Chapter 24

The ISLM

World

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

Learning Objectives

• Identify the shift and slope determinants of the LM

curve

• Identity the shift and slope determinants of the IS curve

• Understand how combining the IS and LM curves

determines an equilibrium level of real GDP and

interest rates

• Explain how ISLM analysis is connected to the

aggregate demand curve

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-2

Introduction

• ISLM analysis—a more complex model of GDP

determination

– Shows how monetary and fiscal policy interact

– Shows what determines the relative multiplier effects of each

– Provides a partial integration of the classical and Keynesian

systems into one conceptual framework

– Demonstrates some of the fundamental features

distinguishing classical and Keynesian outlooks

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-3

Introduction (Cont.)

• Initially assume a fixed price level—concerned

with the level of real GDP

• Followed by an analysis of the implications of

flexible wages and prices

• Ultimately the discussion shows how the ISLM

model collapses into an aggregate demand

schedule

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-4

The LM Curve

• Classical economists stressed the transactions demand

for money

• Keynes had a more complex view of the transactions

demand

– Since transactions demand increases with income, the rate of

interest rises as income rises

– Not only does the interest rate help determine income

(classical view), income helps determine the interest rate

(Keynesian)

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-5

The LM Curve (Cont.)

• Keynesian View (Cont.)

– Causation runs both ways—from interest rate to

income and from income to the interest rate

– A reformulation of the model permits determination

of both interest rates and income

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-6

The LM Curve (Cont.)

• Figure 24.1

– Shows three alternative money-demand functions,

each associated with a different level of economic

activity

– Each level of GDP has its own liquidity-preference

function since more money is demanded for

transaction balances at higher income levels

– Therefore, the demand for money is really a function

of two variables—income and interest rate

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-7

FIGURE 24.1 How to derive the LM curve: At higher

levels of income, the demand for money rises and so

do interest rates.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-8

The LM Curve (Cont.)

• Figure 24.1 (Cont.)

– The equilibrium condition (money demanded =

money supplied) no longer provides a single interest

rate

– There is a combination of income (Y) and interest

rate (r) that satisfies this equilibrium condition,

when the money supply is fixed

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-9

The LM Curve (Cont.)

• Figure 24.2

– A plot of the relationship between Y and r that satisfies

equilibrium conditions in the money market

– Interest rate is on the vertical axis and income on the

horizontal axis

– This relationship is labeled the LM curve since is it the locus

of combinations of Y and r that satisfy the equilibrium

condition

– At different interest rates, shows what the resulting income

would have to be to make demand for money equal to (fixed)

supply

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-10

FIGURE 24.2 The LM curve.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-11

The LM Curve (Cont.)

• Figure 24.2 (Cont.)

– Tells what the resulting interest rate would have to be at

different income levels to insure demand and supply of

money were equal

– At higher income levels, more transaction money is

desired, so the interest rate must be higher to reduce the

demand to maintain equilibrium with a fixed supply

– However, this relationship by itself does not determine the

actual value of Y and r—need another relationship to interact

with the LM curve

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-12

The Slope of the LM Curve

• Figure 24.3

– Explores the slope of the LM curve

– Assume point A is the initial equilibrium point and

income increases from Y1 to Y2

– At the original interest rate r1, the demand for money

is too great and interest rates must increase to r2 to

restore equilibrium

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-13

FIGURE 24.3 The slope of the LM

curve.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-14

The Slope of the LM Curve (Cont.)

• Figure 24.3 (Cont.)

– The actual slope of the LM curve is determined by

two factors

• The size of the gap between money demand and supply at

point C—the larger the distance, the greater the required

increase in r and steeper the slope

• The interest-sensitivity of money demanded—the greater

the interest-sensitivity the steeper the slope

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-15

The Slope of the LM Curve (Cont.)

• Monetary Policy and the LM curve

– Figure 24.4

– An increase in the money supply causes the LM curve to shift

to the right

– Therefore, the Federal Reserve can increase the potential

equilibrium level of GDP associated with a given interest rate

(point a to point b)

– However a change in income is not the only way an increase

in the money supply can be absorbed into the economy

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-16

Figure 24.4 An increase in the money

supply shifts the LM curve to the right

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-17

The Slope of the LM Curve (Cont.)

