in __________- and control. – Note: This rule applies only if seller is not at fault. Marketable Title • Every land sale contract has an implied warranty that at closing, seller will give buyer a marketable title – not necessarily perfect, just one that a reasonable person would accept (minor defects, Okay) – Building encroaches a half inch over the neighbor’s line. Does this half inch encroachment make title unmarketable? ____ because it is _______ and does not present a significant threat of litigation. Marketable Title • Seller must give Buyer three things: – _____- of ___________ (abstract or copy of all deeds recorded in chain of title) – Title free of _________________ (no easements, no liens, restrictive covenants, no mortgages, options, etc., that are not mentioned in the contract) • Harry and Leona leased their estate to Donald and Maria for five years and in the lease tenants were given an option to purchase the estate at the end of the lease. Two years into the lease Harry and Leona contracted to sell the property to Rudy and Donna. The contract does not mention the option to purchase given to Donald and Marla. Has seller breached the warranty of marketable title? _________, because the option is an _____________ which makes it _______________. • Zoning restrictions are not an encumbrance • Not unmarketable title if encumbrance (i.e., easement, road, sewer, etc.) is open and obvious. Remedies of Buyer if Seller’s Title is Unmarketable • Buyer must notify Seller and give Seller reasonable time to ________ the defect, even if that postpones closing. • If problem not corrected, Buyer has 3 remedies – ________ - buyer walks – _______________ - Measure is difference between contract price and value of the land on the day of breach • If Buyer breaches, Buyer’s deposit can be forfeited as liquidated damages as long as it is not more than _____ of sales price. – _______________ - buyer takes what seller can give and price gets lowered to cover defect in title. Seller has Implied Warranty of Habitability • Common Law - Caveat Emptor, buyer has to inspect for defects • Two exceptions – Seller must _____ serious defects that the seller knows of and are not ________ to the buyer. Seller can not actively _______ defects. • Seller paints roofing tiles to hide holes and make roof look new. OK? ____________ • Seller covers termite damage with paint and wallpaper. OK? __________ • Implied warranty of __________ for new homes sold by a Builder-Seller. Deed • Execution – Deed is subject to the S/F, I.e., ________ • Description of the land must be enough to ________ the property. If vague, nothing gets transferred. Delivery – does not always mean ______ transfer. Legal test is solely a question of ______ to pass title. Delivery is valid if grantor makes delivery to a third party in _____ with instructions to deliver to grantee when condition is satisfied. Once deed goes to _______ agent, grantor cannot get deed back Types of Deeds • If grantor makes no promises regarding title, the grantee gets a ____________; grantee gets whatever grantor owns and grantor promises nothing. • ______________ - Grantor make promises regarding title, called “covenants for title” – Title/seisen – Seller warrants he has title and the right to convey – Covenant against encumbrances – no easements, etc. – Covenant against quiet enjoyment – Seller promises Buyer no one will show up later and claim title. • ____________ - Grantor merely warrants the title so far as his acts/omissions are concerned. He does not warrant the title to be free of defects caused by the acts/omissions of others. Title Insurance • Insurance Policy, gives protection to Buyer if title is subject to an encumbrance or defect. • A standard title insurance policy insures the holder has good record title at the policy’s date. If the title turns out defective, the title insurer will reimburse the insured for its loss. Recording of Interests • At recording office, clerk files copy of deed in book of deeds. • Clerk indexes deed in two indexes: In the grantor index, the clerk lists transaction alphabetically by grantor, notes the grantee, gives a description of the property, and cites the volume and page of the book where the copy can be found. • Same info put in grantee index, filed alphabetically by grantee. Recording Acts–Earlier Purchasers vs. Subsequent Purchasers • _________ acts – protects subsequent Bona Fide Purchasers. Recording is Irrelevant! • ______ - ________ acts – protect BFP’s who take without __________ and are first to _________. – Teddy sold the Palm Beach mansion to will on January 1st for $800,000; Will did not record. Then on March 1st Teddy sold the same house to Patrick for $600,000. Patrick knew nothing of the earlier sale to Willy; Patrick did not record. Then on April 1st Willy recorded and on May 1st Patrick recorded. – If notice statute,who wins?