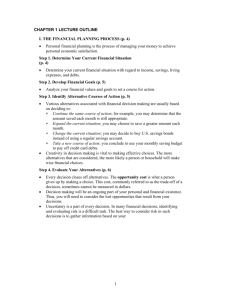

ECONOMIC POLICY

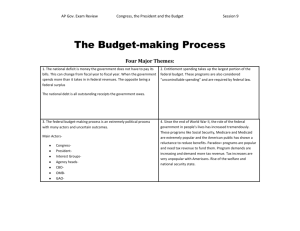

Understanding how our elected officials work with one another and other agencies to formulate economic policy and the federal budget.

Part 1

Health of American economy generates majoritarian politics

(everyone wants increases in wealth and income).

Voters see connections between the nation as a whole and their own well-being.

Voting behavior and economic conditions are not always correlated at the national and individual levels – people do not always vote based on their pocketbooks

– People understand what government can and cannot be held accountable for

– People see economic conditions having indirect effects on them

Many officials take economic policy positions based either on ideological grounds or on their reading of public opinion.

Elected officials are often tempted to take a short-term approach of the economy and to adapt those policies that will best satisfy the self-regarding voter.

Government will not always do whatever is economically necessary to win the election; government doesn’t know how to produce desirable outcomes

– Reducing inflation by raising interest rates (could possibly slow down the economy by hurting housing markets, etc.)

Ideology plays a large role in shaping policy choices; higher income people tend to be concerned with inflation; lower income people tend to be more concerned with employment

Believes inflation occurs when there is too much chasing too few goods.

Federal government has the power to create money; according to Monetarists, inflation occurs when it prints too much money.

When inflation becomes rampant and government tries to do something about it, it often cuts back sharply on the amount of money in circulation. Then a recession will occur, with slowed economic growth and an increase in unemployment.

Advocates increasing the money supply at a rate about equal to the growth of economic productivity; beyond that, it should leave matters alone and let the free market operate.

John Maynard Keynes; believed that the market will not automatically operate at a full-employment, low-inflation level; rather its health depends largely on what fraction of people’s incomes they save or spend.

Government should create the level of demand.

When demand is too low, government should pump more money into the economy (spending more than it takes in in taxes and creating public works programs).

When demand is too high, the government should take money out of the economy (by increasing taxes or cutting federal expenditures)

Not concerned with balanced budget on year-to-year basis, but rather on economic performance.

Some view free market as too undependable to ensure healthy economic activity; argue that government should plan parts of a country’s economic activity when markets fail to account for public good.

Wage and price controls when markets are unable to constrain inflation.

Demand-side

Others have argued that government should direct some investments to needed industries that are unable to attract private investment.

Not as popular in the United States; often found in

European, Asian, and African economies.

Stress there is a need for less government interference in the market and for lower taxes – lower taxes create incentives for investment, and the greater economic productivity that results will produce more tax revenue

Fits both libertarian and conservative political values

Ignores political concerns about both inflation and unemployment

Combination of monetarism, supply-side tax cuts, and domestic budget-cutting.

Effects of Reaganomics:

– Economy was stimulated

Wanted to reduce the size of the federal government, stimulate economic growth, increase strength of the military

– Government spending continued to increase, but at a slower rate than before

– Military spending increased sharply

– Money supply was controlled, cutting inflation but allowing interest rates to rise Inconsistencies were the result of trying to combine concerns about inflation, economic freedom, unemployment, and increasing military spending

– Personal income taxes were cut, but

Social Security taxes were increased

– Large deficits incurred, dramatically increasing the size of the national debt

– Several important industries (airlines and telephone companies) were deregulated.

Part 2

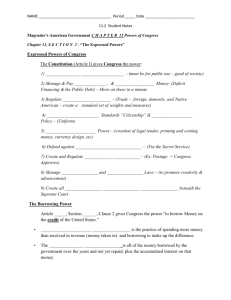

Federal Reserve System (FED) was created by

Congress to regulate lending practices of banks and thus the money supply.

Made up of a Board of Governors (appointed by POTUS and confirmed by the Senate); seven individuals given fourteen year terms; Ben Bernanke is the current

Federal Reserve Chairman.

Most important tool the government has to manage the economy is its control of the money supply.