• Monetary Policy and the LM curve

– Since the supply of money exceeds the demand at

the old rate, the interest rate may fall (point a to

point c) to increase the demand

– Therefore, it is possible to increase Y or decrease

r, or some combination of the two

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-18

The IS Curve

• According to classical economists, interest rates are

determined by the interaction between desired saving

and investment

• Figure 24.5 and 24.6 demonstrate the inverse

(negative) relationship between the level of interest and

the level of investment

• Figure 24.6 summarizes the inverse relationship

between interest rate determined in the goods market

and the level of income

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-19

FIGURE 24.5 How to derive the IS curve: At

lower rates of interest the level of investment is

higher,and so is the level of income.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-20

FIGURE 24.5 How to derive the IS curve: At

lower rates of interest the level of investment is

higher,and so is the level of income. (Cont.)

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-21

Figure 24.6 The investment-demand function.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-22

The IS Curve (Cont.)

• IS curve (Figure 24.7)—locus of points satisfying the

investment-equals-savings equilibrium condition with

interest (r) on the vertical and income (Y) on the

horizontal

– At lower interest rates, there is more investment, so income

must be higher to increase the amount of savings

– At higher income levels, savings is higher, so the interest

rate must be lowered to encourage the additional savings

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-23

FIGURE 24.7 The IS curve and its

slope.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-24

The Slope of the IS Curve

• The slope of the IS curve is determined by two

factors—the sensitivity of the investment

function (I versus r) and the marginal propensity

to save (1 – b)

– A highly interest-sensitive investment function will

result in a flat IS curve

– A low marginal propensity to save also implies a flat

IS curve

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-25

The Slope of the IS Curve (Cont.)

• The position of the IS curve is altered by any

change in autonomous spending

– Government spending or taxation

– Private investment that is independent of the rate of

interest, but depends on the expectations of

entrepreneurs

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-26

The Slope of the IS Curve (Cont.)

• Figure 24.8

– Shows the effect of an increase in government spending on

position of IS curve [IS(G1) to IS(G2)]

– This causes each of the total-expenditure functions to shift

upward, producing a higher level of Y for each interest rate

– Starting at point a, shifting the IS curve upward can result in

different outcomes

• An increase in income (point a to point b)

• An increase in interest rates (point a to point c)

• Some combination of the two—higher income and higher interest

rates

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-27

FIGURE 24.8 An increase in government

spending shifts the IS curve to the right

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-28

The Slope of the IS Curve (Cont.)

• Figure 24.8 (Cont.)

– Keynesians argue that an increase in government

spending will significantly increase GDP—

movement toward point b

– However, classical economists feel increased

government spending would result in increased

interest with no increase in GDP—movement toward

point c

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-29

Determination of Income/Interest: IS

and LM Together

• Figure 24.9

– This represents a simultaneous plot of the LM curve (given a

fixed supply of money) and the IS curve (given a level of

autonomous spending)

– The intersection of the two curves (point E) represents the

equilibrium level of income (Y) and interest (r)

– At any other point on the graph, equilibrium conditions are

violated and dynamic forces will move income and interest

rate toward point E.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-30

FIGURE 24.9 The simultaneous

determination of income and interest

(fantastic!).

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-31

Determination of Income/Interest: IS

and LM Together (Cont.)

• Figure 24.9 (Cont.)

– Point E is a stable equilibrium--as long as nothing shifts the

IS or LM curves, there is no tendency for Y or r to change

– However, this is nothing sacred about income YE—it may

or may not be a full employment level of output

– This opens up the possibility of using monetary or fiscal

policy to shift one or both of the curve to move the economy

to the full employment level

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-32

Monetary and Fiscal Policy

• Monetary Policy

– Figure 24.10—Shifting the LM curve to the right along a

stable IS curve will simultaneously increase Y and decrease r

(Y to Y1 and r to r1)

– Figure 24.11

• Contrasts the effects of the LM curve interacting with a steep IS curve

and a flat IS curve

• A flat IS curve can be due to a highly interest-sensitive investment

function

• Flat IS curve—impact of monetary policy is effective on increasing

GDP, relatively smaller effect on interest

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-33

FIGURE 24.10 An expansionary

monetary policy.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-34

FIGURE 24.11 Monetary policy is more

effective the flatter the IS curve.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-35

Monetary and Fiscal Policy (Cont.)

• Monetary Policy (Cont.)

– Figure 24.12

• Contrasts the effects monetary policy with a steep LM

curve versus a flat LM curve interacting with a given IS

curve

• If the demand for money is rather insensitive to changes in

the rate of interest, the LM curve is steeper

• Steep LM curve—larger the decline in the rate of interest

and the greater the increase in GDP

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-36

FIGURE 24.12 Monetary policy is more

effective the steeper the LM curve.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-37

Monetary and Fiscal Policy (Cont.)