____________________ – If race-notice? __________________________ • _______ race - _______ is irrelevant, whoever records first wins. The subsequent purchaser can know about the earlier sale and still win. Bona Fide Purchaser • One who purports to take property as an heir, donee, or devisee cannot be a BFP and can never defeat the claim of someone who has a prior conveyance from O. • BFP’s – those who give value and who take without notice of the earlier transaction. Mortgages – RESPA Reg’s • A mortgage is a voluntary lien on real property arising from a contract; it is a security interest in real property, typically conveyed by a written instrument to secure payment of a debt. • Underlying debt evidenced by a promissory note, lender has alternative remedies if a default. • Debtor – mortgagor, has an affirmative duty not to commit waste, and to preserve the property at least to the amount of the debt; pay taxes and assessments • Creditor – mortgagee; right to obtain insurance to protect his interest. • Formal requirements – Writing – Mortgage must be delivered to mortgagee. – Proper recording gives public constructive notice of security interest, but it is optional Foreclosure • Right to foreclosure arises upon default. • Mortgagee (or assignee) takes property away from mortgagor to pay debt. • Must initiate a judicial proceeding to secure order of sale. The debt is then satisfied with the proceeds, debtor gets excess monies. If the sale proceeds are insufficient to cover the debt (plus costs and interests), mortgagee may usually obtain a judgment for deficiency. (Some jurisdictions do not allow deficiency judgments when property is over-mortgaged). • First mortgages have priority and must be paid in full before the second;PMM’s (mortgages taken out to buy the property) are given priority over other mortgages secured interests have priority over unsecured.. Prior to Foreclosure • Mortgagor may exercise her equitable right of redemption; prior to foreclosure sale, she may refinance with another lender and regain rights by paying off the full amount of the mortgage. • Some states have a “statutory right of redemption”; provides that mortgagor may repurchase the property AFTER the judicial foreclosure sale, for a certain period generally not exceeding 1 year. – This would create an unmarketable title Trust Deed • A debtor transfers title to a disinterested third party (the trustee) to be held in trust as security for the performance of an obligation. • The trustee is typically given the power to sell the property if the debtor (mortgagor) defaults. • Trustee holds bare legal title, not a true ownership interest. • Trust deed is treated as a lien (mortgage) on the real property. • When the obligation is satisfied, the trustee reconveys legal title to the debtor. Mechanics and Materialman’s Liens • Statutory liens against real property. • Preliminary notice to the property owner of intent to file the lien is generally required, identifying the labor/materials furnished. • The liens secure unpaid debts that arise from contracts for labor, materials or services to improve real property. These liens prevent transferring real property with a clear title. • Lien must be recorded with public records within a specified statutory period after performing the work. • Liens may be enforced by foreclosure and sale of property. Eminent Domain • State takes property by its power of condemnation. – Phil and Marlo moved to New York City from Chicago. A few months after they moved, the State of New York decided to build a new freeway out to Long Island. The state may take by powers of eminent domain. • “Just compensation” must be made to owners of the property, equal to fair market value of the property at the time of taking. Restrictive Covenants • May bind original parties, and future owners, if covenant “runs with the land” (touches and concerns the land), and successive owner had notice. – O owned lots one and two and operated a gas station on lot one. O sold lot two to A with a covenant in the deed that neither the buyer nor his heirs would compete by operating a gas station on lot two. A later sold lot two to B with no such covenant in the deed. B knew that the covenant was in the deed from O to A but was delighted that it was not in his deed. However, the covenant not to compete runs with the land and is enforceable. • Restrictive covenants often found in subdivisions (i,e., 100 lots, single family residence restriction. One buyer wants to put up gas station, any plaintiff in subdivision can seek injunction). • Termination – by changed circumstances Zoning • States, and local authorities) may enact statutes or ordinances to reasonably control the use of the land. Zoning power based on a state’s police powers. • Nonconforming Use – A use that exists at the time of passage of a zoning act that does not conform to the statute cannot be eliminated at once (gets grandfathered in, or may continue for a time). • Special Use permit – Must be obtained even though the zoning is proper for its intended use (hospitals, funeral homes, drive-in businesses) • Variance – A variance is a departure from the literal zoning restrictions, if there are special circumstances or it would be an “undue hardship” to deny.