MidTermReview

advertisement

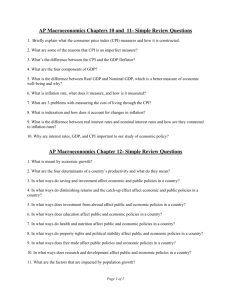

Chapter 1 & 2 Microeconomics - is the study of how individuals and firms make decisions. Therefore, macroeconomists are more likely to create models than analyze the decisions of firms (such as pricing) and consumers (such as shopping choices), and how government policies affect those decisions. Macroeconomics - is the study of matters affecting the entire economy. Therefore, macroeconomists would be more likely to create models that analyze the policy decisions of governments and central banks and how these decisions affect growth, inflation, and unemployment. The annual inflation rate measures the percentage change in prices over a given year. If inflation rate is positive, this means that prices have increased in that year. However, when there is deflation (or a negative inflation rate), prices have decreased in that time period. In order for an inflation time graph to portray increasing prices the only requirement is that the line representing rate of inflation is above zero during that time period. Even when the graph is decreasing, as long as the evaluation of the graph at a particular time period is positive prices are still rising just at a slowing rate. Exogenous variables are those that the model takes as given, whereas endogenous variables are what a model tries to explain. In other words, models aim to show how various exogenous variables affect the endogenous variables. The functional form of the demand curve is an abstract way to state how one variable is affected by other variables. Ex. Quantity of sleds demanded (QD) is affected by the price of a sled (P) and the chance snow (S), which is QD=(P,S). The equilibrium quantity and price is the intersection of the supply and demand curves. When an economist constructs a model of the economy, he or she must decide the speed of price adjustments that is most appropriate for the model. In many standard models, economists assume that the price of a good or service adjusts quickly to changing economic conditions in order for quantity supplied to equate to quantity demanded; this is known as market clearing. Therefore, market-clearing models assume all wages and prices are flexible. While market clearing models might not be appropriate for every minute of the day, they model the equilibrium toward with the economy is moving. Therefore, if a macroeconomist wants to analyze long-run implication of policy, then it is reasonable to assume prices are flexible. However, when an economist creates a model to analyze the short-run behavior of an economy, it’s better to assume prices are sticky rather than flexible. Circular flow diagram, households purchase goods from firms through product market. When this happens, household expenditures go to firms in exchange for goods. Similarly, factor markets allow firms to purchase labor from households. When this happens, firms send income to households in exchange for labor that will be used to make finished goods. Stock variable – measures how much of something there is at a given time. A flow variable measures how much something changes over time. Nominal GDP measures the value of current output using current prices. Real GDP measures the value of output in the current year using prices from the base year. (Quantities vary) GDP deflator/IPD (implicit price deflator) = nominal GDP/real GDP. (Note: price index) Inflation rate = change in IPD or change in CPI CPI = cost of basket in the given year/cost of basket in a base year (in other word’s quantities stay the same but prices vary) (Note: price index) Price index, any price index compares the amount something would cost in a given year to the amount it would cost in the base year. Real GDP is the value of an economies output after the impact of price changes has been removed, in other words prices stay the same and quantities change. Therefore, nominal GDP rises and falls with price changes and may provide a misleading indication of whether output is increasing or decreasing. GDP does not account for “off the book” activities like babysitting, which add value to the economy but are not reported to the government. It also doesn’t take into account the true value of housing that must be imputed for residents own their own housing; rather, the values of housing and government services are typically measured as imputations and are thus only estimates of the true value. Finally, the sale of used goods is not included as part of GDP. The final market price of a good contains the value added by each stage of its production process. The value added at each stage of production = sale value minus - cost of intermediate good (partly finished good). Consumption consists of expenditures by individuals on goods and services. C(y-t) Investment consists of spending on capital goods (capital - assets available for use in the production of further assets) and (net) additions to inventories by firms and individuals. Government purchases consist of any purchase by a state, local, or federal government. When a good is sent across national boundaries, or when the service is provided by a company in another country for a company in another country, the value of that good or service is included in the exports category for the country in which the good or service originated, and in the imports category for the country that receives the good or service. Net exports = exports – imports = (X-M) GDP or Y = C + I + G + (X – M) GDP measures the total income produced domestically, GNP measures the total income earned by