Chapter 2

Professional Standards

“All my growth and development led me to believe that if you

really do the right thing, and if you play by the rules, and if you’ve

got good enough, solid judgment and common sense, that you’re

going to be able to do whatever you want to do with your life….”

– Barbara Jordan, first African-American woman from the South

ever elected to the U.S. House of Representatives

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved.

2-2

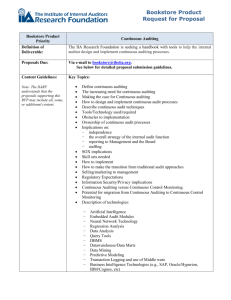

Practice Standards

Client

Public

Entities

Private

Entities

Governmental

Entities

Foreign

Entities

Rulemaking

body

Public Company

Accounting

Oversight Board

(PCAOB)

AICPA Auditing

Standards Board

(ASB)

U.S.

Government

Accountability

Office (GAO)

IFAC International

Auditing and

Assurance

Standards Board

(IAASB)

Standards

Auditing

Standards (ASs)

Statements on

Auditing

Standards

(SASs)

Government

Auditing

Standards

(The “Yellow

Book”)

International

Standards on

Auditing (ISAs)

Web site

www.pcaobus.org

www.aicpa.org

www.gao.gov

www.ifac.org

2-3

Generally Accepted Auditing

Standards

• Measures of the quality of auditors’

performance

• Same from audit to audit

• Auditing standards versus auditing

procedures

Exhibit 2.1

Generally Accepted Auditing Standards

2-4

2-5

Engagement Overview and GAAS

OBTAIN

(OR RETAIN)

CLIENT

ENGAGEMENT

PLANNING

RISK

ASSESSMENT

SUBSTANTIVE

PROCEDURES

ISSUE

REPORT

General Standards (Due Professional Care)

Standards of Field Work

Standards of

Reporting

2-6

General Standards

Affect all phases of audit

1. Training and proficiency

– Experience and expertise

2. Independence

– Independence in fact vs. independence in appearance

– Financial and managerial relationships

3. Due professional care

– Observe standards of field work and standards of

reporting.

2-7

Standards of Field Work

Affect conduct of the audit

1. Planning and supervision

–

–

2.

Use of audit program

Interim and year-end work

Understanding of entity and environment (including I/C)

–

–

3.

Assess risk of material misstatement

Determine effectiveness of substantive procedures

Sufficient appropriate evidence

–

–

Sufficient = quantity

Appropriate = quality (relevance, reliability)

2-8

Sufficient evidence

• Related to quantity (number of transactions

or components examined)

• Influenced by effectiveness of entity’s

internal control

Effective internal

control

Lower level of

control risk

Reduced effectiveness of

substantive procedures

Ineffective internal

control

Higher level of

control risk

Increased effectiveness of

substantive procedures

2-9

Appropriate Evidence

• Relates to the quality of evidence

• Reliability (from highest to lowest)

–

–

–

–

–

Auditors’ direct personal knowledge

External documentary evidence

External-internal evidence

Internal documentary evidence

Verbal and written representations

2-10

Examples of Evidence

• Auditors’ direct personal knowledge

– Observe PPE, inventories

• External documentary evidence

– A/R confirmations, bank confirmations

• External-internal evidence

– Vendor invoices for purchases

• Internal documentary evidence

– Client sales invoices

• Verbal and written representations

– Management representations (SAS 85)

2-11

Standards of Reporting

Identify contents of auditors’ reports

1. Are F/S in conformity with GAAP?

2. Have GAAP been consistently applied

(implicit reporting)?

3. Are disclosures adequate (implicit reporting)?

4. Report must express or disclaim an opinion

2-12

Independent Auditors’ Report (AS 5)

Report Title

Report of Independent Registered Public Accounting Firm

Report Address

To the Board of Directors and Shareholders

APOLLO SHOES, INC.

Introductory

Paragraph

We have audited the accompanying balance sheets of APOLLO SHOES, INC. as of December 31, 2008 and 2007,

and the related statements of income, comprehensive income, shareholders’ equity, and cash flows for each of the

years in the three-year period ended December 31, 2008. These financial statements are the responsibility of the

APOLLO SHOES, INC.’s management. Our responsibility is to express an opinion on these financial statements

based on our audits.

Scope

Paragraph

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board

(United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about

whether the financial statements are free of material misstatement. An audit includes examining, on a test basis,

evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the

accounting principles used and significant estimates made by management, as well as evaluating the overall

financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

Opinion

Paragraph

Internal Control

Paragraph (AS 5)

Signature

Report Date

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial

position of APOLLO SHOES, INC. as of December 31, 2008 and 2007, and the results of its operations and its

cash flows for each of the years in the three-year period ended December 31, 2008 in conformity with accounting

principles generally accepted in the United States of America.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board

(United States), APOLLO SHOES INC.’S' internal control over financial reporting as of December 31, 2008,

based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring

Organizations of the Treadway Commission (COSO), and our report dated January 29, 2009 expressed an

unqualified opinion on the effective operation of internal control over financial reporting.

Smith & Smith, CPAs

January 29, 2009

2-13

Types of Audit Opinions

• Unqualified

– F/S are in conformity with GAAP

• Qualified

– Except for one (limited) item, F/S are in conformity with GAAP

– Can issue for GAAP departure and scope limitation

• Adverse

– F/S are not in conformity with GAAP

– Can issue for GAAP departure (more serious)

• Disclaimer

– Auditors do not express an opinion

– Can issue for scope limitation (more serious)

2-14

Attestation Standards

• Cover a broader range of engagements than

GAAS

• Differences from GAAS

– Subject matter must be evaluated against

reasonable criteria

– No requirement to assess risk of material

misstatement (unless attestation engagement

involves risk of material misstatement)

– May have limited distribution of report

2-15

Quality Control Standards for Accounting

Firms

• Guide the performance of firm-wide services

• Categories

– Independence, integrity, objectivity

– Personnel management

– Acceptance and continuance of clients

– Engagement performance

– Monitoring

2-16

The Public Company Accounting

Oversight Board (PCAOB)

• Establishes standards (Auditing Standards)

–

–

–

–

Auditors’ reports (AS 1)

Audit documentation (AS 3)

Material weaknesses in internal control (AS 4)

Audits of internal control over financial reporting (AS

5)

• Standards must be approved by SEC

• ASB and AICPA standards prior to April 16, 2003

are Interim Auditing Standards

– May be modified or amended by Auditing Standards

2-17

The Public Company Accounting

Oversight Board (PCAOB)

• Monitors accounting firms through inspections

– Firms auditing > 100 public entities: annual

– Firms auditing < 100 public entities: every 3 years

• Inspection reports list deficiencies in audits

conducted by registered firms