• Fiscal Policy

– Figure 24.13

• Shifting the IS curve upward will simultaneously increase

income and interest rates (Y to Y1 and r to r1)

• In previous chapters, the multiplier effect on GDP

resulting from an increase of government spending

ignored the impact of increasing interest rates—shown by

a movement from Y to Yn

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-38

FIGURE 24.13 An expansionary

fiscal policy.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-39

Monetary and Fiscal Policy (Cont.)

• Fiscal Policy (Cont.)

– Figure 24.13 (Cont.)

• Crowding-out effect

– Increased government borrowing to finance the spending will

increase interest rates

– Higher interest rates will reduce investment spending which will

tend to reduce the increase in GDP

– Therefore, the net effect of increased government spending

will be diminished by the reduction in investment spending

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-40

Monetary and Fiscal Policy (Cont.)

• Fiscal Policy (Cont.)

– Figure 24.14

• Shows two LM curves—the flatter the curve, the smaller

the interest-sensitivity of liquidity preferences—

interacting with a given shift of the IS curve

• The flatter the LM curve, the less the increase in interest

rates and the greater the increase in GDP—smaller

crowding-out effect

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-41

FIGURE 24.14 Fiscal policy is more

effective the flatter the LM curve.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-42

Monetary and Fiscal Policy (Cont.)

• Fiscal Policy (Cont.)

– Figure 24.15

• Shows two IS curves—the flatter the curve, the greater the

interest-sensitivity of the investment function—interacting

with a fixed LM curve

• The flatter the IS curve, the less the increase in interest

rates and the greater the increase in GDP—smaller

crowding-out effect

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-43

FIGURE 24.15 Fiscal policy is more

effective the steeper the IS curve.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-44

What about Velocity

• While it appears the Keynesian analysis does not

utilize the concept of velocity, it is actually

embedded in the LM function

• Given a fixed money supply, as one moves up

along an LM function, the income velocity of

money is necessarily going up since Y is

increasing

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-45

What about Velocity (Cont.)

• Figure 24.16

– Rightward shifts of the IS curve caused by increased

government spending results in raising GDP through

increased velocity

– This occurs since the demand for money is sensitive

to the rate of interest and the increased interest

induces public to hold less speculative balances,

freeing more cash to be used for transactions

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-46

FIGURE 24.16 When the IS curve shifts,

both income and velocity rise.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-47

What about Velocity (Cont.)

• Figure 26.17

– If the demand for money were totally insensitive to

the interest, velocity would be constant and GDP

would not be affected by shifts in autonomous

spending

– This results in a perfectly vertical LM curve at that

level of GDP

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-48

Figure 24.17 When the LM curve is vertical,

shifts in the IS curve raise neither income

nor velocity.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-49

What about Velocity (Cont.)

• Figure 26.17 (Cont.)

– In this case, increased government spending results

only in higher interest rates and no increase in GDP

– Complete crowding-out—the increase in interest

reduces investment spending by the same amount as

the increase in government spending

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-50

What about Velocity (Cont.)

• ISLM curves—integration of classical and

Keynesian economics

– Keynesian theory—the rate of interest is

determined by the supply of and demand for

money—LM curve

– Classical theory—the rate of interest is determined

exclusively by savings and investment—IS curve

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-51

When Will Full Employment Prevail?

• The question remains—why do not variations in

interest automatically result in full employment in

Keynesian system

• Nothing in the analysis will permit the automatic

shifting of the IS or LM curves without additional

autonomous spending

• The Keynesian analysis states that the only way to push

the economy toward full employment is to increase

economic activity through additional government

spending

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-52

When Will Full Employment Prevail?

(Cont.)

• Classical adjustment with ISLM curves

(Figure 24.18)

– If prices are permitted to vary, the ISLM analysis will

permit the automatic adjustment

– Under conditions of less than full employment, both

prices and wages would fall

– Since real income would remain the same, this

suggests there would be no automatic change in real

factors

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-53

FIGURE 24.18 The classical position: Lower

prices shift the LM curve to the right and

automatically produce full employment.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-54

When Will Full Employment Prevail?

(Cont.)

• Classical adjustment with ISLM curves

(Cont.)

– However, falling prices would increase the real

value of the supply of money

– This in turn would tend to shift the LM curve to the

right, lowering interest rates and increasing desired

investment until full employment was restored

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-55

When Will Full Employment Prevail?

(Cont.)