residents of a nation. That is, gross national product adjusts GDP for factor payment from and to abroad. Therefore, adding factor payments from abroad to GDP and subtracting factor payments to abroad from GDP yields gross national product (GNP). (GNP = GDP + factor payments to foreigners (ex. includes wages, profit, and rent that we own to foreigners)–factor payments from foreigners (ex. Foreigner owns assets in this country so he owns wages to the employees here)). NNP or net national income = GNP – Depreciation One reason why CPI overstates inflation is that it uses a fixed basket of goods. In reality, when the price of goods increases, people tend to buy less of it; so it overstates inflation, because it doesn’t account for it. Another reason CPI overstates in inflation is that it assumes the quality of goods doesn’t change from year to year. Therefore, if the price of something increases because of the quality, the price index would overstate the increase in the cost of an item of a given quality. Ex. Price of calculators increased because they have memory card slots not just because of the same calculator. CPI vs IPD CPI measures all goods/services bought by typical consumers, includes foreign/domestic goods/services (ex. Rise in Toyota made in Japan), and fixed basket of goods (Laspeyres). IPD measures all goods/services domestically produced (ex. Things bought by government and firms show here but not CPI), and changing basket of goods (Paasche). An unemployed person is a person who is in the adult population, did not work for pay in the previous week, and is actively seeking work. Labor force = number in labor force/adult population Unemployment rate = number of unemployed workers/number in the labor force Discouraged workers are jobless people who have not looked for work in the past four weeks. Production function = Y=F(K,L), relationship between output and capital and labor. When the production function exhibits constant returns to scale (xY = F(zK,zL), this means that an increase of an equal percentage in all factors of production causes an increase in output of the same percentage. In other words, if you double both capital and labor, then output must also be exactly double. If when you double inputs you get more than double the output this is called increasing returns to scale; and if you double your inputs and get less than double the output this is called decreasing returns to scale. All Cobb-Douglas functions of the form F(K,L) = AKaL1-a exhibit constant returns to scale. The marginal product of labor or MPL is the extra amount of output a firm gets from one extra unit of labor, holding the amount of capital fixed. MPL=(Kconstant, L+1) –F(Kconstant,L). A production function displays the diminishing marginal product of labor if, when capital is held fixed, the marginal product of labor decreases as the amount of labor increases. In other words, the amount by which total output increases as you hire more labor is actually shrinking. Profit = Revenue – Labor Cost – Capital Cost = P(F(K,L)) – WL – RK W = market wage, L = Labor, K=Capital, R=rental price of capital, P= Price MPK is the number of additional output produced as a result of renting one additional unit of capital. If a firm can earn more profit from renting an additional unit of capital, then the firm will continue to rent. However, once no profit can be gained from additional renting, the firm will cease renting. A firm will never rents an additional unit of capital if it lowers profit. In other words, firms rent up until change in profit is zero: Change in Profit = Change in Revenue – Change in Cost 0= P*MPK-R => R= P*MPK => MPK = R/P Profit maximizing capital choice of the firm = MPK = R/K also known as real rental price . Using similar analysis for a firm’s decision on how much labor to hire, firms will hire labor until the marginal product of labor or MPL equals MPL = W/P also known as real wage (W/P). A person should only purchase an object if the expected rate of return is greater than or equal to the real interest rate. Supply = Y, and Demand = C(Y-T) +I(r)+G for closed economy or Demand = C+I+G+NX for open economy National Savings = private savings + public savings Private savings = Y-T-C Public savings = T-G Savings = Investment, in a closed economy Savings = Investment + NX, in an open economy NX = Exports – Imports = Output – Domestic Spending Net capital outflow = net exports; net capital outflow is defined as the purchase of foreign assets by domestic residents minus the purchase of domestic assets by foreigners. 3 key assumptions in the small open economy model: 1. The economy’s output is fixed by the levels of factors of production and the production function. Therefore output is also constant. 2. The level of consumption is assumed to be positively related to disposable income. In other words consumers spend more when they have more disposable income. 3. Investment is negatively related to the real interest rate; or people invest more with lower interest rates then with higher interest rates. Note: small economy can’t influence the world interest rate they are too small to do so. Real exchange rate = (e*P)/P*, e = nominal exchange rate, p = domestic price, p*= foreign price. PPP Exchange rate = price in one country for same thing/price in another for the same thing CIP => (1+i$) = (1+ie)(F$/e/E$/e), CIP approx.=> i$-ie = (F$/e – E$/e)/E$/e UIP => (1+i$) = (1+ie)(Ee$/e/E$/e), UIP approx.=> i$-ie = (Ee$/e – E$/e)/E$/e M*V = P*Y , M = money supply, V=velocity of money, p=GDP deflator, y=real GDP; V and Y constant