M = supply of Money in economy

V = velocity of money, or the number of times a year that the average dollar is spent on final goods and services

P = the overall price level in the economy, reflecting the average price at which all output is sold

Q = the quantity of all goods and services produced; also known as REAL output.

MV = PQ is a simple model of a marco economy during a time period. MV represents the total amount spent by buyers in the economy, and PQ represents the total amount received by sellers, so the two must be equal. If there is a change in one of the variables, there must be a change in one of the other variables to keep MV equal to PQ

Government’s main economic policy is MONETARY POLICY (manipulation of the money supply and credit).

Monetarism states that the supply of money is key to the nation’s economic health.

How the FED works:

– Federal Open Market Committee (FOMC) meets eight times a year; sets “Federal Funds Rate” (interest banks can charge each other for overnight loans)

– FED purchases or sells government bonds from banks; by buying or selling bonds form banks, the FED determines whether banks have more or less money to lend out

– The more money banks have to lend, the cheaper borrowing is; if banks have less to loan, loans become more expensive and interest rates go up.

FED can influence the state of the economy; the amount of money available, interest rates, inflation, and the availability of jobs are all affected either directly or indirectly by the complicated financial dealings of the FED.

Fiscal policy (POTUS and Congress) outlines the impact of the federal budget – taxes, spending, borrowing – on the economy.

Congress:

– Most important part of economic policy machine

– Approves taxes and almost all expenditures

– Can alter/influence FED by threatening to reduce powers

– Can determine how high taxes should be and how much money the government should spend

Part 3

The budget is a document that announces how much the government will collect in taxes and spend in revenues and how those expenditures will be allocated among various programs.

Fiscal year runs from October 1 through September 30.

Federal budget is a list of everything the government is going to spend money on, with only slight regard (if any) for how much money is available to be spent.

President submits his budget in February, two budget committees (one in House, one in Senate) study his overall plan and obtain analysis from the CBO.

– House Ways and Means Committee, Senate Finance Committee

Each committee then submits to its respective house a budget resolution that proposes a total budget ceiling and a ceiling for each of several spending areas.

In May, Congress is supposed to adopt, with some modifications, these budget resolutions, intending them to be targets to guide the work of each legislative committee.

During the summer, Congress then takes up the specific appropriations bills, informing its members as it goes along whether or not the spending proposal in these bills conforms to the May budget resolutions

(restrain committees).

After each committee approves its appropriations bill and Congress passes it, it goes to the POTUS for signature.

About two-thirds of the spending is mandatory spending

(money goes to those entitled to it).

Entitlements include social security, Medicare, VA benefits, food stamps, and money the government owes investors who have bought Treasury bonds.

Government can alter only one-third of the federal budget every year (discretionary spending).

Nothing exists to ensure Congress tightens its budget and spending.

Called for automatic cuts from 1986

–1991, until the federal deficit disappeared

If there was a lack of agreement between the president and

Congress on the total spending level, there would be automatic across-the board cut (a sequester)

The president and Congress still found ways to increase spending (plan failed)

By 1990, new plan emerged: (1) Congress would vote for a tax increase, (2) Budget Enforcement Act of 1990 imposed a cap on discretionary spending. As long as the POTUS and

Congress stay under the cap, they can change the amount of money they spend.

– Imposed a “pay-as-you-go” approach and ultimately helped restrain the debt.

Entitlement programs account for 60% (approximately); limits what Congress and POTUS can do.

Incrementalism: agencies assume their annual budgets will increase in small amounts each year; built into budgetary process

Fragmented federal system enables interest groups to successfully resist tax increases

Deficits require huge interest payments; in 2008, government spent $249 billion to service the debt

Sixteenth Amendment

Progressive vs. Regressive Taxes: Progressive is proportionate to income and regressive is levied at a flat rate without regard to the level of a taxpayer’s income or ability to pay.

Individual income taxes account for roughly 46% of federal tax revenue.

Corporate taxes: corporations pay a tax that ranges from 15-35% of taxable income; make up about 12% of federal tax revenue.

Social Security (FICA): employers and employees each pay a tax equal to 6.2% of the first $106,800 earnings. For Medicare, employees pay a 1.45% tax on their total annual income; employers match the amounts withheld from their employee’s paychecks; these are regressive taxes (fixed rate); generate approximately 36% of federal tax revenue.