• Keynesian attack on the above:

– Inflexibility of prices and wages would not permit

the adjustment

– Liquidity trap (Figure 24.19)

• The LM curve is perfectly horizontal

• Increase in the money supply (though lowering of prices)

would not lower the interest rate

• No automatic increase in investment/output and

employment would remain below full employment levels

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-56

FIGURE 24.19 An extreme

Keynesian position: A liquidity trap.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-57

When Will Full Employment Prevail?

(Cont.)

• Keynesian attack on the above: (Cont.)

– Interest-insensitive investment function (Figure

24.20)

• The IS curve is very steep

• Therefore, declining prices and the reduction in interest

rates will not be able to raise investment sufficiently to

generate full employment levels

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-58

FIGURE 24.20 Another extreme Keynesian

position: Investment unresponsive to the

interest rate.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-59

When Will Full Employment Prevail?

(Cont.)

• Wealth effect of lowering prices (classical

counter)

– Falling prices increase both liquidity and wealth

– Increased wealth will raise desired consumption

function at every level of income

– This acts like any autonomous increase in spending

and will automatically shift the IS curve to the right

toward full employment

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-60

ISLM and Aggregate Demand

• The aggregate demand curve relates the price

level to demand for real output

• The ISLM analysis focuses on the relation

between interest and demand for real output

• Therefore, it is relatively straightforward to

generate a complete aggregate demand schedule

from the ISLM model

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-61

ISLM and Aggregate Demand

(Cont.)

• Figure 24.21

– Different price levels are associated with a family of

LM curves

– Lowering the price levels will cause the LM curves

to shift to the right

– The equilibrium level of output (Y) of the different

LM curves and a fixed IS curve will trace out an

aggregate demand that relates prices to output

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-62

Figure 24.21 Deriving aggregate

demand from ISLM.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-63

Figure 24.21 Deriving aggregate

demand from ISLM. (Cont.)

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-64

ISLM and Aggregate Demand

(Cont.)

• Figure 24.21 (Cont.)

– Additionally, a shifting of the IS curve, coupled with

different LM curves generated by different price

levels, will trace out a different aggregate demand

curve

– Less obvious, but also true, an increase in the stock

of money shifts the aggregate demand to the right

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-65

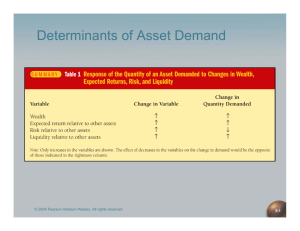

TABLE 24.1 A Summary of Monetary

and Fiscal Policy Effectiveness

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-66

Appendix

THE SIMPLE

ALGEBRA

OF INCOME

DETERMINATION

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

APPENDIX—THE SIMPLE ALGEBRA

OF INCOME DETERMINATION

• Much of ISLM analysis can be summarized in

equation form

• The economy is divided into two sectors

– The goods or product markets, comprising the

demand for goods and services

– The monetary sector, comprising the demand for and

supply of money

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-68

APPENDIX—THE SIMPLE ALGEBRA

OF INCOME DETERMINATION (Cont.)

• The Model

– The product market can be described by four functional

relationships (behavior equations) and one equilibrium

condition (an identity)

• All functional relationships are assumed to be linear

• The functional relationships (numbers shown in the textbook)

– (1) Consumption (C) function

– (2) Investment (I) function

– (3) Tax (T) function

– (4) government spending (G)

• The equilibrium condition

– (5) C + I + G + Y or S + T = I + G

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-69

APPENDIX—THE SIMPLE ALGEBRA

OF INCOME DETERMINATION (Cont.)

– The monetary sector of the economy consists of

two functional relationships and one equilibrium

condition

• Functional relationships

– (6) Liquidity preference (L) or demand-for-money function

– (7) Money supply (M)

• Equilibrium condition

– (8) L = M

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-70

APPENDIX—THE SIMPLE ALGEBRA

OF INCOME DETERMINATION (Cont.)

– The IS and LM functions

• By solving equations (1) through (5), we find the IS function: equation

(9)

• By solving equations (6) through (8), we find the LM function:

equation (10)

– Equilibrium Income and Interest

• By solving equations (9) and (10) simultaneously, we obtain:

– equilibrium income (Y): equation (11)

– interest rate (r): equation (12)

– Multiplier Effects on Income and Interest Rates

• From equation (11) we can derive the multiplier effects on income:

equations (13) through (15)

• From equation (12) we can derive the multiplier effects on the interest

rate: equations (16) through (18)

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

24-71